Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Fund Folio<br />

{ Corporate finance }<br />

Debt<br />

challenge<br />

The Gulf’s credit quality<br />

declines as SWFs shun bailouts<br />

of distressed companies<br />

COMPANIES in the Gulf Arab states are seen<br />

<strong>to</strong> accept a more expensive funding in<br />

exchange for better long-term liquidity, as<br />

they will struggle <strong>to</strong> refinance maturing debt<br />

instruments, and the state-owned investment<br />

funds remain <strong>to</strong> be passive long-term inves<strong>to</strong>rs. This will<br />

not change the rating activity for companies while the<br />

world’s sovereign wealth funds (SWFs) wait for better value<br />

later in the year before making new investments.<br />

“In turn, we see new rating activity remaining steady<br />

with greater need for differentiation of credit risk, and<br />

in line with companies’ attempts <strong>to</strong> lock in liquidity as<br />

it becomes available,” said Moody’s Inves<strong>to</strong>rs Service in<br />

a corporate finance outlook. The global rating agency<br />

also described the overall credit quality in the Gulf<br />

Co-operation Council (GCC) as having “declined”, and said<br />

this is “likely <strong>to</strong> continue <strong>to</strong> do so going forward”.<br />

The SWFs, according <strong>to</strong> the Financial Dynamics<br />

International, are interested <strong>to</strong> acquire minority stakes<br />

in listed companies without playing any management<br />

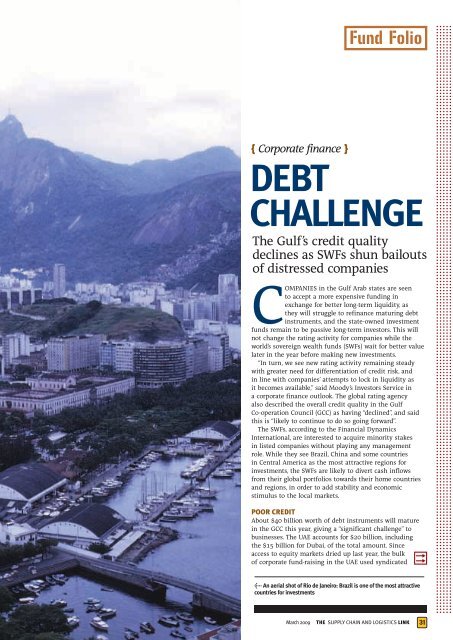

role. While they see Brazil, China and some countries<br />

in Central America as the most attractive regions for<br />

investments, the SWFs are likely <strong>to</strong> divert cash inflows<br />

from their global portfolios <strong>to</strong>wards their home countries<br />

and regions, in order <strong>to</strong> add stability and economic<br />

stimulus <strong>to</strong> the local markets.<br />

POOR CREDIT<br />

About $40 billion worth of debt instruments will mature<br />

in the GCC this year, giving a “significant challenge” <strong>to</strong><br />

businesses. The UAE accounts for $20 billion, including<br />

the $15 billion for Dubai, of the <strong>to</strong>tal amount. Since<br />

access <strong>to</strong> equity markets dried up last year, the bulk<br />

of corporate fund-raising in the UAE used syndicated<br />

< An aerial shot of Rio de Janeiro: Brazil is one of the most attractive<br />

countries for investments<br />

March 2009 The supply chain and logistics link 31