Risk Management - Public Bank | PBeBank.com

Risk Management - Public Bank | PBeBank.com

Risk Management - Public Bank | PBeBank.com

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

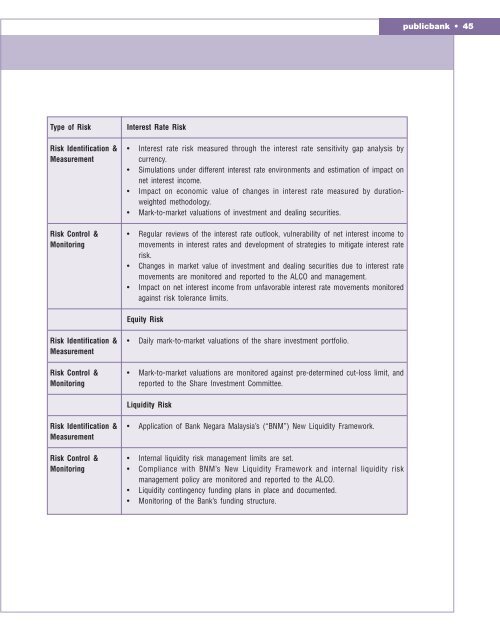

publicbank • 45<br />

Type of <strong>Risk</strong><br />

<strong>Risk</strong> Identification &<br />

Measurement<br />

<strong>Risk</strong> Control &<br />

Monitoring<br />

Interest Rate <strong>Risk</strong><br />

• Interest rate risk measured through the interest rate sensitivity gap analysis by<br />

currency.<br />

• Simulations under different interest rate environments and estimation of impact on<br />

net interest in<strong>com</strong>e.<br />

• Impact on economic value of changes in interest rate measured by durationweighted<br />

methodology.<br />

• Mark-to-market valuations of investment and dealing securities.<br />

• Regular reviews of the interest rate outlook, vulnerability of net interest in<strong>com</strong>e to<br />

movements in interest rates and development of strategies to mitigate interest rate<br />

risk.<br />

• Changes in market value of investment and dealing securities due to interest rate<br />

movements are monitored and reported to the ALCO and management.<br />

• Impact on net interest in<strong>com</strong>e from unfavorable interest rate movements monitored<br />

against risk tolerance limits.<br />

Equity <strong>Risk</strong><br />

<strong>Risk</strong> Identification &<br />

Measurement<br />

<strong>Risk</strong> Control &<br />

Monitoring<br />

• Daily mark-to-market valuations of the share investment portfolio.<br />

• Mark-to-market valuations are monitored against pre-determined cut-loss limit, and<br />

reported to the Share Investment Committee.<br />

Liquidity <strong>Risk</strong><br />

<strong>Risk</strong> Identification &<br />

Measurement<br />

<strong>Risk</strong> Control &<br />

Monitoring<br />

• Application of <strong>Bank</strong> Negara Malaysia’s (“BNM”) New Liquidity Framework.<br />

• Internal liquidity risk management limits are set.<br />

• Compliance with BNM’s New Liquidity Framework and internal liquidity risk<br />

management policy are monitored and reported to the ALCO.<br />

• Liquidity contingency funding plans in place and documented.<br />

• Monitoring of the <strong>Bank</strong>’s funding structure.