CFSP PowerPoint presentation

CFSP PowerPoint presentation

CFSP PowerPoint presentation

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

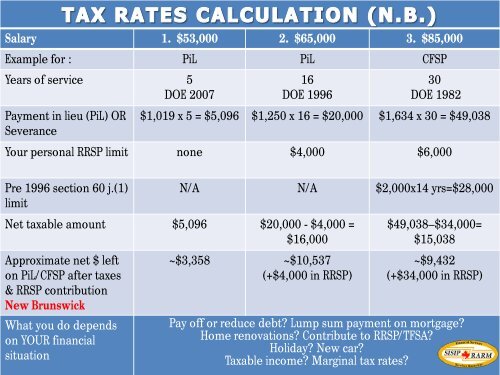

Salary 1. $53,000 2. $65,000 3. $85,000<br />

Example for : PiL PiL <strong>CFSP</strong><br />

Years of service 5<br />

DOE 2007<br />

Payment in lieu (PiL) OR<br />

Severance<br />

16<br />

DOE 1996<br />

30<br />

DOE 1982<br />

$1,019 x 5 = $5,096 $1,250 x 16 = $20,000 $1,634 x 30 = $49,038<br />

Your personal RRSP limit none $4,000 $6,000<br />

Pre 1996 section 60 j.(1)<br />

limit<br />

SISIP Financial Services / Services financiers du RARM<br />

N/A N/A $2,000x14 yrs=$28,000<br />

Net taxable amount $5,096 $20,000 - $4,000 =<br />

$16,000<br />

Approximate net $ left<br />

on PiL/<strong>CFSP</strong> after taxes<br />

& RRSP contribution<br />

New Brunswick<br />

What you do depends<br />

on YOUR financial<br />

situation<br />

~$3,358 ~$10,537<br />

(+$4,000 in RRSP)<br />

$49,038–$34,000=<br />

$15,038<br />

~$9,432<br />

(+$34,000 in RRSP)<br />

Pay off or reduce debt Lump sum payment on mortgage<br />

Home renovations Contribute to RRSP/TFSA<br />

Holiday New car<br />

Taxable income Marginal tax rates