SAILING THE SEAS OF SUCCESS - Swissco Holdings Limited

SAILING THE SEAS OF SUCCESS - Swissco Holdings Limited

SAILING THE SEAS OF SUCCESS - Swissco Holdings Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO <strong>THE</strong> FINANCIAL STATEMENTS<br />

FOR <strong>THE</strong> FINANCIAL YEAR ENDED 31 DECEMBER 2004<br />

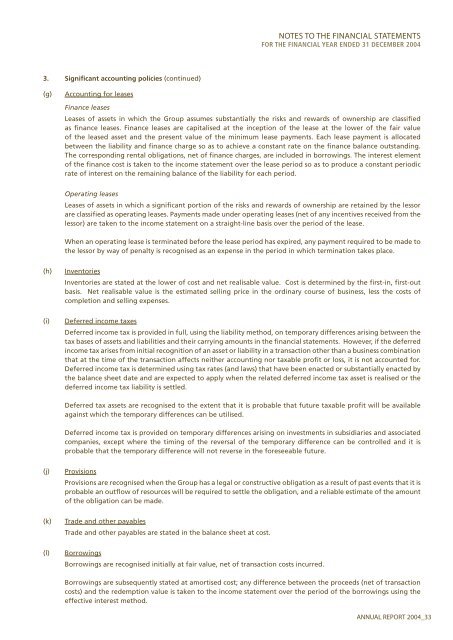

3. Significant accounting policies (continued)<br />

(g)<br />

Accounting for leases<br />

Finance leases<br />

Leases of assets in which the Group assumes substantially the risks and rewards of ownership are classified<br />

as finance leases. Finance leases are capitalised at the inception of the lease at the lower of the fair value<br />

of the leased asset and the present value of the minimum lease payments. Each lease payment is allocated<br />

between the liability and finance charge so as to achieve a constant rate on the finance balance outstanding.<br />

The corresponding rental obligations, net of finance charges, are included in borrowings. The interest element<br />

of the finance cost is taken to the income statement over the lease period so as to produce a constant periodic<br />

rate of interest on the remaining balance of the liability for each period.<br />

Operating leases<br />

Leases of assets in which a significant portion of the risks and rewards of ownership are retained by the lessor<br />

are classified as operating leases. Payments made under operating leases (net of any incentives received from the<br />

lessor) are taken to the income statement on a straight-line basis over the period of the lease.<br />

When an operating lease is terminated before the lease period has expired, any payment required to be made to<br />

the lessor by way of penalty is recognised as an expense in the period in which termination takes place.<br />

(h)<br />

Inventories<br />

Inventories are stated at the lower of cost and net realisable value. Cost is determined by the first-in, first-out<br />

basis. Net realisable value is the estimated selling price in the ordinary course of business, less the costs of<br />

completion and selling expenses.<br />

(i)<br />

Deferred income taxes<br />

Deferred income tax is provided in full, using the liability method, on temporary differences arising between the<br />

tax bases of assets and liabilities and their carrying amounts in the financial statements. However, if the deferred<br />

income tax arises from initial recognition of an asset or liability in a transaction other than a business combination<br />

that at the time of the transaction affects neither accounting nor taxable profit or loss, it is not accounted for.<br />

Deferred income tax is determined using tax rates (and laws) that have been enacted or substantially enacted by<br />

the balance sheet date and are expected to apply when the related deferred income tax asset is realised or the<br />

deferred income tax liability is settled.<br />

Deferred tax assets are recognised to the extent that it is probable that future taxable profit will be available<br />

against which the temporary differences can be utilised.<br />

Deferred income tax is provided on temporary differences arising on investments in subsidiaries and associated<br />

companies, except where the timing of the reversal of the temporary difference can be controlled and it is<br />

probable that the temporary difference will not reverse in the foreseeable future.<br />

(j)<br />

Provisions<br />

Provisions are recognised when the Group has a legal or constructive obligation as a result of past events that it is<br />

probable an outflow of resources will be required to settle the obligation, and a reliable estimate of the amount<br />

of the obligation can be made.<br />

(k)<br />

Trade and other payables<br />

Trade and other payables are stated in the balance sheet at cost.<br />

(l)<br />

Borrowings<br />

Borrowings are recognised initially at fair value, net of transaction costs incurred.<br />

Borrowings are subsequently stated at amortised cost; any difference between the proceeds (net of transaction<br />

costs) and the redemption value is taken to the income statement over the period of the borrowings using the<br />

effective interest method.<br />

ANNUAL REPORT 2004_33