Tax Efficient Review of Octopus Eureka EIS Fund with ... - Clubfinance

Tax Efficient Review of Octopus Eureka EIS Fund with ... - Clubfinance

Tax Efficient Review of Octopus Eureka EIS Fund with ... - Clubfinance

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Octopus</strong> <strong>Eureka</strong> <strong>EIS</strong> Portfolio<br />

Service<br />

Strategy<br />

Business<br />

<strong>Fund</strong> investing both in UK quoted and unquoted<br />

companies<br />

Size<br />

No cap (evergreen portfolio service)<br />

<strong>Fund</strong> Manager<br />

<strong>Octopus</strong> Investments (Ventures team)<br />

Minimum investment £25,000<br />

Maximum Investment<br />

None<br />

Estimated period to full investment 12-18 months<br />

Commission<br />

2.5% up-front plus 0.5% trail<br />

Available <strong>Tax</strong> Years 2011/12 and 2012/13<br />

<strong>Eureka</strong> <strong>EIS</strong> Portfolio Service is a discretionary portfolio service <strong>of</strong>fering from <strong>Octopus</strong> Investments,<br />

one <strong>of</strong> the largest providers <strong>of</strong> tax-efficient investments. Through various operating divisions (see<br />

Table 2), <strong>Octopus</strong> <strong>of</strong>fers Venture Capital Trusts, Enterprise Investment Schemes and Inheritance <strong>Tax</strong><br />

products in various forms, each <strong>with</strong> different risk/reward combinations.<br />

This <strong>EIS</strong> <strong>of</strong>fering is managed by <strong>Octopus</strong>' Ventures team, which also manages the Titan series<br />

<strong>of</strong> VCTs (see Issue 75 for a review <strong>of</strong> <strong>Octopus</strong> Titan VCT 5). <strong>Fund</strong>s raised by this <strong>EIS</strong> <strong>of</strong>fering will be<br />

co-invested alongside, and on the same terms as) the Titan VCTs and private investor group, the<br />

<strong>Octopus</strong> Venture Partners, run by <strong>Octopus</strong>. The <strong>Octopus</strong> Ventures Team has been investing into <strong>EIS</strong><br />

qualifying companies since 1999 and has built a strong track record <strong>with</strong> a realised IRR <strong>of</strong> 36.1%.<br />

This track record however is not one that investors in the <strong>Eureka</strong> product will recognise as relevant<br />

for reasons we elaborate on later.<br />

<strong>Eureka</strong> aims to <strong>of</strong>fer investors the opportunity to generate returns by investing into a portfolio<br />

<strong>of</strong> early stage, fast growth UK companies which also qualify for the <strong>EIS</strong> tax reliefs. <strong>Eureka</strong> is clearly<br />

differentiated from <strong>Octopus</strong>’ other <strong>EIS</strong> <strong>of</strong>fering, <strong>Octopus</strong> <strong>EIS</strong>. <strong>Octopus</strong> <strong>EIS</strong> is designed to produce<br />

predictable returns for investors by investing into companies <strong>with</strong> the emphasis on risk mitigation.<br />

<strong>Eureka</strong> invests for capital growth<br />

As at the 15 August 2011, funds raised by this <strong>of</strong>fering totalled £22.4m.<br />

<strong>Eureka</strong> started life as an AIM <strong>EIS</strong> portfolio <strong>of</strong>fering in early 2004 as a three year “rolling” <strong>EIS</strong><br />

portfolio and raised £11.5m. The intention was to hold individual AIM companies for at least three<br />

years before selling and reinvesting, thus allowing the investor to claim a further 20% tax relief. The<br />

expectation in 2004 was that the manager would be very rigorous in only selecting those companies<br />

<strong>with</strong> clear visibility in revenue streams and where the manager thought there would be very<br />

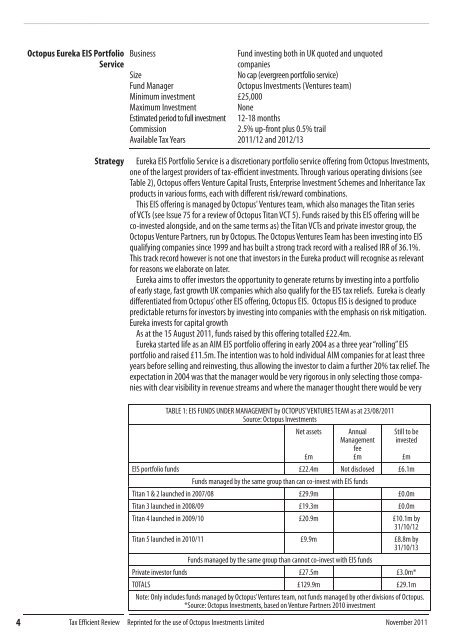

TABLE 1: <strong>EIS</strong> FUNDS UNDER MANAGEMENT by OCTOPUS’ VENTURES TEAM as at 23/08/2011<br />

Source: <strong>Octopus</strong> Investments<br />

Net assets<br />

£m<br />

Annual<br />

Management<br />

fee<br />

£m<br />

Still to be<br />

invested<br />

£m<br />

<strong>EIS</strong> portfolio funds £22.4m Not disclosed £6.1m<br />

<strong>Fund</strong>s managed by the same group than can co-invest <strong>with</strong> <strong>EIS</strong> funds<br />

Titan 1 & 2 launched in 2007/08 £29.9m £0.0m<br />

Titan 3 launched in 2008/09 £19.3m £0.0m<br />

Titan 4 launched in 2009/10 £20.9m £10.1m by<br />

31/10/12<br />

Titan 5 launched in 2010/11 £9.9m £8.8m by<br />

31/10/13<br />

<strong>Fund</strong>s managed by the same group than cannot co-invest <strong>with</strong> <strong>EIS</strong> funds<br />

Private investor funds £27.5m £3.0m*<br />

TOTALS £129.9m £29.1m<br />

Note: Only includes funds managed by <strong>Octopus</strong>’ Ventures team, not funds managed by other divisions <strong>of</strong> <strong>Octopus</strong>.<br />

*Source: <strong>Octopus</strong> Investments, based on Venture Partners 2010 investment<br />

4 <strong>Tax</strong> <strong>Efficient</strong> <strong>Review</strong> Reprinted for the use <strong>of</strong> <strong>Octopus</strong> Investments Limited November 2011