English Version - National Bank of Abu Dhabi

English Version - National Bank of Abu Dhabi

English Version - National Bank of Abu Dhabi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NBAD’s first branch in Amman, Jordan. It will form the base for<br />

further expansion into neighbouring markets.<br />

Investment <strong>Bank</strong>ing Group<br />

Although regional credit, as an asset class, was challenged<br />

in 2009, the involvement <strong>of</strong> our Debt Capital Markets in<br />

new issue transaction flows continued to be strong and<br />

we successfully closed eight key financing transactions<br />

for prime <strong>Abu</strong> <strong>Dhabi</strong> names.<br />

Opportunities for our Corporate Advisory business<br />

within the Gulf remained subdued with no initial public<br />

<strong>of</strong>ferings (IPO) in the UAE in 2009. Project finance<br />

advisory business showed a healthy trend, especially the<br />

major infrastructure projects undertaken by the public<br />

sector in the UAE and elsewhere in the Gulf.<br />

Wholesale <strong>Bank</strong>ing Group<br />

Wholesale <strong>Bank</strong>ing Group’s Global Project & Structured<br />

Finance (GPSF) experienced a record performance<br />

closing 14 new deals. GPSF maintained its lead position<br />

in project and structured finance in the regional and<br />

in the local syndication market with their participation<br />

in lead roles <strong>of</strong> structuring and co-ordinating bank,<br />

bookrunner and mandated lead arranger.<br />

<strong>Abu</strong> <strong>Dhabi</strong> <strong>National</strong> Leasing<br />

<strong>Abu</strong> <strong>Dhabi</strong> <strong>National</strong> Leasing (ADNL) showed excellent<br />

growth closing large ticket size lease transactions despite<br />

the challenging market situation. Major lease business<br />

arose from private jets, helicopters, cargo vessels and<br />

vehicles.<br />

The success story <strong>of</strong> ADNL in 2009 is also reflected in<br />

numbers. The net investment in leased assets increased<br />

129% to over AED 1 billion. Net pr<strong>of</strong>it increased 174%.<br />

Global Wealth<br />

Global Wealth comprises Private <strong>Bank</strong>ing, Asset<br />

Management Group and <strong>Abu</strong> <strong>Dhabi</strong> Financial Services.<br />

Adverse market conditions severely impacted all <strong>of</strong> these<br />

businesses and earnings were down at AED 15 million.<br />

During the year NBAD hired highly experienced<br />

executives to manage the asset management and<br />

brokerage businesses and underline the Group’s<br />

commitment to building its global wealth business<br />

Islamic <strong>Bank</strong>ing<br />

Islamic <strong>Bank</strong>ing comprises <strong>Abu</strong> <strong>Dhabi</strong> <strong>National</strong> Islamic<br />

Finance (ADNIF) and NBAD Islamic Division. Islamic<br />

banking delivered another strong financial performance<br />

with earnings <strong>of</strong> AED 59 million and contributing 1.3%<br />

<strong>of</strong> NBAD’s operating pr<strong>of</strong>its.<br />

Islamic <strong>Bank</strong>ing’s activities enjoyed excellent growth in<br />

customer finances compared with 2008 and attracted<br />

more than AED 4 billion <strong>of</strong> Shariah compliant deposits<br />

in 2009. It also introduced three new products including<br />

Shariah compliant corporate trade finance services,<br />

an ADNIF branded debit MasterCard and a Shariah<br />

compliant home finance product.<br />

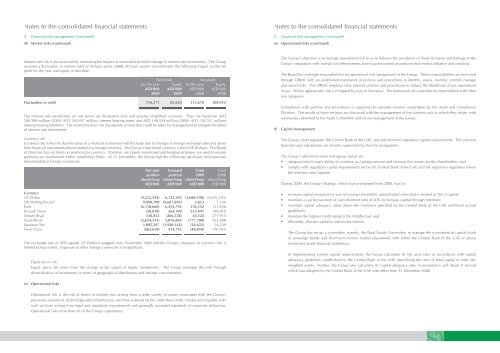

ADNIF’s head <strong>of</strong>fice was <strong>of</strong>ficially inaugurated on 25<br />

May 2009. A dedicated ADNIF website was launched at<br />

the beginning <strong>of</strong> 2009.<br />

2010. This is a new market for us and will form the base<br />

for further expansion into neighbouring markets.<br />

Our strategy continues to be one <strong>of</strong> organic growth and<br />

our international expansion is not confined only to the<br />

MENA region. In December 2009, we opened our full<br />

commercial banking branch in Hong Kong. The Hong<br />

Kong branch will be a gateway for our Middle East clients<br />

to access China and a gateway for our Asian investors<br />

and businesses to access the opportunities in the Middle<br />

East especially in <strong>Abu</strong> <strong>Dhabi</strong> itself.<br />

Corporate and Investment <strong>Bank</strong>ing<br />

Division<br />

NBAD has been ranked first in the league tables by<br />

Dealogic as mandated lead arranger and bookrunner for<br />

UAE-based syndications and third overall for the Middle<br />

East region.<br />

In addition, NBAD has received top honours, winning<br />

three Euromoney Awards for deals <strong>of</strong> the year for the<br />

Dolphin Energy, Zayed University and <strong>Abu</strong> <strong>Dhabi</strong> ISTP2<br />

transactions.<br />

Despite the weak market conditions in 2009, Global<br />

Trade Finance improved its net pr<strong>of</strong>it by 28% on the back<br />

<strong>of</strong> reciprocity business from NBAD’s overseas branch<br />

network.<br />

The combined business units within Corporate and<br />

Investment <strong>Bank</strong>ing Division produced a resilient<br />

performance with earnings <strong>of</strong> AED 2,133 million or<br />

47.4% <strong>of</strong> NBAD’s operating pr<strong>of</strong>its.<br />

Corporate <strong>Bank</strong>ing Group<br />

Corporate <strong>Bank</strong>ing Group’s (CBG) excellent results were<br />

attributed to the Group’s focused approach <strong>of</strong> capitalising<br />

on its relationships within government entities as well<br />

as select strategic business client relationships. This has<br />

had the added benefit <strong>of</strong> making the NBAD franchise<br />

synonymous with iconic transactions and UAE landmark<br />

projects.<br />

During 2009, CBG reviewed and updated all its key<br />

processes, and was recognised for its efforts by receiving<br />

the ISO 9001-2008 accreditation for quality management<br />

systems.<br />

<strong>Abu</strong> <strong>Dhabi</strong> <strong>National</strong> Property Company<br />

<strong>Abu</strong> <strong>Dhabi</strong> <strong>National</strong> Property Company PJS (ADNP)<br />

has been fully registered and an operating licence was<br />

granted in May 2009.<br />

Notwithstanding that its first year <strong>of</strong> operation coincided<br />

with the unprecedented downturn in the real estate<br />

market in the UAE, ADNP was able to grow its revenue<br />

base. However, staff costs, new <strong>of</strong>fice premises and<br />

general business set-up costs reduced its pr<strong>of</strong>its.<br />

ADNP established two key strategic alliances<br />

with international best-in-class institutions: Hines<br />

(commercial property management and development<br />

management services) and Knight Frank (international<br />

brokerage, landlord brokerage, tenant representation<br />

and advisory services), thereby allowing ADNP to<br />

provide comprehensive best-in-class solutions across the<br />

entire real estate value chain.<br />

H.E. Nasser Ahmed Khalifa Alsowaidi, the Chairman <strong>of</strong> <strong>National</strong> <strong>Bank</strong> <strong>of</strong> <strong>Abu</strong> <strong>Dhabi</strong> and Mr. Sultan Bin Rashid Al Dhaheri, Board Director,<br />

inaugurating <strong>Abu</strong> <strong>Dhabi</strong> <strong>National</strong> Islamic Finance (ADNIF), the Islamic finance and banking arm <strong>of</strong> NBAD.<br />

35