S&B Industrial Minerals S.A. Annual Financial Report for the year ...

S&B Industrial Minerals S.A. Annual Financial Report for the year ...

S&B Industrial Minerals S.A. Annual Financial Report for the year ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Despite <strong>the</strong> delivery of solid results on a consolidated Group level, due to <strong>the</strong> reported net loss of<br />

<strong>the</strong> parent company, S&B will not be paying an annual dividend <strong>for</strong> fiscal <strong>year</strong> 2011 in line with<br />

current legislation, though our Board may propose an alternative reward to shareholders at a later<br />

time.<br />

Continuing and Discontinuing Operations<br />

On November 8, 2011, we announced jointly with Mytilineos Holdings S.A. <strong>the</strong> attainment of an<br />

initial agreement <strong>for</strong> <strong>the</strong> gradual acquisition of S&B’s bauxite operations in Greece by Mytilineos’<br />

fully owned subsidiary Aluminium S.A. The initially agreed price <strong>for</strong> this transaction is € 61,1 million<br />

and is to be confirmed upon completion of a financial, legal, tax and technical due diligence<br />

process. Upon <strong>the</strong> successful completion of <strong>the</strong> due diligence process, a detailed procedure, <strong>the</strong><br />

terms and <strong>the</strong> relevant timeline <strong>for</strong> <strong>the</strong> gradual transfer of our bauxite operations to Aluminium S.A.<br />

will be established. The initial agreement <strong>for</strong>esees <strong>the</strong> divestment, contribution to and absorption of<br />

<strong>the</strong> Group’s bauxite activity in Greece by Delphi Distomon (D.D.), a fully-owned subsidiary of<br />

Aluminium S.A. engaged in bauxite production. At that stage, S&B will become a shareholder in <strong>the</strong><br />

resulting structure (New D.D.). Thereafter, Aluminium S.A. will gradually acquire S&B’s contributed<br />

share, such that, its own share initially reaches a 51% participation in New D.D. and acquire <strong>the</strong><br />

remaining 49% gradually, over <strong>the</strong> following 30-month period.<br />

In accordance with <strong>the</strong> provisions of IFRS 5, at December 31, 2011 S&B’s bauxite operations in<br />

Greece and “Greek Helicon Bauxite S.A.”, a fully-owned subsidiary of <strong>the</strong> Parent Company, were<br />

classified as a discontinuing operation.<br />

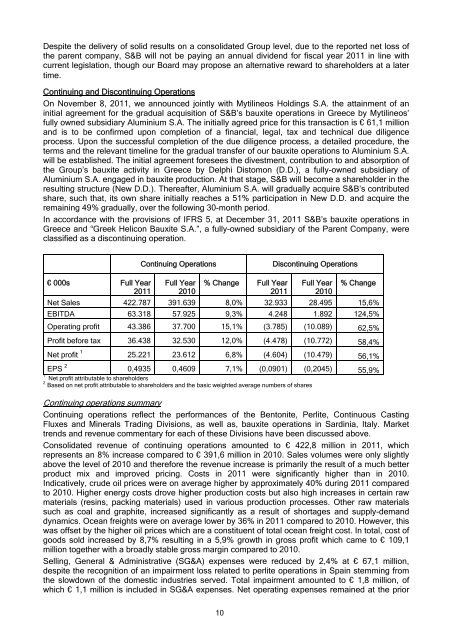

Continuing Operations<br />

Discontinuing Operations<br />

€ 000s Full Year<br />

2011<br />

Full Year<br />

2010<br />

% Change Full Year<br />

2011<br />

Full Year<br />

2010<br />

% Change<br />

Net Sales 422.787 391.639 8,0% 32.933 28.495 15,6%<br />

EBITDA 63.318 57.925 9,3% 4.248 1.892 124,5%<br />

Operating profit 43.386 37.700 15,1% (3.785) (10.089) 62,5%<br />

Profit be<strong>for</strong>e tax 36.438 32.530 12,0% (4.478) (10.772) 58,4%<br />

Net profit 1 25.221 23.612 6,8% (4.604) (10.479) 56,1%<br />

EPS 2 0,4935 0,4609 7,1% (0,0901) (0,2045) 55,9%<br />

1<br />

Net profit attributable to shareholders<br />

2<br />

Based on net profit attributable to shareholders and <strong>the</strong> basic weighted average numbers of shares<br />

Continuing operations summary<br />

Continuing operations reflect <strong>the</strong> per<strong>for</strong>mances of <strong>the</strong> Bentonite, Perlite, Continuous Casting<br />

Fluxes and <strong>Minerals</strong> Trading Divisions, as well as, bauxite operations in Sardinia, Italy. Market<br />

trends and revenue commentary <strong>for</strong> each of <strong>the</strong>se Divisions have been discussed above.<br />

Consolidated revenue of continuing operations amounted to € 422,8 million in 2011, which<br />

represents an 8% increase compared to € 391,6 million in 2010. Sales volumes were only slightly<br />

above <strong>the</strong> level of 2010 and <strong>the</strong>re<strong>for</strong>e <strong>the</strong> revenue increase is primarily <strong>the</strong> result of a much better<br />

product mix and improved pricing. Costs in 2011 were significantly higher than in 2010.<br />

Indicatively, crude oil prices were on average higher by approximately 40% during 2011 compared<br />

to 2010. Higher energy costs drove higher production costs but also high increases in certain raw<br />

materials (resins, packing materials) used in various production processes. O<strong>the</strong>r raw materials<br />

such as coal and graphite, increased significantly as a result of shortages and supply-demand<br />

dynamics. Ocean freights were on average lower by 36% in 2011 compared to 2010. However, this<br />

was offset by <strong>the</strong> higher oil prices which are a constituent of total ocean freight cost. In total, cost of<br />

goods sold increased by 8,7% resulting in a 5,9% growth in gross profit which came to € 109,1<br />

million toge<strong>the</strong>r with a broadly stable gross margin compared to 2010.<br />

Selling, General & Administrative (SG&A) expenses were reduced by 2,4% at € 67,1 million,<br />

despite <strong>the</strong> recognition of an impairment loss related to perlite operations in Spain stemming from<br />

<strong>the</strong> slowdown of <strong>the</strong> domestic industries served. Total impairment amounted to € 1,8 million, of<br />

which € 1,1 million is included in SG&A expenses. Net operating expenses remained at <strong>the</strong> prior<br />

10