MORTGAGE REVENUE BOND PROGRAM BULLETIN #366 Via ...

MORTGAGE REVENUE BOND PROGRAM BULLETIN #366 Via ...

MORTGAGE REVENUE BOND PROGRAM BULLETIN #366 Via ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

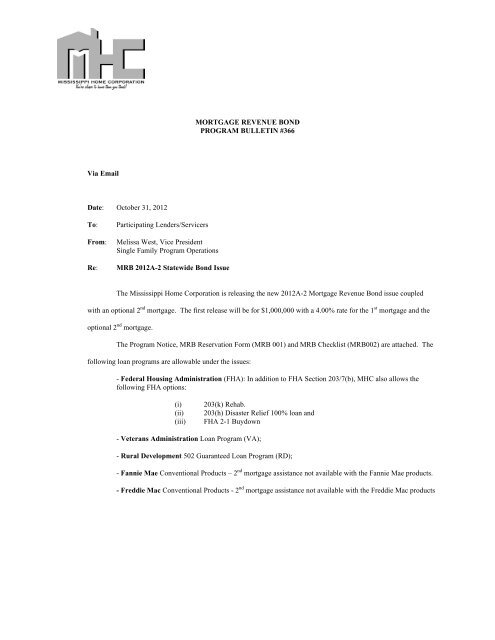

<strong>MORTGAGE</strong> <strong>REVENUE</strong> <strong>BOND</strong><br />

<strong>PROGRAM</strong> <strong>BULLETIN</strong> <strong>#366</strong><br />

<strong>Via</strong> Email<br />

Date: October 31, 2012<br />

To:<br />

From:<br />

Re:<br />

Participating Lenders/Servicers<br />

Melissa West, Vice President<br />

Single Family Program Operations<br />

MRB 2012A-2 Statewide Bond Issue<br />

The Mississippi Home Corporation is releasing the new 2012A-2 Mortgage Revenue Bond issue coupled<br />

with an optional 2 nd mortgage. The first release will be for $1,000,000 with a 4.00% rate for the 1 st mortgage and the<br />

optional 2 nd mortgage.<br />

The Program Notice, MRB Reservation Form (MRB 001) and MRB Checklist (MRB002) are attached. The<br />

following loan programs are allowable under the issues:<br />

- Federal Housing Administration (FHA): In addition to FHA Section 203/7(b), MHC also allows the<br />

following FHA options:<br />

(i)<br />

(ii)<br />

(iii)<br />

203(k) Rehab.<br />

203(h) Disaster Relief 100% loan and<br />

FHA 2-1 Buydown<br />

- Veterans Administration Loan Program (VA);<br />

- Rural Development 502 Guaranteed Loan Program (RD);<br />

- Fannie Mae Conventional Products – 2 nd mortgage assistance not available with the Fannie Mae products.<br />

- Freddie Mac Conventional Products - 2 nd mortgage assistance not available with the Freddie Mac products

<strong>PROGRAM</strong> NOTICE<br />

<strong>MORTGAGE</strong> <strong>REVENUE</strong> <strong>BOND</strong> with OPTIONAL 2 ND <strong>MORTGAGE</strong> ASSISTANCE <strong>PROGRAM</strong><br />

ISSUE/SERIES 2012A-2 Statewide Bond Issue<br />

$1,000,000<br />

1 st & 2 nd <strong>MORTGAGE</strong> LOAN RATE: 4.00% (Subject to change)<br />

1 st & 2 nd <strong>MORTGAGE</strong> P&I FACTORS: 4.75829198<br />

LOAN TYPE:<br />

FHA, VA, Rural Dev., Fannie Mae* & Freddie Mac*<br />

Conventional Products *May only use the rate for the<br />

30-year loan, but cannot have use the 2 nd mortgage 10-<br />

year loan assistance.<br />

1 st MTG. LOAN TERM: 30 Years<br />

2 nd MTG. LOAN TERM: 10 Years<br />

<strong>BOND</strong> MATURITY DATE: December 1, 2041<br />

1 st MTG. LOAN TERM: 30 Years<br />

2 nd MTG. LOAN TERM: 10 Years<br />

<strong>BOND</strong> MATURITY DATE: December 1, 2041<br />

2 nd <strong>MORTGAGE</strong> LOAN: Equates to 3% of the 1 st mortgage full loan amount can be<br />

applied to the applicable loan type required down payment,<br />

if applicable, a 1% or 1.5% Origination fee (not required to<br />

be charged) & buyer paid closing costs (excluding prepaid<br />

items). Discount points cannot be charged to buyer or<br />

seller. Any funds remaining at time of closing must be<br />

applied as a principal reduction to the 1 st mortgage &<br />

reflected as such on the HUD-1, pg. 2 under Borrower<br />

Funds column.<br />

POOL NOTIFICATION CONTACTS:<br />

Blair Bingham, CFO – Blair.Bingham@mshc.com<br />

Carol Edmonds, Controller – Carol.Edmonds@mshc.com<br />

MS Home Corporation<br />

735 Riverside Drive<br />

Jackson, MS 39202<br />

Ph. # (601)718-4642<br />

Fax # (601)718-4643<br />

DVP DELIVERY INSTRUCTIONS<br />

BK OF NYC/MLGOV<br />

FOR Ginnie Mae, Fannie Mae ABA: 021000018<br />

Securities or Freddie Mac Certificates ML Acct #16H-01604<br />

TIMETABLE - (Subject to change)<br />

SEPTEMBER 7, 2012<br />

FEBRUARY 13, 2013<br />

FEBRUARY 21, 2013<br />

FEBRUARY 26, 2013<br />

MARCH 5, 2013<br />

MARCH 12, 2013<br />

MARCH 19, 2013<br />

First Day of Reservations<br />

Final Day to Reserve Funds<br />

Final Day to Submit a Package for Compliance<br />

Review<br />

Final Day to Close Loans<br />

Final Day to Submit Purchase Certification Package for<br />

Review<br />

Final Day to Issue Purchase Certificate<br />

Final Day to Sell Loans to Servicing Lender<br />

APRIL 8, 2013 Final Day to Notify MHC of Pool Delivery (MRB 012)<br />

APRIL 17, 2013<br />

Final Day to Deliver Pool to Purchase Security<br />

/Rev. 11/12/12

MISSISSIPPI HOME CORPORATION<br />

<strong>MORTGAGE</strong> <strong>REVENUE</strong> <strong>BOND</strong><br />

& DOWN PAYMENT ASSISTANCE RESERVATION FORM<br />

INSTRUCTIONS TO LENDER:<br />

This form must be fully completed prior to faxing in for a MRB w/2 nd Mortgage reservation to (601) 718-4672. The<br />

following documents must be submitted within three (3) business days of receiving your reservation or the reservation<br />

will be canceled.<br />

1. MRB with Down Payment Assistance Reservation Form (MRB 001)<br />

2. MRB with Down Payment Assistance Checklist (MRB 002)<br />

3. Executed copy of Sales Contract<br />

4. Reservation fee of $200, excludes HAT/HOYO, payable to MHC (Non-Refundable)<br />

5. Copy of Executed Loan Application<br />

6. Original Executed MRB Potential Recapture Tax Form<br />

7. Original MRB Assistance and Fee Disclosure Form (Excludes HAT/HOYO loans)<br />

8. Copy of Homebuyer Education Certificate<br />

9. Original HAT Loan Agreement (If Applicable)<br />

INTEREST RATE: 4.00% MRB RESERVATION NUMBER: 2012A-2____________<br />

2 Nd <strong>MORTGAGE</strong> NUMBER: _________________________<br />

SERVICER: _______________________________________________________<br />

COMPANY NAME: _____________________________________________________________________________________________<br />

BRANCH ADDRESS: ____________________________________________________________________________________________<br />

COMPLETED BY: ______________________________________ DATE: _________________________________________________<br />

PHONE NUMBER: _____________________________________ FAX NUMBER: __________________________________________<br />

___________________________________ ___________________________________ ________________________________<br />

:<br />

BORROWER (S) NAME: _________________________________________________________________________________________<br />

COMPLETE PROPERTY ADDRESS: ______________________________________________________________________________<br />

APPLICATION DATE: _____________________________ ESTIMATED CLOSING DATE: _________________________________<br />

SALES PRICE: ____________________________________ COUNTY NAME: _____________________________________________<br />

TARGET: _____ NON-TARGET: ______<br />

**LOAN AMOUNT: $______________________________ (Including MIP, PMI, VA Funding or RD Guarantee Fee)<br />

OPTIONAL 3% SECOND <strong>MORTGAGE</strong> $ ______________________ (Calculated on the Full Loan Amount**)<br />

GRANT ASSISTANCE <strong>PROGRAM</strong>S – Name of Program, i.e. HAT, HOYO, HLP, City Grant: _______________________________<br />

GROSS HOUSEHOLD ANNUAL INCOME: $____________________<br />

COUNTY INCOME LIMIT: $___________________________<br />

REPRESENTATIVE CREDIT SCORE: __________ __________<br />

Check if Non-Traditional Credit Approval – With No Score (___)<br />

LOAN TYPE: ( )FHA ( )VA ( )RD ( )Fannie Mae Conventional Products* ( )Freddie Mac Conventional Products*<br />

*Only if NO Down Payment Assistance is being used<br />

_<br />

_____<br />

: :<br />

___SINGLE FAMILY DETACHED<br />

___CONSTRUCTION<br />

___SINGLE FAMILY ATTACHED<br />

___NEW (LESS THAN 1 YEAR OLD)<br />

___CONDOMINIUM OR PUD<br />

___EXISTING<br />

___"DE MINIMUS PUD"<br />

___MANUFACTURED HOUSING<br />

_________________________________________________________________________________________________________________<br />

CLOSING ATTORNEY (Name, Physical Address, Phone and Fax Numbers):<br />

______________________________________________________________________________________________________________<br />

______________________________________________________________________________________________________________<br />

CONTACT PERSON: _______________________________ ESTIMATED CLOSING DATE: _______________________________<br />

___________________________________________________ _____________________________________________________<br />

:<br />

RECEIVED BY: __________RESERVATION DATE: _______________ RESERVATION EXPIRATION DATE: _______________<br />

MRB 001 Rev. 10/31/12

MRB with Optional Down Payment Assistance<br />

______________________________________<br />

Borrower<br />

<strong>PROGRAM</strong> CHECKLIST<br />

Statewide Rate: 4.00%<br />

P & I Factors Respectively: 4.75829198<br />

2012A-2_______________________<br />

MRB Reservation Number<br />

2 ND Mtg. No: _________________<br />

RESERVATION PACKAGE<br />

RESERVATIONS ACCEPTED FROM SEPTEMBER 7, 2012 TO FEBRUARY 13, 2013<br />

_____1. MRB with Down Payment Assistance Reservation Form (MRB 001)<br />

_____2. MRB with Down Payment Assistance Checklist (MRB 002)<br />

_____3. Reservation fee of $200, except for HAT/HOYO (Non-Refundable and No Personal Checks allowed)<br />

_____4. Copy of Executed Sales Contract or for HUD Repo’s. the HUD Property Disposition Form 9548<br />

_____5. Copy of Complete/Executed Loan Application<br />

_____6. Original Executed Potential Recapture Tax Form<br />

_____7. Original MRB Assistance and Fee Disclosure (MRB/DISC, Excludes HAT/HOYO)<br />

_____8. Copy of Homebuyer Education Certificate<br />

_____9. Original HAT Loan Agreement (If Applicable)<br />

CONDITIONS: ____________________________________________________________________________________________________<br />

__________________________________________________________________________________________________________________<br />

MHC must receive the Reservation package within three (3) business days of receiving the reservation.<br />

COMPLIANCE PACKAGE<br />

FINAL DAY TO SUBMIT A COMPLIANCE PACKAGE WILL BE FEBRUARY 21, 2013<br />

FINAL DAY TO CLOSE LOANS WILL BE FEBRUARY 26, 2013<br />

_____1. MRB with Down Payment Assistance Checklist (MRB 002)<br />

_____2. FHA Transmittal Summary or VA Loan Analysis or Fannie Mae 1008 (Dependent upon loan type)<br />

_____3. Verification of Employment (s) and pay stub (s) (All Applicable Household Members)<br />

_____4. MHC Income Calculation Worksheet<br />

_____5. Federal Tax returns-Previous 3Yr.’s for ALL applicable household members with original signatures of each tax payer on ea.<br />

Years Federal tax returns (Not applicable for Target Counties)<br />

_____6. Original Borrowers Affidavit Part I (MRB 003)<br />

_____7. Copy of Appraisal (URAR or Conditional CRV)<br />

_____8. Notification of Change Form (MRB 011, if applicable)<br />

_____9. Attorney Information Form (MRB 010) and Completed Air Bill (if applicable)<br />

____10. Exception Documentation (if applicable)<br />

____11. Copy of FHA Buydown Agreement (if applicable)<br />

____12. 203(k) Maximum Mortgage Worksheet (if applicable)<br />

____13. Copy of HUD-1 (HAT Only)<br />

CONDITIONS: ___________________________________________________________________________________________________<br />

_________________________________________________________________________________________________________________<br />

MHC requires three (3) business days for the compliance review. Once MHC has reviewed the file, a Conditional Commitment approval<br />

or list of conditions will be faxed to the lender contact.<br />

PURCHASE CERTIFICATION PACKAGE<br />

FINAL DAY TO SUBMIT A PURCHASE CERTIFICATION PACKAGE WILL BE MARCH 5, 2013<br />

FINAL DAY PURCHASE CERTIFICATIONS WILL BE ISSUED WILL BE MARCH 12, 2013<br />

_____1. MRB with Down Payment Assistance Checklist (MRB 002)<br />

_____2. Original Lenders Closing Certificate (MRB 006)<br />

_____3. Original Borrowers Affidavit Part II (MRB 007)<br />

_____4. Original Affidavit of Seller (MRB 004) N/A on HUD Repo.<br />

_____5. Copy of Executed HUD-1<br />

_____6. Copy of Executed First Mortgage Note<br />

_____7. Copy of Executed First Mortgage Deed of Trust<br />

_____8. Original DPA Note<br />

_____9. Original Recorded DPA Deed of Trust<br />

____10. Original DPA Truth-in-Lending<br />

____11. Original DPA Disclosure<br />

CONDITIONS: ___________________________________________________________________________________________________<br />

_________________________________________________________________________________________________________________<br />

Once MHC has reviewed the closing documents, a Purchase Certification or a list of conditions will be issued. If the PC is issued the<br />

mortgage loan may be pooled to back a Ginnie Mae or Fannie Mae Mortgage Backed Security or Freddie Mac Certificate.<br />

FINAL DAY LOAN CAN BE SOLD TO THE SERVICER WILL BE MARCH 19, 2013<br />

FINAL DAY TO NOTIFY TRUSTEE OF DELIVERY (MRB 012) APRIL 8, 2013<br />

FINAL DAY TRUSTEE TO PURCHASE SECURITY WILL ALSO BE APRIL 17, 2013<br />

MRB 002 Rev. 10/31/12

![UNDER $5,000 ASSET CERTIFICATION TOTAL Add [(a) through (t)]](https://img.yumpu.com/35351421/1/190x245/under-5000-asset-certification-total-add-a-through-t.jpg?quality=85)