Post merger profitability analysis of shareholders. Evidence from ...

Post merger profitability analysis of shareholders. Evidence from ...

Post merger profitability analysis of shareholders. Evidence from ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Chapter 1: Introduction<br />

In combination with other trends, such as privatisation and<br />

deregulation <strong>of</strong> financial markets, a large and accelerating process<br />

<strong>of</strong> consolidation <strong>of</strong> public listed firms has taken place in Europe<br />

during the last decade. Analysing investment decisions reveals that<br />

the largest investment decisions that most firms make are<br />

acquisitions <strong>of</strong> other firms.<br />

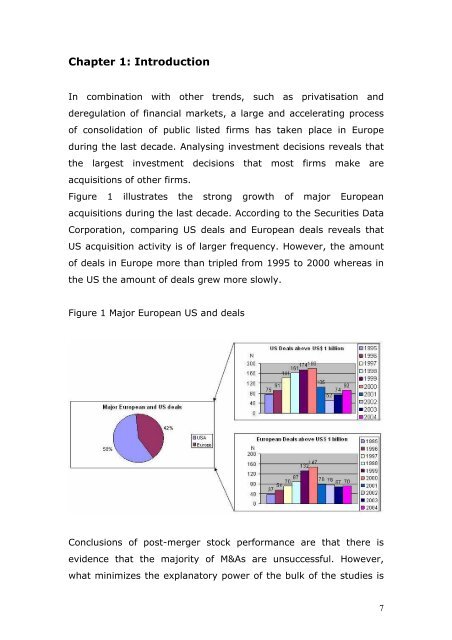

Figure 1 illustrates the strong growth <strong>of</strong> major European<br />

acquisitions during the last decade. According to the Securities Data<br />

Corporation, comparing US deals and European deals reveals that<br />

US acquisition activity is <strong>of</strong> larger frequency. However, the amount<br />

<strong>of</strong> deals in Europe more than tripled <strong>from</strong> 1995 to 2000 whereas in<br />

the US the amount <strong>of</strong> deals grew more slowly.<br />

Figure 1 Major European US and deals<br />

Conclusions <strong>of</strong> post-<strong>merger</strong> stock performance are that there is<br />

evidence that the majority <strong>of</strong> M&As are unsuccessful. However,<br />

what minimizes the explanatory power <strong>of</strong> the bulk <strong>of</strong> the studies is<br />

7