Business plans - UK Power Networks

Business plans - UK Power Networks

Business plans - UK Power Networks

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

l<br />

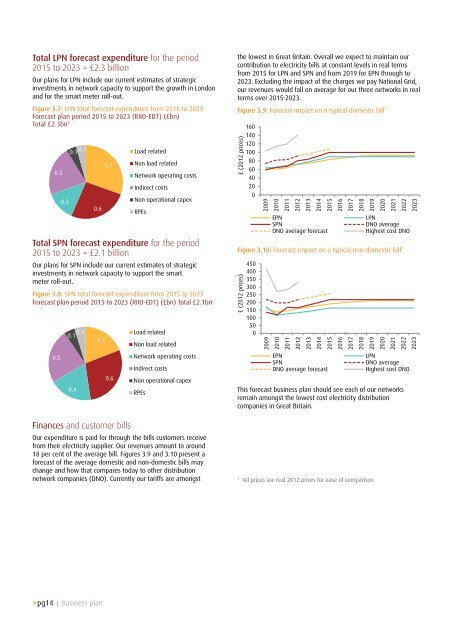

Total LPN forecast expenditure for the period<br />

2015 to 2023 = £2.3 billion<br />

Our <strong>plans</strong> for LPN include our current estimates of strategic<br />

investments in network capacity to support the growth in London<br />

and for the smart meter roll-out.<br />

Figure 3.7: LPN total forecast expenditure from 2015 to 2023<br />

Forecast plan period 2015 to 2023 (RIIO-ED1) (£bn)<br />

Total £2.3bn 5<br />

0.5<br />

0.3<br />

0.1 0.1 Load related<br />

0.6<br />

0.7<br />

Total SPN forecast expenditure for the period<br />

2015 to 2023 = £2.1 billion<br />

Our <strong>plans</strong> for SPN include our current estimates of strategic<br />

investments in network capacity to support the smart<br />

meter roll-out.<br />

Figure 3.8: SPN total forecast expenditure from 2015 to 2023<br />

Forecast plan period 2015 to 2023 (RIIO-ED1) (£bn) Total £2.1bn 5<br />

0.5<br />

Finances and customer bills<br />

Non load related<br />

Network operating costs<br />

Indirect costs<br />

Non operational capex<br />

RPEs<br />

0.1 Load related<br />

0.1<br />

0.4<br />

Non load related<br />

0.4<br />

0.6<br />

Network operating costs<br />

Indirect costs<br />

Non operational capex<br />

RPEs<br />

Our expenditure is paid for through the bills customers receive<br />

from their electricity supplier. Our revenues amount to around<br />

18 per cent of the average bill. Figures 3.9 and 3.10 present a<br />

forecast of the average domestic and non-domestic bills may<br />

change and how that compares today to other distribution<br />

network companies (DNO). Currently our tariffs are amongst<br />

the lowest in Great Britain. Overall we expect to maintain our<br />

contribution to electricity bills at constant levels in real terms<br />

from 2015 for LPN and SPN and from 2019 for EPN through to<br />

2023. Excluding the impact of the charges we pay National Grid,<br />

our revenues would fall on average for our three networks in real<br />

terms over 2015-2023.<br />

Figure 3.9: Forecast impact on a typical domestic bill 7<br />

£ (2012 prices)<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

2015<br />

2016<br />

2017<br />

2018<br />

2019<br />

2020<br />

2021<br />

2022<br />

2023<br />

EPN<br />

SPN<br />

DNO average forecast<br />

Figure 3.10: Forecast impact on a typical non-domestic bill 7<br />

£ (2012 prices)<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

This forecast business plan should see each of our networks<br />

remain amongst the lowest cost electricity distribution<br />

companies in Great Britain.<br />

7<br />

All prices are real 2012 prices for ease of comparison<br />

LPN<br />

DNO average<br />

Highest cost DNO<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

2015<br />

2016<br />

2017<br />

2018<br />

2019<br />

2020<br />

2021<br />

2022<br />

2023<br />

EPN<br />

SPN<br />

DNO average forecast<br />

LPN<br />

DNO average<br />

Highest cost DNO<br />

>pg14 | <strong>Business</strong> plan