feb11_hng corp.pdf - Hindusthan National Glass & Industries Limited.

feb11_hng corp.pdf - Hindusthan National Glass & Industries Limited.

feb11_hng corp.pdf - Hindusthan National Glass & Industries Limited.

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CORPORATE PRESENTATION<br />

December, 2010

Disclaimer<br />

Corporate Presentation (the “Presentation”) of <strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & <strong>Industries</strong> <strong>Limited</strong> (HNG), as contained in this document, is<br />

based on management estimates and is being provided to you (herein referred to as the “Recipient”) only for information purposes. The<br />

sole purpose of this Presentation is to provide preliminary information on the business activities of the Company, in order to assist the<br />

recipient in understanding the Company. This Presentation does not purport to be all inclusive or necessarily include all information that<br />

a prospective investor may desire in evaluating the Company. The Company expressly disclaims any and all liability for any errors<br />

and/or omissions, representations or warranties, expressed or implied, as contained in this document.<br />

This Presentation contains certain forward looking statements, which are based on certain assumptions of future events over which the<br />

Company exercises no control. Hence this involves number of risks and uncertainties which could cause the actual results to differ<br />

materially from those that may be projected or implied by these forward looking statements. Such risks and uncertainties include, but<br />

are not limited to: Company’s ability to manage growth, competition, attracting and retaining skilled professionals, time and cost<br />

overruns, regulatory approvals, market risks, domestic and international economic conditions, changes in laws governing the Company<br />

including the tax regimes and exchange control regulations.<br />

The Company does not undertake to update any forward looking statements that may be made from time to time by or on behalf of the<br />

Company. This Presentation may not be photocopied, reproduced or distributed to others at any time without prior consent of the<br />

Company. Upon request, the Recipient will promptly return all material received from the Company without retaining any copies thereof.<br />

In furnishing this Presentation, the Company does not take any obligation to provide the Recipient with access to any additional<br />

information on the Company or its Subsidiaries. This Presentation should not be deemed an indication of the state of affairs of the<br />

Company nor shall it constitute an indication that there has been no change in the business or state of affairs of the Company since the<br />

date of publication of this Presentation.<br />

Any clarifications / queries, as well as any future communication, regarding the Company should be addressed to the Company. “This<br />

presentation does not constitute a prospectus, offering circular or offering memorandum or an offer, invitation, or a solicitation of any<br />

offer, to purchase or sell or subscribe, any shares of the Company and should not be considered or construed in any manner<br />

whatsoever as a recommendation that any person should subscribe for or purchase any of the Company’s shares.”<br />

2

Table of Contents<br />

• Introduction of the Company<br />

• Industry Snapshot<br />

• Business Overview<br />

• Float <strong>Glass</strong> Business<br />

• Business Strategy and Expansion Plans<br />

• Financial Snapshot<br />

3

Introduction of the Company

Overview<br />

Growth in respective Economies<br />

Industry leader – market<br />

share ~ 55%<br />

Diversified customer<br />

base across all market<br />

segments<br />

Pan-India presence<br />

Successful turn around<br />

of loss making<br />

acquisitions<br />

Strong focus on value<br />

creation through<br />

strategic initiatives<br />

Robust start in high<br />

growth oriented Float<br />

<strong>Glass</strong> business<br />

Decline Low growth Medium growth High growth Not illustrated<br />

Professionally run<br />

organization with<br />

competent management<br />

HNG: Unique and only of its kind in high growth Indian market<br />

5

Vision<br />

“To create a world-class glass<br />

manufacturing plant that pursues<br />

Quality, Cost Reduction, and<br />

Productivity Improvement measures in<br />

a truly holistic manner, leading to<br />

Customers‟, Shareholders‟,<br />

Employees‟ and Suppliers‟<br />

Satisfaction; this integrated effort will<br />

result in the Company becoming an<br />

Industry Benchmark and a role model<br />

for systems, processes and results”<br />

6

Corporate history – Milestones<br />

1952<br />

Foundation<br />

Stone laid for<br />

first plant at<br />

Rishra<br />

1964<br />

Start-up of<br />

second plant<br />

at<br />

Bahadurgarh<br />

1970<br />

Formation of<br />

GEIL (HNG‟s<br />

Engineering<br />

Subsidiary) in<br />

collaboration<br />

with Wheaton<br />

2002<br />

Acquisition of<br />

Owens<br />

Brockway<br />

India <strong>Limited</strong><br />

(plants at<br />

Rishikesh,<br />

Puducherry<br />

and Pune)<br />

2005<br />

Acquisition of<br />

the <strong>Glass</strong> Unit<br />

of Larsen<br />

&Toubro at<br />

Nashik<br />

2007<br />

Acquisition of<br />

the<br />

Neemrana<br />

unit of<br />

Haryana<br />

Sheet <strong>Glass</strong><br />

2010<br />

Start-up of<br />

production at<br />

HNG Float<br />

<strong>Glass</strong> in Halol<br />

7

Corporate structure<br />

<strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> &<br />

<strong>Industries</strong> Ltd<br />

- Consolidated net revenues: INR 13,834 m<br />

- Standalone net revenues: INR 13,599 m<br />

<strong>Glass</strong> Equipment<br />

(India) Ltd.<br />

100% 100%<br />

Quality Minerals Ltd<br />

47.4% 1<br />

HNG Float <strong>Glass</strong> Ltd<br />

(HNGFL)<br />

Capital Goods & Spares<br />

Supplier to <strong>Glass</strong> Industry<br />

Net revenues: INR 366 m<br />

Mineral Supplier to <strong>Glass</strong><br />

Industry<br />

Net revenues: INR 29 m<br />

Manufacturer of Float &<br />

Processed <strong>Glass</strong><br />

Net revenues: INR 275 m<br />

Note:<br />

1 HNGFL is proposed to be made a Subsidiary<br />

2 All figures of revenues are of FY 2010<br />

3 All Values are in INR million<br />

8

Organization<br />

HNG Board<br />

Chandra Kumar Somany,<br />

Chairman<br />

Sanjay Somany,<br />

VC & MD<br />

Mukul Somany,<br />

VC & MD<br />

HR & Admin<br />

Procurement<br />

Manufacturing<br />

Finance<br />

Commercial<br />

Marketing<br />

Professionally managed organization with clear delegation of responsibilities and authority.<br />

9

Shareholding pattern<br />

Particulars<br />

% Shareholding<br />

(as on September, 2010)<br />

Promoters 69.98<br />

Public Shareholding<br />

Insurance Companies 0.37<br />

30.02<br />

Bodies Corporate 3.14<br />

Financial Institutional Investors 7.27<br />

Individuals & Others* 19.24<br />

Total 100.00<br />

* Includes 16.76% held as Treasury Shares in the Company<br />

Total 87.4 million shares of face value of (INR. 2.00) each.<br />

Listed at: <strong>National</strong> Stock Exchange (NSE)<br />

Bombay Stock Exchange (BSE)<br />

Calcutta Stock Exchange (CSE)<br />

10

Overview<br />

• Current capacity of 2,825 Tpd – producing over ~ 15m bottles per day ranging from 5 ml to 3200 ml<br />

• Expanding to ~ 4,150 Tpd over the next 2 years<br />

Standalone operations<br />

30,000<br />

25,000<br />

16.8%<br />

20,000<br />

15,000 7,016<br />

10,000<br />

5,000<br />

1,175<br />

Successfully combated the<br />

impact of recession and<br />

increase in global crude prices<br />

21.0%<br />

10,212<br />

13,110<br />

18.0%<br />

2,147 2,359<br />

Sales CAGR: ~ 25%<br />

PBITDA CAGR: ~ 39%<br />

23.3% 25%<br />

13,599<br />

20%<br />

15%<br />

10%<br />

3,163<br />

5%<br />

-<br />

FY2007 FY2008 FY2009 FY2010<br />

Net Revenue (INR m) PBITDA (INR m) PBITDA margin<br />

0%<br />

11

Pan – India presence<br />

• Manufacturing locations in all regions in<br />

the Country<br />

• Pan-India presence enables :<br />

Delhi<br />

◊ Lowering overall landed cost to<br />

customers and ensuring JIT<br />

Kolkata<br />

supplies.<br />

◊ Comprehensive coverage of the<br />

key customers across India<br />

Mumbai<br />

Bengaluru<br />

Hyderabad<br />

Naidupeta<br />

Chennai<br />

Plant Locations<br />

Marketing Office<br />

Upcoming Greenfield Mega<br />

Project<br />

12

Inorganic growth<br />

January 2002<br />

◊ Acquired Owens Brockway India Ltd, a subsidiary of<br />

Owens Illinois, USA.<br />

◊ Capacity acquired: 700 Tpd (plants at Puducherry and<br />

Rishikesh).<br />

◊ Closed the 3 rd<br />

October 2005<br />

commercially not viable.<br />

plant of the Company at Pune, since<br />

◊ Acquired loss making unit of Larsen & Toubro<br />

◊ Capacity acquired: 320 Tpd (at Nashik)<br />

October 2007<br />

– Acquired the assets Containerr <strong>Glass</strong> division of Haryana<br />

Sheet <strong>Glass</strong>.<br />

– Capacity acquired: 180 Tpd (at Neemrana)<br />

Successful turnaround of loss making businesses – demonstrates strong<br />

management capabilities<br />

13

Ratings, Rankings & Accreditations<br />

• Business Standard Ranking (Out of 1000 top listed <strong>corp</strong>orates, as of Feb ‟10)<br />

◊<br />

◊<br />

◊<br />

In terms of Revenue – 299 th<br />

On Operating Profit Quantum – 265 th<br />

On Net Profit Quantum – 253 rd<br />

• Rating by CARE (Credit Analysis & Research Ltd.)<br />

◊<br />

◊<br />

Long Term credit rating of AA+ (implying high safety for timely servicing of debt obligations and carrying very low credit<br />

risk).<br />

Short Term credit rating of PR1(+) (implying the lowest credit risk).<br />

• CRISIL Equity Rating<br />

◊<br />

◊<br />

On „Fundamental‟ side 4/5 meaning „Superior Fundamentals‟<br />

On „Valuation‟ Side 5/5 meaning „Strong upside‟<br />

• Rated as the best Indian Company in the <strong>Glass</strong> & Ceramics category by Dun & Bradstreet in<br />

year 2009<br />

• Accredited with ISO 9001:2008 certification, ensuring stringent quality standards and ISO 22000 for<br />

food and safety<br />

• Rated at No.35, out of the best 500 companies by Inc.India(Comprehensive ranking of India‟s best<br />

performing mid-sized companies) in their Sep-Oct, 2010 issue.<br />

14

Industry Snapshot

Global packaging industry<br />

• As per World Packaging Organization, the global packaging industry at present is estimated to be<br />

higher than US$ 500 bn in revenues, with ten year historical growth at ~ 3.1% CAGR<br />

• Projected to grow at ~ 3.6% CAGR in the next five years mainly driven by growth in emerging<br />

markets (Asia Pacific region)<br />

6.3%<br />

7.0%<br />

3.4%<br />

3.2%<br />

3.6%<br />

3.1%<br />

0.7%<br />

0.5%<br />

0.4% 0.2%<br />

Asia Pacific Latin America Europe North America Global<br />

10-year historical growth (1999-2009E)<br />

Forecasted growth (2008-2013E)<br />

Source: Owens-Illinois, Inc. - Investor presentation, March 2010<br />

16

FY 2005<br />

FY 2006<br />

FY 2007<br />

FY 2008<br />

FY 2009<br />

FY 2010<br />

1961<br />

1971<br />

1981<br />

1991<br />

2001<br />

2010<br />

Indian macroeconomic overview<br />

10.0%<br />

7.5%<br />

5.0%<br />

2.5%<br />

7.5%<br />

9.4% 9.9% 9.0%<br />

6.7%<br />

7.4%<br />

1250<br />

1000<br />

750<br />

500<br />

250<br />

18%<br />

439<br />

20%<br />

548<br />

26%<br />

23%<br />

846<br />

683<br />

28%<br />

1029<br />

32%<br />

1162<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0.0%<br />

0<br />

0%<br />

GDP growth rate<br />

Total Population (m)<br />

% Urban<br />

India is the seventh largest Country by geographical area and the second-most<br />

populous Country in the world. According to IMF estimates, India‟s GDP is expected to<br />

grow by 8.5% in the current year.<br />

17

Indian <strong>Glass</strong> Packaging Industry<br />

• At US$ 14 bn, Indian packaging industry has been growing at<br />

~ 15% over the last few years<br />

World glass container per capita<br />

consumption<br />

◊ Expected to accelerate further with increasing<br />

urbanization, growing middle class and expansion of<br />

South Korea<br />

(kg)<br />

89.0<br />

modern retail<br />

France<br />

63.9<br />

• Indian glass container market stood at US$ 0.8 bn in FY09<br />

Spain<br />

50.3<br />

with a growth of ~ 12% over FY08<br />

UK<br />

27.5<br />

◊<br />

Entry barrier owing to capital intensive nature<br />

USA<br />

27.5<br />

◊<br />

Top 3 players are HNG, Piramal <strong>Glass</strong> and AGI<br />

Mexico<br />

19.5<br />

Glaspac<br />

Japan<br />

10.2<br />

• Low per capita glass container consumption of 1.4 kg in India<br />

as compared to 27.5 kg. in US and 10.2 kg. in Japan<br />

• Strong economic drivers for end-user segments (liquor and<br />

beer, pharmaceuticals, food, cosmetics, etc.)<br />

China<br />

Brazil<br />

India<br />

Indonesia<br />

5.9<br />

4.8<br />

1.4<br />

1.2<br />

18

Liquor<br />

Cases in millions<br />

• Size of Indian IMFL market is estimated to be ~ US$<br />

4.5 bn with total sales volumes of 236m cases<br />

250<br />

200<br />

190<br />

214<br />

236<br />

• Industry projected to grow at 10-12% p.a. over next few<br />

years<br />

Growth Drivers:<br />

• Low per capita consumption in India of 1.8 litres as<br />

against 8.7 litres in Europe and 8.5 litres in USA<br />

• Increasing disposable incomes<br />

• Youth & Middle-Aged population expected to increase<br />

from ~ 48% of population (2001) to 54% in 2011<br />

• ~ 485m people in the drinking age and another 100m<br />

likely to be added over next 5 years<br />

• Cultural change – acceptance of social drinking and<br />

growing drinking habits in women<br />

• Increasing deregulation by state governments<br />

150<br />

100<br />

50<br />

0<br />

49 56 57<br />

2007-08 2008-09 2009-10<br />

HNG Supply Liquor Industry Volumes<br />

Increasing awareness of health &<br />

hygiene issues leading to greater<br />

usage of new glass bottles.<br />

19

Beer<br />

Cases in millions<br />

• Size of industry in terms of volumes: 191 m cases<br />

• Industry projected to grow at 12-15% p.a. over next few<br />

years<br />

250<br />

200<br />

150<br />

157<br />

174<br />

191<br />

Growth Drivers:<br />

• Low per capita consumption in India of 1.3 litres,<br />

compared to global average of 24 litres<br />

• Increase in disposable income<br />

• Increasing exposure to beer, mainly due to increase in<br />

100<br />

50<br />

0<br />

19 20 21<br />

2007-08 2008-09 2009-10<br />

HNG Supply Industry Volumes<br />

number of outlets<br />

• Rising popularity of beer among urban working women<br />

Given the growth of beer industry<br />

in India, there is large potential for<br />

the new glass bottles.<br />

20

Food<br />

• As per Government of India‟s Vision 2025, the food processing<br />

Figures in MT – HNG <strong>Glass</strong><br />

bottles<br />

industry is expected to more than double in size from the current<br />

US$ 70 bn to ~ US$ 150 bn in 2025<br />

CAGR: ~15%<br />

100,625<br />

Growth Drivers:<br />

• Increase in disposable income<br />

• Changing lifestyles of urban and rural middle class<br />

• Increasing health consciousness with shift from traditional<br />

unpackaged formats to packaged, branded goods<br />

• Increasing working women population<br />

• Increase in penetration of glass containers – currently 10-12% of<br />

all food and beverages are packed in glass containers in India as<br />

compared to 40-50% in developed markets<br />

66,040<br />

FY2007<br />

FY2010<br />

21

Soft Drinks<br />

• The Indian soft drinks market is estimated to be ~ US$ 1.8 bn<br />

with carbonated drinks contributing US$ 1.5 bn and juices US$<br />

0.3 bn<br />

• Overall industry growing at ~ 8% p.a. with fruit drinks/ juices<br />

Figures in MT – HNG <strong>Glass</strong><br />

bottles<br />

CAGR: ~ 38%<br />

51,852<br />

category growing at ~ 25% p.a.<br />

Growth Drivers:<br />

19,731<br />

• India‟s consumption amongst one of the lowest in the world<br />

at 5 bottles (equivalent to 8 oz) p.a.<br />

• Increase in disposable income<br />

• Increasing penetration in rural India and faster urbanization<br />

• Introduction of healthier fruit based substitutes / juices and<br />

energy drinks to tap newer market aspirations<br />

FY2007<br />

FY2010<br />

22

Pharmaceuticals<br />

• India's Pharmaceutical Industry is the 3 rd largest in the world in<br />

volume terms and 14 th in value terms<br />

Figures in MT – HNG <strong>Glass</strong><br />

bottles<br />

95,009<br />

• The Indian domestic market is currently ~ US$ 12.3 bn and is<br />

growing at CAGR of 12-15% as against a global average of 4-7%<br />

◊ Projected to grow to US$ 20 bn by 2015<br />

83,460<br />

Growth Drivers:<br />

• Increase in disposable income<br />

• Increased health awareness and propensity / capacity to spend<br />

• Expansion of healthcare facilities in the rural and far-flung areas<br />

to further boost demand<br />

FY2007<br />

FY2010<br />

<strong>Glass</strong> Bottle market has<br />

experienced a de-growth of<br />

5% CAGR due to penetration of<br />

PET Bottles<br />

• Increasing penetration of customized insurance plans would drive<br />

affordability of healthcare services<br />

23

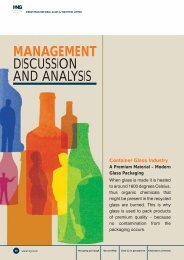

Business Overview

Summary<br />

• Largest <strong>Glass</strong> Container manufacturer in India (~ 55% volumes) with about six decades of<br />

experience. Present capacity of 2,825 Tpd<br />

• Robust financial position<br />

◊<br />

◊<br />

During the period of FY07 to FY10, standalone sales grew at a CAGR of 25% while<br />

PBITDA grew at a CAGR of 39%<br />

Enjoys economies of scale owing to size and has best in class PBITDA margins<br />

• Strong manufacturing platform spread across India through six manufacturing units<br />

• Markets container products to several top clients including United Spirits, SAB Miller, HUL,<br />

Nestle, Glaxo, Heinz, etc.<br />

• Highly experienced and competent management team<br />

• Compliance with Health, Environment and Safety regulations in India<br />

• Group is committed to CSR<br />

25

Competitive benchmarking<br />

Player<br />

Market<br />

Cap (INR)<br />

Capacity<br />

(tpd)<br />

Sales<br />

(consolidat<br />

ed) FY10-<br />

INR<br />

HNG 22.70 bn 2,825 13.8 bn<br />

Piramal<br />

<strong>Glass</strong><br />

8.46 bn 1,115 11.0 bn<br />

Other comments<br />

• Produces glass bottles to liquor, beer,<br />

pharmaceuticals, food and carbonated drinks<br />

industries<br />

• Produces glass bottles for cosmetics, pharma,<br />

food and beverages for both domestic and<br />

international markets<br />

• Key segment: Cosmetics & Pharma<br />

Vitrum <strong>Glass</strong> NA 130 NA • Produces amber glass containers for pharma<br />

Haldyn <strong>Glass</strong> 0.74 bn 320 1.34 bn<br />

• Produces glass bottles for liquor, cosmetics,<br />

pharma, food and beverage<br />

<strong>Hindusthan</strong><br />

Sanitaryware<br />

8.65bn 950 8.06* bn<br />

• <strong>Glass</strong> Division named “AGI Glaspac”<br />

• Produces glass bottles for liquor, pharma, food<br />

and beverage<br />

• *Total revenues of the company ( includes revenues from sanitary-ware business)<br />

26

Volume Mix (FY 2010)<br />

End user segment<br />

1<br />

Others,<br />

11%<br />

North, 42%<br />

Geography<br />

Pharma,<br />

11%<br />

East, 20%<br />

Food,<br />

13%<br />

Liquor,<br />

50%<br />

Beer,<br />

15%<br />

West, 16%<br />

South, 22%<br />

1 Others includes soft drinks<br />

27

Customers – Some names<br />

Liquor<br />

Beer<br />

Food<br />

Carbonated drinks<br />

(Soft drinks)<br />

Pharmaceuticals<br />

28

HNG’s Share of Top 10 Customers<br />

HNG's Share in the Total Requirement of Top 10 Customers in<br />

2009-10 (%)<br />

100<br />

95<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

60<br />

65<br />

55<br />

60<br />

80<br />

40<br />

70<br />

80<br />

50<br />

30<br />

20<br />

10<br />

0<br />

United<br />

Spirits<br />

<strong>Limited</strong><br />

United<br />

Breweries<br />

<strong>Limited</strong><br />

Pernod<br />

Ricard<br />

India<br />

SAB Miller<br />

India<br />

Allied<br />

Blenders &<br />

Distillers<br />

Coca Cola<br />

India<br />

Pepsico<br />

India<br />

Bajaj Corp<br />

<strong>Limited</strong><br />

Shiva<br />

Distilleries<br />

John<br />

Distilleries<br />

<strong>Limited</strong><br />

29

Manufacturing Facilities<br />

Plant details: Rishra (West Bengal)<br />

Description<br />

Year of start of<br />

operation<br />

Installed capacity<br />

Production in FY10<br />

Furnaces<br />

Other comments<br />

1952 (Area: 38.3 acres)<br />

805 tpd<br />

207,748 MT<br />

3 (13 manufacturing lines)<br />

• On-site bottle printing facility<br />

• Amber, flint and green glass<br />

manufacturer<br />

Rishra<br />

30

Manufacturing Facilities (contd.)<br />

Plant details: Bahadurgarh (Haryana)<br />

Description<br />

Year of start of<br />

operation<br />

Installed capacity<br />

Production in FY10<br />

Furnaces<br />

Other comments<br />

1964 (Area: 57.9 acres)<br />

655 tpd<br />

180,831 MT<br />

3 (15 manufacturing lines)<br />

• On-site bottle printing facility<br />

with four decorating lines<br />

• Amber and flint glass<br />

manufacturer<br />

• Foundry and mould workshop<br />

• Energy feed through captive<br />

power generating facilities<br />

Bahadurgarh<br />

31

Manufacturing Facilities (contd.)<br />

Plant details: Rishikesh (Uttarakhand)<br />

Description<br />

Year of acquisition<br />

Installed capacity<br />

Production in FY10<br />

Furnaces<br />

Other comments<br />

2002 (Area: 14.3 acres)<br />

425 tpd<br />

116,054 MT<br />

2 (1 furnace used for Green glass<br />

manufacture; 6 manufacturing<br />

lines )<br />

• On-site printing facility with<br />

three decorating lines<br />

• Green, flint and Georgia green<br />

Rishikesh<br />

32

Manufacturing Facilities (contd.)<br />

Plant details: Puducherry (Union territory)<br />

Description<br />

Year of acquisition<br />

Installed capacity<br />

Production in FY10<br />

Furnace<br />

Other comments<br />

2002 (Area: 46.5 acres)<br />

370 tpd<br />

114,745 MT<br />

1 (4 manufacturing lines)<br />

• On-site printing facility with three<br />

decoration lines<br />

• Sand beneficiation plant, foundry<br />

and mould workshop<br />

Puducherry<br />

33

Manufacturing Facilities (contd.)<br />

Plant details: Nashik (Maharashtra)<br />

Description<br />

Year of acquisition<br />

Installed capacity<br />

Production in FY10<br />

Furnace<br />

Other comments<br />

2005 (Area: 70.3 acres)<br />

390 tpd<br />

109,127 MT<br />

1 (4 manufacturing lines)<br />

• On-site bottle printing facility<br />

with three decorating lines<br />

• Flint glass<br />

Nashik<br />

34

Manufacturing Facilities (contd.)<br />

Plant details: Neemrana (Rajasthan)<br />

Description<br />

Year of acquisition<br />

Installed capacity<br />

Production in FY10<br />

Furnace<br />

Other comments<br />

2007 (Area: 12.3 acres)<br />

180 tpd<br />

56,795 MT<br />

1 (3 manufacturing lines)<br />

• Manufactures flint and amber<br />

glass<br />

Neemrana<br />

35

Technology Partners<br />

Technology sourced from Global majors helps boost operational efficiencies and product quality :<br />

• Batch-houses from Zippe (Germany)<br />

• Furnaces from Sorg and Horn (Germany)<br />

• Forehearths from Emhart /Sorg (USA/Germany), PSR (UK) & BH-F (UK)<br />

• IS machine control system from Botterro (Italy) and Futronic (Germany)<br />

• Bottle handling equipment from Sheppee (UK), Heye (Germany) & Pennekamp (Germany)<br />

• Annealing Lehrs from Carmet (Italy) & Pennekamp (Germany)<br />

• Bottle inspection machines from SGCC–MSC (France), Heye (Germany) and IRIS (France)<br />

• Bottle printing equipment from Strutz (USA), Rosario (Netherlands) & Kamann (Germany)<br />

36

Supply chain<br />

Procurement<br />

• Sourcing and Service contracts with various global parties<br />

• Strong procurement and supply chain systems in place with diversified supplier base to de-risk<br />

operations<br />

• Key raw materials include: silica, limestone, dolomite, feldspar, soda ash and cullet<br />

Marketing and Distribution<br />

• Presence of multiple manufacturing locations across the country presents a strategic advantage over<br />

its peers yielding higher Net Sales Realization (NSR) due to lower freight cost to the customers<br />

• Flexibility to offer JIT supplies due to lower lead<br />

• Strategic acquisitions helped increase the geographic footprint and customer penetration<br />

• Six marketing offices spread across India<br />

• In-house fleet of over 100 trucks to de-risk supply side logistics<br />

• Over 90% customers are B2B<br />

37

Environment, Health and Safety<br />

• Compliance with all EHS (Environment, Health and Safety) related legislations<br />

• Emission standards maintained within norms<br />

• Focus on zero discharge and recirculation of water<br />

• CDM projects are registered. More are in the pipeline<br />

• Qualified safety professionals at each plant<br />

• Periodical risk assessments and safety audits<br />

38

Corporate Social Responsibility<br />

The group remains committed to CSR and some of the programs embarked upon are:<br />

• Provision of street lighting and maintenance of a children‟s park in the colony (Tulsi Vihar) adjacent<br />

to the plant at Rishikesh<br />

• Sunetra Eye Clinic<br />

◊ The Group started an eye check-up centre for underprivileged citizens in collaboration with<br />

Calcutta Eye Research Foundation<br />

• School operated at Bahadurgarh (Bal Bharti) that caters to the education requirements of most of<br />

the children in the vicinity. 1,700 students registered under CBSE curriculum<br />

• Training programs conducted for underprivileged girls.<br />

• Regularly conducts free medical camps<br />

• Undertaken plantation of trees in large numbers<br />

• Maintenance of park “Maharana Pratap Square” in Kolkata<br />

39

Float <strong>Glass</strong> Business

Summary<br />

• A Strategic move to venture into high growth Float <strong>Glass</strong> industry through Associate - HNG Float<br />

<strong>Glass</strong> <strong>Limited</strong> (~ 47% shareholding)<br />

◊ Proposed to be made a subsidiary<br />

• Indian Float <strong>Glass</strong> industry has been growing at ~ 12% CAGR over the last three years:<br />

◊<br />

◊<br />

Low per capita consumption of 0.8kg as compared to 8kg in China, 12.5Kg in Europe<br />

and 10.4kg in USA<br />

Growth in construction and automobile sectors in India<br />

• Plant setup at plant at Halol, Gujarat<br />

◊ Strategic Locational advantage:<br />

Proximity to Large consuming markets of Western and Northern India<br />

Located on Delhi-Mumbai Industrial Corridor<br />

Availability of Natural Gas Sources & nearness to sources all raw-materials<br />

◊ Capacity: 600 Tpd set up at a capex of (INR 6 bn)<br />

◊ Commenced production in Feb ‟10.<br />

◊ Expected to break-even within the current fiscal<br />

41

Market overview<br />

• Nascent industry in India with just 8 float glass lines compared with 196 in China<br />

• India‟s total installed capacity for float glass is ~ 4,700 Tpd<br />

• Growth drivers<br />

◊ Growth in the Construction Sector driven by<br />

◊<br />

◊<br />

◊<br />

Growth in the services sector - telecom, financial services, IT & ITeS etc<br />

Boom in retail marketing through shopping malls<br />

Increasing demand for affordable housing and high rate of urbanization<br />

◊ Growth in Automobile Sector mainly driven by growth in passenger vehicles, LCV & HCV<br />

and increased exports<br />

42

Highlights – HNG Float <strong>Glass</strong><br />

• Overview<br />

◊ Commenced production in a record time of 21 months<br />

◊ Plant achieved global production quality & efficiency benchmarks within a short span of 5 months<br />

◊ Competitors include Saint Gobain, Asahi, Gujarat Guardian, Gold Plus, Sejal, etc.<br />

• Certifications - European standards and ASPM (U.S. standards) and ISO 9001:2000<br />

• Procurement of raw material<br />

◊ Diversified supplier base for each raw material to reduce any business<br />

• 25% market share captured in 9 months with a wide distribution network of 758 agents spread<br />

across India<br />

• Growth plans<br />

◊ Capacity expansion by 900 Tpd<br />

◊ Also planning a wider range to meet the market demand for value added products.<br />

43

Competitive benchmarking<br />

Player<br />

Installed<br />

capacity (tpd)<br />

Dealer network in diff geographical regions in India<br />

North East West South Total<br />

HNGFL 600 161 44 320 223 758<br />

Saint Gobain 1400 195 75 210 279 759<br />

Asahi 1200 112 40 90 177 419<br />

Gujarat Guardian 550 93 30 160 171 454<br />

Gold Plus 460 68 10 48 20 146<br />

Sejal 550 54 11 80 81 226<br />

44

Business Strategy and Expansion<br />

Plans

Key Success Factors<br />

• Size and Strength of the Balance Sheet:<br />

◊ Provides flexibility and power to negotiate with<br />

suppliers and customers<br />

◊ Enables the Company to build capacity and<br />

pursue expansion plans<br />

• Cost management and optimal utilization of<br />

resources (manufacturing assets)<br />

◊ Ability to manage costs and suitably placed to<br />

pass increases (if any) to the customer<br />

◊ Ability to sweat the assets to the maximum<br />

extent for delivering better operational results<br />

• Strong technological capabilities<br />

◊ Ability to innovate and provide customers with<br />

optimized product, ensuring sustainable<br />

competitive advantage in the market<br />

• Well diversified spread across verticals and<br />

segments<br />

◊ Presence across entire primary end user<br />

industries and customer segments<br />

HNG’s Status<br />

◊ Market share of ~ 55%<br />

◊ Low debt/equity of 0.5x<br />

◊ Strong credit rating of AA (Long term)<br />

◊ Diversified supplier base<br />

◊ Strong focus on margin improvement<br />

◊ Backward integration to reduce costs<br />

◊ Optimum utilization of furnace capacities<br />

◊ Introduction of NNPB technology<br />

◊ Technology tie up with global majors<br />

including JV with OMCO, Belgium<br />

◊ Presence across key user industries –<br />

liquor, beer, pharmaceuticals and food<br />

◊ Planning entry into Perfumery segment<br />

46

Strategic initiatives<br />

• Emerge as a value driven manufacturer through increased production of light weighted bottles<br />

thus enhancing margins<br />

◊ PBITDA margin for standalone operations improved from ~ 17% in FY2007 to ~ 23% in<br />

FY2010<br />

• Setting up a Mega <strong>Glass</strong> Manufacturing Complex in Naidupeta, Andhra Pradesh (110Km from<br />

Chennai)<br />

• Enhancing SAP Information System (Business Intelligence modules and Performance<br />

Management Systems) to closely monitor and improve key operating metrics<br />

• Leveraging capabilities of acquiring and turning around underperforming global assets by<br />

replicating the model already successfully achieved in India<br />

• Investing in fresh capacity to improve market share<br />

• Leveraging existing relationships with customers and service their growing needs in other<br />

countries with supplies being made out of facilities in India<br />

47

Strategic initiatives (contd.)<br />

• Further enhancement of Product Range in NNPB<br />

• Emerge as a leading player in the Float <strong>Glass</strong> container business in India<br />

◊ Current market share of ~ 25% and projected to grow further<br />

◊ Further capacity of ~ 900 Tpd planned to be added to existing capacity of 600 Tpd<br />

• Captive mining for silica procurement for Rishra plant (West Bengal) and Float <strong>Glass</strong> plant<br />

(owned by HNGFL)<br />

• Building up a strong team in Technology Center to provide technical excellence across the plants<br />

and reduce capital costs for upcoming projects.<br />

• Ongoing technology upgradation with global majors<br />

48

Expansion plans<br />

Greenfield in<br />

Andhra<br />

Pradesh<br />

New Furnace<br />

in Nashik<br />

Capacity<br />

addition (tpd)<br />

Investment<br />

650 INR 5.0 bn<br />

650 INR 4.7 bn<br />

Other comments<br />

• Land has already been allotted<br />

• Project commenced from July‟10<br />

• Targeted project completion date is Mar‟12<br />

• Existing Plant has huge space for this<br />

• Production expected by the end of yr. 2011<br />

Furnace<br />

Rebuilds<br />

220 INR 2.0 bn • Rebuilds at Rishra and Rishikesh<br />

HNGFL 900 INR 6.0 bn • Increase in float glass production capacity<br />

Other plans include:<br />

• Acquisitions (domestic and international) in the <strong>Glass</strong> Container<br />

space guided by the “value buy” proposition, as in the past<br />

• JV with OMCO, Belgium for Moulds & Accessories<br />

49

Enhancing margins<br />

• Shift to natural gas in manufacturing process, by replacing Furnace Oil and LPG across all 6 plants.<br />

Bahadurgarh<br />

Already in place<br />

Neemrana<br />

Already in Place<br />

Nashik By September, 2011<br />

Puducherry By October, 2012<br />

Rishikesh, Rishra By June, 2013<br />

• Enhanced Mould Quality for higher performance and life<br />

• Competitive advantage in marketing – quantity and pricing<br />

• Introducing NNPB across all plants thus reducing bottle weight and producing more bottles<br />

• Acquisition and Operation of Captive Mining and Beneficiation of Raw Materials.<br />

• Expansion of transportation fleet – ensuring both economy and in-time delivery<br />

50

Financial Snapshot

Consolidated P&L<br />

All values in INR million<br />

Particulars FY08 FY09 FY10<br />

Net Revenue 10,291 13,305 13,834<br />

Net Revenue growth 46.7% 29.3% 4.0%<br />

PBITDA 2,165 2,388 3,192<br />

PBITDA Margin 21.0% 18.0% 1 23.1%<br />

PBIT 1,455 1,634 2,323<br />

PBIT Margin 14.1% 12.3% 16.8%<br />

PAT 2 1,205 1,081 1,541<br />

PAT Margin 11.7% 8.1% 1 11.1%<br />

Note:<br />

1 Due to high global crude prices, overall recession in global economy and some losses in financial derivative transaction<br />

2 PAT does not include adjustments for share in associate company<br />

52

Realisation, volume and revenue<br />

900,000<br />

40,000<br />

30,000<br />

30%<br />

675,000<br />

14,677<br />

17,126 17,377<br />

30,000<br />

24,000<br />

18,000<br />

21%<br />

18%<br />

23%<br />

25%<br />

20%<br />

450,000<br />

225,000<br />

695,820<br />

765,478 782,585<br />

20,000<br />

10,000<br />

12,000<br />

6,000<br />

10,212<br />

13,110 13,599<br />

15%<br />

10%<br />

5%<br />

-<br />

FY 2008 FY 2009 FY 2010<br />

-<br />

-<br />

FY 2008 FY 2009 FY 2010<br />

0%<br />

Sales Quantity in MT (LHS)<br />

Average Realisation in INR/MT (RHS)<br />

Sales in INR m (LHS)<br />

PBITDA margin (%) (RHS)<br />

53

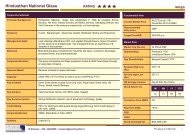

Realisation by segment<br />

Segment<br />

Net Realizations (INR/MT)<br />

FY2008 FY2009 FY2010<br />

CAGR<br />

(2008-10)<br />

Food 14,655 17,730 18,377 12.0%<br />

Soft Drinks 15,873 18,107 20,132 12.6%<br />

Beer 12,242 15,433 16,066 14.6%<br />

Liquor 13,852 16,658 16,503 9.2%<br />

Pharmaceuticals 16,505 19,117 19,726 9.3%<br />

Toiletries 15,593 18,787 18,560 9.1%<br />

Vials 25,643 29,404 29,246 6.8%<br />

Household 20,077 21,445 22,363 5.5%<br />

Total 14,677 17,127 17,377 8.8%<br />

Realisation has further increased by approximately 6-7% w.e.f. 1 August 2010<br />

54

Consolidated Balance Sheet<br />

All values in INR million<br />

Particulars FY08 FY09 FY10<br />

Net Fixed Assets 8,979 9,904 11,380<br />

Investments 1,139 1,021 1,446<br />

Net Working Capital 3,074 4,087 4085<br />

Total Assets 13,192 15,012 16,911<br />

Shareholders equity 8,799 9,490 10,545<br />

Secured Loans 2,896 4,180 5,495<br />

Unsecured Loans 1,313 921 171<br />

Deferred tax liabilities 184 421 700<br />

Total liabilities and equity 13,192 15,012 16,911<br />

Long term debt/ equity 0.17 0.35 0.36<br />

Total debt/ equity (x) 0.5 0.5 0.5<br />

Operating in a capital intensive industry, the Company has been able to maintain a<br />

total debt/ equity ratio of 0.5x<br />

55

<strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & <strong>Industries</strong> Ltd. (HNG)<br />

THANK<br />

YOU<br />

For any queries/to obtain more info, please<br />

write at investor.relations@<strong>hng</strong>il.com

Annexure

Management team<br />

Jagdish Prasad Kasera, Senior President<br />

• Over 40 years of experience. Joined Company in Jan-98. Responsible for operations and M&A<br />

• Worked with several prominent groups - Williamson Magor, Usha Martin, Aditya Birla and Ispat<br />

• Fellow member of the Institute of Chartered Accountants of India and the Institute of Company Secretaries of<br />

India. Also a Qualified Cost Accountant.<br />

Ratan Lal Khandelia, President<br />

• Over 34 years of experience. Joined Company in Mar-99<br />

• Currently looking after Bahadurgarh, Rishikesh and Neemrana Plant<br />

• Worked with various companies, including MP Birla Group and Ferro Alloys Group. Qualified Chartered<br />

Accountant from the Institute of Chartered Accountants of India<br />

Vinay Saran, Senior Vice President - Marketing<br />

• Over 22 years of experience in the field of consumer products and consumer durable marketing. Joined Company<br />

in 2007<br />

• Key member of the governing body of the Indian Institute of Packaging, Mumbai, All India Management<br />

Association, Kolkata, Management Association, <strong>National</strong> HRD Network and the Indian Institute of Packaging,<br />

Kolkata<br />

Laxmi Narayan Mandhana, Chief Financial Officer<br />

• Qualified Chartered Accountant and Company Secretary<br />

• Over 20 years of experience in in finance - comprising capital issues, mergers, acquisitions, banking, project activities,<br />

business evaluations and monitoring. Is associated with the Group for about seven years<br />

• Member of the Finance Committee of the Confederation of Indian Industry, Eastern Region<br />

• Expert in <strong>corp</strong>orate finance, taxation and accounts<br />

58

Management team<br />

Animesh Banerjee, Senior Vice President<br />

• Over 23 years of experience in polymers, pharmaceuticals, chemicals, fine chemicals, petrochemicals, dyes and<br />

intermediates, paints and varnishes, food processing and FMCG<br />

• Worked with companies like Shaw Wallace, IPCCL, Mafatlal <strong>Industries</strong> Ltd., TATA Kansai, Berger Paints<br />

• Currently looking after Rishra, Nashik and Puducherry Plant<br />

• Post graduate from IIT Kharagpur and MBA from IIM, Kolkata<br />

Amar Chand Jain, Vice President – Tech Centre<br />

• Over 47 years in all areas of Container <strong>Glass</strong> Production. He joined the Company in 1963<br />

• Currently is a leading member of the Group Technical Centre, responsible for Research, Development,<br />

Technological Absorption, Innovations, Acquisitions and New Projects<br />

• He is a science graduate<br />

Ram Surat Prasad Gupta, Vice President<br />

• Over 35 years of experience in various industries - electrical (lighting division Philips), mechanical (HNG & Ind.),<br />

electronics (Binatone Electronics), process industries (Sheela Foam)<br />

• He studied engineering (mechanical) and did his post graduation in management<br />

• Associated with Quality Certifications<br />

Chandra Singh. K Mehta, Plant Head – Nashik<br />

• He started his career with M/s <strong>Hindusthan</strong> Development Corporation <strong>Limited</strong> and worked with M/s Shakti<br />

Insulated Ltd before joining HNG<br />

• He has served 21 years in the career<br />

59

Management team<br />

Jalaj Kumar Malpani, Vice President - Commercial<br />

• He handles <strong>corp</strong>orate MIS, annual business plan and quarterly performance reviews<br />

• Recipient of Jawahar Award for meritorious performance in the area of cost reduction and cost control<br />

• Worked with SAIL for 15 years at Bokaro Steel Plant and CMO, Kolkata, and ICI India Ltd for one year. Worked<br />

closely with Mckinsey & Co in the area of inventory management and debt<br />

Kulur Satish Shetty, Plant Head, Puducherry<br />

• Over 28 years of experience, with over 25 years in the field of glass manufacture. He joined the Company in 2006<br />

• He has worked with Bharat Electronics Ltd ,Taloja ,Maharashtra (a public sector company), Videocon Narmada<br />

<strong>Glass</strong>, Bharuch ,Gujarat, and Hotline <strong>Glass</strong> Ltd, Gwalior, Madhya Pradesh<br />

• Holds a bachelor degree in mechanical engineering from a regional engineering college, Surathkal, Karnataka<br />

Devdutta Hoare, Exports Head<br />

• Over 19 years of experience in in marketing of industrial products in India and abroad. Joined Company in 2007<br />

• Previously worked with Dr. Beck & Co, Atul <strong>Limited</strong> and Gwalior Chemicals<br />

• He is chemical engineering graduate from Jadavpur University, Kolkata<br />

Ravindra Kr Sitani, Vice President-Works<br />

• Over 26 years of experience. He joined the Company in 2007<br />

• Previously worked with Grasim <strong>Industries</strong> Ltd, Kanoria Chemicals & Ind Ltd and <strong>Hindusthan</strong> Vidyut Prod Ltd<br />

• He has B.E. (Hons) Mechanical and ME (Industrial Production) from BITS, Pilani<br />

• Currently posted at Bahadurgarh Plant<br />

60

Management team<br />

Bimal Kumar Garodia, Vice President - Finance<br />

• Over 20 years of industry experience. He joined the company in Apr-08<br />

• Previous experience includes Bajaj Eco-tech <strong>Limited</strong>, a wholly owned subsidiary of Bajaj <strong>Hindusthan</strong> Ltd<br />

• He is qualified Chartered Accountant, Cost Accountant and a Company Secretary<br />

Chandra Kumar Tharad (Vice President –Commercial)<br />

• Over 25 years of experience<br />

• Previous experience includes Usha Martin and LNG Bhilwara Group<br />

• Commerce Graduate with Calcutta University. He completed Chartered Accountancy in 1984<br />

Bishnu Kumar Kedia, AVP - Materials<br />

• Joined Company in 2003<br />

• Previously worked with Khaitan (India) <strong>Limited</strong>, Agarwal Hardwares <strong>Limited</strong> and Magma Leasing <strong>Limited</strong><br />

• B. Com. (Hons.) from St. Xavier‟s College (Calcutta University) where he scored 49th rank in the University and<br />

received national scholarship. He is qualified Chartered Accountant<br />

Kuldeep Kumar Sharma, Plant Head – Neemrana<br />

• Over 31 years of experience in glass industry<br />

• He is B.Sc., M.A. (Eng), M.Ed.. Took training at O.I. (USA) for glass operations and quality management systems,<br />

HACCP (hazard analysis & critical control points) Course from DNV, IMS (Integrated Management System)<br />

Shammo Roy Choudhury, AVP – HR<br />

• Has over 25 years of rich experience having worked in renowned multinationals Pfizer, Otis Elevator Co (I) Ltd &<br />

Flakt India Ltd and engineering company Shriram Bearings Ltd & Stone India <strong>Limited</strong><br />

• He is Commerce Graduate from St Xavier‟s with Post Graduate in Industrial Relations & Personnel Management<br />

from Xavier Institute of Social Service, Ranchi<br />

61