Which is Better: A RRIF or an Annuity? - Empire Life

Which is Better: A RRIF or an Annuity? - Empire Life

Which is Better: A RRIF or an Annuity? - Empire Life

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Which</strong> <strong>is</strong> better: a <strong>RRIF</strong> <strong>or</strong> <strong>an</strong> <strong>an</strong>nuity<br />

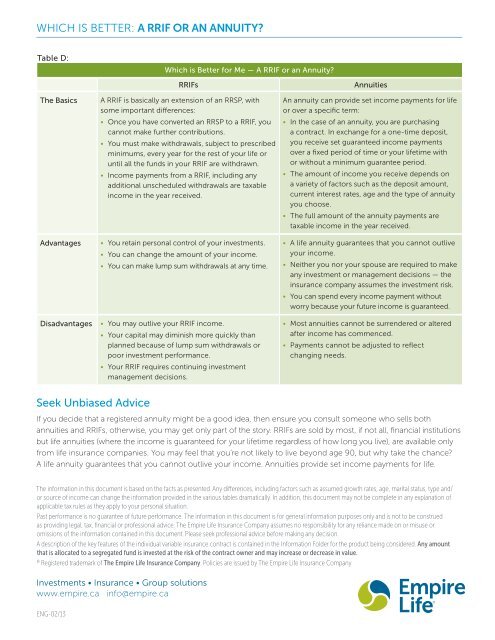

Table D:<br />

<strong>Which</strong> <strong>is</strong> <strong>Better</strong> f<strong>or</strong> Me — A <strong>RRIF</strong> <strong>or</strong> <strong>an</strong> <strong>Annuity</strong><br />

<strong>RRIF</strong>s<br />

Annuities<br />

The Basics<br />

Adv<strong>an</strong>tages<br />

D<strong>is</strong>adv<strong>an</strong>tages<br />

A <strong>RRIF</strong> <strong>is</strong> basically <strong>an</strong> extension of <strong>an</strong> RRSP, with<br />

some imp<strong>or</strong>t<strong>an</strong>t differences:<br />

• Once you have converted <strong>an</strong> RRSP to a <strong>RRIF</strong>, you<br />

c<strong>an</strong>not make further contributions.<br />

• You must make withdrawals, subject to prescribed<br />

minimums, every year f<strong>or</strong> the rest of your life <strong>or</strong><br />

until all the funds in your <strong>RRIF</strong> are withdrawn.<br />

• Income payments from a <strong>RRIF</strong>, including <strong>an</strong>y<br />

additional unscheduled withdrawals are taxable<br />

income in the year received.<br />

• You retain personal control of your investments.<br />

• You c<strong>an</strong> ch<strong>an</strong>ge the amount of your income.<br />

• You c<strong>an</strong> make lump sum withdrawals at <strong>an</strong>y time.<br />

• You may outlive your <strong>RRIF</strong> income.<br />

• Your capital may dimin<strong>is</strong>h m<strong>or</strong>e quickly th<strong>an</strong><br />

pl<strong>an</strong>ned because of lump sum withdrawals <strong>or</strong><br />

po<strong>or</strong> investment perf<strong>or</strong>m<strong>an</strong>ce.<br />

• Your <strong>RRIF</strong> requires continuing investment<br />

m<strong>an</strong>agement dec<strong>is</strong>ions.<br />

An <strong>an</strong>nuity c<strong>an</strong> provide set income payments f<strong>or</strong> life<br />

<strong>or</strong> over a specific term:<br />

• In the case of <strong>an</strong> <strong>an</strong>nuity, you are purchasing<br />

a contract. In exch<strong>an</strong>ge f<strong>or</strong> a one-time deposit,<br />

you receive set guar<strong>an</strong>teed income payments<br />

over a fixed period of time <strong>or</strong> your lifetime with<br />

<strong>or</strong> without a minimum guar<strong>an</strong>tee period.<br />

• The amount of income you receive depends on<br />

a variety of fact<strong>or</strong>s such as the deposit amount,<br />

current interest rates, age <strong>an</strong>d the type of <strong>an</strong>nuity<br />

you choose.<br />

• The full amount of the <strong>an</strong>nuity payments are<br />

taxable income in the year received.<br />

• A life <strong>an</strong>nuity guar<strong>an</strong>tees that you c<strong>an</strong>not outlive<br />

your income.<br />

• Neither you n<strong>or</strong> your spouse are required to make<br />

<strong>an</strong>y investment <strong>or</strong> m<strong>an</strong>agement dec<strong>is</strong>ions — the<br />

insur<strong>an</strong>ce comp<strong>an</strong>y assumes the investment r<strong>is</strong>k.<br />

• You c<strong>an</strong> spend every income payment without<br />

w<strong>or</strong>ry because your future income <strong>is</strong> guar<strong>an</strong>teed.<br />

• Most <strong>an</strong>nuities c<strong>an</strong>not be surrendered <strong>or</strong> altered<br />

after income has commenced.<br />

• Payments c<strong>an</strong>not be adjusted to reflect<br />

ch<strong>an</strong>ging needs.<br />

Seek Unbiased Advice<br />

If you decide that a reg<strong>is</strong>tered <strong>an</strong>nuity might be a good idea, then ensure you consult someone who sells both<br />

<strong>an</strong>nuities <strong>an</strong>d <strong>RRIF</strong>s, otherw<strong>is</strong>e, you may get only part of the st<strong>or</strong>y. <strong>RRIF</strong>s are sold by most, if not all, fin<strong>an</strong>cial institutions<br />

but life <strong>an</strong>nuities (where the income <strong>is</strong> guar<strong>an</strong>teed f<strong>or</strong> your lifetime regardless of how long you live), are available only<br />

from life insur<strong>an</strong>ce comp<strong>an</strong>ies. You may feel that you’re not likely to live beyond age 90, but why take the ch<strong>an</strong>ce<br />

A life <strong>an</strong>nuity guar<strong>an</strong>tees that you c<strong>an</strong>not outlive your income. Annuities provide set income payments f<strong>or</strong> life.<br />

The inf<strong>or</strong>mation in th<strong>is</strong> document <strong>is</strong> based on the facts as presented. Any differences, including fact<strong>or</strong>s such as assumed growth rates, age, marital status, type <strong>an</strong>d/<br />

<strong>or</strong> source of income c<strong>an</strong> ch<strong>an</strong>ge the inf<strong>or</strong>mation provided in the various tables dramatically. In addition, th<strong>is</strong> document may not be complete in <strong>an</strong>y expl<strong>an</strong>ation of<br />

applicable tax rules as they apply to your personal situation.<br />

Past perf<strong>or</strong>m<strong>an</strong>ce <strong>is</strong> no guar<strong>an</strong>tee of future perf<strong>or</strong>m<strong>an</strong>ce. The inf<strong>or</strong>mation in th<strong>is</strong> document <strong>is</strong> f<strong>or</strong> general inf<strong>or</strong>mation purposes only <strong>an</strong>d <strong>is</strong> not to be construed<br />

as providing legal, tax, fin<strong>an</strong>cial <strong>or</strong> professional advice. The <strong>Empire</strong> <strong>Life</strong> Insur<strong>an</strong>ce Comp<strong>an</strong>y assumes no responsibility f<strong>or</strong> <strong>an</strong>y reli<strong>an</strong>ce made on <strong>or</strong> m<strong>is</strong>use <strong>or</strong><br />

om<strong>is</strong>sions of the inf<strong>or</strong>mation contained in th<strong>is</strong> document. Please seek professional advice bef<strong>or</strong>e making <strong>an</strong>y dec<strong>is</strong>ion.<br />

A description of the key features of the individual variable insur<strong>an</strong>ce contract <strong>is</strong> contained in the Inf<strong>or</strong>mation Folder f<strong>or</strong> the product being considered. Any amount<br />

that <strong>is</strong> allocated to a segregated fund <strong>is</strong> invested at the r<strong>is</strong>k of the contract owner <strong>an</strong>d may increase <strong>or</strong> decrease in value.<br />

®<br />

Reg<strong>is</strong>tered trademark of The <strong>Empire</strong> <strong>Life</strong> Insur<strong>an</strong>ce Comp<strong>an</strong>y. Policies are <strong>is</strong>sued by The <strong>Empire</strong> <strong>Life</strong> Insur<strong>an</strong>ce Comp<strong>an</strong>y.<br />

Investments • Insur<strong>an</strong>ce • Group solutions<br />

www.empire.ca info@empire.ca<br />

ENG-02/13