THE INSTITUTE OF CHARTERED ACCOUNTANTS ... - Resourcedat

THE INSTITUTE OF CHARTERED ACCOUNTANTS ... - Resourcedat

THE INSTITUTE OF CHARTERED ACCOUNTANTS ... - Resourcedat

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

PATHFINDER<br />

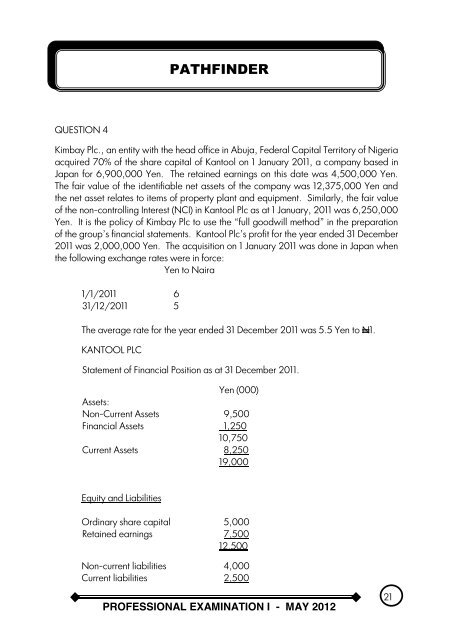

QUESTION 4<br />

Kimbay Plc., an entity with the head office in Abuja, Federal Capital Territory of Nigeria<br />

acquired 70% of the share capital of Kantool on 1 January 2011, a company based in<br />

Japan for 6,900,000 Yen. The retained earnings on this date was 4,500,000 Yen.<br />

The fair value of the identifiable net assets of the company was 12,375,000 Yen and<br />

the net asset relates to items of property plant and equipment. Similarly, the fair value<br />

of the non-controlling Interest (NCI) in Kantool Plc as at 1 January, 2011 was 6,250,000<br />

Yen. It is the policy of Kimbay Plc to use the “full goodwill method” in the preparation<br />

of the group’s financial statements. Kantool Plc’s profit for the year ended 31 December<br />

2011 was 2,000,000 Yen. The acquisition on 1 January 2011 was done in Japan when<br />

the following exchange rates were in force:<br />

Yen to Naira<br />

1/1/2011 6<br />

31/12/2011 5<br />

The average rate for the year ended 31 December 2011 was 5.5 Yen to N1.<br />

KANTOOL PLC<br />

Statement of Financial Position as at 31 December 2011.<br />

Yen (000)<br />

Assets:<br />

Non-Current Assets 9,500<br />

Financial Assets 1,250<br />

10,750<br />

Current Assets 8,250<br />

19,000<br />

Equity and Liabilities<br />

Ordinary share capital 5,000<br />

Retained earnings 7,500<br />

12,500<br />

Non-current liabilities 4,000<br />

Current liabilities 2,500<br />

PR<strong>OF</strong>ESSIONAL EXAMINATION I - MAY 2012<br />

21