Tomato processing in China

Tomato processing in China

Tomato processing in China

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Tomato</strong> <strong>process<strong>in</strong>g</strong> <strong>in</strong> Ch<strong>in</strong>a<br />

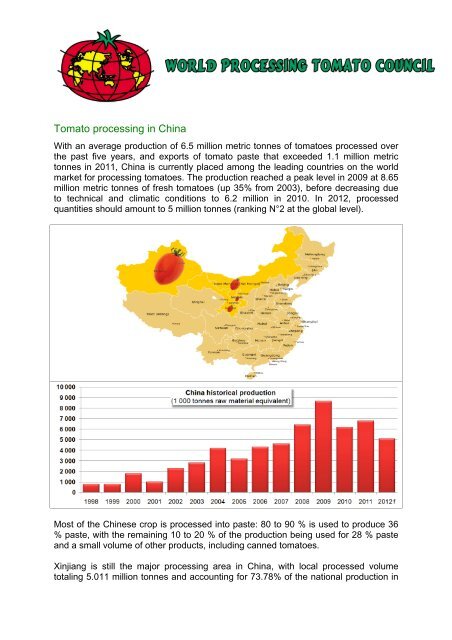

With an average production of 6.5 million metric tonnes of tomatoes processed over<br />

the past five years, and exports of tomato paste that exceeded 1.1 million metric<br />

tonnes <strong>in</strong> 2011, Ch<strong>in</strong>a is currently placed among the lead<strong>in</strong>g countries on the world<br />

market for <strong>process<strong>in</strong>g</strong> tomatoes. The production reached a peak level <strong>in</strong> 2009 at 8.65<br />

million metric tonnes of fresh tomatoes (up 35% from 2003), before decreas<strong>in</strong>g due<br />

to technical and climatic conditions to 6.2 million <strong>in</strong> 2010. In 2012, processed<br />

quantities should amount to 5 million tonnes (rank<strong>in</strong>g N°2 at the global level).<br />

Most of the Ch<strong>in</strong>ese crop is processed <strong>in</strong>to paste: 80 to 90 % is used to produce 36<br />

% paste, with the rema<strong>in</strong><strong>in</strong>g 10 to 20 % of the production be<strong>in</strong>g used for 28 % paste<br />

and a small volume of other products, <strong>in</strong>clud<strong>in</strong>g canned tomatoes.<br />

X<strong>in</strong>jiang is still the major <strong>process<strong>in</strong>g</strong> area <strong>in</strong> Ch<strong>in</strong>a, with local processed volume<br />

total<strong>in</strong>g 5.011 million tonnes and account<strong>in</strong>g for 73.78% of the national production <strong>in</strong>

2011. The ma<strong>in</strong> area for tomato cultivation is the X<strong>in</strong>jiang region, <strong>in</strong> the northwest,<br />

where the <strong>in</strong>dustry's lead<strong>in</strong>g companies like TunHe and Chalkis operate major<br />

factories. This region is composed of high plateaus (approximately 1 000 meters <strong>in</strong><br />

altitude) that enjoy a dry cont<strong>in</strong>ental climate, with little ra<strong>in</strong> <strong>in</strong> summer, long daylight<br />

hours, and general conditions that are ideal for grow<strong>in</strong>g tomatoes. Furthermore, the<br />

Ch<strong>in</strong>ese government has pushed for a strong development of the country's western<br />

regions <strong>in</strong> recent years. The economic evolution of X<strong>in</strong>jiang is similar to that of the<br />

entire western zone <strong>in</strong> that it depends on large-scale agriculture. This provides<br />

processors that are already established <strong>in</strong> the region with many opportunities,<br />

particularly those whose diversification is l<strong>in</strong>ked to activities that tie <strong>in</strong> with agriculture<br />

<strong>in</strong> a variety of ways. But X<strong>in</strong>jiang is not only the largest region to produce <strong>process<strong>in</strong>g</strong><br />

tomatoes, it is also the largest region to produce cotton (over 30% of the total<br />

Ch<strong>in</strong>ese output). In northern X<strong>in</strong>jiang, cotton and corn are the most competitive<br />

crops. In 2010, the profit from plant<strong>in</strong>g cotton experienced a sharp rise, and the<br />

<strong>in</strong>come of corn and wheat also steadily <strong>in</strong>creased, while <strong>in</strong>come from tomato grow<strong>in</strong>g<br />

experienced a notable decrease.<br />

The second largest production region is situated <strong>in</strong> Inner Mongolia. This prov<strong>in</strong>ce has<br />

enjoyed rapid growth <strong>in</strong> recent years and accounts for 15 to 20% of the total volume<br />

processed <strong>in</strong> Ch<strong>in</strong>a. However, the acreage of sunflower and corn has <strong>in</strong>creased <strong>in</strong><br />

this region, shr<strong>in</strong>k<strong>in</strong>g the tomato grow<strong>in</strong>g surfaces over the past few years. The third<br />

region is located <strong>in</strong> the Gansu prov<strong>in</strong>ce and accounts for about 5 to 10% of the total<br />

Ch<strong>in</strong>ese production of tomato paste. Recent years have also seen some<br />

developments <strong>in</strong> the N<strong>in</strong>gxia region.<br />

The first factories were set up between 1983 and 1985. The Ch<strong>in</strong>ese <strong>process<strong>in</strong>g</strong><br />

capacity reached 50 000 metric tonnes <strong>in</strong> 1995, and it is generally considered that<br />

the annual development rate did not run below 25 % from 1995 to 2004, but slowed<br />

down <strong>in</strong> recent years. To date, the ma<strong>in</strong> production capacity of the Ch<strong>in</strong>ese tomato<br />

<strong>process<strong>in</strong>g</strong> <strong>in</strong>dustry is shared between COFCO TunHe and Chalkis (a subsidiary of<br />

the X<strong>in</strong>jiang Production and Construction Group, also the owner of Tianje). The<br />

current capacity of Chalkis amounts to approximately 270 000 tonnes of paste<br />

whereas the TunHe group has a potential capacity of 335 000 tonnes. The third and<br />

fourth Ch<strong>in</strong>ese processors respectively are the Haohan Group (with an annual<br />

capacity of 150 000 tonnes) and the Guan Nong Group (55 000 tonnes).<br />

In 2011, the total surface planted with tomatoes <strong>in</strong> Ch<strong>in</strong>a amounted to 94 899 ha.<br />

The most commonly used varieties are local (80%), half of which are fixed varieties<br />

(Open Poll<strong>in</strong>ated), 30% are hybrids and 20% are He<strong>in</strong>z hybrids. Sow<strong>in</strong>g is carried out<br />

<strong>in</strong> greenhouses around March 10 th with plant<strong>in</strong>g out start<strong>in</strong>g after the last frosts<br />

around May 15 th . Depend<strong>in</strong>g on the region, the season gets under way between July<br />

20 th and the beg<strong>in</strong>n<strong>in</strong>g of August. It lasts about 60 days, until the beg<strong>in</strong>n<strong>in</strong>g of<br />

October. An <strong>in</strong>creas<strong>in</strong>g proportion of the crop (about 50%) is mach<strong>in</strong>e harvested.<br />

Depend<strong>in</strong>g on the situation, contracts are signed either with official local structures<br />

such as village authorities for an average planted area of 1 000 Mu (approximately<br />

67 hectares), or directly with producers who rent the land that belongs to the state.<br />

Contracts determ<strong>in</strong>e the area to be planted as well as provisional volumes. They also<br />

set out a program for plant<strong>in</strong>g and harvest<strong>in</strong>g, and <strong>in</strong>clude supplies of seeds and<br />

plant health <strong>in</strong>puts.

In market terms, the Ch<strong>in</strong>ese tomato <strong>in</strong>dustry has made an explosive entrance on the<br />

<strong>in</strong>ternational scene, with export volumes ris<strong>in</strong>g from 100 000 tonnes <strong>in</strong> 1999 to more<br />

than 1 million tonnes <strong>in</strong> 2010 and 1.1 million tonnes <strong>in</strong> 2011. Chronologically,<br />

Ch<strong>in</strong>ese exports were <strong>in</strong>itially shipped (1995 and 96) to the neighbor<strong>in</strong>g regions <strong>in</strong><br />

the Far East (Japan, Philipp<strong>in</strong>es, Korea). But the trade-flow was <strong>in</strong>creas<strong>in</strong>g with the<br />

European Union (Italy, Germany, UK) and Russia. This has been ma<strong>in</strong>ta<strong>in</strong>ed and<br />

consolidated over the past fifteen years. After 2004 and 2005, Ch<strong>in</strong>ese processors<br />

opened up new markets for their products, especially <strong>in</strong> North Africa (Algeria) and<br />

West Africa (Nigeria, Ghana, Togo). Currently, it is this region which is the ma<strong>in</strong><br />

market outlet for Ch<strong>in</strong>ese exports of tomato paste.<br />

Ch<strong>in</strong>a is a huge consumer of fresh table tomatoes. In 2009, the annual consumption<br />

of fresh tomatoes was 20 kilos per capita, but the consumption of processed tomato<br />

per capita was one kilo, only account<strong>in</strong>g for 5% of total consumption. However, this<br />

makes room for future developments, mak<strong>in</strong>g Ch<strong>in</strong>a a potential market for processed<br />

tomato consumption. Statistics show that fresh tomato consumption represented 98<br />

% of total consumption <strong>in</strong> 1999 and 95 % ten years later. Canned tomato paste<br />

(repacked or direct filled) is the largest category consumed, account<strong>in</strong>g for 60% of<br />

consumption. The rema<strong>in</strong><strong>in</strong>g categories <strong>in</strong>clude sauce and ketchup, diced and whole<br />

peeled, juice and lycopene, etc. In 2010, Ch<strong>in</strong>ese people consumed approximately<br />

1.02 million metric tonnes of processed tomatoes (farm weight equivalent), and the<br />

Ch<strong>in</strong>ese <strong>in</strong>dustry expects domestic consumption to reach 1.38 million tonnes (farm<br />

weight equivalent) by 2015.<br />

The Ch<strong>in</strong>ese tomato <strong>process<strong>in</strong>g</strong> <strong>in</strong>dustry is represented with<strong>in</strong> WPTC by the Ch<strong>in</strong>a<br />

Canned Food Industry Association (CCFIA).