Government-wide Financial Reporting - AGA

Government-wide Financial Reporting - AGA

Government-wide Financial Reporting - AGA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

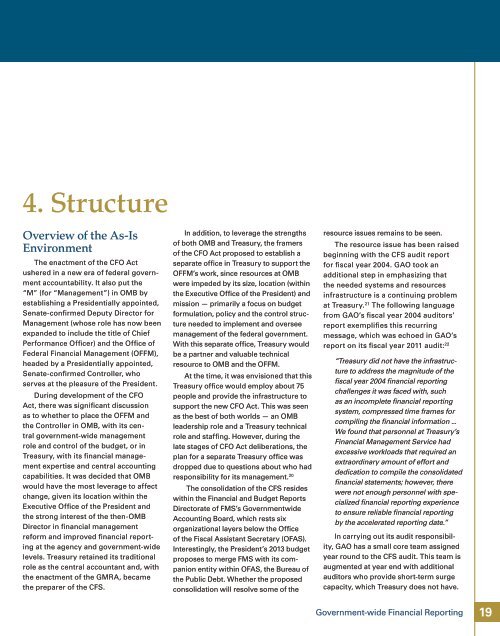

4. Structure<br />

Overview of the As-Is<br />

Environment<br />

The enactment of the CFO Act<br />

ushered in a new era of federal government<br />

accountability. It also put the<br />

“M” (for “Management”) in OMB by<br />

establishing a Presidentially appointed,<br />

Senate-confirmed Deputy Director for<br />

Management (whose role has now been<br />

expanded to include the title of Chief<br />

Performance Officer) and the Office of<br />

Federal <strong>Financial</strong> Management (OFFM),<br />

headed by a Presidentially appointed,<br />

Senate-confirmed Controller, who<br />

serves at the pleasure of the President.<br />

During development of the CFO<br />

Act, there was significant discussion<br />

as to whether to place the OFFM and<br />

the Controller in OMB, with its central<br />

government-<strong>wide</strong> management<br />

role and control of the budget, or in<br />

Treasury, with its financial management<br />

expertise and central accounting<br />

capabilities. It was decided that OMB<br />

would have the most leverage to affect<br />

change, given its location within the<br />

Executive Office of the President and<br />

the strong interest of the then-OMB<br />

Director in financial management<br />

reform and improved financial reporting<br />

at the agency and government-<strong>wide</strong><br />

levels. Treasury retained its traditional<br />

role as the central accountant and, with<br />

the enactment of the GMRA, became<br />

the preparer of the CFS.<br />

In addition, to leverage the strengths<br />

of both OMB and Treasury, the framers<br />

of the CFO Act proposed to establish a<br />

separate office in Treasury to support the<br />

OFFM’s work, since resources at OMB<br />

were impeded by its size, location (within<br />

the Executive Office of the President) and<br />

mission — primarily a focus on budget<br />

formulation, policy and the control structure<br />

needed to implement and oversee<br />

management of the federal government.<br />

With this separate office, Treasury would<br />

be a partner and valuable technical<br />

resource to OMB and the OFFM.<br />

At the time, it was envisioned that this<br />

Treasury office would employ about 75<br />

people and provide the infrastructure to<br />

support the new CFO Act. This was seen<br />

as the best of both worlds — an OMB<br />

leadership role and a Treasury technical<br />

role and staffing. However, during the<br />

late stages of CFO Act deliberations, the<br />

plan for a separate Treasury office was<br />

dropped due to questions about who had<br />

responsibility for its management. 20<br />

The consolidation of the CFS resides<br />

within the <strong>Financial</strong> and Budget Reports<br />

Directorate of FMS’s <strong>Government</strong><strong>wide</strong><br />

Accounting Board, which rests six<br />

organizational layers below the Office<br />

of the Fiscal Assistant Secretary (OFAS).<br />

Interestingly, the President’s 2013 budget<br />

proposes to merge FMS with its companion<br />

entity within OFAS, the Bureau of<br />

the Public Debt. Whether the proposed<br />

consolidation will resolve some of the<br />

resource issues remains to be seen.<br />

The resource issue has been raised<br />

beginning with the CFS audit report<br />

for fiscal year 2004. GAO took an<br />

additional step in emphasizing that<br />

the needed systems and resources<br />

infrastructure is a continuing problem<br />

at Treasury. 21 The following language<br />

from GAO’s fiscal year 2004 auditors’<br />

report exemplifies this recurring<br />

message, which was echoed in GAO’s<br />

report on its fiscal year 2011 audit: 22<br />

“Treasury did not have the infrastructure<br />

to address the magnitude of the<br />

fiscal year 2004 financial reporting<br />

challenges it was faced with, such<br />

as an incomplete financial reporting<br />

system, compressed time frames for<br />

compiling the financial information ...<br />

We found that personnel at Treasury’s<br />

<strong>Financial</strong> Management Service had<br />

excessive workloads that required an<br />

extraordinary amount of effort and<br />

dedication to compile the consolidated<br />

financial statements; however, there<br />

were not enough personnel with specialized<br />

financial reporting experience<br />

to ensure reliable financial reporting<br />

by the accelerated reporting date.”<br />

In carrying out its audit responsibility,<br />

GAO has a small core team assigned<br />

year round to the CFS audit. This team is<br />

augmented at year end with additional<br />

auditors who provide short-term surge<br />

capacity, which Treasury does not have.<br />

<strong>Government</strong>-<strong>wide</strong> <strong>Financial</strong> <strong>Reporting</strong> 19