You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

38<br />

On-net Pricing in Mobile Moving the debate forward • The Policy Paper Series • Number 8 • April 2008<br />

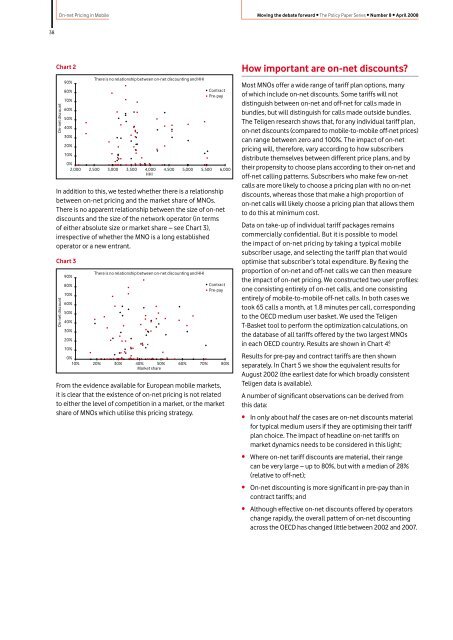

Chart 2<br />

On-net discount<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

There is no relationship between on-net discounting and HHI<br />

Contract<br />

Pre-pay<br />

0%<br />

2,000 2,500 3,000 3,500 4,000<br />

HHI<br />

4,500 5,000 5,500 6,000<br />

In addition to this, we tested whether there is a relationship<br />

between on-net pricing and the market share of MNOs.<br />

There is no apparent relationship between the size of on-net<br />

discounts and the size of the network operator (in terms<br />

of either absolute size or market share – see Chart 3),<br />

irrespective of whether the MNO is a long established<br />

operator or a new entrant.<br />

Chart 3<br />

On-net discount<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

There is no relationship between on-net discounting and HHI<br />

Contract<br />

Pre-pay<br />

0%<br />

10% 20% 30% 40% 50% 60% 70% 80%<br />

Market share<br />

From the evidence available for European mobile markets,<br />

it is clear that the existence of on-net pricing is not related<br />

to either the level of competition in a market, or the market<br />

share of MNOs which utilise this pricing strategy.<br />

How important are on-net discounts?<br />

Most MNOs offer a wide range of tariff plan options, many<br />

of which include on-net discounts. Some tariffs will not<br />

distinguish between on-net and off-net for calls made in<br />

bundles, but will distinguish for calls made outside bundles.<br />

The Teligen research shows that, for any individual tariff plan,<br />

on-net discounts (compared to mobile-to-mobile off-net prices)<br />

can range between zero and 100%. The impact of on-net<br />

pricing will, therefore, vary according to how subscribers<br />

distribute themselves between different price plans, and by<br />

their propensity to choose plans according to their on-net and<br />

off-net calling patterns. Subscribers who make few on-net<br />

calls are more likely to choose a pricing plan with no on-net<br />

discounts, whereas those that make a high proportion of<br />

on-net calls will likely choose a pricing plan that allows them<br />

to do this at minimum cost.<br />

Data on take-up of individual tariff packages remains<br />

commercially confidential. But it is possible to model<br />

the impact of on-net pricing by taking a typical mobile<br />

subscriber usage, and selecting the tariff plan that would<br />

optimise that subscriber’s total expenditure. By flexing the<br />

proportion of on-net and off-net calls we can then measure<br />

the impact of on-net pricing. We constructed two user profiles:<br />

one consisting entirely of on-net calls, and one consisting<br />

entirely of mobile-to-mobile off-net calls. In both cases we<br />

took 65 calls a month, at 1.8 minutes per call, corresponding<br />

to the OECD medium user basket. We used the Teligen<br />

T-Basket tool to perform the optimization calculations, on<br />

the database of all tariffs offered by the two largest MNOs<br />

in each OECD country. Results are shown in Chart 4. 6<br />

Results for pre-pay and contract tariffs are then shown<br />

separately. In Chart 5 we show the equivalent results for<br />

August 2002 (the earliest date for which broadly consistent<br />

Teligen data is available).<br />

A number of significant observations can be derived from<br />

this data:<br />

• In only about half the cases are on-net discounts material<br />

for typical medium users if they are optimising their tariff<br />

plan choice. The impact of headline on-net tariffs on<br />

market dynamics needs to be considered in this light;<br />

• Where on-net tariff discounts are material, their range<br />

can be very large – up to 80%, but with a median of 28%<br />

(relative to off-net);<br />

• On-net discounting is more significant in pre-pay than in<br />

contract tariffs; and<br />

• Although effective on-net discounts offered by operators<br />

change rapidly, the overall pattern of on-net discounting<br />

across the OECD has changed little between 2002 and 2007.