economic analysis of small-scale tilapia aquaculture in mozambique

economic analysis of small-scale tilapia aquaculture in mozambique

economic analysis of small-scale tilapia aquaculture in mozambique

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Salia<br />

g) Balance sheet: The balance sheet component shows the f<strong>in</strong>ancial status at the<br />

end <strong>of</strong> each year, what the assets are, what the liabilities are and the net worth.<br />

The “bottom l<strong>in</strong>e” <strong>of</strong> a balance sheet shows the total liabilities (company<br />

obligations) subtracted from the assets. This must always balance each other,<br />

that is assets have to be equal to summation <strong>of</strong> liabilities (Appendix 6).<br />

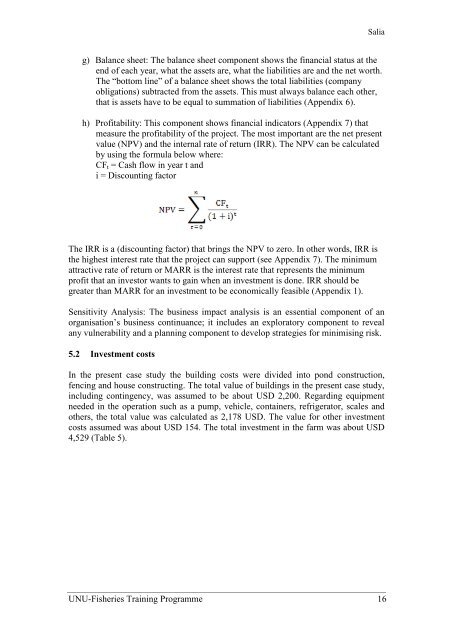

h) Pr<strong>of</strong>itability: This component shows f<strong>in</strong>ancial <strong>in</strong>dicators (Appendix 7) that<br />

measure the pr<strong>of</strong>itability <strong>of</strong> the project. The most important are the net present<br />

value (NPV) and the <strong>in</strong>ternal rate <strong>of</strong> return (IRR). The NPV can be calculated<br />

by us<strong>in</strong>g the formula below where:<br />

CF t = Cash flow <strong>in</strong> year t and<br />

i = Discount<strong>in</strong>g factor<br />

The IRR is a (discount<strong>in</strong>g factor) that br<strong>in</strong>gs the NPV to zero. In other words, IRR is<br />

the highest <strong>in</strong>terest rate that the project can support (see Appendix 7). The m<strong>in</strong>imum<br />

attractive rate <strong>of</strong> return or MARR is the <strong>in</strong>terest rate that represents the m<strong>in</strong>imum<br />

pr<strong>of</strong>it that an <strong>in</strong>vestor wants to ga<strong>in</strong> when an <strong>in</strong>vestment is done. IRR should be<br />

greater than MARR for an <strong>in</strong>vestment to be <strong>economic</strong>ally feasible (Appendix 1).<br />

Sensitivity Analysis: The bus<strong>in</strong>ess impact <strong>analysis</strong> is an essential component <strong>of</strong> an<br />

organisation‟s bus<strong>in</strong>ess cont<strong>in</strong>uance; it <strong>in</strong>cludes an exploratory component to reveal<br />

any vulnerability and a plann<strong>in</strong>g component to develop strategies for m<strong>in</strong>imis<strong>in</strong>g risk.<br />

5.2 Investment costs<br />

In the present case study the build<strong>in</strong>g costs were divided <strong>in</strong>to pond construction,<br />

fenc<strong>in</strong>g and house construct<strong>in</strong>g. The total value <strong>of</strong> build<strong>in</strong>gs <strong>in</strong> the present case study,<br />

<strong>in</strong>clud<strong>in</strong>g cont<strong>in</strong>gency, was assumed to be about USD 2,200. Regard<strong>in</strong>g equipment<br />

needed <strong>in</strong> the operation such as a pump, vehicle, conta<strong>in</strong>ers, refrigerator, <strong>scale</strong>s and<br />

others, the total value was calculated as 2,178 USD. The value for other <strong>in</strong>vestment<br />

costs assumed was about USD 154. The total <strong>in</strong>vestment <strong>in</strong> the farm was about USD<br />

4,529 (Table 5).<br />

UNU-Fisheries Tra<strong>in</strong><strong>in</strong>g Programme 16