Zambia - Oakland Institute

Zambia - Oakland Institute

Zambia - Oakland Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

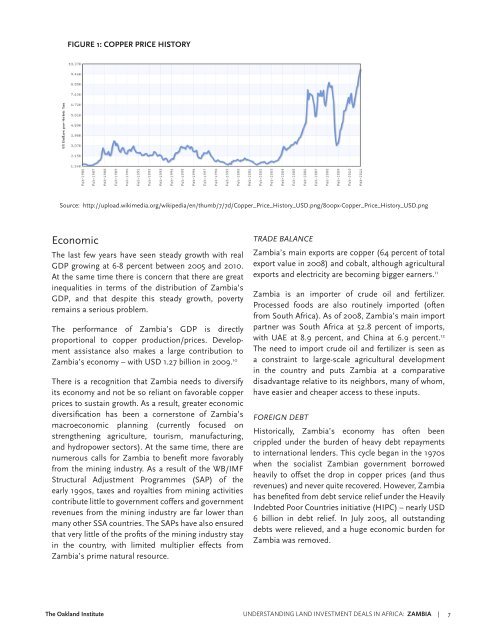

FIGURE 1: COPPER PRICE HISTORY<br />

Source: http://upload.wikimedia.org/wikipedia/en/thumb/7/7d/Copper_Price_History_USD.png/800px-Copper_Price_History_USD.png<br />

Economic<br />

The last few years have seen steady growth with real<br />

GDP growing at 6-8 percent between 2005 and 2010.<br />

At the same time there is concern that there are great<br />

inequalities in terms of the distribution of <strong>Zambia</strong>’s<br />

GDP, and that despite this steady growth, poverty<br />

remains a serious problem.<br />

The performance of <strong>Zambia</strong>’s GDP is directly<br />

proportional to copper production/prices. Development<br />

assistance also makes a large contribution to<br />

<strong>Zambia</strong>’s economy – with USD 1.27 billion in 2009. 10<br />

There is a recognition that <strong>Zambia</strong> needs to diversify<br />

its economy and not be so reliant on favorable copper<br />

prices to sustain growth. As a result, greater economic<br />

diversification has been a cornerstone of <strong>Zambia</strong>’s<br />

macroeconomic planning (currently focused on<br />

strengthening agriculture, tourism, manufacturing,<br />

and hydropower sectors). At the same time, there are<br />

numerous calls for <strong>Zambia</strong> to benefit more favorably<br />

from the mining industry. As a result of the WB/IMF<br />

Structural Adjustment Programmes (SAP) of the<br />

early 1990s, taxes and royalties from mining activities<br />

contribute little to government coffers and government<br />

revenues from the mining industry are far lower than<br />

many other SSA countries. The SAPs have also ensured<br />

that very little of the profits of the mining industry stay<br />

in the country, with limited multiplier effects from<br />

<strong>Zambia</strong>’s prime natural resource.<br />

TRADE BALANCE<br />

<strong>Zambia</strong>’s main exports are copper (64 percent of total<br />

export value in 2008) and cobalt, although agricultural<br />

exports and electricity are becoming bigger earners. 11<br />

<strong>Zambia</strong> is an importer of crude oil and fertilizer.<br />

Processed foods are also routinely imported (often<br />

from South Africa). As of 2008, <strong>Zambia</strong>’s main import<br />

partner was South Africa at 52.8 percent of imports,<br />

with UAE at 8.9 percent, and China at 6.9 percent. 12<br />

The need to import crude oil and fertilizer is seen as<br />

a constraint to large-scale agricultural development<br />

in the country and puts <strong>Zambia</strong> at a comparative<br />

disadvantage relative to its neighbors, many of whom,<br />

have easier and cheaper access to these inputs.<br />

FOREIGN DEBT<br />

Historically, <strong>Zambia</strong>’s economy has often been<br />

crippled under the burden of heavy debt repayments<br />

to international lenders. This cycle began in the 1970s<br />

when the socialist <strong>Zambia</strong>n government borrowed<br />

heavily to offset the drop in copper prices (and thus<br />

revenues) and never quite recovered. However, <strong>Zambia</strong><br />

has benefited from debt service relief under the Heavily<br />

Indebted Poor Countries initiative (HIPC) – nearly USD<br />

6 billion in debt relief. In July 2005, all outstanding<br />

debts were relieved, and a huge economic burden for<br />

<strong>Zambia</strong> was removed.<br />

The <strong>Oakland</strong> <strong>Institute</strong> UNDERSTANDING LAND INVESTMENT DEALS IN AFRICA: ZAMBIA | 7