S&B Industrial Minerals S.A. Annual Financial Report for the year ...

S&B Industrial Minerals S.A. Annual Financial Report for the year ...

S&B Industrial Minerals S.A. Annual Financial Report for the year ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

economic perspective, economic developments in our Greek domestic market were immensely<br />

adverse, though with no material effect on our business, as less than 7% of Group revenues is<br />

generated in Greece.<br />

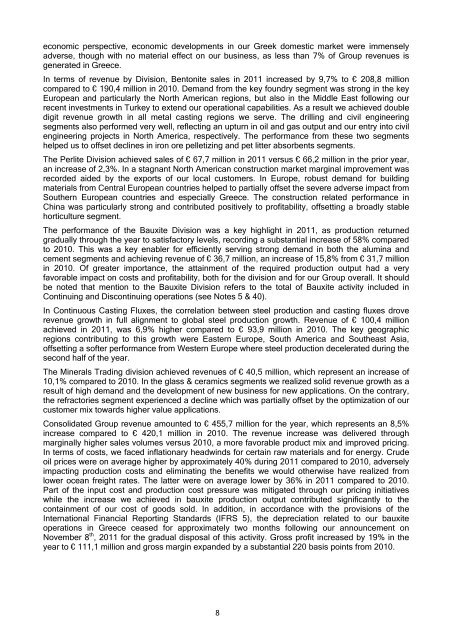

In terms of revenue by Division, Bentonite sales in 2011 increased by 9,7% to € 208,8 million<br />

compared to € 190,4 million in 2010. Demand from <strong>the</strong> key foundry segment was strong in <strong>the</strong> key<br />

European and particularly <strong>the</strong> North American regions, but also in <strong>the</strong> Middle East following our<br />

recent investments in Turkey to extend our operational capabilities. As a result we achieved double<br />

digit revenue growth in all metal casting regions we serve. The drilling and civil engineering<br />

segments also per<strong>for</strong>med very well, reflecting an upturn in oil and gas output and our entry into civil<br />

engineering projects in North America, respectively. The per<strong>for</strong>mance from <strong>the</strong>se two segments<br />

helped us to offset declines in iron ore pelletizing and pet litter absorbents segments.<br />

The Perlite Division achieved sales of € 67,7 million in 2011 versus € 66,2 million in <strong>the</strong> prior <strong>year</strong>,<br />

an increase of 2,3%. In a stagnant North American construction market marginal improvement was<br />

recorded aided by <strong>the</strong> exports of our local customers. In Europe, robust demand <strong>for</strong> building<br />

materials from Central European countries helped to partially offset <strong>the</strong> severe adverse impact from<br />

Sou<strong>the</strong>rn European countries and especially Greece. The construction related per<strong>for</strong>mance in<br />

China was particularly strong and contributed positively to profitability, offsetting a broadly stable<br />

horticulture segment.<br />

The per<strong>for</strong>mance of <strong>the</strong> Bauxite Division was a key highlight in 2011, as production returned<br />

gradually through <strong>the</strong> <strong>year</strong> to satisfactory levels, recording a substantial increase of 58% compared<br />

to 2010. This was a key enabler <strong>for</strong> efficiently serving strong demand in both <strong>the</strong> alumina and<br />

cement segments and achieving revenue of € 36,7 million, an increase of 15,8% from € 31,7 million<br />

in 2010. Of greater importance, <strong>the</strong> attainment of <strong>the</strong> required production output had a very<br />

favorable impact on costs and profitability, both <strong>for</strong> <strong>the</strong> division and <strong>for</strong> our Group overall. It should<br />

be noted that mention to <strong>the</strong> Bauxite Division refers to <strong>the</strong> total of Bauxite activity included in<br />

Continuing and Discontinuing operations (see Notes 5 & 40).<br />

In Continuous Casting Fluxes, <strong>the</strong> correlation between steel production and casting fluxes drove<br />

revenue growth in full alignment to global steel production growth. Revenue of € 100,4 million<br />

achieved in 2011, was 6,9% higher compared to € 93,9 million in 2010. The key geographic<br />

regions contributing to this growth were Eastern Europe, South America and Sou<strong>the</strong>ast Asia,<br />

offsetting a softer per<strong>for</strong>mance from Western Europe where steel production decelerated during <strong>the</strong><br />

second half of <strong>the</strong> <strong>year</strong>.<br />

The <strong>Minerals</strong> Trading division achieved revenues of € 40,5 million, which represent an increase of<br />

10,1% compared to 2010. In <strong>the</strong> glass & ceramics segments we realized solid revenue growth as a<br />

result of high demand and <strong>the</strong> development of new business <strong>for</strong> new applications. On <strong>the</strong> contrary,<br />

<strong>the</strong> refractories segment experienced a decline which was partially offset by <strong>the</strong> optimization of our<br />

customer mix towards higher value applications.<br />

Consolidated Group revenue amounted to € 455,7 million <strong>for</strong> <strong>the</strong> <strong>year</strong>, which represents an 8,5%<br />

increase compared to € 420,1 million in 2010. The revenue increase was delivered through<br />

marginally higher sales volumes versus 2010, a more favorable product mix and improved pricing.<br />

In terms of costs, we faced inflationary headwinds <strong>for</strong> certain raw materials and <strong>for</strong> energy. Crude<br />

oil prices were on average higher by approximately 40% during 2011 compared to 2010, adversely<br />

impacting production costs and eliminating <strong>the</strong> benefits we would o<strong>the</strong>rwise have realized from<br />

lower ocean freight rates. The latter were on average lower by 36% in 2011 compared to 2010.<br />

Part of <strong>the</strong> input cost and production cost pressure was mitigated through our pricing initiatives<br />

while <strong>the</strong> increase we achieved in bauxite production output contributed significantly to <strong>the</strong><br />

containment of our cost of goods sold. In addition, in accordance with <strong>the</strong> provisions of <strong>the</strong><br />

International <strong>Financial</strong> <strong>Report</strong>ing Standards (IFRS 5), <strong>the</strong> depreciation related to our bauxite<br />

operations in Greece ceased <strong>for</strong> approximately two months following our announcement on<br />

November 8 th , 2011 <strong>for</strong> <strong>the</strong> gradual disposal of this activity. Gross profit increased by 19% in <strong>the</strong><br />

<strong>year</strong> to € 111,1 million and gross margin expanded by a substantial 220 basis points from 2010.<br />

8