Risk Management - Public Bank | PBeBank.com

Risk Management - Public Bank | PBeBank.com

Risk Management - Public Bank | PBeBank.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

publicbank • 71<br />

f. Related Party Transactions<br />

Any related party transactions that may<br />

arise within <strong>Public</strong> <strong>Bank</strong> and the <strong>Public</strong><br />

<strong>Bank</strong> Group.<br />

g. Other Matters<br />

Such other matters as the Committee<br />

considers appropriate or as authorised by<br />

the Board of Directors.<br />

3. SUMMARY OF ACTIVITIES<br />

During the year, the Committee carried out the<br />

following activities:<br />

3.1 Financial Results<br />

a. Reviewed the quarterly and half-yearly<br />

unaudited financial results of <strong>Public</strong> <strong>Bank</strong><br />

and the <strong>Public</strong> <strong>Bank</strong> Group before<br />

re<strong>com</strong>mending them for the approval of the<br />

Board of Directors.<br />

b. Reviewed the annual audited financial<br />

statements of <strong>Public</strong> <strong>Bank</strong> and the <strong>Public</strong><br />

<strong>Bank</strong> Group with the external auditors prior<br />

to submission to the Board of Directors for<br />

their approval. The review was, inter-alia, to<br />

ensure <strong>com</strong>pliance with:<br />

• Provisions of the Companies Act, 1965<br />

and the <strong>Bank</strong>ing And Financial<br />

Institutions Act, 1989;<br />

• Listing Requirements of Malaysia<br />

Securities Exchange Berhad;<br />

• Applicable approved accounting<br />

standards in Malaysia; and<br />

• Other legal and regulatory requirements.<br />

3.2 Internal Audit<br />

a. Reviewed the annual audit plan to ensure<br />

adequate scope and coverage of the<br />

activities of <strong>Public</strong> <strong>Bank</strong> and the <strong>Public</strong><br />

<strong>Bank</strong> Group.<br />

b. Reviewed the audit programmes, resource<br />

requirements for the year and assessed the<br />

performance of Internal Audit Division.<br />

c. Reviewed the internal audit reports, audit<br />

re<strong>com</strong>mendations made and management’s<br />

response to these re<strong>com</strong>mendations.<br />

Where appropriate, the Committee has<br />

directed action to be taken by management<br />

to rectify and improve the system of<br />

internal controls and procedures based on<br />

the internal auditors’ re<strong>com</strong>mendations and<br />

suggestions for improvements.<br />

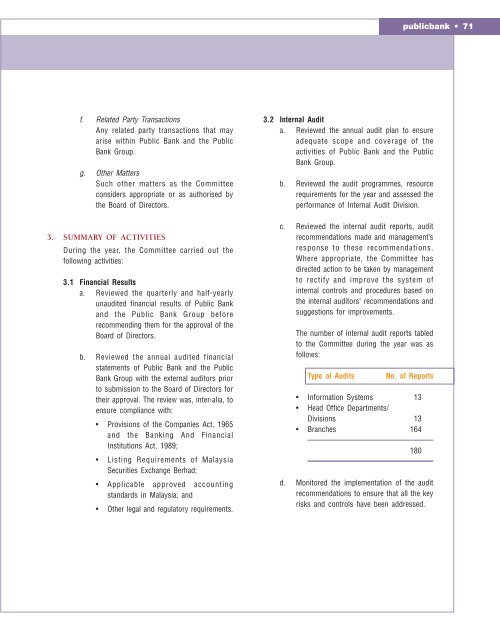

The number of internal audit reports tabled<br />

to the Committee during the year was as<br />

follows:<br />

Type of Audits<br />

No. of Reports<br />

• Information Systems 13<br />

• Head Office Departments/<br />

Divisions 13<br />

• Branches 164<br />

180<br />

d. Monitored the implementation of the audit<br />

re<strong>com</strong>mendations to ensure that all the key<br />

risks and controls have been addressed.