Punjab Power Development Board (PPDB) - Energy Department ...

Punjab Power Development Board (PPDB) - Energy Department ...

Punjab Power Development Board (PPDB) - Energy Department ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FREQUENTLYASKED QUESTIONS<br />

1. What do you know about Pakistan<br />

Pakistan is situated between latitude North and longitude East.<br />

On the west border of the country is Iran, India is on the east, Afghanistan in the<br />

north-west, China in the north and the Arabian Sea is on the south.<br />

Pakistan has a strategically advantageous location vis-à-vis being a geographical<br />

centre of the Asian Continent. Forming a bridge between the Middle East and the<br />

Far East, Pakistan can be a hub for trade and communication. A wide<br />

transportation network complements this strategic placement. With three major<br />

international airports and 38 domestic airports, Pakistan serves more than 50<br />

international airlines. Pakistan also has Karachi, Port-Qasim and Gawadar sea<br />

ports.<br />

Pakistan has a continental type of climate, characterized by extreme variations of<br />

temperature. Very high altitudes modify the climate in the cold, snow-covered<br />

northern mountains. Temperatures on the Balochistan Plateau are somewhat<br />

higher. Along the coastal strip the climate is tempered by sea breezes. In the rest<br />

of the country temperatures rise steeply in the summer and hot winds blow across<br />

the plains during the day. The daily variation in temperature may be as much as<br />

11 degree C to 17 degree centigrade. Winters are cold with minimum mean<br />

temperature of about 4 degree centigrade in January.<br />

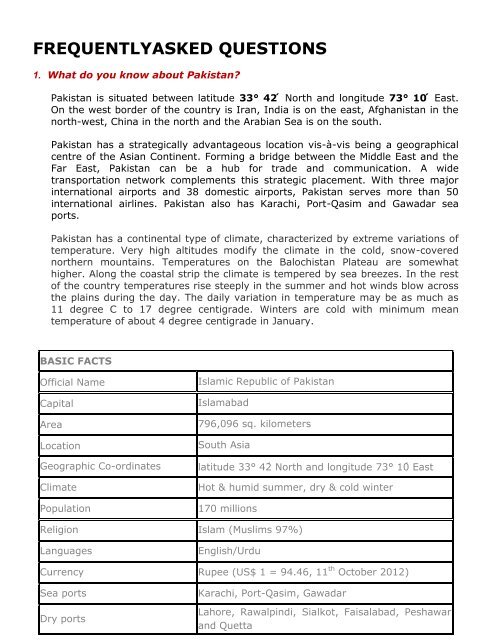

BASIC FACTS<br />

Official Name<br />

Capital<br />

Area<br />

Location<br />

Islamic Republic of Pakistan<br />

Islamabad<br />

796,096 sq. kilometers<br />

South Asia<br />

Geographic Co-ordinates latitude North and longitude East<br />

Climate<br />

Population<br />

Hot & humid summer, dry & cold winter<br />

170 millions<br />

Religion Islam (Muslims 97%)<br />

Languages<br />

English/Urdu<br />

Currency Rupee (US$ 1 = 94.46, 11 th October 2012)<br />

Sea ports<br />

Dry ports<br />

Karachi, Port-Qasim, Gawadar<br />

Lahore, Rawalpindi, Sialkot, Faisalabad, Peshawar<br />

and Quetta

International Airports<br />

Installed Generation Capacity<br />

No of Electricity Consumer<br />

Per Capita Electricity<br />

Consumption in Pakistan<br />

Karachi, Lahore, Islamabad, Peshawar, Sialkot and<br />

Quetta<br />

23412 MW<br />

22.42 million<br />

approx. 465kWh/annum<br />

2. What do you know about the <strong>Punjab</strong> province of Pakistan<br />

<strong>Punjab</strong> also spelled Panjab, is the most populous province of Pakistan, with<br />

approximately 55.06% of the country's total population. Forming most of the <strong>Punjab</strong><br />

region, the province is bordered by Kashmir (Azad Kashmir, Pakistan and Indian<br />

occupied Jammu & Kashmir) to the north-east, the Indian states of <strong>Punjab</strong>, Rajasthan,<br />

and Gujarat to the east, the Pakistani province of Sindh to the south, the province of<br />

Balochistan to the southwest, the province of Khyber Pakhtunkhwa to the west, and<br />

the Islamabad Capital Territory to the north. The <strong>Punjab</strong> is home to the <strong>Punjab</strong>is and<br />

various other groups. The main languages are <strong>Punjab</strong>i and Saraiki and the dialects of<br />

Mewati and Potohari. The name <strong>Punjab</strong> derives from the Persian words Panj (Five),<br />

and Āb (Water), i.e. (the) Five Waters - referring to five tributaries of the Indus River<br />

from which is also the origin of the name of "India" - these being Jhelum, Chenab,<br />

Ravi, Beas and Sutlej, that flow through the larger <strong>Punjab</strong>.<br />

<strong>Punjab</strong> is the most developed, most populous, and most prosperous province of<br />

Pakistan. Lahore has traditionally been the capital of <strong>Punjab</strong> for a thousand years; it is<br />

<strong>Punjab</strong>'s main cultural, historical, administrative and economic center. Historically, the<br />

<strong>Punjab</strong> region has been the gateway to the Indian subcontinent for people from<br />

Greece, Central Asia, Iran and Afghanistan and Vice-versa. Due to its strategic<br />

location, it has been part of various empires and civilizations throughout history,<br />

including the Indus Valley Civilization, Vedic civilization, Mauryans, Kushans,<br />

Scythians, Guptas, Greeks, Persians, Arabs, Turks, Mongols, Timurids, Mughals,<br />

Afghans, Sikhs and the British.<br />

3. What is the organizational structure of Pakistan’s <strong>Power</strong> Sector<br />

i) WAPDA (Water & <strong>Power</strong> <strong>Development</strong> Authority) <strong>Power</strong> Wing: Pursuant to<br />

WAPDA <strong>Power</strong> wing restructuring Program-1992, <strong>Power</strong> wing of WAPDA has been<br />

unbundled into following segments:<br />

A) Generation:<br />

o WAPDA Hydroelectric comprising hydro power stations (Tarbela,<br />

Mangla, Warsak, Ghazi Barotha etc.) located all over the country with<br />

installed capacity of 6443.16 MW. National Electric <strong>Power</strong> Regulatory<br />

Authority (NEPRA) grants blanket/collective Generation Tariff for all of<br />

these hydropower stations.<br />

o WAPDA owned thermal power stations have been configured into four<br />

independent generation companies commonly named as GENCO-I,<br />

GENCO-II, GENCO-III and GENCO-IV (XWAPDA GENCOs).

B) Transmission: In order to own, operate and maintain 220 kV and 500 kV Grid<br />

Stations and Transmission Lines/Network previously owned by WAPDA, a company<br />

named as National Transmission & Despatch Company Limited (NTDC) was<br />

established. NEPRA granted Transmission License to NTDC on 31 st December 2002.<br />

Under the regime set out in the License, the NTDC is entrusted to act as:<br />

a. Central <strong>Power</strong> Purchasing Agency (CPPA): As CPPA, the<br />

Company is responsible to procure power from XWAPDA GNECOs,<br />

WAPDA Hydroelectric and Independent <strong>Power</strong> Producers-IPPs (under<br />

Federal <strong>Power</strong> Generation Policies of 1994 and 2002) on behalf of<br />

Distribution Companies (XWAPDA DISCOs), for delivery through 500<br />

kV, 220 kV and 132 kV network.<br />

b. System Operator: For secure, safe and reliable operation, control<br />

and despatch; generation facilities located all over the country have<br />

been connected with the National Grid. Commonly, it is also referred<br />

to as National <strong>Power</strong> Control Center (NPCC) located at Islamabad.<br />

c. Transmission Network Operator: For operation, maintenance,<br />

planning design and expansion of the 500 kV and 220 kV<br />

transmission network.<br />

d. Central Contract Registrar and <strong>Power</strong> Exchange<br />

Administrator (CRPEA): As CRPEA, the NTDC is responsible to<br />

record and monitor contracts relating to bilateral trading system.<br />

Besides, above mentioned organization structure of NTDC, WAPDA<br />

<strong>Power</strong> Privatization Organization (WPPO) is also functioning under<br />

the administrative control of NTDC. Primarily, it deals with IPPs<br />

under Federal <strong>Power</strong> Policy-1994 and is also responsible for<br />

negotiating and finalizing the <strong>Power</strong> Purchase Agreement (of above<br />

50 MW capacities) between NTDC and Private <strong>Power</strong> Producers<br />

falling under the ambit of Federal <strong>Power</strong> Generation Policy-2002.<br />

For inference, NTDC may be referred to as a Vehicle for acquisition of power<br />

generated by generation facilities (under public and private sector) and delivery<br />

thereof to distribution companies for ultimate dissemination of electricity to<br />

different categories of end consumers.<br />

C) Distribution: WAPDA owned eight (08) distribution units (named as Area<br />

Electricity <strong>Board</strong>s) have been configured into independent Distribution Companies-<br />

XWAPDA DISCOs (duly incorporated by Securities and Exchange Commission of<br />

Pakistan). Two additional DISCOs, namely Sukkur Electric Supply Company<br />

(SEPCO) and Tribal Areas Electric Supply Company (TESCO) have also been carved<br />

out of these XWAPDA DISCOs. These DISCOs are responsible for channeling<br />

electricity from the transmission substations below 220 kV to the consumers at<br />

different distribution voltages. The end users are classified as residential,<br />

commercial, industrial, agriculture, bulk supply and street lighting etc. The<br />

distribution network is composed of lines and grid stations of 132 kV and lower<br />

voltage capacities, and each DISCO is responsible for constructing, operating, and<br />

maintaining the power distribution facilities within its dedicated geographic area.

(ii)<br />

One-Window Facilitators for Private <strong>Power</strong> Producers:<br />

o Private <strong>Power</strong> & Infrastructure <strong>Board</strong> (PPIB) at federal level is<br />

responsible for promoting, evaluating and negotiating private<br />

investments in the electric power sector all over the country. It also<br />

reviews Feasibility Studies and Implementation Time Tables.<br />

o Similar to PPIB, Alternative <strong>Energy</strong> <strong>Development</strong> <strong>Board</strong> (AEDB) plays<br />

the role of One-Window facility with respect to renewable energy<br />

based power projects in the country.<br />

o Likewise PPIB and AEDB, One-Window facilities have also been<br />

established at provincial levels like <strong>PPDB</strong> and SHYDO etc. in <strong>Punjab</strong><br />

and KPK respectively.<br />

(iii) National Electric <strong>Power</strong> Regulatory Authority (NEPRA): As evident from<br />

the name, NEPRA plays the role of regulator (established under the NEPRA<br />

Act, 1997) with respect to power sector of the country as a whole. NEPRA,<br />

interalia, has been mandated to regulate the provision of electric power<br />

services including determinations of electricity tariff, rates, charges and other<br />

terms and conditions for supply of electric power services by the generation,<br />

transmission and distribution companies.<br />

(iv)<br />

Independent <strong>Power</strong> Producers (IPPs): Generation facilities based on<br />

different fuels have been established in Pakistan under federal power<br />

generation policies issued from time to time.<br />

4. What is the total installed generation capacity in Pakistan<br />

Total installed generation capacity in the country is 23,412 MW.<br />

5. How many IPPs are functional in Pakistan<br />

At present there are 27 private power projects with an installed capacity of<br />

about 6870 MW which are in operation. In addition Kot Addu <strong>Power</strong> Company<br />

(1650MW) and KESC power plants (1946 MW) are also operating in the private<br />

sector.<br />

6. Why has private sector been inducted in power generation<br />

<strong>Power</strong> shortage had been one of the chronic problems hampering Pakistan's<br />

socio-economic growth since late 1980s; the problem had assumed such acute<br />

dimensions that power supply fell short of demand by almost 2000 MW during<br />

peak load hours. On a routine basis, this resulted in forced interruptions in the<br />

supply of electricity to consumers during peak hours resulting in load shedding.<br />

The unreliable power supply shattered the industrial progress. There was a gap<br />

between demand and supply due to the rapid increase in electricity demand<br />

(estimated to be growing at a rate of 7-8 % per annum at that time).<br />

This situation called for immediate intervention by the GOP through adoption of<br />

policy measures aimed at massive resource mobilization for investment in the<br />

power/energy sector. The enormous quantum of required investment compared<br />

with the constrained funding potential of the national exchequer, was not<br />

conducive to allocation of scarce GOP funds for power/energy. Therefore, the

GOP took a bold initiative in late 80s to induct private sector investment in the<br />

power sector.<br />

7. Why were One-Window facilities created at federal and provincial levels<br />

as dedicated institutions to handle Private <strong>Power</strong> Projects<br />

Developing power generation capacity is very capital intensive. Such amounts<br />

cannot be carved out from the annual budget of federal government. As such in<br />

late eighties the Government of Pakistan made in principle decision to seek<br />

private sector investment in power generation. Attracting investment of that big<br />

magnitude require a team of highly qualified professionals who are trained in<br />

project, financial and contract management / analysis beside being courteous<br />

and imbued in corporate culture. Long and tedious experimentations by various<br />

governmental agencies on part time basis with HUBCO (the first private sector<br />

power generation project) and other prospective Independent power Producers<br />

(IPPs) in late 1980's convinced the government to create a dedicated<br />

organization having roots in government but having a corporate look that could<br />

provide a suitable interface to private sector entrepreneurs, their consultants,<br />

lawyers, and lenders feel easy to approach, Private <strong>Power</strong> and Infrastructure<br />

<strong>Board</strong>(PPIB) was created as a dedicated one window facilitator for attracting<br />

private investments in power sector. Similarly, One-Window facilities like <strong>Punjab</strong><br />

<strong>Power</strong> <strong>Development</strong> <strong>Board</strong> (<strong>PPDB</strong>) and Sarhad Hydro <strong>Development</strong> Organization<br />

(SHDO) were also established at provincial levels.<br />

8. What is the institutional structure of power sector in the Province of<br />

<strong>Punjab</strong><br />

Government of the <strong>Punjab</strong> established <strong>Energy</strong> <strong>Department</strong> so that the province<br />

could contribute in the generation, transmission, distribution and conservation of<br />

power. <strong>Punjab</strong> <strong>Power</strong> <strong>Development</strong> <strong>Board</strong> (<strong>PPDB</strong>), working under <strong>Energy</strong><br />

<strong>Department</strong>, provides a ‘One-Window Facility’ to private investors for<br />

implementation of IPPs in the Province under <strong>Punjab</strong> <strong>Power</strong> Generation Policy,<br />

2009. <strong>Punjab</strong> <strong>Power</strong> <strong>Development</strong> <strong>Board</strong> Act, 2011 has been promulgated to<br />

provide legal cover to the activities of <strong>PPDB</strong>. To stimulate development of power<br />

projects in public and public-private partnership modes, <strong>Punjab</strong> <strong>Power</strong><br />

<strong>Development</strong> Company Limited (PPDCL), has been constituted. Moreover,<br />

<strong>Punjab</strong> Minerals Company (PMC), with the objective, interalia, of ensuring<br />

supply of coal to the coal based power projects in the province, has also been<br />

established in the Provincial Mines and Minerals <strong>Department</strong>.<br />

9. Why to invest in energy sector of <strong>Punjab</strong><br />

a) The Extremely Attractive/ investor-friendly <strong>Punjab</strong> <strong>Power</strong> Generation Policy-<br />

2009; ensuring:<br />

Risk (hydrology, wind & solar) Coverage<br />

Buy Back Guarantee<br />

Liberal Political Risk Coverage<br />

Liberal Fiscal / Financial Incentives<br />

Attractive IRR

) Facilitation for procurement / lease of land for projects provided by <strong>PPDB</strong><br />

(unheard of in other territories around the world).<br />

c) Earmarking of 5000 acres of land in Cholistan for Solar Farms<br />

d) Extremely cheap rates offered for land lease for hydro and solar power<br />

projects.<br />

e) Environmental issues dealt with by <strong>PPDB</strong> on behalf of investors.<br />

f) Attractive tariff offered.<br />

10. What is the minimum equity requirement to finance IPPs in Pakistan<br />

The minimum equity requirement for an IPP in Pakistan is 20% of the total<br />

Project Cost.<br />

11. What is the rate of return on equity investment in Pakistan<br />

During recent past, NEPRA has allowed ‘Internal Rate of Return’ based ‘Rate of<br />

Return’ on ‘Equity’ portion of Project’s Capital Cost ranging from 5% (thermal)<br />

to 18% (RE and hydro) net of with-holding tax. Federal government has also<br />

offered higher rate of return up to 20% for indigenous coal based power<br />

projects.<br />

12. What is the structure of projects’ capital cost for power projects in<br />

Pakistan<br />

Normally, NEPRA allows capital structure with Debt: Equity ratio of 80:20 and<br />

in some cases up to maximum of 70:30.<br />

13. What is meant by ‘Financial Charges’ component of projects’ capital cost<br />

for power projects in Pakistan<br />

This component comprises bank charges, commission and fees of the lender,<br />

such as arrangement fee, commitment fee and L/C commission etc. In this<br />

regard, NEPRA has imposed limit of 3% of debt portion of total project capital<br />

cost.<br />

14. What is the repayment period of debt in the tariff structure of<br />

‘Reference Generation Tariff’<br />

Customarily, for IPPs, debt is made available with re-payment period up to 10<br />

years with quarterly installments. Grace period of the loan facility is settled by<br />

keeping in view ‘Construction Period’ of the project with capitalization of<br />

interest/mark-up during said period.<br />

15. What is the ‘Financing Cost’ reckoned in the tariff structure of<br />

‘Reference Generation Tariff’<br />

Normal practice of NEPRA for our IPPs is as under:<br />

Foreign Debt<br />

Local Debt<br />

3 months LIBOR with spread up to 450 bps<br />

3 months KIBOR with spread up to 300 bps

16. Induction of IPPs has resulted in increase in consumer tariff. Is it true<br />

The Bulk <strong>Power</strong> Tariff (BPT) offered by Pakistan to the IPPs inducted under the<br />

1994 <strong>Power</strong> Policy was comparable to the IPP tariffs in other Asian countries.<br />

The increase in tariff with time is mainly due to increase in the prices of furnace<br />

oil, gas, and devaluation of the Pak Rupee. The table below depicts a 495% rise<br />

in furnace oil prices, a 208% increase in gas prices, and a 46.88% devaluation<br />

of the Pak Rupee against the US Dollar during the last eleven years.<br />

2001 2012 %age Increase<br />

RFO Price (Rs./M.ton) 11,569 68,874 495<br />

Gas Price (Rs./MMBtu) 182 560 208<br />

Devaluation of Pak Rupee vs. US Dollar 64 94 46.88<br />

17. What is the average residential and industrial tariff in Pakistan<br />

Average residential and industrial tariff in Pakistan has remained Rs. 9.84/kWh<br />

and Rs. 8/kWh during FY 2010-11.<br />

18. Is the average residential and industrial tariff in Pakistan is higher than<br />

other Asian oil-importing countries<br />

Average residential and industrial tariff in Pakistan was Rs. 5.62/kWh and Rs.<br />

7.12/kWh during FY 2009-10 vis-à-vis Korea (Rs.9.94/kWh & Rs.5.38/kWh),<br />

Japan (Rs.15.05/kWh & Rs.9.32/kWh), Singapore (Rs.12.85/kWh & Rs.<br />

9.51/kWh) Malaysia (Rs.7.46/kWh & Rs. 5.58/kWh), India (Rs.9.16/kWh % -)<br />

and Bangladesh (Rs.6.62/kWh & -).<br />

19. Are IPPs in Pakistan getting their invoices settled in time from <strong>Power</strong><br />

Purchaser (NTDC/DISCO)<br />

Currently, our power sector is beset with huge circular debt; limiting further<br />

investment in the sector. Project sponsors along with debt providers are wary of<br />

the exposure that the power sector presents because of the delayed payments<br />

and cash flow issues. However, the ‘Security Documents’ (<strong>Power</strong> Purchase<br />

Agreement and Implementation Agreement) incidental to development and<br />

operation phases of an IPP inherently provides certain level of comforts to<br />

private power producers (both equity and debt participants) in the form of<br />

guaranteed payments structured in the respective ‘Reference Generation<br />

Tariff(s)’. <strong>Power</strong> Purchaser is obliged to pay ‘Late Payment Charged’ for delayed<br />

payments at the prevalent KIBOR plus four and one-half percent (4.5%) per<br />

annum, compounded semi-annually, calculated for the actual number of Days<br />

for which the relevant amount remains unpaid on the basis of a three hundred<br />

and sixty-five (365) Day year. Under this regime, despite prevalent financial<br />

crunch emanating from higher input cost of electricity generation, IPPs are<br />

getting their invoices settled from the <strong>Power</strong> Purchaser.

20. What type of Security Documents shall be available for <strong>Punjab</strong> based<br />

On-Grid IPPs<br />

With respect to On-grid IPPs, there shall be a:<br />

o <strong>Power</strong> Purchase Agreement between IPP and <strong>Power</strong> Purchaser<br />

(NTDC/CPPA/DISCO)<br />

o Implementation Agreement between IPP and Government of<br />

Pakistan (directly or through Government of <strong>Punjab</strong>)<br />

o Fuel Supply Agreement between IPP and fuel supplier (depending<br />

upon form of fuel)<br />

o Water Use Agreement between IPP and Government of <strong>Punjab</strong>, only<br />

in case of hydropower projects<br />

o Land lease Agreement between IPP and Government of <strong>Punjab</strong>,<br />

where government owned land is under use of the Complex.<br />

21. What are the problems of setting up <strong>Power</strong> Projects in Private Sector<br />

Private sector has been facing multifarious problems in practical terms in setting<br />

up power generation plants in the country. Among others, few of them have<br />

been enumerated as follows:<br />

o Lack of Local Manufacturing Facilities and Capabilities: Presently<br />

most of the equipment and machinery required for the power<br />

generation is being imported from foreign countries. The local<br />

manufacturing capability is very limited.<br />

o High Cost of Imported Equipments: Since the power project<br />

involves multifarious type of imported heavy equipments and<br />

machinery, therefore, the cost of the same is substantially high.<br />

o Much Higher Project Capital Cost: <strong>Power</strong> projects are considered<br />

very large projects. A number of components/variables formulate the<br />

total cost of project. They inter-alia encompass project development<br />

cost, cost of land and land development, civil works, plant and<br />

equipment, spare parts, soil testing, engineering, consultancy, erection<br />

and supervision, importation charges, working capital and financial<br />

charges. Private investors face problem how to match the cost of<br />

project with means of financing.<br />

o Long Implementation and Completion Period: <strong>Power</strong> projects in<br />

private sector normally involve long period for project implementation<br />

and completion. Due to substantial completion time many costs are<br />

escalated/enhanced, ultimately total cost is also increased.<br />

o Difficulty in Finding Foreign Equity and Joint Venture Partners:<br />

Local private investors who desire to establish power generation<br />

projects are also facing difficulties in searching foreign equity or joint<br />

venture partners for the projects.<br />

o Difficulties in Arrangement of Finances: Sponsors of private power<br />

projects are facing problems in obtaining local and foreign currency

loans for their projects. The negotiations with local and foreign loan<br />

giving agencies involve much time due to which it is difficult to achieve<br />

financial close in time. On the other hand many foreign loan giving<br />

agencies require various types of guarantees. It is also difficult to<br />

obtain Supplier's Credit facilities in view of prevailing situation in the<br />

country.<br />

o Most Projects are Based on Imported Fuel: Most of the power<br />

projects are based on imported oil; this in fact is a major component of<br />

the ultimate tariff.<br />

o Lengthy and Complicated Procedures: Presently there exist a<br />

number of lengthy time and money consuming complicated procedures<br />

due to which private investors are facing problems. These include the<br />

provision of bank guarantees, finalization of many Project<br />

Agreement(s) with a number of Agencies etc.<br />

22. What type of efforts is being made by Government of the <strong>Punjab</strong> in<br />

providing financial assistance for speedy development of power projects<br />

in private sector<br />

<strong>Development</strong> of power projects requires heavy funding. Difficulty of accessing<br />

long-term international finance is proving to be a serious obstacle in raising debt<br />

for establishment of power projects. This necessitates efforts to be made by<br />

government in order to encourage private sector to come forward for<br />

investment in power generation. Consequently, in order to gain confidence of<br />

private power producers, Government of the <strong>Punjab</strong> has approved creation of<br />

following two funds:<br />

a) <strong>Punjab</strong> <strong>Power</strong> <strong>Development</strong> Fund: Fund will be dedicated for ‘Equity<br />

Participation’ with the ‘Private Sector’ Equity Partners’ towards capital cost of<br />

the power projects. Initially, Government of the <strong>Punjab</strong> will inject an amount of<br />

Rs. 6 billion in to the Fund with the hope that the Fund Manager will be able to<br />

attract an equal amount in to the Fund from international investors. The Fund<br />

will be supervised and monitored through a General Partnership (the “Fund<br />

Manager”), which will act as a Management Team as well as an Investment<br />

Committee, with investments being injected in Rupees from Government of the<br />

<strong>Punjab</strong> (Onshore Partner) and in US Dollar from international investors (Offshore<br />

Partner) through respective mutual Subscription Agreement(s). The Fund<br />

Manager will be responsible for all investment and divestment decisions and<br />

operations of investees during the investment period in accordance with the predefined<br />

terms and conditions. Besides, the Fund Manager may also be assigned<br />

the responsibility to facilitate Independent <strong>Power</strong> Producers in arrangement of<br />

Debt Component from local and international lending agencies / institutions.<br />

b) <strong>Punjab</strong> <strong>Power</strong> Guarantee Fund: This Fund is being created with the<br />

objective to give assurance by Government of the <strong>Punjab</strong> to the developers of<br />

Off-Grid power projects for payment defaults, if any, by the ultimate <strong>Power</strong><br />

Purchasers (Industrial Estate/Individual Industrial Units etc). Provision of money<br />

into this Fund will be the sole responsibility of Government of the <strong>Punjab</strong>. The<br />

afore-mentioned Fund Manager may also be assigned the responsibility to<br />

administer this Fund as well through pre-defined terms and conditions under a<br />

bilateral contract with Government of the <strong>Punjab</strong>.

23. Who determines generation tariffs for IPPs<br />

In order to promote fair competition in the electricity industry and to protect the<br />

interests of consumers, producers and sellers of electric power, the GOP has<br />

enacted the Regulation of Generation, Transmission and Distribution of Electric<br />

<strong>Power</strong> Act, 1997. Under this Act, the National Electric <strong>Power</strong> Regulatory<br />

Authority (NEPRA) has been created to introduce transparent and judicious<br />

economic regulation, based on sound commercial principles, to the power sector<br />

of Pakistan. One primary responsibility of the regulator is determination of tariff<br />

for the various generation, transmission, and distribution companies including<br />

the IPPs. NEPRA follows a standard and transparent procedure for tariff<br />

determination, which includes public hearing and views from all stakeholders.<br />

24. What are the basic principles of structuring generation tariff<br />

Tariff structure for different electricity generating companies is different.<br />

Accordingly, selection of tariff structure depends on the power sector<br />

requirements and on the capacities (which can include generation of electric<br />

energy, ensuring availability of capacity, operation under synchronous<br />

compensator mode, frequency regulation and etc.) to render necessary services<br />

by the given company for meeting those requirements.<br />

Taking into consideration the type of services to be rendered to the power<br />

system by the generating companies, as well as their metering capacities and<br />

preferences, Single-Part or Two-Part tariffs may be applied to those services.<br />

Basis for the tariff rates calculation are the classified amounts: fixed and<br />

variable expenses allocated between different services. Keeping in view, power<br />

system requirements of the country, NEPRA normally structures Reference<br />

Generation Tariff based on Two-Part regime comprising following components:<br />

a) <strong>Energy</strong> Purchase Price expressed in Rs./kWh;<br />

(Annual Revenue Requirement divided by Annual Plant Generation)<br />

b) Capacity Purchase Price expressed in Rs./kW/Month<br />

(Annual Revenue Requirement divided by Net Capacity in kW)/12<br />

a) <strong>Energy</strong> Purchase Price:<br />

<strong>Energy</strong> Purchase Price (the “EPP”) is the operating cost of a unit of electrical<br />

energy (kWh). It is payable for the energy generated and delivered to the power<br />

purchaser. This has been further bifurcated into following components:<br />

i. Fuel Cost Component: This component of tariff is meant for<br />

the cost of fuel consumed for generation of electricity.<br />

ii. Variable Operation and Maintenance Cost Component: This<br />

component caters for the cost of services of the O&M operator for<br />

routine management of the power plant. It covers operating cost of<br />

lubricants, chemicals etc. as well as maintenance cost such as<br />

replacement of parts and over-hauling of the plant as and when<br />

required.

iii. Water Use Charge (only for Hydropower Projects): This<br />

component is payable to the respective federating unit for each unit<br />

of energy generated by the plant and delivered to the power<br />

purchaser under ‘Water Use Agreement’ to be executed between IPP<br />

and the respective federating unit.<br />

b) Capacity Purchase Price:<br />

Capacity Purchase Price (the “CPP”) is a fixed monthly payment to IPP for each<br />

kilowatt (kW) of the available capacity of the plant to cater for the fixed costs of<br />

the project. It is payable provided the plant is available for dispatch to standards<br />

defined in the <strong>Power</strong> Purchase Agreement to be executed between IPP and<br />

power purchaser. The CPP has been further segregated into following<br />

components:<br />

i. Fixed Operation and Maintenance Cost Component: This<br />

component represents the fixed costs incidental to plant operation<br />

and maintenance. It covers management fee, remuneration to the<br />

personnel, rent, utilities, fee for maintaining consents,<br />

environmental monitoring, local taxes and cost of expatriate services<br />

to be engaged for O&M of the pant.<br />

ii. Insurance Cost Component: This component caters for the<br />

premium in relation to insurance policies required to be maintained<br />

for the plant as specified in the PPA and as required by the lenders.<br />

The risks to be covered through insurance include machinery<br />

breakdown, natural calamities, sabotage and consequential business<br />

interruption etc.<br />

iii.Return on Equity and Return on Equity during Construction:<br />

This component is meant to provide return on the equity invested by<br />

the project sponsors as well as redemption (only for projects on<br />

BOOT basis) thereof during tariff control period.<br />

iv.Debt Servicing: This component caters for repayment of principal<br />

and interest charges to the lenders of the project. It matches the<br />

loan repayment stream. Debt is proposed to be repaid in ten (10)<br />

years after achieving Commercial Operation Date of the plant.<br />

Project Capital Cost: Normally, capital cost of the project can be divided into<br />

following main heads:<br />

o Engineering, Procurement & Construction (EPC) Cost: This takes<br />

into account cost incurred by the project sponsors relating to<br />

preliminary work, civil works, electro-mechanical equipment including<br />

engineering & supervision.<br />

o Costs other than EPC Cost: Besides EPC Cost, project sponsor also<br />

incurs expenses relating to insurance during construction, project<br />

company costs, financing charges and interest during construction<br />

(IDC).<br />

Based on the above premise, Reference Tariff Table is established for 20 to 30<br />

years period (keeping in view technology involved). During tariff control period,

Generation Company (WAPDA Hydroelectric, XWAPDA GENCOs and IPPs) submits<br />

invoices to NTDC with respect to <strong>Energy</strong> Purchase Price and Capacity Purchase<br />

Price on monthly basis after applying already established indexation provisions on<br />

Reference Tariff (detail follows). Besides, Generation Company is also allowed to<br />

submit supplemental charges (expenses not covered in the Reference Tariff)<br />

invoices in line with the provisions of <strong>Power</strong> Purchase Agreement.<br />

Tariff Components<br />

Fuel Cost Component<br />

Variable O&M<br />

(Foreign Currency Portion)<br />

Variable O&M<br />

(Local Currency Portion)<br />

Fixed O&M<br />

(Foreign Currency Portion)<br />

Fixed O&M<br />

(Local Currency Portion)<br />

Insurance<br />

Water Use Charges (hydropower<br />

projects)<br />

Return on Equity<br />

Withholding Tax on Dividend<br />

Principal Repayment (Foreign Currency<br />

Loan)<br />

Principal Repayment (Local Currency<br />

Loan)<br />

Interest/Mark-up Payments (Foreign<br />

Currency Loan)<br />

Interest /Mark-up Payments (Local<br />

Currency Loan)<br />

Tariff Indexation & Adjustment<br />

Dependent on type of fuel used<br />

US$ to Pak Rupees & US CPI<br />

Pakistan WPI<br />

US$ to Pak Rupees & US CPI<br />

Pakistan WPI<br />

US$ to Pak Rupees, in case of foreign<br />

currency denominated insurance cost<br />

evidenced with documents<br />

Pakistan WPI<br />

US$ to Pak Rupees<br />

Nil<br />

US$ / Pak Rupees<br />

Nil<br />

Adjustments for relevant LIBOR variations.<br />

Adjustments for relevant KIBOR variations.<br />

25. What are the basic principles of structuring transmission tariff<br />

NTDC through transmission tariff (duly determined by NEPRA and notified by<br />

federal Government) submits invoices to each of the DISCOs formed consequent<br />

to the unbundling of WAPDA (termed as XWAPDA DISCOs) on account of<br />

‘Transfer Charge’ for procuring power from approved generating companies<br />

(having approved generation tariff from NEPRA) and its delivery to XWAPDA<br />

DISCOs for a billing period as under (the “Transfer Price”):<br />

Transfer Charge = Capacity Transfer Charge + <strong>Energy</strong> Transfer Charge<br />

Where:<br />

a) Capacity Transfer Charge comprises:<br />

1) Summation of the Capacity Purchase Price invoices rendered to<br />

NTDC by all the generation companies during the month divided<br />

by the sum of the maximum demand of the XWAPDA DISCOs in

kW recorded at all the delivery metering points at which power is<br />

received by the XWAPDA DISCOs.<br />

2) Use of System Charge (Fixed): the fixed charge part of the Use of<br />

System Charges in Rs. /kW/Month<br />

b) <strong>Energy</strong> Transfer Charge comprises<br />

Summation of the <strong>Energy</strong> Purchase Price invoices rendered to<br />

NTDC by all the generation companies during the month divided<br />

by summation of the Net Electrical Output (kWh) recorded at all<br />

the delivery metering points at which power is received by the<br />

XWAPDA DISCOs.<br />

As evident, primarily, the Transfer Price of NTDC being charged to XWAPDA<br />

DISCOs consists of two components; firstly impact of invoices (Capacity<br />

Purchase Price and <strong>Energy</strong> Purchase Price) received from generating facilities<br />

(duly approved by NEPRA) and secondly Use of System Charge meant for<br />

recovery of cost of service/revenue requirement of NTDC for provision of<br />

transmission services to XWAPDA DISCOs.<br />

The general revenue, which the NTDC is allowed to receive through tariff (Use of<br />

System Charge) from XWAPDA DISCOs, is called revenue requirement or cost of<br />

service. It should be sufficient to cover all costs required for reliable, safe and<br />

uninterrupted operation of the company and to receive a reasonable profit on<br />

invested capital to cater the future expansion of the transmission related<br />

facilities. As a matter of principle, revenue requirement (RR) is calculated by<br />

applying the below given formula:<br />

RR = AC + D + FC + AP<br />

Where<br />

AC– Allowed annual costs, and includes general establishment & administrative<br />

expenses<br />

D– Annual depreciation of fixed assets<br />

FC– Financial charges relating to long term loans obtained by the company<br />

AP– Allowed profit rate (assessed by the NEPRA) on Equity Base<br />

(Fixed Assets + Current Assets – outsiders’ liabilities) of NTDC<br />

The above matrix results after applying below given formula gives Use of<br />

System Charge in terms of Rs./kW/Month.<br />

(RR in Rs divided by XWAPDA DISCOs Demand in MW x 1000)/12<br />

Besides Use of System Charge (Fixed), NEPRA also determines Use of System<br />

Charge (Variable) dependent upon <strong>Energy</strong> Transfer Charge component of the<br />

Transfer Price. However, it is not applicable to XWAPDA DISCOs because the<br />

Transfer Charge is inclusive of the transmission loss charge as the same is rolled<br />

in on account of the costs divided on units delivered basis to arrive at the

Transfer Charge. Consequently, NEPRA determined Use of System Charge<br />

(Variable) is applicable only to Bulk <strong>Power</strong> Consumers (BPC).<br />

Based on the above premise, NTDC submits monthly invoices to XWAPDA<br />

DISCOs on account of Transfer Price, which becomes <strong>Power</strong> Purchase Price (PPP)<br />

for these XWAPDA DISCOs.<br />

26. What are the basic principles of structuring distribution tariff<br />

For assessing the revenue requirement (cost of service) of a XWAPDA DISCO,<br />

NEPRA carries out due diligence process based on tariff petition submitted by<br />

the Distribution Company. In order to make the Distribution Company viable,<br />

recovery of its total revenue requirement (cost of service) is required to be<br />

assured paving the way towards rehabilitation of its system and improvement of<br />

efficiency for safe and reliable provision of electric power. Revenue requirement<br />

of a XWAPDA DISCO comprises:<br />

o <strong>Power</strong> Purchase Price; as discussed under head ‘Transmission Tariff’<br />

the invoices of NTDC to XWAPDA DISCO on account of Transfer Price<br />

becomes the <strong>Power</strong> Purchase Price of the DISCO.<br />

o Distribution Margin; includes general establishment & administrative<br />

expenses, depreciation of fixed assets and Return on Rate Base.<br />

Average sale rate is calculated from the above determined revenue requirement<br />

(cost of service) by applying below given formula:<br />

Average Sale Rate = Revenue Requirement divided by Units sold by the<br />

DISCOs<br />

The above determined revenue requirement (cost of service) in terms of<br />

‘Average Sale Rate’ after application of below mentioned adjustment, is<br />

recovered from different categories of end-consumers through Tariff.<br />

o Adjustment Mechanism for <strong>Power</strong> Purchase Price:<br />

Δ PPP = + (PPP (Act) – PPP (Ref))<br />

(I – L)<br />

Where:<br />

Δ PPP<br />

PPP (Act)<br />

= Variation in <strong>Power</strong> Purchase Price including fuel<br />

price variation in terms of Rs./kWh purchased<br />

occurred in a month against the reference PPP<br />

= Actual PPP (Rs. /kWh purchased) during the<br />

month for which the adjustment is required to be<br />

made

PPP (Ref)<br />

L<br />

= Reference <strong>Power</strong> Purchase Price (PPP) in terms<br />

of Rs. /kWh<br />

= Target losses in percentage<br />

The impact of change in the PPP in the bill of individual consumer will be<br />

calculated according to the following formula:<br />

Δ PPP Adjustment =<br />

+ PPP x U (c)<br />

Where:<br />

U (c) means units consumed by the consumer during the month<br />

for which adjustment is required to be made.<br />

27. What are the main categories of electricity consumers of distribution<br />

companies<br />

End-consumers of XWAPDA DISCOs have been divided into different categories.<br />

The main categories of end-consumers are as under:<br />

A-1 General Supply Tariff – Residential<br />

A-2 General Supply Tariff – Commercial<br />

B Industrial Supply Tariff<br />

C Single Point Supply for Purchase in Bulk by a Distribution Licensee<br />

and mixed load consumers not falling in any other consumer class<br />

D Agriculture Tariff<br />

E Temporary Supply Tariff<br />

F Seasonal Industrial Supply Tariff<br />

G Public Lighting<br />

H Residential Colonies Attached to Industrial premises<br />

I Railway Traction<br />

28. What is the situation of power generation potential resources of <strong>Punjab</strong><br />

Province<br />

<strong>Punjab</strong> has limited indigenous resources for generation of electricity. It does<br />

have coal reserves that are yet to be tapped and exploited. The potential for<br />

hydro based generation exists on some barrages and canals but could only be<br />

fully harnessed if low-head technology is perfected. Biomass including<br />

agriculture waste, bagasse based co-generation at sugar mills, and municipal<br />

solid waste power projects can be installed with significant generation. Solar<br />

source is indeed practically unlimited but the cost of solar generation is still high<br />

compared to other technologies. Wind resources of the province are minimal,<br />

assessment of which for power generation is underway. The international power<br />

generation scene indicates that base load can only be met through residual<br />

furnace oil, gas, and coal fired power generation. Hydro generation has seasonal<br />

variations. Renewable power, despite the hype about environment and clean<br />

energy, still is only one percent of total power generation in the world. <strong>Punjab</strong>,<br />

therefore, has to rely on coal fired power generation with exploitation of all the<br />

hydro sites while encouraging renewable energy as it becomes more affordable<br />

and widespread.

29. What quantum of coal is required for a 50 MW coal based power<br />

project<br />

The quantity of coal required depends upon various factors like coal<br />

specifications, thermal efficiency and plant availability. A typical 50 MW power<br />

plant on <strong>Punjab</strong> coal specifications, as reported by <strong>Punjab</strong> Minerals Company<br />

(PMC), requires around 0.2 Million Tons of coal per annum (700 Tons per day).<br />

30. Where coal shall be imported from<br />

More than 95% of world seaborne thermal coal exports originate from just six<br />

countries, with the remainder being supplied from half a dozen others. The six<br />

principal coal exporting countries are Indonesia, Australia, Russia, Columbia,<br />

South Africa and USA with their 2009 coal exports as;<br />

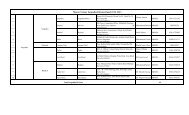

World Top Coal Exporters (2010)<br />

Country<br />

Indonesia 200<br />

Australia 134<br />

Russia 105<br />

Columbia 69<br />

South Africa 66<br />

USA 20<br />

Canada 7<br />

Thermal Coal Exports (million<br />

Ton)<br />

31. What is the coal resource potential in the country<br />

Numerous studies have been conducted all of which have concluded that all coal<br />

reserves of Pakistan are suitable for power generation. Pakistan’s total coal<br />

reserves are 186,007 million tons. The biggest coal reserve of Thar which lies in<br />

Sindh has an estimated potential of 175,506 million tons and preliminary studies<br />

suggest that Thar is capable of generating 100,000 MW for two centuries.<br />

32. What are the difficulties in mining coal from THAR<br />

THAR coal has many technical issues like it has thick overburden (150 m), high<br />

stripping ratio (6.2 cu. m /ton), low heating value (calorific value 12.69 MJ/kg),<br />

high moisture content (50%), unavailability of cooling water, unavailability of<br />

basic infrastructure, brackish underground water, extremely hot climate, high<br />

ambient temperature (51 degrees C), serious clinkering property of coal and<br />

high mining cost.<br />

33. What efforts are being made to develop power projects based on Thar<br />

Coal<br />

The Federal Government has announced a set of incentives for coal mining and<br />

coal based power projects. Whereas the Government of Sindh (GoS) has created<br />

a high power decision making agency i.e. Thar Coal & <strong>Energy</strong> <strong>Board</strong> (TCEB)<br />

which has high level representation from both the federal and provincial<br />

governments. GoS and TCEB have allocated Rs. 27 billion for the provision of<br />

cooling water, Rs. 4.963 billion for the improvement of road network, Rs. 0.972

illion for construction of airport, while 50 acres land has been allocated for<br />

effluent disposal. Accordingly for the development of transmission line and<br />

broad-gauge rail link feasibility studies has been completed and their PC-I has<br />

been approved. Once these facilities will be completed then Thar coal projects<br />

will move smoothly.<br />

34. Instead of conventional mining why underground coal gasification<br />

projects are not being initiated<br />

Underground Coal Gasification (UCG) technology is in development stage and a<br />

pilot project at Thar block-V based on UCG is being implemented. After<br />

ascertaining commercial viability of the pilot project, large scale projects would<br />

be considered.<br />

35. How much coal is being imported into Pakistan<br />

Port Karachi currently handles around 4 Million Tons of Coal per year. An<br />

overview of Coal handled by Karachi Port in the past five years is as below;<br />

Year No of ships Coal handled/year (Tons)<br />

2006-7 69 2,702,971<br />

2007-8 90 3,556,246<br />

2008-9 85 3,387,262<br />

2009-10 93 3,658,368<br />

2010-11 98 3,895,492<br />

36. What is the prevalent Tariff for Industrial Units<br />

Industrial Units fall under the category of ‘Tariff- C Bulk Supply’ as detailed<br />

hereunder:<br />

C-3(a)<br />

For supply at 66 KV and & above and sanctioned load above 5000KW<br />

Fixed Charges Rs. 360/Kw/Month and Variable Charges Rs.11/kWh<br />

C-3 (b) For supply at 66 KV & above and sanctioned load above 5000 KW<br />

Fixed Charges Rs. 360/Kw/Month and Variable Charges Rs.<br />

14.50/kWh (Peak) Rs. 9.10/kWh (Off-Peak)<br />

37. What is the Reference Tariff for different technologies<br />

• Nishat <strong>Power</strong> (Private) Limited-Furnace Oil based 200 MW Plant<br />

Variable Charge Rs. 5.2173/kWh (Fuel Cost Component Rs. 4.7811)<br />

Capacity Charge Rs. 2.2240/kWh<br />

Total<br />

Rs. 7.4413/kWh (cents 12.1988/kWh)<br />

• Orient <strong>Power</strong> (Private) Limited-Combined Cycle based 225 MW Plant<br />

Variable Charge Rs. 2.2772/kWh (Fuel Cost Component Rs. 2.1782<br />

for Gas)<br />

Capacity Charge Rs. 1.7644/kWh<br />

Total<br />

Rs. 4.0416/kWh (cents 6.7360/kWh)

• Laraib <strong>Energy</strong> Limited-Hydro based 84 MW Plant<br />

Variable Charge Rs. 0.1749/kWh<br />

Capacity Charge Rs. 6.6614/kWh<br />

Total<br />

Rs. 6.8362/kWh (cents 8.5453/kWh)<br />

• Up-front Tariff for Wind <strong>Power</strong> Projects<br />

Rs. 17.2755/kWh ((cents 20.0878/kWh) 100% local financing<br />

Rs. 12.6100/kWh (cents 14.6628/kWh) 100% foreign financing<br />

• NEPRA (under consideration) 50 MW Local Coal based Plant<br />

Local Financing Foreign Financing<br />

Variable Charge Rs. 6.1127/kWh Rs. 6.1127/kWh<br />

Capacity Charge Rs. 6.5302/kWh Rs. 5.0037/kWh<br />

Total Rs. 12.6429/kWh Rs. 11.1168/kWh<br />

Cents 13.9392/kWh Cents12.2567/kWh<br />

Fuel Cost Component in both cases amounts to Rs.5.9286 with 27%<br />

thermal efficiency and coal price of Rs. 5,169/M.ton<br />

38. Where can one find data/information on status of power projects under<br />

development in <strong>Punjab</strong><br />

Information on the status of power projects under development in <strong>Punjab</strong> can be<br />

found from website (energy.punjab.gov.pk) of the <strong>Energy</strong> <strong>Department</strong>,<br />

Government of the <strong>Punjab</strong>.<br />

39. What is the model of hydropower project implementation in private<br />

sector<br />

Hydropower Projects in private sector are being implemented on Build- Own-<br />

Operate-Transfer (BOOT) basis and the project based on this model shall be<br />

transferred to the Government at the end of the concession period.<br />

40. What is the construction time required for development of hydropower<br />

project<br />

Due to the site specific nature and being on remote locations, construction time<br />

required for development of hydropower project is a bit longer as compared with<br />

the thermal power projects. For a medium size run of river hydropower project<br />

the development and construction time could be around 5 to 6 years whereas in<br />

case of small hydropower projects, such period could be around 3 years.<br />

41. What is the concession period for hydropower projects<br />

The concession period for BOOT based hydropower projects is up to 30 years.<br />

42. Which are the major hydropower plants in Pakistan<br />

Tarbela (3478 MW), Ghazi-Barotha (1450 MW) and Mangla (1000 MW) are the<br />

major hydropower plants in operation in Pakistan.