Gamuda - the DBS Vickers Securities Equities Research

Gamuda - the DBS Vickers Securities Equities Research

Gamuda - the DBS Vickers Securities Equities Research

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Pulse of Asia Conference<br />

<strong>Gamuda</strong><br />

Bloomberg: GAM MK | Reuters: GAMU.KL<br />

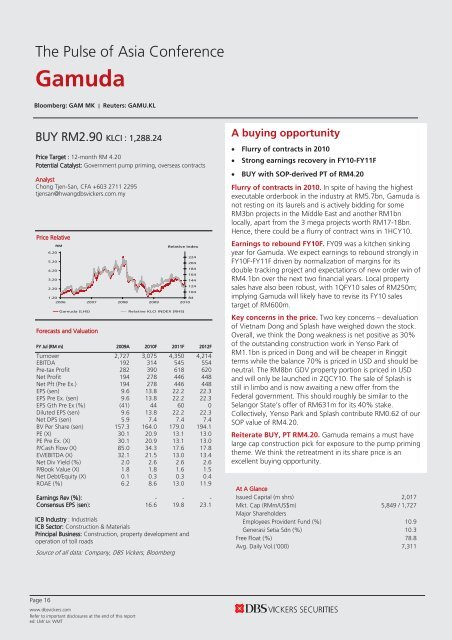

BUY RM2.90 KLCI : 1,288.24<br />

Price Target : 12-month RM 4.20<br />

Potential Catalyst: Government pump priming, overseas contracts<br />

Analyst<br />

Chong Tjen-San, CFA +603 2711 2295<br />

tjensan@hwangdbsvickers.com.my<br />

Price Relative<br />

6.20<br />

5.20<br />

4.20<br />

3.20<br />

2.20<br />

1.20<br />

RM<br />

Relative Index<br />

2006 2007 2008 2009 2010<br />

<strong>Gamuda</strong> (LHS) Relative KLCI INDEX (RHS)<br />

Forecasts and Valuation<br />

FY Jul (RM m) 2009A 2010F 2011F 2012F<br />

Turnover 2,727 3,075 4,350 4,214<br />

EBITDA 192 314 545 554<br />

Pre-tax Profit 282 390 618 620<br />

Net Profit 194 278 446 448<br />

Net Pft (Pre Ex.) 194 278 446 448<br />

EPS (sen) 9.6 13.8 22.2 22.3<br />

EPS Pre Ex. (sen) 9.6 13.8 22.2 22.3<br />

EPS Gth Pre Ex (%) (41) 44 60 0<br />

Diluted EPS (sen) 9.6 13.8 22.2 22.3<br />

Net DPS (sen) 5.9 7.4 7.4 7.4<br />

BV Per Share (sen) 157.3 164.0 179.0 194.1<br />

PE (X) 30.1 20.9 13.1 13.0<br />

PE Pre Ex. (X) 30.1 20.9 13.1 13.0<br />

P/Cash Flow (X) 85.0 34.3 17.6 17.8<br />

EV/EBITDA (X) 32.1 21.5 13.0 13.4<br />

Net Div Yield (%) 2.0 2.6 2.6 2.6<br />

P/Book Value (X) 1.8 1.8 1.6 1.5<br />

Net Debt/Equity (X) 0.1 0.3 0.3 0.4<br />

ROAE (%) 6.2 8.6 13.0 11.9<br />

Earnings Rev (%): - - -<br />

Consensus EPS (sen): 16.6 19.8 23.1<br />

ICB Industry : Industrials<br />

ICB Sector: Construction & Materials<br />

Principal Business: Construction, property development and<br />

operation of toll roads<br />

Source of all data: Company, <strong>DBS</strong> <strong>Vickers</strong>, Bloomberg<br />

224<br />

204<br />

184<br />

164<br />

144<br />

124<br />

104<br />

84<br />

A buying opportunity<br />

Flurry of contracts in 2010<br />

Strong earnings recovery in FY10-FY11F<br />

BUY with SOP-derived PT of RM4.20<br />

Flurry of contracts in 2010. In spite of having <strong>the</strong> highest<br />

executable orderbook in <strong>the</strong> industry at RM5.7bn, <strong>Gamuda</strong> is<br />

not resting on its laurels and is actively bidding for some<br />

RM3bn projects in <strong>the</strong> Middle East and ano<strong>the</strong>r RM1bn<br />

locally, apart from <strong>the</strong> 3 mega projects worth RM17-18bn.<br />

Hence, <strong>the</strong>re could be a flurry of contract wins in 1HCY10.<br />

Earnings to rebound FY10F. FY09 was a kitchen sinking<br />

year for <strong>Gamuda</strong>. We expect earnings to rebound strongly in<br />

FY10F-FY11F driven by normalization of margins for its<br />

double tracking project and expectations of new order win of<br />

RM4.1bn over <strong>the</strong> next two financial years. Local property<br />

sales have also been robust, with 1QFY10 sales of RM250m;<br />

implying <strong>Gamuda</strong> will likely have to revise its FY10 sales<br />

target of RM600m.<br />

Key concerns in <strong>the</strong> price. Two key concerns – devaluation<br />

of Vietnam Dong and Splash have weighed down <strong>the</strong> stock.<br />

Overall, we think <strong>the</strong> Dong weakness is net positive as 30%<br />

of <strong>the</strong> outstanding construction work in Yenso Park of<br />

RM1.1bn is priced in Dong and will be cheaper in Ringgit<br />

terms while <strong>the</strong> balance 70% is priced in USD and should be<br />

neutral. The RM8bn GDV property portion is priced in USD<br />

and will only be launched in 2QCY10. The sale of Splash is<br />

still in limbo and is now awaiting a new offer from <strong>the</strong><br />

Federal government. This should roughly be similar to <strong>the</strong><br />

Selangor State’s offer of RM631m for its 40% stake.<br />

Collectively, Yenso Park and Splash contribute RM0.62 of our<br />

SOP value of RM4.20.<br />

Reiterate BUY, PT RM4.20. <strong>Gamuda</strong> remains a must have<br />

large cap construction pick for exposure to <strong>the</strong> pump priming<br />

<strong>the</strong>me. We think <strong>the</strong> retreatment in its share price is an<br />

excellent buying opportunity.<br />

At A Glance<br />

Issued Capital (m shrs) 2,017<br />

Mkt. Cap (RMm/US$m) 5,849 / 1,727<br />

Major Shareholders<br />

Employees Provident Fund (%) 10.9<br />

Generasi Setia Sdn (%) 10.3<br />

Free Float (%) 78.8<br />

Avg. Daily Vol.(‘000) 7,311<br />

Page 16<br />

www.dbsvickers.com<br />

Refer to important disclosures at <strong>the</strong> end of this report<br />

ed: LM/ sa: WMT

The Pulse of Asia Conference<br />

<strong>Gamuda</strong><br />

Company Background<br />

<strong>Gamuda</strong> is an established Malaysian contractor which also<br />

has interests in property, toll concessions and water<br />

treatment and supply. Its focus has predominantly been on<br />

local government projects but has also carved out a<br />

reputation overseas with projects such as <strong>the</strong> Metro Tunnel,<br />

Taiwan, New Doha International Airport and Durkhan<br />

Highway in Qatar. Key project in hand is its RM12.5bn<br />

electrified double tracking project done jointly with MMC<br />

Corporation. It is now 34% complete while land acquisition<br />

has reached 90%.<br />

Industry Overview, Earnings Drivers & Risks<br />

The prospects for <strong>the</strong> construction industry continue to look<br />

favourable with expectations of <strong>the</strong> award of 3-4 mega<br />

projects in 2010 – LCCT, LRT extensions, Pahang Selangor<br />

Water Transfer and Bakun undersea cables and still benign<br />

cost environment. The tabling of <strong>the</strong> 10MP in June 2010 is<br />

ano<strong>the</strong>r key event to monitor. Earnings will be driven by<br />

construction in FY10F-FY12F from <strong>the</strong> normalization of<br />

margins for its double tracking project and some realistic<br />

assumptions on new order wins of RM4.1bn over FY10F-<br />

FY11F. Key risks for <strong>Gamuda</strong> are timing of rollout of mega<br />

projects, fur<strong>the</strong>r delays and pricing in <strong>the</strong> sale of Splash and<br />

fur<strong>the</strong>r devaluation of <strong>the</strong> Vietnam Dong.<br />

Outlook<br />

In spite of having <strong>the</strong> highest executable orderbook of<br />

RM5.7bn, <strong>Gamuda</strong> is not resting on its laurels. There are 4<br />

Middle East contracts which <strong>Gamuda</strong> is eyeing with a<br />

combined value of up to RM4bn. All are via open tender<br />

apart from one in Qatar which is on a restricted tender basis.<br />

On <strong>the</strong> local front, we understand <strong>Gamuda</strong> has already been<br />

prequalified for two infrastructure projects worth up to<br />

RM1bn.<br />

Its Vietnam property project in Hanoi, Yenso Park will have its<br />

maiden launch in May 2010 with sales of c. RM200m. Besides<br />

Yenso Park, <strong>Gamuda</strong> is also looking to sign a JV agreement<br />

with a Vietnamese party for a property project in Ho Chi<br />

Minh City (HCMC). In FY11, sales from Vietnam may<br />

potentially reach RM1bn once its HCMC project is launched.<br />

This is expected to fill <strong>the</strong> void from Splash.<br />

Sales Trend<br />

RM m<br />

4,000<br />

56.6%<br />

3,500<br />

46.6%<br />

3,000<br />

2,500<br />

36.6%<br />

2,000<br />

26.6%<br />

1,500<br />

16.6%<br />

1,000<br />

500<br />

6.6%<br />

0<br />

-3.4%<br />

2008A 2009A 2010F 2011F 2012F<br />

Total Revenue Revenue Growth (%) (YoY)<br />

Asset Trend<br />

RM m<br />

3,500<br />

3,000<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

2008A 2009A 2010F 2011F 2012F<br />

Net Fixed Assets (Tangible) Total Current Assets<br />

Profitability Trend<br />

RM m<br />

573<br />

523<br />

473<br />

423<br />

373<br />

323<br />

273<br />

223<br />

173<br />

2008A 2009A 2010F 2011F 2012F<br />

Operating EBIT Pre tax Profit Net Profit<br />

Margin Trends (%)<br />

20%<br />

18%<br />

16%<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

2008A 2009A 2010F 2011F 2012F<br />

EBITDA Margin % EBIT Margin % Net Income Margin %<br />

Source: Company, <strong>DBS</strong> <strong>Vickers</strong><br />

Page 17

The Pulse of Asia Conference<br />

<strong>Gamuda</strong><br />

Leverage & Asset Turnover (x)<br />

Financials and Valuation<br />

0.7<br />

0.6<br />

0.5<br />

0.4<br />

0.3<br />

0.2<br />

0.1<br />

0.0<br />

2008A 2009A 2010F 2011F 2012F<br />

0.7<br />

0.7<br />

0.6<br />

0.6<br />

0.5<br />

0.5<br />

0.4<br />

We are expecting 3-year EPS CAGR of 30% driven by its<br />

RM5.7bn executable orderbook and revival in local property<br />

sales. Depending when <strong>the</strong> Sale of Splash materializes, <strong>the</strong>re<br />

could be an earnings gap in FY10-FY11. Splash contributes<br />

c.19% of <strong>Gamuda</strong>’s pretax profit for FY09. But in <strong>the</strong> longer<br />

term we expect <strong>the</strong> earnings void to be filled by earnings from<br />

Vietnam. Our current forecasts exclude any potential<br />

contribution from Vietnam.<br />

Financial Leverage (LHS)<br />

Asset Turnover (RHS)<br />

20.0%<br />

18.0%<br />

16.0%<br />

14.0%<br />

12.0%<br />

10.0%<br />

8.0%<br />

6.0%<br />

4.0%<br />

2.0%<br />

0.0%<br />

44.0<br />

39.0<br />

34.0<br />

29.0<br />

24.0<br />

19.0<br />

14.0<br />

ROE (%)<br />

2008A 2009A 2010F 2011F 2012F<br />

PE (x)<br />

<strong>Gamuda</strong>’s balance sheet continued to streng<strong>the</strong>n, with net<br />

gearing improving to 12% from 16% in 3QFY09, as payments<br />

continued to be prompt for its double tracking project.<br />

None<strong>the</strong>less, we continue to expect net gearing to rise to 0.4x<br />

in FY12F as it is due to draw down on its US$250m loan for<br />

Vietnam.<br />

Our SOP value for <strong>Gamuda</strong> is RM4.20/share. In terms of<br />

contribution to its SOP value/share of RM4.00, construction is<br />

<strong>the</strong> highest at RM2.15/share, followed by concessions at<br />

RM1.24/share, local and foreign property combined at<br />

RM0.81/share and <strong>Gamuda</strong> Water at RM0.26/share. We have<br />

already accounted for <strong>the</strong> sale of Splash which is at<br />

RM0.31/share.<br />

9.0<br />

2006 2007 2008 2009 2010<br />

3.8<br />

P/Book Value (x)<br />

3.3<br />

2.8<br />

2.3<br />

1.8<br />

1.3<br />

0.8<br />

2006 2007 2008 2009 2010<br />

Source: Company, <strong>DBS</strong> <strong>Vickers</strong><br />

Page 18

Income Statement (RM m) Balance Sheet (RM m)<br />

The Pulse of Asia Conference<br />

<strong>Gamuda</strong><br />

FY Jul 2009A 2010F 2011F 2012F FY Jul 2009A 2010F 2011F 2012F<br />

Turnover 2,727 3,075 4,350 4,214 Net Fixed Assets 364 440 512 580<br />

Cost of Goods Sold (2,465) (2,683) (3,672) (3,538) Invts in Associates & JVs 1,287 1,919 2,563 3,215<br />

Gross Profit 262 393 678 675 O<strong>the</strong>r LT Assets 948 948 948 948<br />

O<strong>the</strong>r Opng (Exp)/Inc (88) (103) (161) (154) Cash & ST Invts 1,255 1,066 1,141 1,201<br />

Operating Profit 174 289 517 522 Inventory 101 106 90 77<br />

O<strong>the</strong>r Non Opg (Exp)/Inc 0 0 0 0 Debtors 1,080 1,134 964 819<br />

Associates & JV Inc 143 133 143 152 O<strong>the</strong>r Current Assets 844 844 844 844<br />

Net Interest (Exp)/Inc (35) (32) (42) (53) Total Assets 5,878 6,457 7,061 7,683<br />

Exceptional Gain/(Loss) 0 0 0 0<br />

Pre-tax Profit 282 390 618 620 ST Debt 328 728 1,128 1,528<br />

Tax (78) (102) (161) (161) O<strong>the</strong>r Current Liab 1,099 1,134 1,025 933<br />

Minority Interest (10) (11) (11) (11) LT Debt 1,211 1,211 1,211 1,211<br />

Preference Dividend 0 0 0 0 O<strong>the</strong>r LT Liabilities 33 33 33 33<br />

Net Profit 194 278 446 448 Shareholder’s Equity 3,161 3,294 3,596 3,899<br />

Net Profit before Except. 194 278 446 448 Minority Interests 47 58 69 80<br />

EBITDA 192 314 545 554 Total Cap. & Liab. 5,878 6,457 7,061 7,683<br />

Sales Gth (%) 13.5 12.8 41.4 (3.1) Non-Cash Wkg. Capital 925 950 873 807<br />

EBITDA Gth (%) (39.4) 63.6 73.9 1.5 Net Cash/(Debt) (284) (873) (1,198) (1,538)<br />

Opg Profit Gth (%) (41.6) 66.6 78.7 0.9<br />

Net Profit Gth (%) (40.4) 43.6 60.5 0.3<br />

Effective Tax Rate (%) 27.6 26.0 26.0 26.0<br />

Cash Flow Statement (RM m)<br />

Rates & Ratio<br />

FY Jul 2009A 2010F 2011F 2012F FY Jul 2009A 2010F 2011F 2012F<br />

Pre-Tax Profit 282 390 618 620 Gross Margins (%) 9.6 12.8 15.6 16.0<br />

Dep. & Amort. 18 24 28 32 Opg Profit Margin (%) 6.4 9.4 11.9 12.4<br />

Tax Paid (106) (102) (161) (161) Net Profit Margin (%) 7.1 9.0 10.3 10.6<br />

Assoc. & JV Inc/(loss) (143) (133) (143) (152) ROAE (%) 6.2 8.6 13.0 11.9<br />

Chg in Wkg.Cap. 376 (24) 77 66 ROA (%) 3.3 4.5 6.6 6.1<br />

O<strong>the</strong>r Operating CF 183 (29) (31) (33) ROCE (%) 2.6 4.2 6.7 6.0<br />

Net Operating CF 609 127 388 372 Div Payout Ratio (%) 61.4 53.5 33.3 33.2<br />

Capital Exp.(net) (57) (100) (100) (100) Net Interest Cover (x) 5.0 9.1 12.2 9.8<br />

O<strong>the</strong>r Invts.(net) (81) 0 0 0 Asset Turnover (x) 0.5 0.5 0.6 0.6<br />

Invts in Assoc. & JV (21) (500) (500) (500) Debtors Turn (avg days) 160.6 131.4 88.0 77.2<br />

Div from Assoc & JV 0 0 0 0 Creditors Turn (avg days) 108.8 97.3 67.2 59.4<br />

O<strong>the</strong>r Investing CF 208 29 31 33 Inventory Turn (avg days) 15.8 14.2 9.8 8.7<br />

Net Investing CF 50 (571) (569) (567) Current Ratio (x) 2.3 1.7 1.4 1.2<br />

Div Paid (60) (145) (145) (145) Quick Ratio (x) 1.6 1.2 1.0 0.8<br />

Chg in Gross Debt (297) 400 400 400 Net Debt/Equity (X) 0.1 0.3 0.3 0.4<br />

Capital Issues 8 0 0 0 Net Debt/Equity ex MI (X) 0.1 0.3 0.3 0.4<br />

O<strong>the</strong>r Financing CF 79 0 0 0 Capex to Debt (%) 3.7 5.2 4.3 3.7<br />

Net Financing CF (270) 255 255 255 Z-Score (X) 2.2 2.6 2.4 2.4<br />

Net Cashflow 389 (189) 75 60 N. Cash/(Debt)PS (sen) (14.1) (43.4) (59.6) (76.5)<br />

Opg CFPS (sen) 11.6 7.5 15.5 15.2<br />

Free CFPS (sen) 27.5 1.3 14.3 13.5<br />

Quarterly / Interim Income Statement (RM m)<br />

Segmental Breakdown / Assumptions<br />

FY Jul 2Q2009 3Q2009 4Q2009 1Q2010 FY Jul 2009A 2010F 2011F 2012F<br />

Turnover 592 579 942 624 Revenues (RM m)<br />

Cost of Goods Sold (556) (540) (913) (576) Construction 2,220 2,681 3,852 3,763<br />

Gross Profit 35 40 29 48 Property development 407 290 390 343<br />

O<strong>the</strong>r Oper. (Exp)/Inc 8 9 16 7 Infrastructure 100 104 108 108<br />

Operating Profit 43 48 45 55<br />

O<strong>the</strong>r Non Opg (Exp)/Inc 0 0 0 0 Total 2,727 3,075 4,350 4,214<br />

Associates & JV Inc 35 29 44 39<br />

Net Interest (Exp)/Inc (11) (14) (9) (11) Pretax profit (RM m)<br />

Exceptional Gain/(Loss) 0 0 0 0 Construction 63 215 425 430<br />

Pre-tax Profit 67 63 80 83 Property development 84 87 109 102<br />

Tax (16) (14) (33) (17) Infrastructure 180 159 168 176<br />

Minority Interest (2) (2) (4) (3) O<strong>the</strong>rs (45) (71) (84) (87)<br />

Net Profit 49 46 43 63<br />

Net profit bef Except. 49 46 43 63 Total 282 390 618 620<br />

Pretax profit Margins (%)<br />

Sales Gth (%) (3.6) (2.1) 62.6 (33.8) Construction 2.8 8.0 11.0 11.4<br />

Opg Profit Gth (%) (10.5) 11.7 (7.0) 24.2 Property development 20.7 30.1 28.0 29.8<br />

Net Profit Gth (%) (10.9) (5.6) (6.5) 45.6<br />

Gross Margins (%) 6.0 6.8 3.1 7.7 Total 10.3 12.7 14.2 14.7<br />

Opg Profit Margins (%) 7.3 8.3 4.7 8.9<br />

Net Profit Margins (%) 8.3 8.0 4.6 10.1 Key Assumptions<br />

Construction orderbook N/A 1,623.0 2,500.0 3,000.0<br />

Source: Company, <strong>DBS</strong> <strong>Vickers</strong><br />

Page 19

The Pulse of Asia Conference<br />

<strong>DBS</strong>V recommendations are based an Absolute Total Return* Rating system, defined as follows:<br />

STRONG BUY (>20% total return over <strong>the</strong> next 3 months, with identifiable share price catalysts within this time frame)<br />

BUY (>15% total return over <strong>the</strong> next 12 months for small caps, >10% for large caps)<br />

HOLD (0-15% total return over <strong>the</strong> next 12 months for small caps, 0-10% for large caps)<br />

FULLY VALUED (negative total return i.e. > -10% over <strong>the</strong> next 12 months)<br />

SELL (negative total return of > -20% over <strong>the</strong> next 3 months, with identifiable catalysts within this time frame)<br />

Share price appreciation + dividends<br />

GENERAL DISCLOSURE/DISCLAIMER<br />

This document is published by <strong>DBS</strong> <strong>Vickers</strong> <strong>Research</strong> (Singapore) Pte Ltd ("<strong>DBS</strong>VR"), a direct wholly-owned subsidiary of <strong>DBS</strong> <strong>Vickers</strong><br />

<strong>Securities</strong> (Singapore) Pte Ltd ("<strong>DBS</strong>VS") and an indirect wholly-owned subsidiary of <strong>DBS</strong> <strong>Vickers</strong> <strong>Securities</strong> Holdings Pte Ltd ("<strong>DBS</strong>VH").<br />

[This report is intended for clients of <strong>DBS</strong>V Group only and no part of this document may be (i) copied, photocopied or duplicated in any<br />

form by any means or (ii) redistributed without <strong>the</strong> prior written consent of <strong>DBS</strong>VR.]<br />

The research is based on information obtained from sources believed to be reliable, but we do not make any representation or warranty as<br />

to its accuracy, completeness or correctness. Opinions expressed are subject to change without notice. This document is prepared for<br />

general circulation. Any recommendation contained in this document does not have regard to <strong>the</strong> specific investment objectives, financial<br />

situation and <strong>the</strong> particular needs of any specific addressee. This document is for <strong>the</strong> information of addressees only and is not to be taken<br />

in substitution for <strong>the</strong> exercise of judgement by addressees, who should obtain separate legal or financial advice. <strong>DBS</strong>VR accepts no liability<br />

whatsoever for any direct or consequential loss arising from any use of this document or fur<strong>the</strong>r communication given in relation to this<br />

document. This document is not to be construed as an offer or a solicitation of an offer to buy or sell any securities. <strong>DBS</strong>VH is a whollyowned<br />

subsidiary of <strong>DBS</strong> Bank Ltd. <strong>DBS</strong> Bank Ltd along with its affiliates and/or persons associated with any of <strong>the</strong>m may from time to<br />

time have interests in <strong>the</strong> securities mentioned in this document. <strong>DBS</strong>VR, <strong>DBS</strong>VS, <strong>DBS</strong> Bank Ltd and <strong>the</strong>ir associates, <strong>the</strong>ir directors, and/or<br />

employees may have positions in, and may effect transactions in securities mentioned herein and may also perform or seek to perform<br />

broking, investment banking and o<strong>the</strong>r banking services for <strong>the</strong>se companies.<br />

The assumptions for commodities in this report are for <strong>the</strong> purpose of forecasting earnings of <strong>the</strong> companies mentioned herein. They are<br />

not to be construed as recommendations to trade in <strong>the</strong> physical commodities or in futures contracts relating to <strong>the</strong> commodities<br />

mentioned in this report.<br />

<strong>DBS</strong>VUSA does not have its own investment banking or research department, nor has it participated in any investment banking transaction<br />

as a manager or co-manager in <strong>the</strong> past twelve months. Any US persons wishing to obtain fur<strong>the</strong>r information, including any clarification<br />

on disclosures in this disclaimer, or to effect a transaction in any security discussed in this document should contact <strong>DBS</strong>VUSA exclusively.<br />

ANALYST CERTIFICATION<br />

The research analyst primarily responsible for <strong>the</strong> content of this research report, in part or in whole, certifies that <strong>the</strong> views about <strong>the</strong><br />

companies and <strong>the</strong>ir securities expressed in this report accurately reflect his/her personal views. The analyst also certifies that no part of<br />

his/her compensation was, is, or will be, directly, or indirectly, related to specific recommendations or views expressed in this report. As of<br />

11 Jan 2010, <strong>the</strong> analyst and his / her spouse and/or relatives who are financially dependent on <strong>the</strong> analyst, do not hold interests in <strong>the</strong><br />

securities recommended in this report (“interest” includes direct or indirect ownership of securities, directorships and trustee positions).<br />

COMPANY-SPECIFIC / REGULATORY DISCLOSURES<br />

1. <strong>DBS</strong> <strong>Vickers</strong> <strong>Securities</strong> (Singapore) Pte Ltd and its subsidiaries do not have a proprietary position in <strong>the</strong> mentioned<br />

company as of 7 Jan 2010<br />

PT. <strong>DBS</strong> <strong>Vickers</strong> <strong>Securities</strong> Indonesia ("<strong>DBS</strong>VI") have a proprietary position in Indofood Sukses Makmur, recommended in<br />

this report as of 11 January 2010.<br />

2. <strong>DBS</strong>VR, <strong>DBS</strong>VS, <strong>DBS</strong> Bank Ltd and/or o<strong>the</strong>r affiliates of <strong>DBS</strong> <strong>Vickers</strong> <strong>Securities</strong> (USA) Inc ("<strong>DBS</strong>VUSA"), a U.S.-registered<br />

broker-dealer, may beneficially own a total of 1% or more of any class of common equity securities of <strong>the</strong> mentioned<br />

company as of 11 Jan .<br />

3. Compensation for investment banking services:<br />

(1) <strong>DBS</strong>VR, <strong>DBS</strong>VS, <strong>DBS</strong> Bank Ltd and/or o<strong>the</strong>r affiliates of <strong>DBS</strong>VUSA may have received compensation, within <strong>the</strong> past<br />

12 months, and within <strong>the</strong> next 3 months receive or intends to seek compensation for investment banking services<br />

from <strong>the</strong> mentioned company.<br />

(2) <strong>DBS</strong>VUSA does not have its own investment banking or research department, nor has it participated in any<br />

investment banking transaction as a manager or co-manager in <strong>the</strong> past twelve months. Any US persons wishing to<br />

obtain fur<strong>the</strong>r information, including any clarification on disclosures in this disclaimer, or to effect a transaction in<br />

any security discussed in this document should contact <strong>DBS</strong>VUSA exclusively.

The Pulse of Asia Conference<br />

RESTRICTIONS ON DISTRIBUTION<br />

General<br />

This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or<br />

resident of or located in any locality, state, country or o<strong>the</strong>r jurisdiction where such distribution, publication,<br />

availability or use would be contrary to law or regulation.<br />

Australia<br />

Hong Kong<br />

Singapore<br />

United Kingdom<br />

Dubai/<br />

United Arab Emirates<br />

United States<br />

O<strong>the</strong>r jurisdictions<br />

This report is being distributed in Australia by <strong>DBS</strong>VR and <strong>DBS</strong>VS, which are exempted from <strong>the</strong> requirement to<br />

hold an Australian financial services licence under <strong>the</strong> Corporation Act 2001 [“CA] in respect of financial services<br />

provided to <strong>the</strong> recipients. <strong>DBS</strong>VR and <strong>DBS</strong>VS are regulated by <strong>the</strong> Monetary Authority of Singapore [“MAS”]<br />

under <strong>the</strong> laws of Singapore, which differ from Australian laws. Distribution of this report is intended only for<br />

“wholesale investors” within <strong>the</strong> meaning of <strong>the</strong> CA.<br />

This report is being distributed in Hong Kong by <strong>DBS</strong> <strong>Vickers</strong> (Hong Kong) Limited which is licensed and<br />

regulated by <strong>the</strong> Hong Kong <strong>Securities</strong> and Futures Commission.<br />

This report is being distributed in Singapore by <strong>DBS</strong>VR, which holds a Financial Adviser’s licence and is regulated<br />

by <strong>the</strong> MAS. This report may additionally be distributed in Singapore by <strong>DBS</strong>VS (Company Regn. No.<br />

198600294G), which is an Exempt Financial Adviser as defined under <strong>the</strong> Financial Advisers Act. Any research<br />

report produced by a foreign <strong>DBS</strong> <strong>Vickers</strong> entity, analyst or affiliate is distributed in Singapore only to<br />

“Institutional Investors”, “Expert Investors” or “Accredited Investors” as defined in <strong>the</strong> <strong>Securities</strong> and Futures<br />

Act, Chap. 289 of Singapore. Any distribution of research reports published by a foreign-related corporation of<br />

<strong>DBS</strong>VR/<strong>DBS</strong>VS to “Accredited Investors” is provided pursuant to <strong>the</strong> approval by MAS of research distribution<br />

arrangements under Paragraph 11 of <strong>the</strong> First Schedule to <strong>the</strong> FAA.<br />

This report is being distributed in <strong>the</strong> UK by <strong>DBS</strong> <strong>Vickers</strong> <strong>Securities</strong> (UK) Ltd, who is an authorised person in <strong>the</strong><br />

meaning of <strong>the</strong> Financial Services and Markets Act and is regulated by The Financial Services Authority. <strong>Research</strong><br />

distributed in <strong>the</strong> UK is intended only for institutional clients.<br />

This report is being distributed in Dubai/United Arab Emirates by <strong>DBS</strong> Bank Ltd, Dubai (PO Box 506538, 3 rd Floor,<br />

Building 3, Gate Precinct, DIFC, Dubai, United Arab Emirates) and is intended only for clients who meet <strong>the</strong><br />

DFSA regulatory criteria to be a Professional Client. It should not be relied upon by or distributed to Retail<br />

Clients. <strong>DBS</strong> Bank Ltd, Dubai is regulated by <strong>the</strong> Dubai Financial Services Authority.<br />

Nei<strong>the</strong>r this report nor any copy hereof may be taken or distributed into <strong>the</strong> United States or to any U.S. person<br />

except in compliance with any applicable U.S. laws and regulations.<br />

In any o<strong>the</strong>r jurisdictions, except if o<strong>the</strong>rwise restricted by laws or regulations, this report is intended only for<br />

qualified, professional, institutional or sophisticated investors as defined in <strong>the</strong> laws and regulations of such<br />

jurisdictions.<br />

<strong>DBS</strong> <strong>Vickers</strong> <strong>Research</strong> (Singapore) Pte Ltd – 8 Cross Street, #02-01 PWC Building, Singapore 048424<br />

Tel. 65-6533 9688, Fax: 65-6226 8048<br />

Company Regn. No. 198600295W