Full conference details and booking form (pdf) - CIOT - The ...

Full conference details and booking form (pdf) - CIOT - The ...

Full conference details and booking form (pdf) - CIOT - The ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

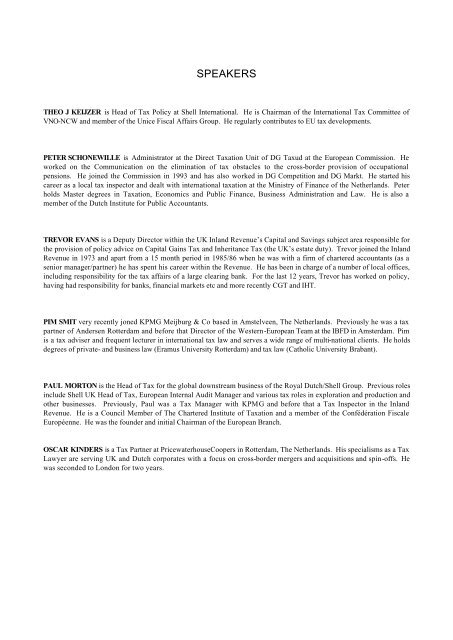

SPEAKERS<br />

THEO J KEIJZER is Head of Tax Policy at Shell International. He is Chairman of the International Tax Committee of<br />

VNO-NCW <strong>and</strong> member of the Unice Fiscal Affairs Group. He regularly contributes to EU tax developments.<br />

PETER SCHONEWILLE is Administrator at the Direct Taxation Unit of DG Taxud at the European Commission. He<br />

worked on the Communication on the elimination of tax obstacles to the cross-border provision of occupational<br />

pensions. He joined the Commission in 1993 <strong>and</strong> has also worked in DG Competition <strong>and</strong> DG Markt. He started his<br />

career as a local tax inspector <strong>and</strong> dealt with international taxation at the Ministry of Finance of the Netherl<strong>and</strong>s. Peter<br />

holds Master degrees in Taxation, Economics <strong>and</strong> Public Finance, Business Administration <strong>and</strong> Law. He is also a<br />

member of the Dutch Institute for Public Accountants.<br />

TREVOR EVANS is a Deputy Director within the UK Inl<strong>and</strong> Revenue’s Capital <strong>and</strong> Savings subject area responsible for<br />

the provision of policy advice on Capital Gains Tax <strong>and</strong> Inheritance Tax (the UK’s estate duty). Trevor joined the Inl<strong>and</strong><br />

Revenue in 1973 <strong>and</strong> apart from a 15 month period in 1985/86 when he was with a firm of chartered accountants (as a<br />

senior manager/partner) he has spent his career within the Revenue. He has been in charge of a number of local offices,<br />

including responsibility for the tax affairs of a large clearing bank. For the last 12 years, Trevor has worked on policy,<br />

having had responsibility for banks, financial markets etc <strong>and</strong> more recently CGT <strong>and</strong> IHT.<br />

PIM SMIT very recently joned KPMG Meijburg & Co based in Amstelveen, <strong>The</strong> Netherl<strong>and</strong>s. Previously he was a tax<br />

partner of Andersen Rotterdam <strong>and</strong> before that Director of the Western-European Team at the IBFD in Amsterdam. Pim<br />

is a tax adviser <strong>and</strong> frequent lecturer in international tax law <strong>and</strong> serves a wide range of multi-national clients. He holds<br />

degrees of private- <strong>and</strong> business law (Eramus University Rotterdam) <strong>and</strong> tax law (Catholic University Brabant).<br />

PAUL MORTON is the Head of Tax for the global downstream business of the Royal Dutch/Shell Group. Previous roles<br />

include Shell UK Head of Tax, European Internal Audit Manager <strong>and</strong> various tax roles in exploration <strong>and</strong> production <strong>and</strong><br />

other businesses. Previously, Paul was a Tax Manager with KPMG <strong>and</strong> before that a Tax Inspector in the Inl<strong>and</strong><br />

Revenue. He is a Council Member of <strong>The</strong> Chartered Institute of Taxation <strong>and</strong> a member of the Confédération Fiscale<br />

Européenne. He was the founder <strong>and</strong> initial Chairman of the European Branch.<br />

OSCAR KINDERS is a Tax Partner at PricewaterhouseCoopers in Rotterdam, <strong>The</strong> Netherl<strong>and</strong>s. His specialisms as a Tax<br />

Lawyer are serving UK <strong>and</strong> Dutch corporates with a focus on cross-border mergers <strong>and</strong> acquisitions <strong>and</strong> spin-offs. He<br />

was seconded to London for two years.