George (Yuqi) Gu - Fox School of Business - Temple University

George (Yuqi) Gu - Fox School of Business - Temple University

George (Yuqi) Gu - Fox School of Business - Temple University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

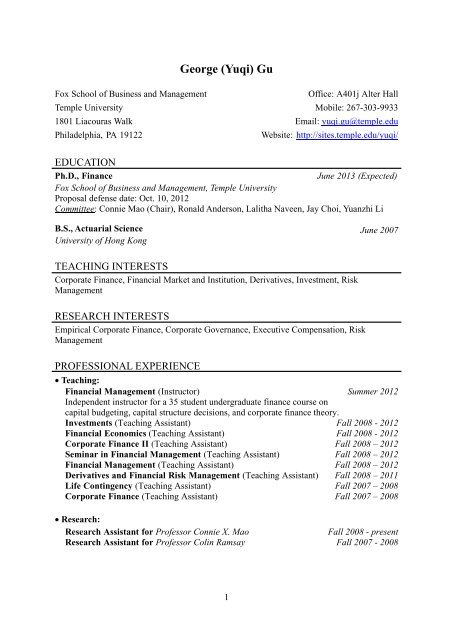

<strong>George</strong> (<strong>Yuqi</strong>) <strong>Gu</strong><br />

<strong>Fox</strong> <strong>School</strong> <strong>of</strong> <strong>Business</strong> and Management<br />

Office: A401j Alter Hall<br />

<strong>Temple</strong> <strong>University</strong> Mobile: 267-303-9933<br />

1801 Liacouras Walk Email: yuqi.gu@temple.edu<br />

Philadelphia, PA 19122<br />

Website: http://sites.temple.edu/yuqi/<br />

EDUCATION<br />

Ph.D., Finance<br />

June 2013 (Expected)<br />

<strong>Fox</strong> <strong>School</strong> <strong>of</strong> <strong>Business</strong> and Management, <strong>Temple</strong> <strong>University</strong><br />

Proposal defense date: Oct. 10, 2012<br />

Committee: Connie Mao (Chair), Ronald Anderson, Lalitha Naveen, Jay Choi, Yuanzhi Li<br />

B.S., Actuarial Science<br />

<strong>University</strong> <strong>of</strong> Hong Kong<br />

June 2007<br />

TEACHING INTERESTS<br />

Corporate Finance, Financial Market and Institution, Derivatives, Investment, Risk<br />

Management<br />

RESEARCH INTERESTS<br />

Empirical Corporate Finance, Corporate Governance, Executive Compensation, Risk<br />

Management<br />

PROFESSIONAL EXPERIENCE<br />

• Teaching:<br />

Financial Management (Instructor) Summer 2012<br />

Independent instructor for a 35 student undergraduate finance course on<br />

capital budgeting, capital structure decisions, and corporate finance theory.<br />

Investments (Teaching Assistant) Fall 2008 - 2012<br />

Financial Economics (Teaching Assistant) Fall 2008 - 2012<br />

Corporate Finance II (Teaching Assistant) Fall 2008 – 2012<br />

Seminar in Financial Management (Teaching Assistant) Fall 2008 – 2012<br />

Financial Management (Teaching Assistant) Fall 2008 – 2012<br />

Derivatives and Financial Risk Management (Teaching Assistant) Fall 2008 – 2011<br />

Life Contingency (Teaching Assistant) Fall 2007 – 2008<br />

Corporate Finance (Teaching Assistant) Fall 2007 – 2008<br />

• Research:<br />

Research Assistant for Pr<strong>of</strong>essor Connie X. Mao<br />

Fall 2008 - present<br />

Research Assistant for Pr<strong>of</strong>essor Colin Ramsay Fall 2007 - 2008<br />

1

WORKING PAPERS<br />

• “Creditor Control and Corporate Innovations: Evidence from Debt Covenant<br />

Violations” joint with Connie X. Mao (Job Market Paper)<br />

Abstract: In this paper, we investigate the impact <strong>of</strong> creditor control on corporate innovation<br />

via the lens <strong>of</strong> corporate events - debt covenant violation, where control right is shifted from<br />

equity-holders to creditors. By employing differences-in-differences tests, we document that<br />

firms experience a significant cut in corporate innovation following financial covenant<br />

breaches, especially in innovation intensive industries. Furthermore, we show that creditor<br />

control plays a direct role in curbing corporate innovative activities upon covenant violations.<br />

We find that in the presence <strong>of</strong> stronger bank control, violation firms experience a<br />

significantly larger reduction in both the quantity (as measured by number <strong>of</strong> patents) and<br />

quality (as measured by non-self citations received) <strong>of</strong> innovations. Interestingly, we find that<br />

banks’ expertise in certain innovative industry can moderate the adverse effect <strong>of</strong> creditor<br />

control on innovations in those industries. These results are consistent with the argument that<br />

banks are less tolerant <strong>of</strong> failures and debt covenants restrict manager flexibility. Our findings<br />

also suggest that banks’ experience, knowledge, and expertise in certain innovative industries<br />

allow them to have a better assessment about borrowers’ innovative projects, and thereby<br />

mitigating the agency conflict.<br />

• “Creditor Control and CEO Compensation: Evidence from Debt Covenant Violations”<br />

joint with Connie X. Mao<br />

Abstract: We present evidence that creditor control has significant impact on CEO<br />

compensation. CEOs experience a sharp cut <strong>of</strong> 17% <strong>of</strong> excessive pay following financial<br />

covenant violations. Differences-in-differences test shows that the reduction in abnormal<br />

CEO compensations is only associated with violation firms, not with their matched nonviolation<br />

peers during the same time period. Furthermore, we find that the cut in excessive<br />

pay upon violations is greater in firms facing stronger creditor control, i.e., firms borrowed<br />

from banks with which they have a stronger prior lending relationship or high reputation<br />

banks. Despite the fact that the prior literature has documented greater CEO compensations in<br />

firms with weaker shareholder governance, we find that shareholder governance has little<br />

significant impact on the reduction <strong>of</strong> abnormal CEO compensations following debt covenant<br />

violations. In addition, we find that managerial pay-risk sensitivity (vega) is significantly<br />

reduced after covenant violation, particularly in the presence <strong>of</strong> greater creditor control power.<br />

In contrast, covenant violations are not associated with any significant change in managerial<br />

pay-performance sensitivity (delta).<br />

• “The Role <strong>of</strong> Entry Deterrence in Explaining Why Prices Fall During Times <strong>of</strong><br />

High Demand” joint with Jose M. Plehn-Dujowich<br />

Abstract: Empirical evidence suggests that for certain products, ranging from groceries to<br />

automobiles, firms lower prices in times <strong>of</strong> high demand. The theory <strong>of</strong> perfect competition,<br />

price war models <strong>of</strong> collusive behavior, and the traditional limit pricing model are<br />

inconsistent with the evidence. This paper proposes that, in the spirit <strong>of</strong> limit pricing theory,<br />

incumbents lower prices in times <strong>of</strong> high demand so as to prevent entry into their product<br />

market. We prove this in the context <strong>of</strong> a standard model <strong>of</strong> entry deterrence with complete<br />

information and an endogenous number <strong>of</strong> potential entrants. The incumbent deters entry by<br />

engaging in marginal cost pricing when demand is high because that is when the market to be<br />

monopolized is largest.<br />

2

WORK IN PROGRESS<br />

• “Time Horizon and Corporate Risk Management” joint with J. Jay Choi<br />

• “Covenant Violation and Corporate Fraud” joint with Jian Zhang<br />

• “The effects <strong>of</strong> traditional and social media exposures on brand purchase:<br />

Applications <strong>of</strong> multi-channel marketing data” awarded by Wharton Customer Analytics<br />

Initiative Research Award, joint with Lijia Xie, ChihChien Chen, and Peiyu Chen<br />

CONFERENCE PRESENTATIONS<br />

“Creditor Control and CEO Compensation: Evidence from Debt Covenant Violations”<br />

joint with Connie X. Mao<br />

• Presented at the 2012 Eastern Finance Association Annual Meeting (Boston, MA)<br />

• Presented at the 2012 Financial Management Association Annual Meeting (Atlanta, GA)<br />

SERVICE<br />

• Jiangsu Certified Public Accounts Program Summer 2012<br />

Translate the accounting seminars<br />

• Hong Kong - <strong>Gu</strong>angDong Youth Exchange Promotion Association 2006 – present<br />

Help to organize managerial meetings and students’ travel programs<br />

AWARD<br />

• <strong>University</strong> <strong>of</strong> Hong Kong Chinese Student Fellowship 2004 – 2007<br />

• Graduate Student Scholarship 2007 – 2008<br />

CERTIFICATE<br />

Society <strong>of</strong> Actuaries,<br />

EXAM P (Probability), EXAM FM (Financial Mathematics),<br />

EXAM M (Actuarial Models), EXAM C (Construction and Evaluation <strong>of</strong> Actuarial Models)<br />

REFERENCES<br />

Pr<strong>of</strong>essor Connie X. Mao (Chair)<br />

Associate Pr<strong>of</strong>essor <strong>of</strong> Finance<br />

<strong>Fox</strong> <strong>School</strong> <strong>of</strong> <strong>Business</strong> and Management<br />

<strong>Temple</strong> <strong>University</strong><br />

Philadelphia, PA 19122<br />

Phone: (215) 204-4895<br />

Email: cmao@temple.edu<br />

Pr<strong>of</strong>essor Lalitha Naveen<br />

Associate Pr<strong>of</strong>essor <strong>of</strong> Finance<br />

<strong>Fox</strong> <strong>School</strong> <strong>of</strong> <strong>Business</strong> and Management<br />

<strong>Temple</strong> <strong>University</strong><br />

Philadelphia, PA 19122<br />

Phone: (215) 204-6435<br />

Email: lnaveen@temple.edu<br />

Pr<strong>of</strong>essor Jongmoo Jay Choi<br />

Laura H. Carnell Pr<strong>of</strong>essor <strong>of</strong> Finance and<br />

International <strong>Business</strong><br />

<strong>Fox</strong> <strong>School</strong> <strong>of</strong> <strong>Business</strong> and Management<br />

<strong>Temple</strong> <strong>University</strong><br />

Philadelphia, PA 19122<br />

Phone: (215) 204-5084<br />

Email: jjchoi@temple.edu<br />

3