Tax Efficient Review of Octopus Eureka EIS Fund with ... - Clubfinance

Tax Efficient Review of Octopus Eureka EIS Fund with ... - Clubfinance

Tax Efficient Review of Octopus Eureka EIS Fund with ... - Clubfinance

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

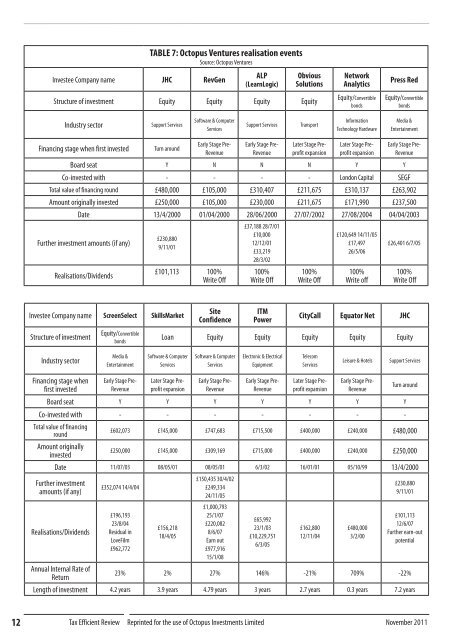

TABLE 7: <strong>Octopus</strong> Ventures realisation events<br />

Source: <strong>Octopus</strong> Ventures<br />

Investee Company name JHC RevGen<br />

ALP<br />

(LearnLogic)<br />

Obvious<br />

Solutions<br />

Network<br />

Analytics<br />

Press Red<br />

Structure <strong>of</strong> investment Equity Equity Equity Equity<br />

Equity/Convertible<br />

bonds<br />

Equity/Convertible<br />

bonds<br />

Industry sector<br />

Support Services<br />

S<strong>of</strong>tware & Computer<br />

Services<br />

Support Services<br />

Transport<br />

Information<br />

Technology Hardware<br />

Media &<br />

Entertainment<br />

Early Stage Pre- Early Stage Pre- Later Stage Prepr<strong>of</strong>it<br />

expansion pr<strong>of</strong>it expansion Revenue<br />

Later Stage Pre-<br />

Early Stage Pre-<br />

Financing stage when first invested<br />

Turn around<br />

Revenue<br />

Revenue<br />

Board seat Y N N N Y Y<br />

Co-invested <strong>with</strong> - - - - London Capital SEGF<br />

Total value <strong>of</strong> financing round £480,000 £105,000 £310,407 £211,675 £310,137 £263,902<br />

Amount originally invested £250,000 £105,000 £230,000 £211,675 £171,990 £237,500<br />

Date 13/4/2000 01/04/2000 28/06/2000 27/07/2002 27/08/2004 04/04/2003<br />

Further investment amounts (if any)<br />

Realisations/Dividends<br />

£230,880<br />

9/11/01<br />

£101,113 100%<br />

Write Off<br />

£37,188 28/7/01<br />

£10,000<br />

12/12/01<br />

£33,219<br />

28/3/02<br />

100%<br />

Write Off<br />

100%<br />

Write Off<br />

£120,649 14/11/05<br />

£17,497<br />

26/5/06<br />

100%<br />

Write <strong>of</strong>f<br />

£26,401 6/7/05<br />

100%<br />

Write Off<br />

Investee Company name ScreenSelect SkillsMarket<br />

Site<br />

Confidence<br />

ITM<br />

Power<br />

CityCall Equator Net JHC<br />

Structure <strong>of</strong> investment<br />

Equity/Convertible<br />

bonds<br />

Loan Equity Equity Equity Equity Equity<br />

Industry sector<br />

Media &<br />

Entertainment<br />

S<strong>of</strong>tware & Computer<br />

Services<br />

S<strong>of</strong>tware & Computer<br />

Services<br />

Electronic & Electrical<br />

Equipment<br />

Telecom<br />

Services<br />

Leisure & Hotels<br />

Support Services<br />

Financing stage when<br />

first invested<br />

Early Stage Pre-<br />

Revenue<br />

Later Stage Prepr<strong>of</strong>it<br />

expansion<br />

Early Stage Pre-<br />

Revenue<br />

Early Stage Pre-<br />

Revenue<br />

Later Stage Prepr<strong>of</strong>it<br />

expansion<br />

Early Stage Pre-<br />

Revenue<br />

Turn around<br />

Board seat Y Y Y Y Y Y Y<br />

Co-invested <strong>with</strong> - - - - - - -<br />

Total value <strong>of</strong> financing<br />

round<br />

£602,073 £145,000 £747,683 £715,500 £400,000 £240,000 £480,000<br />

Amount originally<br />

invested<br />

£250,000 £145,000 £309,169 £715,000 £400,000 £240,000 £250,000<br />

Date 11/07/03 08/05/01 08/05/01 6/3/02 16/01/01 05/10/99 13/4/2000<br />

Further investment<br />

amounts (if any)<br />

Realisations/Dividends<br />

£352,074 14/4/04<br />

£196,193<br />

23/8/04<br />

Residual in<br />

LoveFilm<br />

£962,772<br />

£156,218<br />

18/4/05<br />

£150,435 30/4/02<br />

£249,334<br />

24/11/05<br />

£1,000,793<br />

25/1/07<br />

£220,082<br />

8/6/07<br />

Earn out<br />

£977,916<br />

15/1/08<br />

£65,992<br />

23/1/03<br />

£10,229,751<br />

6/3/05<br />

£162,800<br />

12/11/04<br />

£480,000<br />

3/2/00<br />

£230,880<br />

9/11/01<br />

£101,113<br />

12/6/07<br />

Further earn-out<br />

potential<br />

Annual Internal Rate <strong>of</strong><br />

Return<br />

23% 2% 27% 146% -21% 709% -22%<br />

Length <strong>of</strong> investment 4.2 years 3.9 years 4.79 years 3 years 2.7 years 0.3 years 7.2 years<br />

12 <strong>Tax</strong> <strong>Efficient</strong> <strong>Review</strong> Reprinted for the use <strong>of</strong> <strong>Octopus</strong> Investments Limited November 2011