Personal Superannuation - IOOF Portfolio online > Login

Personal Superannuation - IOOF Portfolio online > Login

Personal Superannuation - IOOF Portfolio online > Login

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

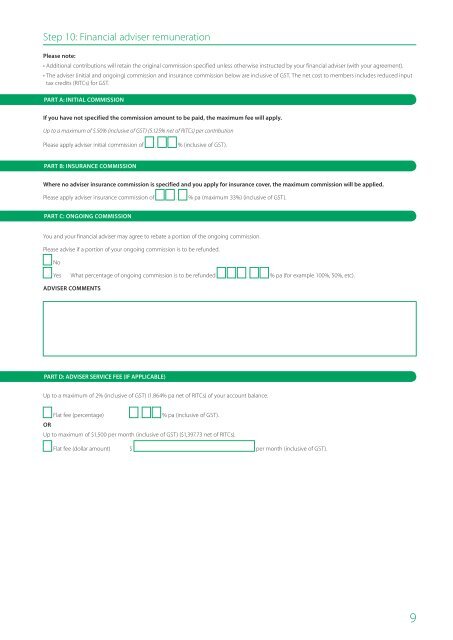

Step 10: Financial adviser remuneration<br />

Please note:<br />

• Additional contributions will retain the original commission specified unless otherwise instructed by your financial adviser (with your agreement).<br />

• The adviser (initial and ongoing) commission and insurance commission below are inclusive of GST. The net cost to members includes reduced input<br />

tax credits (RITCs) for GST.<br />

PART A: INITIAL COMMISSION<br />

If you have not specified the commission amount to be paid, the maximum fee will apply.<br />

Up to a maximum of 5.50% (inclusive of GST) (5.125% net of RITCs) per contribution<br />

Please apply adviser initial commission of . % (inclusive of GST).<br />

PART B: INSuRANCE COMMISSIoN<br />

Where no adviser insurance commission is specified and you apply for insurance cover, the maximum commission will be applied.<br />

Please apply adviser insurance commission of . % pa (maximum 33%) (inclusive of GST).<br />

PART C: oNGOINg COMMISSIoN<br />

You and your financial adviser may agree to rebate a portion of the ongoing commission.<br />

Please advise if a portion of your ongoing commission is to be refunded.<br />

No<br />

Yes What percentage of ongoing commission is to be refunded . % pa (for example 100%, 50%, etc).<br />

ADVISER COMMENTS<br />

PART D: ADVISER SERVICE FEE (IF APPLICABLE)<br />

Up to a maximum of 2% (inclusive of GST) (1.864% pa net of RITCs) of your account balance.<br />

Flat fee (percentage) . % pa (inclusive of GST).<br />

OR<br />

Up to maximum of $1,500 per month (inclusive of GST) ($1,397.73 net of RITCs).<br />

Flat fee (dollar amount) $ per month (inclusive of GST).<br />

9