SAILING THE SEAS OF SUCCESS - Swissco Holdings Limited

SAILING THE SEAS OF SUCCESS - Swissco Holdings Limited

SAILING THE SEAS OF SUCCESS - Swissco Holdings Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO <strong>THE</strong> FINANCIAL STATEMENTS<br />

FOR <strong>THE</strong> FINANCIAL YEAR ENDED 31 DECEMBER 2004<br />

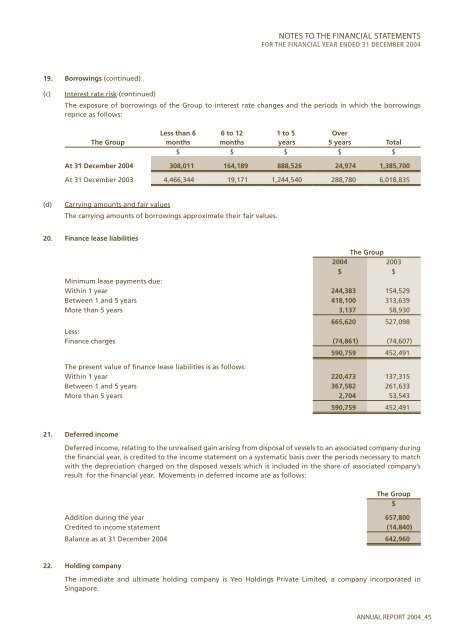

19. Borrowings (continued)<br />

(c)<br />

Interest rate risk (continued)<br />

The exposure of borrowings of the Group to interest rate changes and the periods in which the borrowings<br />

reprice as follows:<br />

The Group<br />

Less than 6<br />

months<br />

6 to 12<br />

months<br />

1 to 5<br />

years<br />

Over<br />

5 years Total<br />

$ $ $ $ $<br />

At 31 December 2004 308,011 164,189 888,526 24,974 1,385,700<br />

At 31 December 2003 4,466,344 19,171 1,244,540 288,780 6,018,835<br />

(d)<br />

Carrying amounts and fair values<br />

The carrying amounts of borrowings approximate their fair values.<br />

20. Finance lease liabilities<br />

The Group<br />

2004 2003<br />

$ $<br />

Minimum lease payments due:<br />

Within 1 year 244,383 154,529<br />

Between 1 and 5 years 418,100 313,639<br />

More than 5 years 3,137 58,930<br />

665,620 527,098<br />

Less:<br />

Finance charges (74,861) (74,607)<br />

590,759 452,491<br />

The present value of finance lease liabilities is as follows:<br />

Within 1 year 220,473 137,315<br />

Between 1 and 5 years 367,582 261,633<br />

More than 5 years 2,704 53,543<br />

590,759 452,491<br />

21. Deferred income<br />

Deferred income, relating to the unrealised gain arising from disposal of vessels to an associated company during<br />

the financial year, is credited to the income statement on a systematic basis over the periods necessary to match<br />

with the depreciation charged on the disposed vessels which is included in the share of associated company’s<br />

result for the financial year. Movements in deferred income are as follows:<br />

The Group<br />

$<br />

Addition during the year 657,800<br />

Credited to income statement (14,840)<br />

Balance as at 31 December 2004 642,960<br />

22. Holding company<br />

The immediate and ultimate holding company is Yeo <strong>Holdings</strong> Private <strong>Limited</strong>, a company incorporated in<br />

Singapore.<br />

ANNUAL REPORT 2004_45