Examination Entry Form - CIOT - The Chartered Institute of Taxation

Examination Entry Form - CIOT - The Chartered Institute of Taxation

Examination Entry Form - CIOT - The Chartered Institute of Taxation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

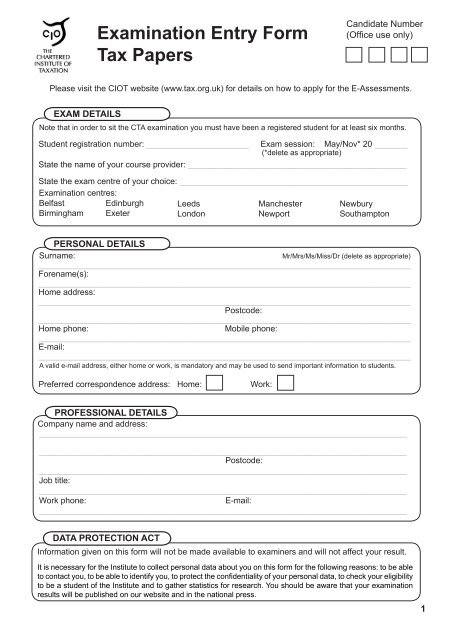

<strong>Examination</strong> <strong>Entry</strong> <strong>Form</strong><br />

Tax Papers<br />

Candidate Number<br />

(Office use only)<br />

Please visit the <strong>CIOT</strong> website (www.tax.org.uk) for details on how to apply for the E-Assessments.<br />

EXAM DETAILS<br />

Note that in order to sit the CTA examination you must have been a registered student for at least six months.<br />

Student registration number: ______________________ Exam session: May/Nov* 20 _______<br />

(*delete as appropriate)<br />

State the name <strong>of</strong> your course provider: _______________________________________________<br />

State the exam centre <strong>of</strong> your choice: _________________________________________________<br />

<strong>Examination</strong> centres:<br />

Belfast Edinburgh Leeds<br />

Manchester Newbury<br />

Birmingham Exeter<br />

London<br />

Newport<br />

Southampton<br />

PERSONAL DETAILS<br />

Surname:<br />

Mr/Mrs/Ms/Miss/Dr (delete as appropriate)<br />

________________________________________________________________________________<br />

Forename(s):<br />

________________________________________________________________________________<br />

Home address:<br />

________________________________________________________________________________<br />

Postcode:<br />

________________________________________________________________________________<br />

Home phone:<br />

Mobile phone:<br />

________________________________________________________________________________<br />

E-mail:<br />

________________________________________________________________________________<br />

A valid e-mail address, either home or work, is mandatory and may be used to send important information to students.<br />

Preferred correspondence address: Home:<br />

Work:<br />

PROFESSIONAL DETAILS<br />

Company name and address:<br />

_______________________________________________________________________________<br />

_______________________________________________________________________________<br />

Postcode:<br />

_______________________________________________________________________________<br />

Job title:<br />

_______________________________________________________________________________<br />

Work phone:<br />

E-mail:<br />

_______________________________________________________________________________<br />

DATA PROTECTION ACT<br />

Information given on this form will not be made available to examiners and will not affect your result.<br />

It is necessary for the <strong>Institute</strong> to collect personal data about you on this form for the following reasons: to be able<br />

to contact you, to be able to identify you, to protect the confidentiality <strong>of</strong> your personal data, to check your eligibility<br />

to be a student <strong>of</strong> the <strong>Institute</strong> and to gather statistics for research. You should be aware that your examination<br />

results will be published on our website and in the national press.<br />

1

TAX PAPERS<br />

Indicate below the examination papers you are sitting at this session.<br />

NOTE that candidates must pass or apply for credit(s) in the two E-Assessments, Pr<strong>of</strong>essional Responsibilities & Ethics<br />

and Law, before candidates are able to enter for their last tax paper. This includes those candidates who are taking<br />

all the tax papers at one sitting.<br />

Advisory - One Paper<br />

Advisory - Two Papers<br />

Awareness Paper<br />

Application and Interaction Paper<br />

_____________________________________________________________________________<br />

Indicate below the chosen Advisory and/or Awareness Papers you are sitting at this session.<br />

NOTE that the modules you sit for the Awareness Paper cannot be the same as the papers you sit at the Advisory<br />

level (for example, if you have sat or plan to sit <strong>Taxation</strong> <strong>of</strong> Owner-Managed Businesses at Advisory level you may<br />

not sit <strong>Taxation</strong> <strong>of</strong> Unincorporated Businesses at the Awareness level).<br />

Advisory Papers<br />

Morning<br />

(Only one <strong>of</strong> these papers may be taken per sitting)<br />

<strong>Taxation</strong> <strong>of</strong> Owner-Managed Businesses<br />

VAT on UK Domestic Transactions<br />

(including SDLT)<br />

Inheritance Tax, Trusts & Estates<br />

Afternoon<br />

(Only one <strong>of</strong> these papers may be taken per sitting)<br />

<strong>Taxation</strong> <strong>of</strong> Individuals<br />

VAT on Cross-Border Transactions<br />

& other Indirect Taxes<br />

Advanced Corporation Tax<br />

Awareness Paper<br />

(Three modules must be taken together by candidates sitting the Awareness Paper)<br />

<strong>Taxation</strong> <strong>of</strong> Unincorporated Businesses<br />

<strong>Taxation</strong> <strong>of</strong> Individuals<br />

VAT including Stamp Taxes<br />

_____________________________________________________________________________<br />

<strong>Examination</strong> Fees<br />

I enclose the non-refundable fee as follows:<br />

£440 for four papers<br />

£330 for three papers<br />

Inheritance Tax, Trusts & Estates<br />

Corporation Tax<br />

Please make cheques payable to <strong>The</strong> <strong>Chartered</strong> <strong>Institute</strong> <strong>of</strong> <strong>Taxation</strong> or complete the debit/credit card<br />

payment form (available at www.tax.org.uk).<br />

DECLARATION<br />

£220 for two papers<br />

£110 for one paper<br />

I understand that my examination fee is NON-REFUNDABLE (unless the application is unsuccessful)<br />

and payable in addition to the student registration fee.<br />

I agree that my examination scripts will be the property <strong>of</strong> the <strong>Institute</strong> alone and will not be returned to<br />

me under any circumstances.<br />

Date:<br />

Signature:<br />

Please return this form to:<br />

<strong>The</strong> <strong>Chartered</strong> <strong>Institute</strong> <strong>of</strong> <strong>Taxation</strong><br />

1st Floor, Artillery House,<br />

11-19 Artillery Row,<br />

London SW1P 1RT<br />

All examination entry forms are normally acknowledged and<br />

receipted within ten working days.<br />

Contact the <strong>Institute</strong> on 020 7235 9381 if you do not receive<br />

a receipt.<br />

FOR OFFICIAL USE ONLY<br />

Fee taken:<br />

Date:<br />

Initials:<br />

<strong>The</strong> <strong>Chartered</strong> <strong>Institute</strong> <strong>of</strong> <strong>Taxation</strong> is registered as a charity no. 1037771 1st Floor, Artillery House, 11-19 Artillery Row, London SW1P 1RT<br />

2