Government-wide Financial Reporting - AGA

Government-wide Financial Reporting - AGA

Government-wide Financial Reporting - AGA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

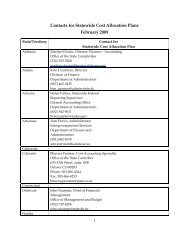

Appendix A<br />

Act, much has been accomplished to<br />

move the federal government’s financial<br />

operations and reporting closer to<br />

Jefferson’s vision. Widely heralded<br />

as the most comprehensive financial<br />

management improvement in 40 years,<br />

the CFO Act ushered in a new era of<br />

federal government accountability. It significantly<br />

changed the landscape for the<br />

federal government agency CFO, moving<br />

the role far beyond basic accounting<br />

responsibilities to that of agency leader<br />

in providing support across a range of<br />

critical programs and operations. 30 But<br />

one achievement that remains elusive<br />

is the ability to prepare consolidated<br />

financial statements for the federal<br />

government as a whole that can obtain a<br />

“clean” auditors’ opinion from GAO.<br />

Among a range of requirements to<br />

reform federal government financial<br />

management practices and capabilities,<br />

the CFO Act required 10 selected federal<br />

government agencies to prepare audited<br />

financial statements beginning with<br />

fiscal year 1992. In commenting on the<br />

requirement for audited agency financial<br />

statements, GAO provided the following<br />

insight:<br />

“Most importantly, the act requires<br />

that financial statements be prepared<br />

and audited. … Together, these features<br />

of the CFO Act will improve the<br />

reliability and usefulness of Agency<br />

financial information.” 31<br />

The requirement for audited agency<br />

financial statements was later made<br />

permanent and expanded to all 24 CFO<br />

Act agencies with the enactment of the<br />

<strong>Government</strong> Management Reform Act<br />

of 1994 (GMRA) 32 and expanded even<br />

further to other federal government<br />

agencies with the Accountability of Tax<br />

Dollars Act of 2002 (ATDA). 33 The GMRA<br />

also included a requirement for Treasury<br />

to prepare auditable CFS for the federal<br />

government beginning in fiscal year<br />

1997. Preparing the CFS was not new<br />

for Treasury, which was at the forefront<br />

of producing prototype statements<br />

beginning in 1973. 34 Treasury continued<br />

to prepare prototype CFS until the 1994<br />

requirements of the GMRA mandated<br />

Treasury’s preparation and GAO’s audit.<br />

The CFO Act laid the foundation for a<br />

series of ensuing management reforms<br />

and legislation built on the concepts<br />

of improved accountability and better<br />

management practices. For example,<br />

we have witnessed the enactment of<br />

the Federal <strong>Financial</strong> Management<br />

Improvement Act of 1996 (FFMIA) 35<br />

and its focus on improving financial<br />

management systems, which are at<br />

the heart of the CFO Act. Similarly, the<br />

<strong>Government</strong> Performance and Results<br />

Act of 1993 (GPRA) mandated reporting<br />

on actual results agencies achieved. 36<br />

The Improper Payments Information<br />

Act of 2002 (IPIA) 37 and the Improper<br />

Payments Elimination and Recovery<br />

Act of 2010 (IPERA) 38 have spearheaded<br />

the war against improper payments.<br />

The Federal Funding Accountability<br />

and Transparency Act of 2006 (FFATA) 39<br />

and the American Recovery and<br />

Reinvestment Act of 2009 (ARRA) 40 have<br />

opened the door for unprecedented<br />

accountability and transparency over<br />

federal government spending and have<br />

spawned additional systems, controls,<br />

reporting regimens and oversight<br />

mechanisms. There has been important<br />

related information technology legislation,<br />

such as the Clinger-Cohen Act of<br />

1996, 41 the <strong>Government</strong> Information<br />

Security Reform Act of 2000 (GISRA) 42<br />

and the Federal Information Security<br />

Management Act of 2002 (FISMA). 43<br />

Over the past two decades, with the<br />

implementation of the CFO Act and the<br />

GMRA, significant change has been<br />

realized in how financial management<br />

is viewed in the federal government.<br />

Now considered an essential component<br />

of agency management, financial<br />

management helps ensure accountability<br />

and provides valuable information<br />

and enhanced internal controls.<br />

Today, the CFO leadership structure is<br />

focused on the issues and considers<br />

the future much more broadly than<br />

it did even five years ago. The CFO<br />

Council, established by the CFO Act,<br />

undertakes a variety of initiatives and<br />

has provided a forum to address issues<br />

on a government-<strong>wide</strong> basis.<br />

<strong>Government</strong>-<strong>wide</strong> <strong>Financial</strong> <strong>Reporting</strong> 25