CTA News Jan 2005 - CIOT - The Chartered Institute of Taxation

CTA News Jan 2005 - CIOT - The Chartered Institute of Taxation

CTA News Jan 2005 - CIOT - The Chartered Institute of Taxation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>CTA</strong> <strong>News</strong><br />

<strong>Jan</strong>uary <strong>2005</strong><br />

<strong>The</strong> membership newsletter for all <strong>Chartered</strong> Tax Advisers<br />

New <strong>CTA</strong>s at London’s<br />

historic Guildhall<br />

75th ANNIVERSARY<br />

1930 - <strong>2005</strong><br />

Christmas<br />

Carol Service<br />

<strong>The</strong> Carol Service was attended by<br />

over 60 Members and guests.<br />

<strong>The</strong> <strong>CIOT</strong> celebrated the<br />

festive season with its third<br />

Carol Service (jointly with ATT)<br />

held at St Peter’s Church, Eaton<br />

Square, London SW1 on<br />

Monday 13 December 2004.<br />

Father Desmond Tillyer<br />

conducted the service and John<br />

Beattie (<strong>CIOT</strong> President), Les<br />

Beckett (ATT President), Natalie<br />

Miller and Patrick Stevens<br />

(<strong>CIOT</strong> Council Members) and<br />

<strong>CIOT</strong> and ATT staff, read the<br />

nine lessons.<br />

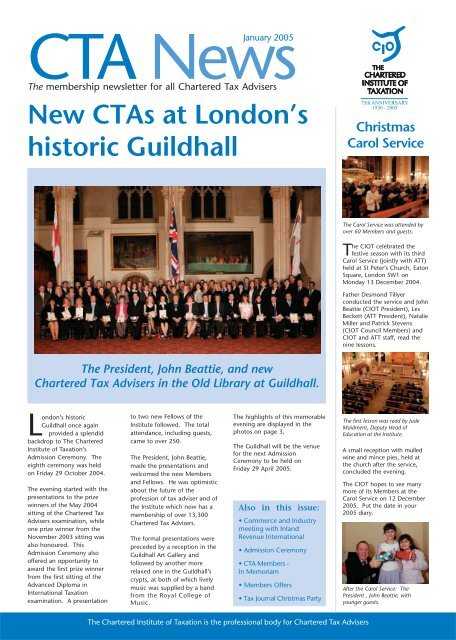

<strong>The</strong> President, John Beattie, and new<br />

<strong>Chartered</strong> Tax Advisers in the Old Library at Guildhall.<br />

London’s historic<br />

Guildhall once again<br />

provided a splendid<br />

backdrop to <strong>The</strong> <strong>Chartered</strong><br />

<strong>Institute</strong> <strong>of</strong> <strong>Taxation</strong>’s<br />

Admission Ceremony. <strong>The</strong><br />

eighth ceremony was held<br />

on Friday 29 October 2004.<br />

<strong>The</strong> evening started with the<br />

presentations to the prize<br />

winners <strong>of</strong> the May 2004<br />

sitting <strong>of</strong> the <strong>Chartered</strong> Tax<br />

Advisers examination, while<br />

one prize winner from the<br />

November 2003 sitting was<br />

also honoured. This<br />

Admission Ceremony also<br />

<strong>of</strong>fered an opportunity to<br />

award the first prize winner<br />

from the first sitting <strong>of</strong> the<br />

Advanced Diploma in<br />

International <strong>Taxation</strong><br />

examination. A presentation<br />

to two new Fellows <strong>of</strong> the<br />

<strong>Institute</strong> followed. <strong>The</strong> total<br />

attendance, including guests,<br />

came to over 250.<br />

<strong>The</strong> President, John Beattie,<br />

made the presentations and<br />

welcomed the new Members<br />

and Fellows. He was optimistic<br />

about the future <strong>of</strong> the<br />

pr<strong>of</strong>ession <strong>of</strong> tax adviser and <strong>of</strong><br />

the <strong>Institute</strong> which now has a<br />

membership <strong>of</strong> over 13,300<br />

<strong>Chartered</strong> Tax Advisers.<br />

<strong>The</strong> formal presentations were<br />

preceded by a reception in the<br />

Guildhall Art Gallery and<br />

followed by another more<br />

relaxed one in the Guildhall’s<br />

crypts, at both <strong>of</strong> which lively<br />

music was supplied by a band<br />

from the Royal College <strong>of</strong><br />

Music.<br />

<strong>The</strong> highlights <strong>of</strong> this memorable<br />

evening are displayed in the<br />

photos on page 3.<br />

<strong>The</strong> Guildhall will be the venue<br />

for the next Admission<br />

Ceremony to be held on<br />

Friday 29 April <strong>2005</strong>.<br />

Also in this issue:<br />

• Commerce and Industry<br />

meeting with Inland<br />

Revenue International<br />

• Admission Ceremony<br />

• <strong>CTA</strong> Members -<br />

In Memoriam<br />

• Members Offers<br />

• Tax Journal Christmas Party<br />

<strong>The</strong> first lesson was read by Jude<br />

Maidment, Deputy Head <strong>of</strong><br />

Education at the <strong>Institute</strong>.<br />

A small reception with mulled<br />

wine and mince pies, held at<br />

the church after the service,<br />

concluded the evening.<br />

<strong>The</strong> <strong>CIOT</strong> hopes to see many<br />

more <strong>of</strong> its Members at the<br />

Carol Service on 12 December<br />

<strong>2005</strong>. Put the date in your<br />

<strong>2005</strong> diary.<br />

After the Carol Service: <strong>The</strong><br />

President , John Beattie, with<br />

younger guests.<br />

<strong>The</strong> <strong>Chartered</strong> <strong>Institute</strong> <strong>of</strong> <strong>Taxation</strong> is the pr<strong>of</strong>essional body for <strong>Chartered</strong> Tax Advisers

Commerce & Industry Group Meeting with Inland<br />

Revenue International<br />

On 22 September 2004 the Commerce &<br />

Industry group held an afternoon<br />

discussion with a team from Inland Revenue<br />

International on the areas <strong>of</strong> (i) permanent<br />

establishments, (ii) transfer pricing (iii)<br />

disclosure regime and (iv) EU issues and<br />

current tax competition.<br />

Diane Hay, the newly appointed Deputy<br />

Director <strong>of</strong> Inland Revenue International (on<br />

her second day in the position) introduced<br />

her team and described some <strong>of</strong> the<br />

organisational changes being undertaken at<br />

the Revenue. Responsibility for tax policy<br />

development was being moved to the<br />

Treasury, while the role <strong>of</strong> tax policy<br />

maintenance and implementation will<br />

remain with the Revenue. As part <strong>of</strong> this<br />

process several people from the Inland<br />

Revenue International had moved to the<br />

Treasury. In Diane’s opinion the combining <strong>of</strong><br />

Revenue and Customs (still in progress)<br />

would lead to a more seamless service<br />

available to the government’s taxpaying<br />

‘customers’.<br />

Ian Menzies-Conacher <strong>of</strong> Barclays Group<br />

provided an industry perspective <strong>of</strong> the areas<br />

to be discussed, drawing on his extensive<br />

interaction with government bodies and the<br />

OECD through the British Bankers Association,<br />

the CBI and the <strong>CIOT</strong>. Diane’s team<br />

responded to these points and to others<br />

raised by the audience.<br />

Permanent Establishments (PE)<br />

Ian highlighted industry concerns on potential<br />

administrative burdens arising from the<br />

determination <strong>of</strong> a dependent agent PE,<br />

commenting that this could affect both nonfinancial<br />

and financial organisations. On the<br />

attribution <strong>of</strong> capital and pr<strong>of</strong>its to PE’s,<br />

uncertainty surrounding the determination <strong>of</strong><br />

key entrepreneurial risk factors, the<br />

possibilities <strong>of</strong> double taxation arising and<br />

differences <strong>of</strong> opinion due to the lack <strong>of</strong> one<br />

agreed method were discussed.<br />

Kate Ramm, who had recently moved from<br />

the Revenue to the Treasury, provided some<br />

further background to the development <strong>of</strong><br />

the PE legislation and the discussions that had<br />

taken place at OECD level. She clarified that<br />

article 5 <strong>of</strong> double tax treaties and OECD<br />

model tax convention dealt with whether<br />

there was a PE for tax purposes, while the PE<br />

working hypothesis developed at OECD level<br />

dealt with the interpretation <strong>of</strong> article 7 on<br />

the attribution <strong>of</strong> pr<strong>of</strong>its. Whilst the work at<br />

the OECD confirmed the UK was out <strong>of</strong> line<br />

with its major treaty partners on the<br />

attribution <strong>of</strong> capital, the legislation<br />

introduced into Schedule A1 I<strong>CTA</strong>88<br />

incorporates existing OECD principles into<br />

UK legislation rather than the principles set<br />

out in the working hypothesis. Her colleague<br />

Mike Hogan from the Inland Revenue team<br />

was on hand to deal with specific questions<br />

on PE’s the resolution <strong>of</strong> which depended in<br />

many cases on the facts and circumstances.<br />

Kate provided further background on the<br />

development <strong>of</strong> the three possible methods<br />

<strong>of</strong> attributing capital to a PE, and did not<br />

anticipate the application <strong>of</strong> these methods<br />

by other Revenue authorities would result in<br />

unacceptable results from a UK perspective.<br />

She also mentioned that where a Revenue<br />

authority in the host state applied the OECD<br />

PE hypothesis using one <strong>of</strong> the approved<br />

capital attribution methods, then provided<br />

this achieved an arm’s length result then this<br />

should be accepted by the Revenue authority<br />

in the home state. <strong>The</strong> risk <strong>of</strong> double taxation<br />

should therefore be minimised. She also<br />

commented that Inland Revenue had spoken<br />

to some other jurisdictions to try and resolve<br />

certain double taxation issues.<br />

Transfer pricing<br />

Ian commented on the background for the<br />

introduction <strong>of</strong> the UK:UK transfer pricing<br />

regime asking for clarification on how the<br />

policing <strong>of</strong> this regime would be operated at<br />

district level and for guidance on<br />

documentation. He also highlighted<br />

difficulties around transfer pricing arising<br />

from the Waterloo case concerning options<br />

granted to employees and where the cost <strong>of</strong><br />

remuneration would be recognised.<br />

Andrew Page from the Inland Revenue<br />

transfer pricing team commented that<br />

taxpayers should consider adopting a more<br />

interactive dialogue with Revenue <strong>of</strong>ficers<br />

assigned to their cases. He suggested<br />

taxpayers discuss transfer pricing proposals<br />

and related risk assessment with their<br />

revenue <strong>of</strong>ficer. He stressed it was not the<br />

government’s intention to create unnecessary<br />

extra documentary and record keeping<br />

requirements for tax payers, but equally it<br />

did not anticipate providing a general<br />

clearance procedure for this area.<br />

Andrew also commented on the Revenue’s<br />

attitude to the use <strong>of</strong> the cost-plus<br />

methodology and cost sharing. On cost-plus<br />

methodology he commented the Revenue<br />

did not see this being restricted in its<br />

application so that it could never apply to<br />

transactions involving (for example) research<br />

& development. He encouraged a further<br />

review <strong>of</strong> the Inland Revenue international<br />

manuals for guidance on cost sharing and<br />

transfer pricing methodology. On risk<br />

assessment he commented that transactions<br />

with low tax jurisdictions, and with<br />

jurisdictions where defensive documentation<br />

on transfer pricing policies was used, were<br />

two examples which would be regarded as<br />

high risk from a UK transfer pricing<br />

perspective.<br />

Disclosure<br />

Ian commented that the introduction <strong>of</strong> the<br />

new disclosure rules provided an example <strong>of</strong><br />

how industry and the pr<strong>of</strong>essions had<br />

provided significant input into the practical<br />

application <strong>of</strong> this new legislation and<br />

improved it as a result. He commented that<br />

in his opinion it was still very subjective in<br />

parts and therefore would not always be easy<br />

to apply in practice. He anticipated further<br />

development <strong>of</strong> this legislation over time.<br />

Ray McCann provided more background on<br />

the introduction <strong>of</strong> the new rules,<br />

highlighting the government’s concern <strong>of</strong> the<br />

time lag between implementation <strong>of</strong><br />

avoidance schemes and the government<br />

being able to review these through the tax<br />

return and the enquiry system. Ray is in<br />

charge <strong>of</strong> the new disclosure team at the<br />

Revenue and commented that the<br />

registration system would permit the<br />

government to make a much earlier<br />

assessment <strong>of</strong> the impact and application <strong>of</strong><br />

certain schemes. He commented that<br />

experience from the US and Australia on the<br />

introduction <strong>of</strong> this type <strong>of</strong> reporting<br />

requirement had led to a perceived<br />

reduction in the use <strong>of</strong> avoidance not<br />

originally intended by government.<br />

EU Issues<br />

Ian commented that many <strong>of</strong> the decisions<br />

coming for the ECJ were destructive rather<br />

than constructive in their effect on taxing<br />

authorities’ rights. <strong>The</strong> imminent European<br />

cases <strong>of</strong> Marks & Spencers (loss relief across<br />

border), Cadburys (application <strong>of</strong> CFC<br />

legislation) and the decided cases <strong>of</strong> De<br />

Lasteyrie du Saillaut (C-9/02) and Manninen<br />

(C-319/02) and their potential impact on UK<br />

legislation were highlighted.<br />

John Connors who had also recently moved<br />

from Revenue to Treasury, commented that<br />

the focus <strong>of</strong> the UK government was to work<br />

with its European partners to create a<br />

business and administrative environment that<br />

promoted efficient economic development,<br />

while enabling sufficient revenue to be raised<br />

for the electoral agenda. He commented<br />

that UK were in favour <strong>of</strong> achieving an<br />

outward focussed European business<br />

environment as opposed to a protectionist<br />

environment. With that background he also<br />

commented that while the UK did not<br />

believe its own legislative systems to be<br />

divergent from the EU treaty, there was<br />

always a willingness to review suggestions for<br />

improvements and re-design.<br />

Conclusion<br />

<strong>The</strong> meeting was attended by over 50<br />

delegates who raised many points <strong>of</strong> interest<br />

throughout the meeting. <strong>The</strong> facilities and<br />

catering for the meeting provided by Shell<br />

were <strong>of</strong> the highest standard, and for future<br />

meetings with similar attendance levels,<br />

microphones will be available to improve<br />

amplification <strong>of</strong> presentations. <strong>The</strong> next<br />

meeting <strong>of</strong> the commerce & industry group,<br />

which starts at 5pm is on 27 <strong>Jan</strong>uary <strong>2005</strong>,<br />

focusing upon US/UK cross border tax issues.<br />

To register for this meeting please email<br />

chrislall@aol.com<br />

ii<br />

<strong>The</strong> <strong>Chartered</strong> <strong>Institute</strong> <strong>of</strong> <strong>Taxation</strong> is the pr<strong>of</strong>essional body for <strong>Chartered</strong> Tax Advisers

At the Admission Ceremony<br />

Friday 29 October 2004<br />

<strong>The</strong> President, John Beattie, with the prize winners for May 2004<br />

(unless otherwise indicated).<br />

Back row, left to right: Stuart Farrow-Smith (Ian Walker Medal for<br />

Paper I), Katherine Alexander (John Wood Medal for Paper IIC) and<br />

Matthew Rees (Avery Jones Medal for Paper III).<br />

Front row, left to right: Anja Krech (Victor Durkacz Medal for Paper<br />

IID, November 2003), Helen Wainwright (<strong>Institute</strong> Medal and<br />

LexisNexis Prize), the President, Sarah Allatt (Gilbert Burr Medal for<br />

Paper IIA) and Rodney Adams (<strong>Institute</strong> Gold Medal for the highest<br />

mark in the LLB <strong>Taxation</strong> & Law 2004, Bournemouth University).<br />

<strong>The</strong> reception in the Guildhall Art Gallery.<br />

Photo No: 4361<br />

<strong>The</strong> President (left) with new Fellows, Liz Lathwood (centre) and<br />

Sivahar Mahalingham (right).<br />

New Members and their guests, in the Old Library at Guildhall,<br />

awaiting the presentation <strong>of</strong> their <strong>CTA</strong> certificates.<br />

New <strong>Chartered</strong> Tax Advisers and their families relaxed in the Crypt<br />

after the <strong>of</strong>ficial ceremony.<br />

From left to right: <strong>The</strong> Advanced Diploma in International <strong>Taxation</strong> -<br />

Martin Harty (ADIT certificate holder), Ruth Bruce (Winner <strong>of</strong> the<br />

Heather Self Medal for the highest marks in ADIT Paper I - Principles <strong>of</strong><br />

International <strong>Taxation</strong>) and Sam Golcher (ADIT certificate holder).<br />

Guided tours <strong>of</strong> the historic Guildhall were provided at the end <strong>of</strong> the<br />

evening for new Members and their guests.<br />

iii<br />

<strong>The</strong> <strong>Chartered</strong> <strong>Institute</strong> <strong>of</strong> <strong>Taxation</strong> is the pr<strong>of</strong>essional body for <strong>Chartered</strong> Tax Advisers

<strong>CTA</strong> Members - In Memoriam<br />

This section is dedicated to those Members who passed away this year.<br />

Our condolences to their family and friends.<br />

Mr Peter Adcr<strong>of</strong>t Mr Jack Farraday Mr Gordon Naylor<br />

Mr Leslie Assender Mr Bryan Gair Mr Jack Ozerovitch<br />

Mr Alfred Atkinson Mr John Griffiths Mr Michael Phillips<br />

Mr Edward Batty Mr John Hall Mr Paul Powell<br />

Mr Peter Bigg Mr Fraser Heggie Mr Donald Pritchard<br />

Mr Wilfred Boyles Mr Dennis Hirst Mrs Christine Rogers<br />

Mr Henry Brown Mr Julian Hodge Mr Derek Strath<br />

Mr David Casswell Mr Ian Jay Mr Peter Swaine<br />

Mr Kenneth Castle Mr Bernard Keane Mr David Thomas<br />

Mr Darayas Chinoy Mr Alan Lodge Mr George Tricker<br />

Mr Charles Coulson Mr Raymond Lowen Mr Donald Ward<br />

Mr William Crabb Mr John Martin Mr Frederick Williams<br />

Mr Wallace Davis Mr Ronald Maton Mr David Williams<br />

Mr William Dickinson Mr James Morris Mr Phillip Younghusband<br />

Mr Richard Downs<br />

Mr Thomas Munn<br />

Latest Members’ Offer:<br />

£50 <strong>of</strong>f ADIT Paper II Tutor<br />

Tax Journal Christmas Party<br />

is <strong>of</strong>fering <strong>CIOT</strong> Members an<br />

outstanding deal on the<br />

<strong>CIOT</strong> Tolley ADIT Paper II Tutor.<br />

<strong>The</strong> recently published course notes and interactive<br />

tutorial CD are being <strong>of</strong>fered at a discounted price <strong>of</strong><br />

£799 until <strong>Jan</strong>uary <strong>2005</strong>; a saving <strong>of</strong> £50 <strong>of</strong>f the normal<br />

price <strong>of</strong> £849.<br />

<strong>The</strong> course materials include written notes covering all<br />

the topics, and an interactive tutor CD with examples to<br />

guide the student through the course. Both will be fully<br />

updated to incorporate the Finance Act 2004.<br />

Visit: http://www.tax.org.uk/member<strong>of</strong>fers/<br />

to find out more!<br />

<strong>The</strong> Tax Journal Christmas Party took place at Halsbury House, UK<br />

headquarters <strong>of</strong> LexisNexis, on Thursday 9 December 2004 and was<br />

hosted by the Editor <strong>of</strong> Tax Journal, Alison Lovejoy. Many Members<br />

and <strong>of</strong>ficials from the <strong>CIOT</strong> attended the event including the <strong>CIOT</strong><br />

Past Presidents (pictured above). From left to right: Tim Ambrose,<br />

Penny Hamilton and John Whiting.<br />

iv<br />

<strong>CTA</strong><strong>News</strong> <strong>Jan</strong>uary <strong>2005</strong>