Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6<br />

On-net Pricing in Mobile Moving the debate forward • The Policy Paper Series • Number 8 • April 2008<br />

relevant fact when we consider groups of individuals which<br />

share social ties (ie. families, groups of friends, co-workers,<br />

etc.). These social groups determine “exogenous” networks,<br />

for which the network effect is particularly strong.<br />

The network effect becomes even more relevant if the billing<br />

system is ruled by the calling party pays (CPP) principle.<br />

When CPP is used, as in Europe, users generally do not care<br />

much about the price of call termination, since they do not pay<br />

directly for that service. This is not, however, the case within<br />

so-called closed user groups (CUGs). Within the members of a<br />

family or a company, users care for the welfare of their callers<br />

(and very often, as in families or companies, they even pay for<br />

the bills of their callers) and, as a consequence, this increases<br />

their sensitivity to the costs of terminating calls. In this case,<br />

the network externality is “internalized”.<br />

It is therefore not surprising that on-net calls tend to be much<br />

lower than off-net calls in telephony markets. With these price<br />

differentials companies either try to develop “endogenously”<br />

closed user groups or communities (ie. this has been the<br />

strategy recently of the retailer Carphone Warehouse1 in<br />

the UK and Spanish cable operators such as ONO), or try to<br />

capture market share by incorporating into their client base<br />

exogenous CUGs, such as families, groups of friends or groups<br />

of employees working for specific companies (in mobile,<br />

pricing plans target families (ie. TME’s Plus Familia) or friends<br />

(ie. Amena’s Duo) and this is of course also a feature present<br />

in many products of <strong>Vodafone</strong> targeting the business market<br />

(ie. Planes Universales and VPN). To be able to capture these<br />

customer groups, firms compete by offering pricing plans that<br />

lower the cost of on-net calls. Users recognize that most of<br />

their calls are placed within the CUG and, as a consequence,<br />

they are attracted by these price advantages. Examples of low<br />

(or even free) on net calls abound both for fixed and mobile<br />

telephony in many EU markets.<br />

These basic economic features of telephony markets and their<br />

consequences for firm strategy are clearly detected in the<br />

recent evolution of the Spanish voice telephony market and,<br />

in particular, in mobile telephony.<br />

Mobile competition<br />

In the Spanish market there are three main providers of<br />

mobile network and retail services: Telefónica Móviles España<br />

(TME), <strong>Vodafone</strong> and Amena, although a fourth licensee<br />

(Xfera) can enter the market with the introduction of 3G<br />

services. The current market leader is TME with more than<br />

half of the market, followed by <strong>Vodafone</strong> and Amena, both<br />

with market shares below 30% (see table 1). In recent times,<br />

the third provider (Amena) has gained market share at the<br />

expense of both TME and <strong>Vodafone</strong>.<br />

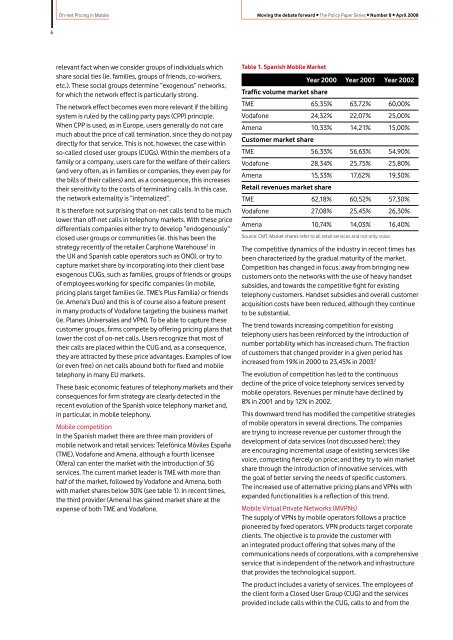

Table 1. Spanish Mobile Market<br />

Year 2000<br />

Traffic volume market share<br />

Year 2001 Year 2002<br />

TME 65,35% 63,72% 60,00%<br />

<strong>Vodafone</strong> 24,32% 22,07% 25,00%<br />

Amena 10,33% 14,21% 15,00%<br />

Customer market share<br />

TME 56,33% 56,63% 54,90%<br />

<strong>Vodafone</strong> 28,34% 25,75% 25,80%<br />

Amena 15,33% 17,62% 19,30%<br />

Retail revenues market share<br />

TME 62,18% 60,52% 57,30%<br />

<strong>Vodafone</strong> 27,08% 25,45% 26,30%<br />

Amena 10,74% 14,03% 16,40%<br />

Source: CMT. Market shares refer to all retail services and not only voice.<br />

The competitive dynamics of the industry in recent times has<br />

been characterized by the gradual maturity of the market.<br />

Competition has changed in focus, away from bringing new<br />

customers onto the networks with the use of heavy handset<br />

subsidies, and towards the competitive fight for existing<br />

telephony customers. Handset subsidies and overall customer<br />

acquisition costs have been reduced, although they continue<br />

to be substantial.<br />

The trend towards increasing competition for existing<br />

telephony users has been reinforced by the introduction of<br />

number portability which has increased churn. The fraction<br />

of customers that changed provider in a given period has<br />

increased from 19% in 2000 to 23,45% in 2003. 2<br />

The evolution of competition has led to the continuous<br />

decline of the price of voice telephony services served by<br />

mobile operators. Revenues per minute have declined by<br />

8% in 2001 and by 12% in 2002.<br />

This downward trend has modified the competitive strategies<br />

of mobile operators in several directions. The companies<br />

are trying to increase revenue per customer through the<br />

development of data services (not discussed here); they<br />

are encouraging incremental usage of existing services like<br />

voice, competing fiercely on price; and they try to win market<br />

share through the introduction of innovative services, with<br />

the goal of better serving the needs of specific customers.<br />

The increased use of alternative pricing plans and VPNs with<br />

expanded functionalities is a reflection of this trend.<br />

Mobile Virtual Private Networks (MVPNs)<br />

The supply of VPNs by mobile operators follows a practice<br />

pioneered by fixed operators. VPN products target corporate<br />

clients. The objective is to provide the customer with<br />

an integrated product offering that solves many of the<br />

communications needs of corporations, with a comprehensive<br />

service that is independent of the network and infrastructure<br />

that provides the technological support.<br />

The product includes a variety of services. The employees of<br />

the client form a Closed User Group (CUG) and the services<br />

provided include calls within the CUG, calls to and from the