Our mortgage range and rates - NatWest

Our mortgage range and rates - NatWest

Our mortgage range and rates - NatWest

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Our</strong> <strong>mortgage</strong><br />

<strong>range</strong> <strong>and</strong> <strong>rates</strong><br />

Only for use by <strong>mortgage</strong> intermediaries<br />

<strong>NatWest</strong> Bank Base Rate: 0.5%<br />

Issue 12 September 2012<br />

All <strong>rates</strong> correct as at 12.09.2012<br />

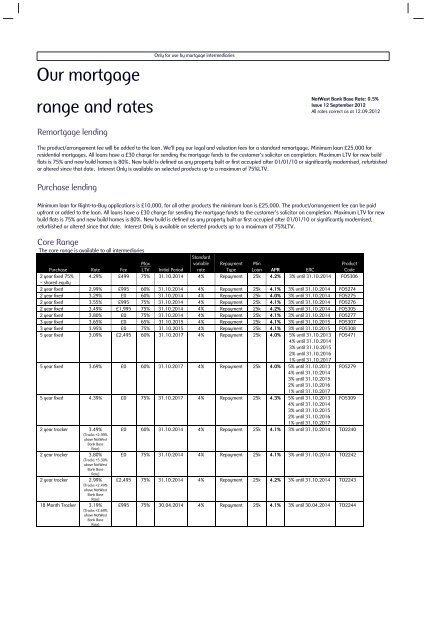

Re<strong>mortgage</strong> lending<br />

The product/ar<strong>range</strong>ment fee will be added to the loan. We’ll pay our legal <strong>and</strong> valuation fees for a st<strong>and</strong>ard re<strong>mortgage</strong>. Minimum loan £25,000 for<br />

residential <strong>mortgage</strong>s. All loans have a £30 charge for sending the <strong>mortgage</strong> funds to the customer’s solicitor on completion. Maximum LTV for new build<br />

flats is 75% <strong>and</strong> new build homes is 80%. New build is defined as any property built or first occupied after 01/01/10 or significantly modernised, refurbished<br />

or altered since that date. Interest Only is available on selected products up to a maximum of 75%LTV.<br />

Purchase lending<br />

Minimum loan for Right-to-Buy applications is £10,000, for all other products the minimum loan is £25,000. The product/ar<strong>range</strong>ment fee can be paid<br />

upfront or added to the loan. All loans have a £30 charge for sending the <strong>mortgage</strong> funds to the customer’s solicitor on completion. Maximum LTV for new<br />

build flats is 75% <strong>and</strong> new build homes is 80%. New build is defined as any property built or first occupied after 01/01/10 or significantly modernised,<br />

refurbished or altered since that date. Interest Only is available on selected products up to a maximum of 75%LTV.<br />

Core Range<br />

The core <strong>range</strong> is available to all intermediaries<br />

Purchase Rate Fee<br />

Max<br />

LTV Initial Period<br />

St<strong>and</strong>ard<br />

variable<br />

rate<br />

Repayment<br />

Type<br />

Min<br />

Loan APR ERC<br />

Product<br />

Code<br />

2 year fixed 75% 4.29% £499 75% 31.10.2014 4% Repayment 25k 4.2% 3% until 31.10.2014 FO5306<br />

– shared equity<br />

2 year fixed 2.99% £995 60% 31.10.2014 4% Repayment 25k 4.1% 3% until 31.10.2014 FO5274<br />

2 year fixed 3.29% £0 60% 31.10.2014 4% Repayment 25k 4.0%<br />

2 year fixed 3.55% £995 75% 31.10.2014 4% Repayment 25k 4.1%<br />

3% until 31.10.2014<br />

3% until 31.10.2014<br />

FO5275<br />

FO5276<br />

2 year fixed 3.49% £1,995 75% 31.10.2014 4% Repayment 25k 4.2% 3% until 31.10.2014 FO5305<br />

2 year fixed 3.80% £0 75% 31.10.2014 4% Repayment 25k 4.1% 3% until 31.10.2014 FO5277<br />

3 year fixed 3.65% £0 65% 31.10.2015 4% Repayment 25k 4.1% 3% until 31.10.2015 FO5307<br />

3 year fixed 3.95% £0 75% 31.10.2015 4% Repayment 25k 4.1% 3% until 31.10.2015 FO5308<br />

5 year fixed 3.09% £2,495 60% 31.10.2017 4% Repayment 25k 4.0% 5% until 31.10.2013 FO5471<br />

4% until 31.10.2014<br />

3% until 31.10.2015<br />

2% until 31.10.2016<br />

1% until 31.10.2017<br />

5 year fixed 3.69% £0 60% 31.10.2017 4% Repayment 25k 4.0% 5% until 31.10.2013 FO5279<br />

4% until 31.10.2014<br />

3% until 31.10.2015<br />

2% until 31.10.2016<br />

1% until 31.10.2017<br />

5 year fixed 4.39% £0 75% 31.10.2017 4% Repayment 25k 4.3% 5% until 31.10.2013 FO5309<br />

4% until 31.10.2014<br />

3% until 31.10.2015<br />

2% until 31.10.2016<br />

1% until 31.10.2017<br />

2 year tracker 3.49% £0 60% 31.10.2014 4% Repayment 25k 4.1% 3% until 31.10.2014 TO2240<br />

(Tracks +2.99%<br />

above <strong>NatWest</strong><br />

Bank Base<br />

Rate)<br />

2 year tracker 3.80% £0 75% 31.10.2014 4% Repayment 25k 4.1% 3% until 31.10.2014 TO2242<br />

(Tracks +3.30%<br />

above <strong>NatWest</strong><br />

Bank Base<br />

Rate)<br />

2 year tracker 2.99% £2,495 75% 31.10.2014 4% Repayment 25k 4.2% 3% until 31.10.2014 TO2243<br />

(Tracks +2.49%<br />

above <strong>NatWest</strong><br />

Bank Base<br />

Rate)<br />

18 Month Tracker 3.19%<br />

(Tracks +2.69%<br />

above <strong>NatWest</strong><br />

Bank Base<br />

Rate)<br />

£995 75% 30.04.2014 4% Repayment 25k 4.1% 3% until 30.04.2014 TO2244

Re<strong>mortgage</strong> Rate Fee<br />

Max<br />

LTV Initial Period<br />

St<strong>and</strong>ard<br />

variable<br />

rate<br />

Repayment<br />

Type<br />

Min<br />

Loan APR ERC<br />

Product<br />

Code<br />

2 year fixed 2.99% £995 60% 31.10.2014 4% Repayment 25k 4.0% 3% until 31.10.2014 FO5280<br />

2 year fixed 3.29% £0 60% 31.10.2014 4% Repayment 25k 3.9% 3% until 31.10.2014 FO5281<br />

2 year fixed 3.55% £995 75% 31.10.2014 4% Repayment 25k 4.1% 3% until 31.10.2014 FO5282<br />

2 year fixed 3.49% £1,995 75% 31.10.2014 4% Repayment 25k 4.2% 3% until 31.10.2014 FO5325<br />

2 year fixed 3.80% £0 75% 31.10.2014 4% Repayment 25k 4.0% 3% until 31.10.2014 FO5283<br />

3 year fixed 3.65% £0 65% 31.10.2015 4% Repayment 25k 4.0% 3% until 31.10.2015 FO5326<br />

3 year fixed 3.95% £0 75% 31.10.2015 4% Repayment 25k 4.1% 3% until 31.10.2015 FO5327<br />

5 year fixed 3.09% £2,495 60% 31.10.2017 4% Repayment 25k 4.0% 5% until 31.10.2013 FO5473<br />

4% until 31.10.2014<br />

3% until 31.10.2015<br />

2% until 31.10.2016<br />

1% until 31.10.2017<br />

5 year fixed 3.69% £0 60% 31.10.2017 4% Repayment 25k 3.9% 5% until 31.10.2013 FO5285<br />

4% until 31.10.2014<br />

3% until 31.10.2015<br />

2% until 31.10.2016<br />

1% until 31.10.2017<br />

5 year fixed 4.39% £0 75% 31.10.2017 4% Repayment 25k 4.1% 5% until 31.10.2013 FO5328<br />

4% until 31.10.2014<br />

3% until 31.10.2015<br />

2% until 31.10.2016<br />

1% until 31.10.2017<br />

2 year tracker 3.49% £0 60% 31.10.2014 4% Repayment 25k 4.0% 3% until 31.10.2014 TO2252<br />

(Tracks +2.99%<br />

above <strong>NatWest</strong><br />

Bank Base<br />

Rate)<br />

2 year tracker 3.80% £0 75% 31.10.2014 4% Repayment 25k 4.0% 3% until 31.10.2014 TO2254<br />

(Tracks +3.30%<br />

above <strong>NatWest</strong><br />

Bank Base<br />

Rate)<br />

2 year tracker 2.99% £2,495 75% 31.10.2014 4% Repayment 25k 4.1% 3% until 31.10.2014 TO2255<br />

(Tracks +2.49%<br />

above <strong>NatWest</strong><br />

Bank Base<br />

Rate)<br />

18 Month Tracker 3.19%<br />

(Tracks +2.69%<br />

above <strong>NatWest</strong><br />

Bank Base<br />

Rate)<br />

£995 75% 30.04.2014 4% Repayment 25k 4.0% 3% until 30.04.2014 TO2256

Current Account Range<br />

The current account <strong>range</strong> is available to all intermediaries<br />

Eligibility Criteria: at least one applicant must have a <strong>NatWest</strong> or RBS personal current account which was open on 1st July 2012 <strong>and</strong> which is still open at the time<br />

of application. For business customers sole traders <strong>and</strong> simple partnerships are also eligible. Limited company <strong>and</strong> commercial accounts are excluded.<br />

There is no minimum balance requirement.<br />

Purchase Rate Fee<br />

2 year fixed -<br />

£250 cash back<br />

-2 year fixed -<br />

£250 cash back<br />

2 year fixed -<br />

£250 cash back<br />

2 year fixed -<br />

£250 cash back<br />

2 year fixed -<br />

£250 cash back<br />

2 year fixed -<br />

£250 cash back<br />

2 year fixed -<br />

£250 cash back<br />

5 year fixed –<br />

£250 cash back<br />

5 year fixed –<br />

£250 cash back<br />

5 year fixed –<br />

£250 cash back<br />

5 year fixed –<br />

£250 cash back<br />

5 year fixed –<br />

£250 cash back<br />

5 year fixed –<br />

£250 cash back<br />

5 year fixed –<br />

£250 cash back<br />

5 year fixed –<br />

First Time Buyer<br />

Only<br />

2 year tracker –<br />

£250 cash back<br />

2 year tracker –<br />

£250 cash back<br />

2 year Tracker -<br />

£250 cash Back<br />

St<strong>and</strong>ard<br />

variable<br />

rate<br />

Max<br />

LTV Initial Period<br />

Repayment<br />

Type<br />

2.99% £995 60% 31.10.2014 4% Repayment<br />

& Interest<br />

Only<br />

Min<br />

Product<br />

Loan APR ERC<br />

Code<br />

25k 4.0% 3% until 31.10.2014 FO5310<br />

3.29% £0 60% 31.10.2014 4% Repayment<br />

& Interest<br />

Only<br />

25k 4.0% 3% until 31.10.2014 FO5311<br />

3.55% £995 75% 31.10.2014 4% Repayment 25k 4.1% 3% until 31.10.2014 FO5312<br />

& Interest<br />

Only<br />

3.80% £0 75% 31.10.2014 4% Repayment 25k 4.1% 3% until 31.10.2014 FO5313<br />

& Interest<br />

Only<br />

3.89% £995 80% 31.10.2014 4% Repayment 25k 4.2% 3% until 31.10.2014 FO5314<br />

4.19% £0 80% 31.10.2014 4% Repayment 25k 4.1% 3% until 31.10.2014 FO5315<br />

5.95% £995 90% 31.10.2014 4% Repayment 25k 4.6% 3% until 31.10.2014 FO5316<br />

3.09% £2,495 60% 31.10.2017 4% Repayment<br />

& Interest<br />

Only<br />

3.69% £0 60% 31.10.2017 4% Repayment<br />

& Interest<br />

Only<br />

4.19% £995 75% 31.10.2017 4% Repayment<br />

& Interest<br />

Only<br />

4.39% £0 75% 31.10.2017 4% Repayment<br />

& Interest<br />

Only<br />

25k 4.0% 5% until 31.10.2013<br />

4% until 31.10.2014<br />

3% until 31.10.2015<br />

2% until 31.10.2016<br />

1% until 31.10.2017<br />

25k 4.0% 5% until 31.10.2013<br />

4% until 31.10.2014<br />

3% until 31.10.2015<br />

2% until 31.10.2016<br />

1% until 31.10.2017<br />

25k 4.3% 5% until 31.10.2013<br />

4% until 31.10.2014<br />

3% until 31.10.2015<br />

2% until 31.10.2016<br />

1% until 31.10.2017<br />

25k 4.3% 5% until 31.10.2013<br />

4% until 31.10.2014<br />

3% until 31.10.2015<br />

2% until 31.10.2016<br />

1% until 31.10.2017<br />

4.59% £995 80% 31.10.2017 4% Repayment 25k 4.5% 5% until 31.10.2013<br />

4% until 31.10.2014<br />

3% until 31.10.2015<br />

2% until 31.10.2016<br />

1% until 31.10.2017<br />

4.89% £0 80% 31.10.2017 4% Repayment 25k 4.5% 5% until 31.10.2013<br />

4% until 31.10.2014<br />

3% until 31.10.2015<br />

2% until 31.10.2016<br />

1% until 31.10.2017<br />

6.19% £995 90% 31.10.2017 4% Repayment 25k 5.2% 5% until 31.10.2013<br />

4% until 31.10.2014<br />

3% until 31.10.2015<br />

2% until 31.10.2016<br />

1% until 31.10.2017<br />

4.79% £0 90% 31.10.2017 4% Repayment 25k 4.5% 5% until 31.10.2013<br />

4% until 31.10.2014<br />

3% until 31.10.2015<br />

2% until 31.10.2016<br />

1% until 31.10.2017<br />

3.49%<br />

(Tracks +2.99%<br />

above <strong>NatWest</strong><br />

Bank Base<br />

Rate)<br />

3.80%<br />

(Tracks +3.30%<br />

above <strong>NatWest</strong><br />

Bank Base<br />

Rate)<br />

4.09%<br />

(Tracks +3.59%<br />

above <strong>NatWest</strong><br />

Bank Base<br />

Rate)<br />

£0 60% 31.10.2014 4% Repayment<br />

& Interest<br />

Only<br />

£0 75% 31.10.2014 4% Repayment<br />

& Interest<br />

Only<br />

FO5472<br />

FO5318<br />

FO5319<br />

FO5320<br />

FO5321<br />

FO5322<br />

FO5323<br />

FO5324<br />

25k 4.0% 3% until 31.10.2014 TO2246<br />

25k 4.1% 3% until 31.10.2014 TO2248<br />

£0 80% 31.10.2014 4% Repayment 25k 4.1% 3% until 31.10.2014 TO2250

Re<strong>mortgage</strong> Rate Fee<br />

2 year fixed -<br />

£250 cash back<br />

-2 year fixed -<br />

£250 cash back<br />

2 year fixed -<br />

£250 cash back<br />

2 year fixed -<br />

£250 cash back<br />

2 year fixed -<br />

£250 cash back<br />

2 year fixed -<br />

£250 cash back<br />

2 year fixed -<br />

£250 cash back<br />

5 year fixed –<br />

£250 cash back<br />

5 year fixed –<br />

£250 cash back<br />

5 year fixed –<br />

£250 cash back<br />

5 year fixed –<br />

£250 cash back<br />

5 year fixed –<br />

£250 cash back<br />

5 year fixed –<br />

£250 cash back<br />

5 year fixed –<br />

£250 cash back<br />

2 year tracker –<br />

£250 cash back<br />

2 year tracker –<br />

£250 cash back<br />

2 year Tracker -<br />

£250 cash Back<br />

St<strong>and</strong>ard<br />

variable<br />

rate<br />

Max<br />

LTV Initial Period<br />

Repayment<br />

Type<br />

2.99% £995 60% 31.10.2014 4% Repayment<br />

& Interest<br />

Only<br />

Min<br />

Product<br />

Loan APR ERC<br />

Code<br />

25k 4.0% 3% until 31.10.2014 FO5329<br />

3.29% £0 60% 31.10.2014 4% Repayment<br />

& Interest<br />

Only<br />

25k 3.9% 3% until 31.10.2014 FO5330<br />

3.55% £995 75% 31.10.2014 4% Repayment 25k 4.1% 3% until 31.10.2014 FO5331<br />

& Interest<br />

Only<br />

3.80% £0 75% 31.10.2014 4% Repayment 25k 4.0% 3% until 31.10.2014 FO5332<br />

& Interest<br />

Only<br />

3.89% £995 80% 31.10.2014 4% Repayment 25k 4.1% 3% until 31.10.2014 FO5333<br />

4.19% £0 80% 31.10.2014 4% Repayment 25k 4.1% 3% until 31.10.2014 FO5334<br />

5.95% £995 90% 31.10.2014 4% Repayment 25k 4.5% 3% until 31.10.2014 FO5335<br />

3.09% £2,495 60% 31.10.2017 4% Repayment<br />

& Interest<br />

Only<br />

3.69% £0 60% 31.10.2017 4% Repayment<br />

& Interest<br />

Only<br />

4.19% £995 75% 31.10.2017 4% Repayment<br />

& Interest<br />

Only<br />

4.39% £0 75% 31.10.2017 4% Repayment<br />

& Interest<br />

Only<br />

25k 3.9% 5% until 31.10.2013<br />

4% until 31.10.2014<br />

3% until 31.10.2015<br />

2% until 31.10.2016<br />

1% until 31.10.2017<br />

25k 3.9% 5% until 31.10.2013<br />

4% until 31.10.2014<br />

3% until 31.10.2015<br />

2% until 31.10.2016<br />

1% until 31.10.2017<br />

25k 4.2% 5% until 31.10.2013<br />

4% until 31.10.2014<br />

3% until 31.10.2015<br />

2% until 31.10.2016<br />

1% until 31.10.2017<br />

25k 4.2% 5% until 31.10.2013<br />

4% until 31.10.2014<br />

3% until 31.10.2015<br />

2% until 31.10.2016<br />

1% until 31.10.2017<br />

4.59% £995 80% 31.10.2017 4% Repayment 25k 4.4% 5% until 31.10.2013<br />

4% until 31.10.2014<br />

3% until 31.10.2015<br />

2% until 31.10.2016<br />

1% until 31.10.2017<br />

4.89% £0 80% 31.10.2017 4% Repayment 25k 4.4% 5% until 31.10.2013<br />

4% until 31.10.2014<br />

3% until 31.10.2015<br />

2% until 31.10.2016<br />

1% until 31.10.2017<br />

6.19% £995 90% 31.10.2017 4% Repayment 25k 5.1% 5% until 31.10.2013<br />

4% until 31.10.2014<br />

3% until 31.10.2015<br />

2% until 31.10.2016<br />

1% until 31.10.2017<br />

3.49%<br />

(Tracks +2.99%<br />

above <strong>NatWest</strong><br />

Bank Base<br />

Rate)<br />

3.80%<br />

(Tracks +3.30%<br />

above <strong>NatWest</strong><br />

Bank Base<br />

Rate)<br />

4.09%<br />

(Tracks +3.59%<br />

above <strong>NatWest</strong><br />

Bank Base<br />

Rate)<br />

£0 60% 31.10.2014 4% Repayment<br />

& Interest<br />

Only<br />

£0 75% 31.10.2014 4% Repayment<br />

& Interest<br />

Only<br />

FO5474<br />

FO5337<br />

FO5338<br />

FO5339<br />

FO5340<br />

FO5341<br />

FO5342<br />

25k 4.0% 3% until 31.10.2014 TO2258<br />

25k 4.0% 3% until 31.10.2014 TO2260<br />

£0 80% 31.10.2014 4% Repayment 25k 4.1% 3% until 31.10.2014 TO2262

Buy-to-let lending<br />

The Buy-to-let <strong>range</strong> is available to all intermediaries<br />

Purchase Rate Fee<br />

Max<br />

LTV Initial Period<br />

St<strong>and</strong>ard<br />

variable<br />

rate<br />

Repayment<br />

Type<br />

2 year fixed – BTL 3.49% £1,999 60% 31.10.2014 4.50% Repayment<br />

& Interest<br />

Only<br />

2 year fixed – BTL 4.49% £1,999 75% 31.10.2014 4.50% Repayment<br />

& Interest<br />

Only<br />

2 year tracker –<br />

BTL<br />

2 year tracker –<br />

BTL<br />

3.49%<br />

(Tracks +2.99%<br />

above <strong>NatWest</strong><br />

Bank Base<br />

Rate)<br />

4.09%<br />

(Tracks +3.59%<br />

above <strong>NatWest</strong><br />

Bank Base<br />

Rate)<br />

£1,999 60% 31.10.2014 4.50% Repayment<br />

& Interest<br />

Only<br />

£1,999 75% 31.10.2014 4.50% Repayment<br />

& Interest<br />

Only<br />

Remo<br />

Max<br />

St<strong>and</strong>ard<br />

variable Repayment<br />

rtgage Rate Fee LTV Initial Period rate Type<br />

2 year fixed – BTL 3.49% £1,999 60% 31.10.2014 4.50% Repayment<br />

& Interest<br />

Only<br />

2 year fixed – BTL 4.49% £1,999 75% 31.10.2014 4.50% Repayment<br />

& Interest<br />

Only<br />

2 year tracker –<br />

BTL<br />

2 year tracker –<br />

BTL<br />

3.49%<br />

(Tracks +2.99%<br />

above <strong>NatWest</strong><br />

Bank Base<br />

Rate)<br />

4.09%<br />

(Tracks +3.59%<br />

above <strong>NatWest</strong><br />

Bank Base<br />

Rate)<br />

£1,999 60% 31.10.2014 4.50% Repayment<br />

& Interest<br />

Only<br />

£1,999 75% 31.10.2014 4.50% Repayment<br />

& Interest<br />

Only<br />

Product<br />

Min<br />

Code<br />

Loan APR ERC<br />

15k 4.8% 3% until 31.10.2014 FO5249<br />

15k 4.8% 3% until 31.10.2014 FO5344<br />

15k 4.8% 3% until 31.07.2014 TO2226<br />

15k 4.8% 3% until 31.07.2014 TO2264<br />

Product<br />

Min<br />

Code<br />

Loan APR ERC<br />

15k 4.7% 3% until 31.10.2014 FO5343<br />

15k 4.8% 3% until 31.10.2014 FO5345<br />

15k 4.7% 3% until 31.07.2014 TO2263<br />

15k 4.7% 3% until 31.07.2014 TO2265<br />

0845 900 1110 www.natwest.com/intermediarysolutions<br />

<strong>NatWest</strong> <strong>mortgage</strong>s are provided by National Westminster Home Loans Limited. NWis 8018 02/05/2012

Transitional Ar<strong>range</strong>ments & Missing Information Process<br />

Please see the Latest News section on intermediary.natwest.com for this information.<br />

Additional notes<br />

On re<strong>mortgage</strong>-only deals, we’ll pay our legal <strong>and</strong> valuation fees for a st<strong>and</strong>ard re<strong>mortgage</strong>. The customer must meet their own legal <strong>and</strong> valuation costs on<br />

all other products. The product/ar<strong>range</strong>ment fee can be paid upfront or added to the loan. Minimum loan for all products is £15,000 (minimum property<br />

value/purchase price for buy-to-let is £50,000). All products have a £30 charge for sending the <strong>mortgage</strong> funds to the customer’s solicitor on completion.<br />

Maximum LTV is 75% (65% on new build flats/houses). New build is defined as any property built or first occupied after 01/01/10 or significantly<br />

modernised, refurbished or altered since that date.<br />

All products<br />

If the application is withdrawn before offer, the product/ar<strong>range</strong>ment fee will not be applied <strong>and</strong>, if it was paid up front, will be refunded to the customer.<br />

If the application is withdrawn after offer, the product/ar<strong>range</strong>ment fee will be applied.<br />

Interest Only Criteria<br />

• Have a minimum of the last three months’ salary, of at least £1,000 a month, paid into their <strong>NatWest</strong> or RBS current account<br />

• Earn a minimum of £50,000 pa gross basic salary (i.e. before any regular overtime/bonus income is taken into account). For joint applications, the main<br />

applicant must earn at least £50,000 gross basic salary.<br />

• Have a suitable repayment vehicle in place for the term of the loan. St<strong>and</strong>ard repayment vehicles that are acceptable are endowments, pensions <strong>and</strong><br />

ISAs/PEPs. Enhanced repayment vehicles can be used provided the applicant fulfils additional criteria.<br />

2011/12 Your Mortgage Awards<br />

The Your Mortgage Awards celebrate those <strong>mortgage</strong> brokers, lenders <strong>and</strong> associated product providers that have excelled in their field over<br />

the past year.<br />

<strong>NatWest</strong> won the following categories:<br />

Best Bank for Mortgages — <strong>NatWest</strong><br />

Best First-time Buyer Lender — <strong>NatWest</strong><br />

Best Large Loans Mortgage Lender — <strong>NatWest</strong><br />

If you have any questions on this or any other queries, please contact us via livetalk, we’re open 9am to 5.15pm, Monday to Friday or visit us at<br />

intermediary.natwest.com<br />

Intermediary Solutions

![[PDF] NatWest Welcome Account](https://img.yumpu.com/50935011/1/124x260/pdf-natwest-welcome-account.jpg?quality=85)

![[PDF] NatWest Welcome Account](https://img.yumpu.com/50820486/1/123x260/pdf-natwest-welcome-account.jpg?quality=85)

![[PDF] Graduate Accounts Application Form - NatWest](https://img.yumpu.com/49773169/1/182x260/pdf-graduate-accounts-application-form-natwest.jpg?quality=85)