Amadeus Introductory presentation - Investor relations at Amadeus

Amadeus Introductory presentation - Investor relations at Amadeus

Amadeus Introductory presentation - Investor relations at Amadeus

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

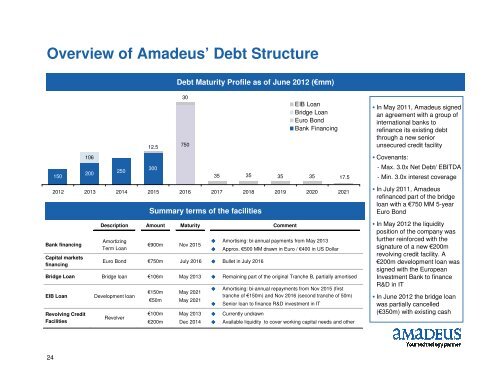

Overview of <strong>Amadeus</strong>’ Debt Structure<br />

Debt M<strong>at</strong>urity Profile as of June 2012 (€mm)<br />

Bank financing<br />

Capital markets<br />

financing<br />

Summary terms of the facilities<br />

Description Amount M<strong>at</strong>urity Comment<br />

Amortizing<br />

Term Loan<br />

€900m Nov 2015<br />

Euro Bond €750m July 2016 Bullet in July 2016<br />

Amortising: bi-annual payments from May 2013<br />

<br />

Approx. €500 MM drawn in Euro / €400 in US Dollar<br />

Bridge Loan Bridge loan €106m May 2013 Remaining part of the original Tranche B, partially amortised<br />

EIB Loan<br />

Revolving Credit<br />

Facilities<br />

106<br />

Development loan<br />

Revolver<br />

12.5<br />

€150m<br />

€50m<br />

€100m<br />

€200m<br />

30<br />

750<br />

May 2021<br />

May 2021<br />

May 2013<br />

Dec 2014<br />

<br />

<br />

<br />

<br />

Amortising: bi-annual repayments from Nov 2015 (first<br />

tranche of €150m) and Nov 2016 (second tranche of 50m)<br />

Senior loan to finance R&D investment in IT<br />

Currently undrawn<br />

EIB Loan<br />

Bridge Loan<br />

Euro Bond<br />

Bank Financing<br />

300<br />

200<br />

250<br />

150 35 35 35 35 17.5<br />

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021<br />

Available liquidity to cover working capital needs and other<br />

In May 2011, <strong>Amadeus</strong> signed<br />

an agreement with a group of<br />

intern<strong>at</strong>ional banks to<br />

refinance its existing debt<br />

through a new senior<br />

unsecured credit facility<br />

Covenants:<br />

- Max. 3.0x Net Debt/ EBITDA<br />

- Min. 3.0x interest coverage<br />

In July 2011, <strong>Amadeus</strong><br />

refinanced part of the bridge<br />

loan with a €750 MM 5-year<br />

Euro Bond<br />

In May 2012 the liquidity<br />

position of the company was<br />

further reinforced with the<br />

sign<strong>at</strong>ure of a new €200m<br />

revolving credit facility. A<br />

€200m development loan was<br />

signed with the European<br />

Investment Bank to finance<br />

R&D in IT<br />

In June 2012 the bridge loan<br />

was partially cancelled<br />

(€350m) with existing cash<br />

24