Earnings Release - Coca Cola İçecek

Earnings Release - Coca Cola İçecek

Earnings Release - Coca Cola İçecek

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Mn TL<br />

Mn uc<br />

Mn TL<br />

FOR IMMEDIATE DISTRIBUTION<br />

NEWSRELEASE<br />

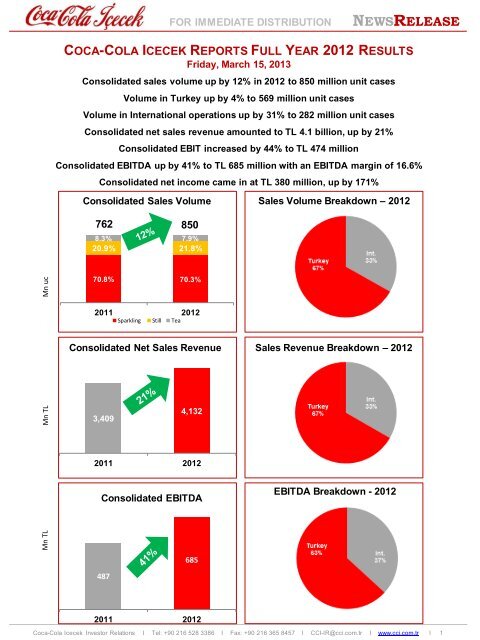

COCA-COLA ICECEK REPORTS FULL YEAR 2012 RESULTS<br />

Friday, March 15, 2013<br />

Consolidated sales volume up by 12% in 2012 to 850 million unit cases<br />

Volume in Turkey up by 4% to 569 million unit cases<br />

Volume in International operations up by 31% to 282 million unit cases<br />

Consolidated net sales revenue amounted to TL 4.1 billion, up by 21%<br />

Consolidated EBIT increased by 44% to TL 474 million<br />

Consolidated EBITDA up by 41% to TL 685 million with an EBITDA margin of 16.6%<br />

Consolidated net income came in at TL 380 million, up by 171%<br />

Consolidated Sales Volume<br />

Sales Volume Breakdown – 2012<br />

762 850<br />

8.3% 7.9%<br />

20.9% 21.8%<br />

70.8% 70.3%<br />

2011 2012<br />

Sparkling Still Tea<br />

Consolidated Net Sales Revenue<br />

Sales Revenue Breakdown – 2012<br />

3,409<br />

4,132<br />

2011 2012<br />

Consolidated EBITDA<br />

EBITDA Breakdown - 2012<br />

685<br />

487<br />

2011 2012<br />

<strong>Coca</strong>-<strong>Cola</strong> Icecek Investor Relations I Tel: +90 216 528 3386 I Fax: +90 216 365 8457 I CCI-IR@cci.com.tr I www.cci.com.tr I 1

FOR IMMEDIATE DISTRIBUTION<br />

NEWSRELEASE<br />

Comments from the Chief Executive Officer, Mr. Damian Gammell<br />

I am very pleased to announce the full year 2012 results for CCI. Our 2012 results are in-line with<br />

our long term guidance, with revenue growing ahead of volume and EBITDA ahead of net<br />

revenue.<br />

Consolidated CCI volume increased by 12% versus 2011, international operations grew a very<br />

impressive 31% while Turkey grew 4%. In line with our focus, the sparkling category grew at low<br />

double digits, this growth was led by brand <strong>Coca</strong>-<strong>Cola</strong>. We continued to offer consumers more<br />

choice and our still category grew at mid-teens.<br />

In 2012, we continued to focus on translating strong volume growth into value. Consolidated<br />

revenues at CCI increased by 21% versus 2011, reaching TL 4.1 billion for the full year.<br />

Consistent execution of our revenue growth management strategies, package segmentation, cold<br />

drink investment and pricing resulted in a very healthy revenue per case growth of 9%.<br />

The revenue growth, coupled with a supportive cost environment and ongoing productivity<br />

improvements brought about 2.3pp expansion in our EBITDA margin. We continued to invest into<br />

the market, expanding our cooler universe and improving execution. Our EBIT margin also<br />

improved by 1.8pp as we continued to drive cost leverage at CCI.<br />

Working ever closer with our customers we continued to enjoy market share gains in all our key<br />

markets. Our focus on a customer driven supply chain and the use of even more efficient<br />

technologies ensured our customer satisfaction continued to increase in 2012.<br />

Net income improved significantly as CCI benefited from a stronger Turkish lira, I am particular<br />

pleased with our free cash flow generation before acquisitions which reached TL 154 million for<br />

the full year.<br />

Our focus on long term growth was supported in 2012 through the acquisition of Al Waha in South<br />

Iraq, adding significant capacity and revenue in our third largest market.<br />

In line with our long term growth model we continued to focus on sustainable growth across CCI.<br />

Water, energy and packaging usage continued to be reduced in 2012 and through a number of<br />

local initiatives we continued to support our local communities.<br />

As we leave the first couple of months of the year behind, our optimism fueled by better economic<br />

growth prospects for Turkey and stable cost environment. In 2013, we expect Turkey volume to<br />

grow mid to high single digits, and organic mid-teens growth in international operations. In<br />

addition, we expect our sales revenue to grow faster than our volume, and a flat to slightly positive<br />

EBITDA margin expansion due to the impact of South Iraq and Pakistan consolidation.<br />

We believe CCI will continue to deliver successful results for the years to come. We are only at the<br />

beginning of the journey.<br />

<strong>Coca</strong>-<strong>Cola</strong> Icecek Investor Relations I Tel: +90 216 528 3386 I Fax: +90 216 365 8457 I CCI-IR@cci.com.tr I www.cci.com.tr I 2

FOR IMMEDIATE DISTRIBUTION<br />

NEWSRELEASE<br />

Consolidated (million TL) 2012 2011 Change % 4Q12 4Q11 Change %<br />

Volume (million uc) 850.5 761.7 11.7% 173.8 140.6 23.6%<br />

Net Sales 4,132.4 3,408.6 21.2% 844.9 670.5 26.0%<br />

EBIT 474.2 328.3 44.4% 17.1 15.9 7.7%<br />

EBIT (Exc. other) 475.4 322.9 47.2% 20.5 15.9 29.4%<br />

EBITDA 685.5 486.9 40.8% 75.0 58.4 28.5%<br />

EBITDA (Exc. other) 682.6 484.8 40.8% 76.4 59.6 28.2%<br />

Net Income/(Loss) 380.1 140.3 171.0% 0.9 (6.0) n.m.<br />

Gross Prof it Margin 38.4% 37.0% 36.2% 38.0%<br />

EBIT Margin 11.5% 9.6% 2.0% 2.4%<br />

EBIT Margin (Exc. other) 11.5% 9.5% 2.4% 2.4%<br />

EBITDA Margin 16.6% 14.3% 8.9% 8.7%<br />

EBITDA Margin (Exc. other) 16.5% 14.2% 9.0% 8.9%<br />

Net Income Margin 9.2% 4.1% 0.1% (0.9%)<br />

Turkey (million TL) 2012 2011 Change % 4Q12 4Q11 Change %<br />

Volume (million uc) 568.5 546.8 4.0% 108.9 96.9 12.5%<br />

Net Sales 2,757.6 2,472.8 11.5% 535.8 446.3 20.0%<br />

EBIT 311.2 267.9 16.2% 3.8 25.1 (85.0%)<br />

EBIT (Exc. other) 300.4 244.4 22.9% 5.9 6.2 (5.5%)<br />

EBITDA 434.7 362.6 19.9% 35.9 47.5 (24.3%)<br />

EBITDA (Exc. other) 423.4 340.8 24.3% 37.3 30.2 23.6%<br />

Net Income/(Loss) 285.1 119.8 138.0% 6.8 19.8 (65.8%)<br />

Gross Prof it Margin 41.8% 40.3% 40.7% 45.1%<br />

EBIT Margin 11.3% 10.8% 0.7% 5.6%<br />

EBIT Margin (Exc. other) 10.9% 9.9% 1.1% 1.4%<br />

EBITDA Margin 15.8% 14.7% 6.7% 10.6%<br />

EBITDA Margin (Exc. other) 15.4% 13.8% 7.0% 6.8%<br />

Net Income Margin 10.3% 4.8% 1.3% 4.4%<br />

International (US$ million) 2012 2011 Change % 4Q12 4Q11 Change %<br />

Volume (million uc) 282.0 215.0 31.2% 64.9 43.7 48.3%<br />

Net Sales 770.6 576.2 33.7% 173.2 120.9 43.3%<br />

EBIT 94.0 45.4 107.1% 7.6 2.2 241.4%<br />

EBIT (Exc. other) 92.2 43.8 110.7% 7.2 3.7 94.0%<br />

EBITDA 143.4 83.9 70.8% 22.1 13.4 65.3%<br />

EBITDA (Exc. other) 139.7 83.4 67.4% 21.0 14.8 42.1%<br />

Net Income/(Loss) 56.1 22.2 152.9% (4.1) (4.7) (13.3%)<br />

Gross Prof it Margin 31.5% 27.6% 28.4% 23.1%<br />

EBIT Margin 12.2% 7.9% 4.4% 1.8%<br />

EBIT Margin (Exc. other) 12.0% 7.6% 4.1% 3.1%<br />

EBITDA Margin 18.6% 14.6% 12.8% 11.1%<br />

EBITDA Margin (Exc. other) 18.1% 14.5% 12.1% 12.2%<br />

Net Income Margin 7.3% 3.9% (2.4%) (3.9%)<br />

Note 1: EBITDA = EBIT + Amortization & Depreciation + Relevant Non Cash Expenses including Provision for Employee Benefits - Relevant Non-cash income<br />

including Negative Goodwill<br />

Note 2: EBIT/EBITDA (Exc. other) = EBIT/EBITDA Excluding Net Other Operating Items<br />

<strong>Coca</strong>-<strong>Cola</strong> Icecek Investor Relations I Tel: +90 216 528 3386 I Fax: +90 216 365 8457 I CCI-IR@cci.com.tr I www.cci.com.tr I 3

FOR IMMEDIATE DISTRIBUTION<br />

NEWSRELEASE<br />

2012 Full Year Highlights<br />

CCI’s consolidated sales volume increased by 11.7% to 850 million unit cases in 2012, successfully<br />

cycling strong 14.5% growth in the prior year. Like-for-like growth (inclusion of 1Q11 proforma N.Iraq<br />

volume and exclusion of 4Q12 S.Iraq volume) of consolidated volume was 9.9%. International<br />

operations constituted 33% of total volume, up from 28% in 2011.<br />

Sparkling category grew at low double digits, which was driven by <strong>Coca</strong>-<strong>Cola</strong> brand while still category<br />

grew at mid-teens. The strong growth of all categories was on the back of successful execution, better<br />

RTM initiatives, cooler investments, marketing campaigns and promotions, as well as activations<br />

during Eurocup, Ramadan and New Year.<br />

Net sales increased by 21.2% to TL 4.1 billion. Net revenue per case increased by 8.6% to TL 4.86 as<br />

a result of higher average pricing particularly in Turkey and Central Asia. International operations<br />

formed 33% of the total net sales in 2012, compared to 28% in 2011.<br />

Gross profit margin increased by 1.4pp to 38.4% on the back of growth in net revenue per case and<br />

lower input costs versus 2011. EBIT grew by 44.4% on the back of improved gross profitability and<br />

lower distribution, selling and marketing expenses as percentage of net sales. Hence, EBIT margin<br />

was up by 1.8pp to 11.5% while EBITDA margin enhanced by 2.3pp to 16.6%.<br />

Turkish Lira appreciated by 5.6% between the beginning and the end of the reporting period.<br />

Accordingly, net financial income was TL 8 million vs. TL 145 million of net financial expense in 2011,<br />

primarily driven by non-cash FX gains.<br />

Consequently, net income increased by 171% to TL 380 million.<br />

Fourth Quarter Highlights<br />

Fourth quarter 2012 consolidated sales volume increased by 23.6% to 174 million, cycling 8.0%<br />

growth in the prior year. Like-for-like growth (exclusion of 4Q12 S. Iraq volume) was 15%.<br />

Net revenue grew by 26.0% to TL 845 million and net revenue per case increased by 1.9% to TL 4.86<br />

on the back of Turkey’s net revenue per case growth. Net revenue per case in international<br />

operations was lower than 4Q11 mainly due to first time consolidation of S.Iraq operations where<br />

current per case prices are lower than CCI’s international operations’ average.<br />

Gross profit and EBIT grew in absolute terms. However gross profit margin decreased by 1.8pp to<br />

36.2% mainly due to lower gross profit margin in Turkey, while international operations gross margin<br />

increased. EBIT margin was only down by 0.3pp to 2.0% thanks to strong operating margin<br />

expansion in international operations in spite of lower operating margin in Turkey. Consequently,<br />

EBITDA margin was up only by 0.2pp t to 8.9%.<br />

Net financial expenses decreased by 67.1% to TL 6 million as TL/US$ was flat in 4Q12 vs. a<br />

depreciation in 4Q11.<br />

Net income was TL 1 million vs. a loss of TL 6 million year ago, as a result of higher consolidated<br />

EBIT and lower financial expenses.<br />

<strong>Coca</strong>-<strong>Cola</strong> Icecek Investor Relations I Tel: +90 216 528 3386 I Fax: +90 216 365 8457 I CCI-IR@cci.com.tr I www.cci.com.tr I 4

FOR IMMEDIATE DISTRIBUTION<br />

NEWSRELEASE<br />

Turkey Operations<br />

Sales Volume (mn uc)<br />

568.5<br />

546.8<br />

2011 2012<br />

Sales Revenue (TL mn)<br />

2,757.6<br />

2,472.8<br />

Full Year: Turkey volume increased by 4.0% to 569 million unit cases,<br />

cycling a very strong 10.6% growth in the prior year. The growth was<br />

driven by portfolio optimization as well as increased focus on category<br />

and package mix management.<br />

All categories posted growth in 2012, thanks to increased cold<br />

availability as well as successful new product, package, and brand<br />

launches. Sparkling and still categories registered low single and low<br />

double digit growth, respectively, while tea category grew at mid-single<br />

digits.<br />

Consequently our market share in sparkling, juice and water categories<br />

were 67%, 25% and 7%, respectively in 2012 (Market share numbers<br />

are restated due to a change in forecasting universe).<br />

Net sales rose by 11.5% to TL 2.8 billion, whereas net sales per unit<br />

case was up by 7.3% to TL 4.85 on the back of effective price/mix<br />

management.<br />

Cost of sales increased by 8.7%, lower than the net sales growth,<br />

driven by lower can and resin prices. Accordingly, gross profit margin<br />

increased by 1.5pp to 41.8%.<br />

2011 2012<br />

EBIT (TL mn)<br />

10.8% *<br />

267.9<br />

11.3%<br />

311.2<br />

Excluding net other operating items, operating expenses as a<br />

percentage of net revenues increased by 0.5pp due to the relatively<br />

higher in distribution, selling and marketing expenses. Consequently,<br />

EBIT margin rose by 0.5pp to 11.3%.<br />

EBITDA was up by 19.9% to TL 434.7 and EBITDA margin increased<br />

by 1.1pp to 15.8%.<br />

2011 2012<br />

* EBIT Margin<br />

EBITDA (TL mn)<br />

* 14.7%<br />

362.6<br />

15.8%<br />

434.7<br />

2011 2012<br />

* EBITDA Margin<br />

<strong>Coca</strong>-<strong>Cola</strong> Icecek Investor Relations I Tel: +90 216 528 3386 I Fax: +90 216 365 8457 I CCI-IR@cci.com.tr I www.cci.com.tr I 5

FOR IMMEDIATE DISTRIBUTION<br />

NEWSRELEASE<br />

Operational Review by Segments<br />

Turkey Operations<br />

Sales Volume (mn uc)<br />

Fourth Quarter: Turkey sales volume growth was 12.5%, cycling a<br />

1.4% growth a year ago, supported by above average weather<br />

temperatures throughout the quarter.<br />

96.9<br />

108.9<br />

Net sales increased by 20.0%, higher than volume growth and net sales<br />

per unit case increased by 6.7% to TL 4.92 due to effective price/mix<br />

management.<br />

Cost of sales rose by 29.6%, higher than net sales mainly due to higher<br />

sweetener prices. Hence, the gross margin decreased by 4.4pp to<br />

40.7% in spite of higher net revenue per case.<br />

4Q11<br />

4Q12<br />

Sales Revenue (TL mn)<br />

535.8<br />

446.3<br />

Excluding net other operating items, operating expenses as a<br />

percentage of net revenues decreased by 4.1pp due to lower per case<br />

marketing expenses compared to 4Q11. Other operating expense was<br />

TL 2.1 million vs. TL 18.9 million of other income in 4Q11, mostly due to<br />

lower dividends from subsidiaries in 4Q12. Hence, EBIT declined by<br />

85% to TL 3.8 million while EBIT margin declined by 4.9pp to 0.7%.<br />

EBITDA declined by 24.3% to TL 35.9 million while EBITDA margin<br />

declined by 3.9pp to 6.7%.<br />

4Q11<br />

4Q12<br />

EBIT (TL mn)<br />

* 5.6%<br />

25.1<br />

0.7%<br />

3.8<br />

4Q11<br />

4Q12<br />

* EBIT Margin<br />

EBITDA (TL mn)<br />

* 10.6%<br />

47.5<br />

6.7%<br />

35.9<br />

4Q11<br />

4Q12<br />

* EBITDA Margin<br />

<strong>Coca</strong>-<strong>Cola</strong> Icecek Investor Relations I Tel: +90 216 528 3386 I Fax: +90 216 365 8457 I CCI-IR@cci.com.tr I www.cci.com.tr I 6

FOR IMMEDIATE DISTRIBUTION<br />

NEWSRELEASE<br />

International Operations<br />

Sales Volume (mn uc)<br />

215.0<br />

576.2<br />

45.4<br />

282.0<br />

2011 2012<br />

Sales Revenue (USD mn)<br />

770.6<br />

2011 2012<br />

*<br />

7.9%<br />

EBIT (USD mn)<br />

12.2%<br />

94.0<br />

2011 2012<br />

* EBIT Margin<br />

EBITDA (USD mn)<br />

*<br />

14.6%<br />

18.6%<br />

143.4<br />

Full Year: International sales volume increased by 31.2% to 282<br />

million unit cases in 2012, driven by the strong organic growth in Central<br />

Asia, N.Iraq and Pakistan. The growth was also driven by the first time<br />

consolidation of S.Iraq’s volume in 4Q12 and full consolidation of N.Iraq<br />

starting from March 2011. Iraq’s share within international operations<br />

increased to 15% from 11% a year ago. Like-for-like growth of<br />

international operations was 24.8% in 2012.<br />

Volume in Kazakhstan and Azerbaijan grew by 32% and 20%,<br />

respectively, supported by market share gains and new product<br />

launches as well as continued customer segmentation of on-premise<br />

channel and fast economic growth in the region. Pakistan volume<br />

growth was 23% assisted by the improvements in the distribution<br />

system and focus on consumer activations and promotions. Business in<br />

N.Iraq continued its strong performance, registering close to 45%<br />

growth in 2012 with the help of improved distribution, and activations<br />

during special occasions in addition to increased cold availability.<br />

Net sales revenue increased by 33.7% to US$ 771 million, ahead of<br />

volume growth. Net sales revenue per unit case increased by 2% to<br />

US$ 2.73 on the back of higher average pricing particularly in key<br />

Central Asian countries.<br />

Cost of sales were up by 26.6%, lower than the revenue growth, driven<br />

by lower sugar and packaging prices. As a result of higher net revenue<br />

per case and lower cost of sales, gross profit margin increased by 3.9pp<br />

to 31.5%.<br />

Excluding net other operating items, operating expenses as a<br />

percentage of net revenues decreased by 0.5pp. Therefore, EBIT more<br />

than doubled to US$ 94 million and EBIT margin improved by 4.3pp to<br />

12.2% thanks to higher gross margin and lower operating expenses as<br />

a percentage of net revenues.<br />

EBITDA was up by 70.8% to US$ 143.4 million with a margin of 18.6%,<br />

expanding by 4.0pp vs. 2011.<br />

83.9<br />

2011 2012<br />

* EBITDA Margin<br />

<strong>Coca</strong>-<strong>Cola</strong> Icecek Investor Relations I Tel: +90 216 528 3386 I Fax: +90 216 365 8457 I CCI-IR@cci.com.tr I www.cci.com.tr I 7

FOR IMMEDIATE DISTRIBUTION<br />

NEWSRELEASE<br />

International Operations<br />

Sales Volume (mn uc)<br />

64.9<br />

43.7<br />

4Q11<br />

4Q12<br />

Sales Revenue (USD mn)<br />

173.2<br />

120.9<br />

Fourth Quarter: International operations volume increased by 48.3%<br />

over 4Q11. All key markets posted double digit volume growth thanks to<br />

New Year campaigns, expanded route to market initiatives and<br />

promotion activities. First time consolidation of S.Iraq also contributed<br />

to this growth. Like-for-like growth of international operations was<br />

20.9% in 4Q12.<br />

Net sales revenue increased by 43.3% to US$ 173 million, whereas net<br />

sales per unit case decreased by 3.4% to US$ 2.67 mainly due to first<br />

time consolidation of S.Iraq operations.<br />

Cost of sales increased by 33.4%, lower than revenue growth on the<br />

back of favorable raw material costs in all key markets. Despite the<br />

contraction of net revenue per case, gross profit margin was up by<br />

5.3pp to 28.4%.<br />

Excluding net other operating items, operating expenses as a<br />

percentage of net revenues increased by 4.2pp. Absolute EBIT almost<br />

quadrupled and EBIT margin improved by 2.6pp to 4.4%.<br />

EBITDA was up by 65.3% to US$22.1 million and EBITDA margin<br />

expanded by 1.7pp to 12.8%.<br />

4Q11<br />

*<br />

1.8%<br />

EBIT (USD mn)<br />

4Q12<br />

4.4%<br />

7.6<br />

2.2<br />

4Q11<br />

* EBIT Margin<br />

4Q12<br />

EBITDA (USD mn)<br />

* 11.1%<br />

12.8%<br />

13.4<br />

22.1<br />

4Q11<br />

* EBITDA Margin<br />

4Q12<br />

<strong>Coca</strong>-<strong>Cola</strong> Icecek Investor Relations I Tel: +90 216 528 3386 I Fax: +90 216 365 8457 I CCI-IR@cci.com.tr I www.cci.com.tr I 8

FOR IMMEDIATE DISTRIBUTION<br />

NEWSRELEASE<br />

Debt Structure<br />

Group Financial Review<br />

Consolidated total financial debt as of December 31, 2012 increased by TL 43 million to TL 1,677 million<br />

from TL 1,634 million as of year end-2011. The maturity profile of the long-term borrowings (including current<br />

portion of long-term borrowing) as of December 31, 2012:<br />

Maturity Date 2013 2014 2015 2016<br />

% of total debt 4.8% 91.9% 3.0% 0.3%<br />

The majority of consolidated financial debt is denominated in foreign currencies, of which 86% is US$, 7% is<br />

EUR and 7% is other currencies. Consolidated net debt as of December 31, 2012 was US$ 600 million<br />

versus US$ 587 million as of December 31, 2011.<br />

Financial Leverage Ratios 2012 2011<br />

Net Debt / EBITDA 1.6 2.3<br />

Debt Ratio (Total Fin. Debt / Total Assets) 39.3% 43.1%<br />

Fin. Debt-to-Equity Ratio 87.6% 97.8%<br />

Financial Expenses<br />

Financial Income / (Expense) Breakdown<br />

(TL m) 2012 2011<br />

Interest income 31.5 31.4<br />

Interest expense (-) (53.7) (54.0)<br />

Foreign exchange gain / (loss) (26.5) 28.2<br />

Realized FX gain / (loss) – Borrowings 0.0 (0.1)<br />

Unrealized FX gain / (loss) – Borrowings 57.0 (150.4)<br />

Gain / (loss) on derivative transactions 0.0 (0.1)<br />

Financial Income / (Expense) Net 8.4 (144.9)<br />

Capital Expenditures<br />

Capital Expenditures (TL m) 2012 2011<br />

PP&E and intangibles 367 499<br />

Subsidiary Acquisitions 210 0<br />

Total 577 499<br />

Total capital expenditures increased by 16% to TL 577 million in 2012. Capital expenditures / net sales ratio,<br />

excluding acquisitions, decreased to 8.9% in 2012 versus 14.6% in 2011.<br />

<strong>Coca</strong>-<strong>Cola</strong> Icecek Investor Relations I Tel: +90 216 528 3386 I Fax: +90 216 365 8457 I CCI-IR@cci.com.tr I www.cci.com.tr I 9

FOR IMMEDIATE DISTRIBUTION<br />

NEWSRELEASE<br />

Accounting Principles<br />

CCI prepares its consolidated financial statements in accordance with the CMB's "Communiqué on Financial<br />

Reporting in Capital Market" Serial XI, No:29. Listed companies are required to prepare their financial<br />

statements in conformity with International Accounting / Financial Reporting Standards (IAS/IFRS) as<br />

prescribed in this CMB Communiqué from the beginning of the year 2008.<br />

Functional and presentation currency of the Company is TL. The multinational structure of foreign entities and<br />

realization of most of their operations in terms of U.S. Dollars (USD) resulted in determination of the foreign<br />

subsidiaries’ and joint ventures’ functional currency as USD. The majority of the consolidated foreign<br />

subsidiaries and joint ventures are regarded as foreign entities since they are financially, economically and<br />

organizationally autonomous.<br />

Since the functional and presentation currency of foreign subsidiaries and joint ventures are determined as<br />

USD in the consolidated financial statements, USD amounts presented in the balance sheet are translated<br />

into Turkish Lira at the official TL exchange rate for purchases of USD announced by the Central Bank of the<br />

Republic of Turkey on December 31, 2012, USD 1.00 (full) = TL 1.7826 (December 31, 2011; USD 1.00 (full)<br />

= TL 1.8889). Furthermore, USD amounts in the income statement have been translated into TL, at the<br />

average TL exchange rate for purchases of U.S. Dollars for the year ended December 31, 2012, is USD 1.00<br />

(full) = TL 1.7922 (January 1, - December 31, 2011; USD 1,00 (full) = TL 1.6708). Differences that occur by<br />

the usage of closing and average exchange rates are followed under currency translation differences<br />

classified under equity.<br />

CCİ’s indirect share in Al Waha became 64,94% by the purchase of 85,00% Al Waha shares by Waha B.V.,<br />

with an amount of USD 133.8 million, equivalent to TL 238.703. Since TL 28.333 of the acquisition cost was<br />

paid as an advance to sellers in 2011 and reflected to other current assets in 2011 consolidated financial<br />

statements, net acquisition cost reflected in the consolidated statement of cash flow as of December 31, 2012<br />

is amounting to TL 210.370. After the completion of the share purchase transaction, Al Waha was<br />

consolidated by using the full consolidation method as of December 31, 2012.<br />

CCI’s indirect share in CCBL increased from 30.00% to 100.00% by the purchase of 100.00% shares of SSG<br />

Investment Limited (SSG) and 50.00% share of CCBI in March 2011. After the completion of these share<br />

purchase transactions, SSG, CCBI and CCBIL were consolidated by using the full consolidation method. CCI<br />

recorded the difference between the net asset value calculated from the financial statements of SSG, CCBI<br />

and CCBIL based on fair value accounting and the acquisition cost amounting to TL 14.691 as positive<br />

goodwill in the consolidated balance sheet as of the acquisition date in accordance with IFRS 3 “Business<br />

Combinations”.<br />

In accordance with the change in scope of consolidation, TL 5.884 fair value increase occurred from the fair<br />

value financial statements of CCBIL was reflected to books for the 30% shares formerly owned by CCI and<br />

separately disclosed under other income in the consolidated income statement as December 31, 2011 in<br />

accordance with IFRS 3 “Business Combinations”.<br />

<strong>Coca</strong>-<strong>Cola</strong> Icecek Investor Relations I Tel: +90 216 528 3386 I Fax: +90 216 365 8457 I CCI-IR@cci.com.tr I www.cci.com.tr I 10

FOR IMMEDIATE DISTRIBUTION<br />

NEWSRELEASE<br />

Accounting Principles<br />

As of December 31, 2012, the list of CCI’s subsidiaries and joint ventures are as follows:<br />

Subsidiaries and Joint Ventures Country Consolidation Method<br />

<strong>Coca</strong>-<strong>Cola</strong> Satış ve Dağıtım A.Ş. Turkey Full Consolidation<br />

Mahmudiye Kaynak Suyu Limited Şirketi Turkey Full Consolidation<br />

J.V. <strong>Coca</strong>-<strong>Cola</strong> Almaty Bottlers LLP Kazakhstan Full Consolidation<br />

Azerbaijan <strong>Coca</strong>-<strong>Cola</strong> Bottlers LLC Azerbaijan Full Consolidation<br />

<strong>Coca</strong>-<strong>Cola</strong> Bishkek Bottlers Closed J. S. Co. Kyrgyzstan Full Consolidation<br />

CCI International Holland B.V. Holland Full Consolidation<br />

Tonus Turkish-Kazakh Joint Venture Limited<br />

Kazakhstan<br />

Full Consolidation<br />

Liability Partnership<br />

The <strong>Coca</strong>-<strong>Cola</strong> Bottling Company of Jordan Ltd. Jordan Full Consolidation<br />

Efes Sınai Dış Ticaret A.Ş. Turkey Full Consolidation<br />

Turkmenistan <strong>Coca</strong>-<strong>Cola</strong> Bottlers Turkmenistan Full Consolidation<br />

CC for Beverage Industry Limited Iraq Full Consolidation<br />

Waha Beverages B.V.<br />

Holland<br />

Full Consolidation<br />

<strong>Coca</strong>-<strong>Cola</strong> Beverages Tajikistan LLC<br />

Tajikistan<br />

Full Consolidation<br />

Irak<br />

Full Consolidation<br />

Al Waha for Soft Drinks, Juices, Mineral Water,<br />

Plastics, and Plastic Caps Production LLC (Al Waha)<br />

Syrian Soft Drink Sales and Distribution LLC Syria Proportionate Consolidation<br />

<strong>Coca</strong>-<strong>Cola</strong> Beverages Pakistan Ltd. Pakistan Proportionate Consolidation<br />

<strong>Coca</strong>-<strong>Cola</strong> Icecek Investor Relations I Tel: +90 216 528 3386 I Fax: +90 216 365 8457 I CCI-IR@cci.com.tr I www.cci.com.tr I 11

FOR IMMEDIATE DISTRIBUTION<br />

NEWSRELEASE<br />

Webcast<br />

CCI will host a webcast to discuss the 2012 results on March 18, 2013, at 13.30, London time (15.30,<br />

İstanbul time and 9.30, New York time). A copy of the conference call presentation can be accessed through<br />

our web site “www.cci.com.tr”. Interested parties can access the live webcast and also view slides of the call<br />

through:<br />

Click here to access webcast<br />

Dial in numbers<br />

UK: +44 (0) 1452 555 566<br />

US: +1 631 510 7498<br />

Confirmation Code: 17776898<br />

Company Profile<br />

<strong>Coca</strong>-<strong>Cola</strong> <strong>İçecek</strong> (CCI) is the 6th largest bottler in the <strong>Coca</strong>-<strong>Cola</strong> System in terms of sales volume. CCI’s<br />

core business is to produce, sell and distribute sparkling and still beverages of The <strong>Coca</strong>-<strong>Cola</strong> Company<br />

(TCCC). CCI employs more than 10,000 people and has operations in Turkey, Pakistan, Kazakhstan,<br />

Azerbaijan, Kyrgyzstan, Turkmenistan, Tajikistan, Jordan and Iraq.<br />

CCI has a total of 22 plants and offers a wide range of beverages to a consumer base of over 360 million<br />

people. In addition to sparkling beverages, the product portfolio includes juices, waters, sports and energy<br />

drinks, tea and iced teas.<br />

CCI’s shares are traded on the Istanbul Stock Exchange under the CCOLA.IS ticker.<br />

Reuters<br />

Bloomberg<br />

CCOLA.IS<br />

CCOLA TI<br />

Contacts<br />

Dr. Deniz Can Yücel<br />

IR Manager<br />

Tel: +90 216 528 3386<br />

deniz.yucel@cci.com.tr<br />

Orhun Köstem<br />

CFO<br />

Tel: +90 216 528 4432<br />

orhun.kostem@cci.com.tr<br />

<strong>Coca</strong>-<strong>Cola</strong> Icecek Investor Relations I Tel: +90 216 528 3386 I Fax: +90 216 365 8457 I CCI-IR@cci.com.tr I www.cci.com.tr I 12

FOR IMMEDIATE DISTRIBUTION<br />

NEWSRELEASE<br />

Special Note Regarding Forward-Looking Statements<br />

This presentation includes forward-looking statements including, but not limited to, statements regarding<br />

<strong>Coca</strong>-<strong>Cola</strong> <strong>İçecek</strong>’s (CCI) plans, objectives, expectations and intentions and other statements that are not<br />

historical facts. Forward-looking statements can generally be identified by the use of words such as “may,”<br />

“will,” “expect,” “intend,” “estimate,” “anticipate,” “plan,” “target,” “believe” or other words of similar meaning.<br />

These forward-looking statements reflect the current views and assumptions of management and are<br />

inherently subject to significant business, economic and other risks and uncertainties. Although management<br />

believes the expectations reflected in the forward-looking statements are reasonable, at this time, you should<br />

not place undue reliance on such forward-looking statements. Important factors that could cause actual<br />

results to differ materially from CCI’s expectations include, without limitation: changes in CCI’s relationship<br />

with The <strong>Coca</strong>-<strong>Cola</strong> Company and its exercise of its rights under our bottler's agreements; CCI’s ability to<br />

maintain and improve its competitive position in its markets; CCI’s ability to obtain raw materials and<br />

packaging materials at reasonable prices; changes in CCI’s relationship with its significant shareholders; the<br />

level of demand for its products in its markets; fluctuations in the value of the Turkish Lira or the level of<br />

inflation in Turkey; other changes in the political or economic environment in Turkey or CCI’s other markets;<br />

adverse weather conditions during the summer months; changes in the level of tourism in Turkey; CCI’s<br />

ability to successfully implement its strategy; and other factors. Should any of these risks and uncertainties<br />

materialize, or should any of management’s underlying assumptions prove to be incorrect, CCI’s actual<br />

results from operations or financial conditions could differ materially from those described herein as<br />

anticipated, believed, estimated or expected. Forward-looking statements speak only as of the date of this<br />

press release and CCI has no obligation to update those statements to reflect changes that may occur after<br />

that date.<br />

<strong>Coca</strong>-<strong>Cola</strong> Icecek Investor Relations I Tel: +90 216 528 3386 I Fax: +90 216 365 8457 I CCI-IR@cci.com.tr I www.cci.com.tr I 13

FOR IMMEDIATE DISTRIBUTION<br />

NEWSRELEASE<br />

CCI – Consolidated IFRS Income Statement as per regulations of the CMB<br />

Jan. 1 - Jan. 1 - Oct. 1 - Oct. 1 -<br />

(TL million)<br />

Dec. 31, 2012 Dec. 31, 2011 Change% Dec. 31, 2012 Dec. 31, 2011 Change%<br />

(audited)<br />

(unaudited)<br />

Sales Volume (million uc) 850.5 761.7 11.7% 173.8 140.6 23.6%<br />

Net Sales 4,132.4 3,408.6 21.2% 844.9 670.5 26.0%<br />

Cost of Sales (2,543.9) (2,145.8) 18.6% (538.8) (415.4) 29.7%<br />

Gross Profit 1,588.5 1,262.8 25.8% 306.1 255.1 20.0%<br />

Operating Expenses (net) (1,113.1) (939.9) 18.4% (285.5) (239.2) 19.3%<br />

Other Income/(Expense) (net) (1.2) 5.4 n.m. (3.4) (0.0) n.m.<br />

EBIT 474.2 328.3 44.4% 17.1 15.9 7.7%<br />

Financial Income/(Expense) (net) 8.4 (144.9) n.m. (6.3) (19.0) (67.1%)<br />

Income Before Minority Interest<br />

& Tax 482.5 183.4 163.2% 10.8 (3.2) n.m.<br />

Income Taxes (97.6) (41.9) 133.0% (9.6) (2.1) 367.7%<br />

Income Before Minority Interest 384.9 141.5 172.1% 1.2 (5.2) n.m.<br />

Minority interest (4.8) (1.2) n.m. (0.3) (0.8) (67.1%)<br />

Net Income/(Loss) 380.1 140.3 171.0% 0.9 (6.0) n.m.<br />

EBITDA 685.5 486.9 40.8% 75.0 58.4 28.5%<br />

CCI – Consolidated IFRS Balance Sheet as per regulations of the CMB<br />

(TL million)<br />

Dec. 31, 2012 Dec. 31, 2011 (TL million) Dec. 31, 2012 Dec. 31, 2011<br />

(audited) (audited) (audited) (audited)<br />

Cash & Cash Equivalents 489.9 522.2 ST Borrow ings 229.3 125.4<br />

Investments in Securities 118.0 3.8 Trade Payables 184.4 185.9<br />

Trade Receivables 297.5 264.6 Due to Related Parties 103.0 89.4<br />

Due from Related Parties 9.5 19.6 Other Payables 130.8 92.5<br />

Inventories 319.0 268.2 Provision for Corporate Tax 2.4 1.4<br />

Other Receivables 13.4 13.2 Provision for Employee Benefits 21.9 14.7<br />

Other Current Assets 311.3 328.3 Other liabilities 20.7 16.9<br />

Total Current Assets 1,558.8 1,419.9 Total Current Liabilities 692.6 526.1<br />

Property, Plant and Equipment 1,927.5 1,707.2 LT Borrow ings 1,447.6 1,508.6<br />

Intangible Assets (including goodw ill) 721.3 593.7 Provision for Employee Benefits 32.8 30.2<br />

Deferred Tax Assets 0.6 1.9 Deferred Tax Liability 58.5 52.6<br />

Other receivables and non-current assets 58.2 65.0 Other Non-Current Liabilities 120.8 0.0<br />

Total Non-Current Assets 2,707.7 2,367.7 Total Non-Current Liabilities 1,659.7 1,591.4<br />

Minority Interest 24.7 20.1<br />

TOTAL ASSETS 4,266.4 3,787.6<br />

Shareholders Equity 1,889.4 1,650.0<br />

TOTAL LIABILITIES AND<br />

SHAREHOLDER’S EQUITY 4,266.4 3,787.6<br />

<strong>Coca</strong>-<strong>Cola</strong> Icecek Investor Relations I Tel: +90 216 528 3386 I Fax: +90 216 365 8457 I CCI-IR@cci.com.tr I www.cci.com.tr I 14

FOR IMMEDIATE DISTRIBUTION<br />

NEWSRELEASE<br />

Turkey Operation – IFRS Income Statement as per regulations of the CMB<br />

(TL million)<br />

Jan. 1- Dec.<br />

31, 2012<br />

Jan. 1- Dec.<br />

31, 2011 Change %<br />

(audited)<br />

International Operations – IFRS Income Statement as per regulations of the CMB<br />

(US$ million)<br />

Jan. 1- Dec.<br />

31, 2012<br />

Jan. 1- Dec.<br />

31, 2011 Change %<br />

(audited)<br />

Oct. 1- Dec.<br />

31, 2012<br />

(unaudited)<br />

Oct. 1- Dec.<br />

31, 2012<br />

Oct. 1- Dec.<br />

31, 2011<br />

(unaudited)<br />

Oct. 1- Dec.<br />

31, 2011<br />

Change %<br />

Sales Volume<br />

(million uc) 568.5 546.8 4.0% 108.9 96.9 12.5%<br />

Net Sales 2,757.6 2,472.8 11.5% 535.8 446.3 20.0%<br />

Cost of Sales (1,604.6) (1,476.1) 8.7% (317.5) (245.0) 29.6%<br />

Gross Profit 1,152.9 996.7 15.7% 218.2 201.3 8.4%<br />

Operating Expenses (net) (852.5) (752.3) 13.3% (212.3) (195.1) 8.9%<br />

Other Income/(Expense) (net) 10.8 23.5 (54.3%) (2.1) 18.9 n.m.<br />

EBIT 311.2 267.9 16.2% 3.8 25.1 (85.0%)<br />

EBITDA 434.7 362.6 19.9% 35.9 47.5 (24.3%)<br />

Change %<br />

Sales Volume<br />

(million uc) 282.0 215.0 31.2% 64.9 43.7 48.3%<br />

Net Sales 770.6 576.2 33.7% 173.2 120.9 43.3%<br />

Cost of Sales (528.0) (417.1) 26.6% (124.1) (93.0) 33.4%<br />

Gross Profit 242.7 159.2 52.4% 49.2 27.9 76.2%<br />

Operating Expenses (net) (150.4) (115.4) 30.3% (42.0) (24.2) 73.5%<br />

Other Income/(Expense) (net) 1.8 1.6 8.7% 0.4 (1.5) n.m.<br />

EBIT 94.0 45.4 107.1% 7.6 2.2 241.4%<br />

EBITDA 143.4 83.9 70.8% 22.1 13.4 65.3%<br />

Financial statements with footnotes are available on our web site at<br />

http://www.cci.com.tr/en/investor-relations/financial-information/financial-results/<br />

<strong>Coca</strong>-<strong>Cola</strong> Icecek Investor Relations I Tel: +90 216 528 3386 I Fax: +90 216 365 8457 I CCI-IR@cci.com.tr I www.cci.com.tr I 15