Mari Pangestu: The Champion of Free Trade - The President Post

Mari Pangestu: The Champion of Free Trade - The President Post

Mari Pangestu: The Champion of Free Trade - The President Post

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

B6<br />

July 12, 2010<br />

<strong>The</strong> <strong>President</strong> <strong>Post</strong><br />

www.thepresidentpost.com<br />

Executive Highlights<br />

Moody’s Investors<br />

Service has raised its<br />

outlook on Indonesia’s<br />

BA2 credit rating to<br />

positive from stable.<br />

<strong>The</strong> positive outlook means the<br />

agency will likely raise the rating,<br />

which is two notches below<br />

investment grade, within 12-18<br />

months. Moody’s last upgraded<br />

Indonesia’s credit rating in September<br />

2009. In its statement,<br />

the ratings agency said the move<br />

reflected Indonesia’s capacity for<br />

sustained growth, its effective fiscal<br />

and monetary policies and<br />

prospects for further improvements<br />

in the government’s financial<br />

and debt position. Aninda<br />

Mitra, Moody’s vice president for<br />

Indonesia, said recent instabilities<br />

in the European debt markets<br />

have had no serious implications<br />

on Indonesia’s improving credit<br />

fundamentals. He noted that<br />

the recent appointment <strong>of</strong> former<br />

banker Agus Martowardojo as finance<br />

minister and the nomination<br />

<strong>of</strong> Darmin Nasution as Bank<br />

Indonesia governor were supportive<br />

<strong>of</strong> policy continuity and institutional<br />

credibility. Mitra also<br />

remarked that the central bank’s<br />

recent measures to reduce volatility<br />

in capital flows were “ratings<br />

neutral” as it did not fundamentally<br />

restrict the servicing <strong>of</strong> debt<br />

obligations.<br />

Bank Indonesia<br />

(BI) has introduced<br />

measures to reduce<br />

speculative money<br />

flow and encourage<br />

investors to keep<br />

funds in longer-term<br />

rupiah denominated<br />

instruments.<br />

Most analysts agree the steps taken<br />

by the central bank are aimed<br />

at short-term, speculative capital<br />

and are unlikely to discourage<br />

foreign investors. <strong>The</strong> measures<br />

include a one month holding period<br />

for those investing in its Bank<br />

Indonesia bills (SBI). BI also widened<br />

the spread between its overnight<br />

repo rate and its benchmark<br />

rate to +100 basis points<br />

(bp), and the spread between the<br />

overnight deposit rate and the<br />

benchmark rate to -100 bp, all <strong>of</strong><br />

which boosts the cost <strong>of</strong> borrowing<br />

from the central bank while<br />

reducing returns from investing<br />

in SBIs. BI will also introduce<br />

nine-month and 12-month SBIs<br />

in the second half <strong>of</strong> the year to<br />

complement the bank’s shorterterm<br />

debt paper. Acting BI governor<br />

Darmin Nasution emphasized<br />

that the new measures were<br />

not “capital controls”, but were<br />

aimed at helping the central bank<br />

improve the effectiveness <strong>of</strong> its<br />

monetary policy and strengthen<br />

the country’s resilience to global<br />

financial shocks.<br />

plan to raise electricity<br />

rates by an average<br />

10% effective 1 July.<br />

It is the country’s first tariff increase<br />

for electricity since 2004<br />

and, despite the sensitivity <strong>of</strong><br />

the issue, the public outcry over<br />

the hike has been modest. In<br />

his statement, <strong>President</strong> Yudhoyono<br />

said the hike was necessary<br />

to safeguard the economy<br />

while protecting the poor. Tariffs<br />

for households with capacity<br />

<strong>of</strong> 1,300-5,500 volt ampere (VA)<br />

will be raised by 18%. Electricity<br />

tariffs for users with capacity <strong>of</strong><br />

between 450 and 900 VA, which<br />

are mostly low-income households<br />

and accounts for almost<br />

half <strong>of</strong> the number <strong>of</strong> users, will<br />

remain unchanged. Tariffs for<br />

businesses and industrial operations<br />

with capacity <strong>of</strong> up to 2,200<br />

VA will be increased by 6%; between<br />

2,200 VA and 200 kiloVA<br />

by 9%; and above 200 kiloVA by<br />

15%. <strong>The</strong> government has allocated<br />

Rp55.1 trillion for electricity<br />

subsidies in its revised 2010<br />

state budget, up from its original<br />

forecast <strong>of</strong> Rp37.8 trillion. Bank<br />

Indonesia, meanwhile, said it did<br />

not expect the increase in electricity<br />

rates to have a significant impact<br />

on inflation, and is retaining<br />

its 2010 inflation projection<br />

<strong>of</strong> 5.1-5.2%.<br />

<strong>The</strong> government has<br />

given the green light<br />

to develop the longdelayed<br />

US$1.4 Billion<br />

Donggi-Senoro LNG<br />

project in Central<br />

Sulawesi.<br />

This comes after the energy ministry<br />

formally approved the allocation<br />

<strong>of</strong> up to 75% <strong>of</strong> the LNG<br />

produced from the planned facility<br />

for exports. Last year, then<br />

Vice <strong>President</strong> Yusuf Kalla insisted<br />

the bulk <strong>of</strong> the project’s output<br />

go to the domestic market,<br />

prompting Mitsubishi – the majority<br />

shareholder in Donggi-Senoro<br />

- to threaten to withdraw<br />

from the project and prevent the<br />

Japan Bank for International Cooperation<br />

(JBIC) from extending<br />

low-cost funding to develop the<br />

facility. State-owned oil and gas<br />

firm Pertamina and local energy<br />

company Medco Energi Internasional<br />

holds 29% and 20% stakes<br />

respectively in the project. <strong>The</strong><br />

LNG facility, which will have a<br />

capacity <strong>of</strong> two million tons per<br />

year, is now scheduled to start operations<br />

in 2014. Japan’s Kyushu<br />

Electric Power Co. and South Korea’s<br />

Korea Gas Corp. are among<br />

the likely buyers <strong>of</strong> the exported<br />

LNG. <strong>The</strong> Donggi-Senoro facility<br />

will get its gas from the Senoro<br />

and Matindok fields jointly operated<br />

by Medco and Pertamina.<br />

its compared to Rp1.6 trillion in<br />

losses in the year earlier period.<br />

<strong>The</strong> firm also posted a 14% increase<br />

in revenue to Rp35.5 trillion<br />

in the first quarter.<br />

Australia’s Churchill<br />

mining has acquired<br />

direct ownership <strong>of</strong> its<br />

Ridlatama Tambang<br />

coal concession in East<br />

Kalimantan.<br />

<strong>The</strong> company said the decision<br />

to convert its indirect contractual<br />

arrangements in the mine to direct<br />

equity interest comes following<br />

passage <strong>of</strong> the 2009 mining<br />

law and the recent issuance <strong>of</strong> the<br />

legislation’s implementing regulations<br />

allowing foreign companies<br />

to taka direct equity ownership<br />

in locally incorporated<br />

companies holding mining concessions.<br />

Churchill managing<br />

director Paul Mazak said the restructuring<br />

to a simple ownership<br />

%<br />

8.0<br />

IDX<br />

3,300<br />

3,100<br />

2,900<br />

2,700<br />

2,500<br />

2,300<br />

2,100<br />

1,900<br />

1,700<br />

1,500<br />

Jun<br />

09<br />

2,027<br />

919<br />

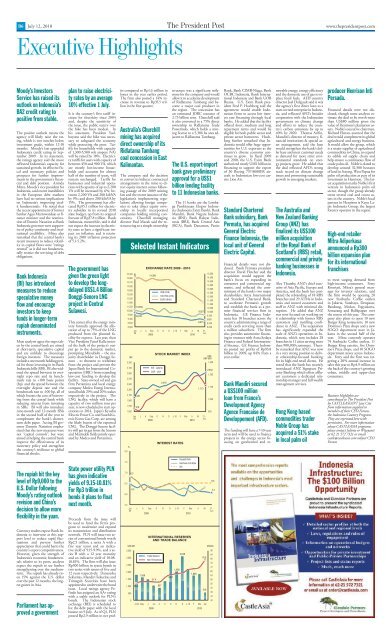

EXCHANGE RATE 2009 - 2010<br />

16,450<br />

14,389<br />

15,800<br />

15,150<br />

14,500<br />

13,850<br />

13,200<br />

12,550<br />

US$ (LHS)<br />

100 YEN (LHS)<br />

EURO (RHS)<br />

11,900<br />

11,250 10,659<br />

10,600<br />

9,950<br />

10,225<br />

9,300<br />

8,650<br />

8,000<br />

Jun J A Sep O N D J-10 F Mar A<br />

09<br />

2009 2010<br />

STOCK MARKET INDEX<br />

IDX - Jakarta<br />

S&P - USA<br />

1,053<br />

2,416<br />

J A Sep O N D J-10 F Mar A<br />

2009 2010<br />

INTEREST RATES<br />

structure was a significant milestone<br />

for the company and would<br />

allow it to accelerate development<br />

<strong>of</strong> Ridlatama Tambang and become<br />

a major coal producer in<br />

the region. <strong>The</strong> concession has<br />

an estimated JORC resource <strong>of</strong><br />

2.73 billion tons. Churchill said<br />

it also converted to a 75% direct<br />

ownership in Ridlatama <strong>Trade</strong><br />

Powerindo, which holds a mining<br />

license to a 5,386 ha area adjacent<br />

to Ridlatama Tambang.<br />

<strong>The</strong> U.S. export-import<br />

bank gave preliminary<br />

approval for a US$1<br />

billion lending facility<br />

to 11 Indonesian banks.<br />

<strong>The</strong> 11 banks are the Lembaga<br />

Pembiayaan Ekspor Indonesia<br />

(Indonesia Exim Bank), Bank<br />

Mandiri, Bank Negara Indonesia<br />

(BNI), Bank Rakyat Indonesia<br />

(BRI), Bank Central Asia<br />

(BCA), Bank Danamon, Panin<br />

Selected Instant Indicators<br />

15,000<br />

14,500<br />

14,000<br />

13,500<br />

13,000<br />

12,500<br />

12,000<br />

11,500<br />

11,000<br />

10,500<br />

9,927 10,000<br />

9,500<br />

9000<br />

9,015<br />

8,500<br />

8,000<br />

M 21 -<br />

Jun<br />

M<br />

1,113<br />

USA<br />

S&P 500<br />

1,300<br />

21 -<br />

Jun<br />

2,942<br />

1,200<br />

1,100<br />

1,000<br />

900<br />

Bank, Bank CIMB-Niaga, Bank<br />

OCBC Indonesia, Bank International<br />

Indonesia and Bank UOB<br />

Buana. U.S. Exim Bank president<br />

Fred P. Hochberg said the<br />

agreement would enable Indonesian<br />

firms to access low interest<br />

rate financing through local<br />

banks. He added that the facility<br />

<strong>of</strong>fered short, medium and long<br />

repayment terms and would be<br />

eligible for both public sector and<br />

private sector borrowers. Hochberg<br />

further remarked that Indonesia<br />

would <strong>of</strong>fer huge opportunities<br />

for U.S. exporters as the<br />

country’s diverse economy continues<br />

to grow. In fiscal 2009<br />

and 2010, the U.S. Exim Bank<br />

authorized nearly US$1 billion in<br />

financing to support the export<br />

<strong>of</strong> 30 Boeing 737-8000ER aircraft<br />

to Indonesian low-cost carrier<br />

Lion Air.<br />

Standard Chartered<br />

Bank subsidiary, Bank<br />

Permata, has acquired<br />

General Electric<br />

Finance Indonesia, the<br />

local unit <strong>of</strong> General<br />

Electric Capital.<br />

Financial details were not disclosed.<br />

Bank Permata president<br />

director David Fletcher said the<br />

acquisition would support the<br />

bank’s focus on expanding its<br />

consumer and commercial segments,<br />

and reflected the commitment<br />

<strong>of</strong> the bank’s two major<br />

shareholders, Astra International<br />

and Standard Chartered Bank,<br />

to accelerate Permata’s growth<br />

and establish the bank as a premier<br />

financial services firm in<br />

Indonesia. GE Finance Indonesia<br />

has 10 branches across the<br />

country, administering a range <strong>of</strong><br />

credit cards servicing more than<br />

a million subscribers. <strong>The</strong> firm<br />

also provides automotive financing<br />

in ventures with Astra Sedaya<br />

Finance and Federal International<br />

Finance. GE Finance Indonesia<br />

posted net pr<strong>of</strong>its <strong>of</strong> Rp93.8<br />

billion in 2009, up 84% from a<br />

year earlier.<br />

Bank Mandiri secured<br />

a US$100 million<br />

loan from France’s<br />

Development Agency<br />

Agence Francaise de<br />

Developpement (AFD).<br />

<strong>The</strong> funding will have a 7-10 year<br />

term and will be used to finance<br />

projects in the energy sector focusing<br />

on geothermal and renewable<br />

energy, energy efficiency<br />

and the domestic use <strong>of</strong> gas to replace<br />

fossil fuels. AFD country<br />

director Joel Daligault said it was<br />

the agency’s first direct loan to a<br />

state-owned enterprise in Indonesia,<br />

and reflected AFD’s broader<br />

cooperation with the Indonesian<br />

government on climate change<br />

and efforts to reduce the country’s<br />

carbon emissions by up to<br />

40% by 2020. Thomas Arifin,<br />

Mandiri’s director <strong>of</strong> treasury, financial<br />

institutions & special asset<br />

management, said the loan<br />

would strengthen the bank’s dollar<br />

base and meet customer needs<br />

as demand for more strict environmental<br />

standards on energy<br />

projects grow. He added that<br />

the deal reflected AFD’s strong<br />

track record on climate change<br />

issues and promoting sustainable<br />

growth in emerging markets.<br />

<strong>The</strong> Australia and<br />

New Zealand Banking<br />

Group (ANZ) has<br />

finalized its US$100<br />

million acquisition<br />

<strong>of</strong> the Royal Bank <strong>of</strong><br />

Scotland’s (RBS) retail,<br />

commercial and private<br />

banking businesses in<br />

Indonesia.<br />

Alex Thursby, ANZ’s chief executive<br />

<strong>of</strong> Asia Pacific, Europe and<br />

America, said the bank has completed<br />

the rebranding <strong>of</strong> 18 RBS<br />

branches and 29 ATMs in Indonesia<br />

and moved customers and<br />

staff to ANZ with minimal disruption.<br />

He added that ANZ<br />

was now focused on working on<br />

it relationship with former RBS<br />

customers and instilling confidence<br />

in ANZ. <strong>The</strong> acquisition<br />

has significantly expanded the<br />

scale <strong>of</strong> ANZ’s operations in Indonesia,<br />

which now includes 28<br />

branches in 11 cities serving more<br />

than 900,000 customers. Thursby<br />

remarked that ANZ was now<br />

in a very strong position to deliver<br />

relationship-focused banking<br />

for its high-end retail clients. He<br />

noted that the bank has recently<br />

introduced ANZ Signature Priority<br />

Banking which <strong>of</strong>fers affluent<br />

customers a dedicated relationship<br />

manager and full wealth<br />

management services.<br />

Hong Kong-based<br />

commodities trader<br />

Noble Group has<br />

acquired a 51% stake<br />

in local palm oil<br />

producer Henrison Inti<br />

Persada.<br />

Financial details were not disclosed,<br />

though some analysts estimate<br />

the deal to be worth more<br />

than US$80 million given the<br />

value <strong>of</strong> Henrison’s plantation assets.<br />

Noble’s executive chairman,<br />

Richard Elman, asserted that the<br />

deal would complement its global<br />

agricultural and energy business.<br />

It would allow the group, which<br />

is a major supplier <strong>of</strong> agricultural<br />

commodities to China, to expand<br />

its edible oil supply chain and<br />

help ensure a continuous flow <strong>of</strong><br />

crude palm oil. Noble is slated to<br />

develop around 32,500 hectares<br />

<strong>of</strong> land in Sorong, West Papua for<br />

palm oil production as part <strong>of</strong> its<br />

investment in Henrison. <strong>The</strong> latest<br />

acquisition marks Noble’s first<br />

venture in Indonesia’s palm oil<br />

sector, though the group already<br />

owns several coal and cocoa assets<br />

in the country. Noble’s local<br />

partner in Henrison is Kayu Lapis<br />

Indonesia Group, the largest<br />

forestry operator in the region.<br />

High-end retailer<br />

Mitra Adiperkasa<br />

announced a Rp300<br />

billion expansion plan<br />

for its international<br />

franchises<br />

to meet surging demand from<br />

high-income consumers. Fetty<br />

Kwartati, Mitra’s general manager<br />

for investor relations, said<br />

the firm would be opening 20<br />

new Starbucks C<strong>of</strong>fee outlets<br />

in Jakarta, Surabaya, Denpasar,<br />

Bandung, Medan, Yogyakarta,<br />

Semarang and Balikpapan over<br />

the course <strong>of</strong> this year. <strong>The</strong> company<br />

also plans to open 10 new<br />

Burger King restaurants, 10 new<br />

Domino’s Pizza shops and a new<br />

SOGO department store in Jakarta<br />

in the second half <strong>of</strong> the<br />

year. Mitra currently operates<br />

74 Starbucks C<strong>of</strong>fee outlets, 11<br />

Burger King eateries, five Domino’s<br />

Pizza shops, and 10 SOGO<br />

department stores across Indonesia.<br />

Fetty said the firm was targeting<br />

a 20% annual increase in<br />

sales this year to Rp4.9 trillion on<br />

the back <strong>of</strong> the country’s growing<br />

urban, middle and upper-class<br />

consumers.<br />

Business Highlights are<br />

contributed to <strong>The</strong> <strong>President</strong> <strong>Post</strong><br />

by CASTLEASIA/PT Jasa Cita<br />

from information supplied to<br />

members <strong>of</strong> their CEO Forum,<br />

the Indonesia Country Program.<br />

<strong>The</strong>y are reprinted here with<br />

permission. For more information<br />

about CASTLEASIA programs,<br />

please contact Juliette or Wijayanti<br />

at 62 21 572 7321 or email<br />

castle@castleasia.com subject CEO<br />

Forum<br />

<strong>The</strong> rupiah hit the key<br />

level <strong>of</strong> Rp9,000 to the<br />

U.S. Dollar following<br />

Moody’s rating outlook<br />

revision and China’s<br />

decision to allow more<br />

flexibility in the yuan.<br />

Currency traders expect Bank Indonesia<br />

to intervene at this support<br />

level to reduce rapid fluctuations<br />

and prevent further<br />

appreciation that could harm the<br />

country’s export competitiveness.<br />

However, given the strength <strong>of</strong><br />

Indonesia’s economic fundamentals<br />

relative to its peers, analysts<br />

expect the rupiah to see further<br />

strengthening over the mediumterm.<br />

<strong>The</strong> rupiah has already risen<br />

15% against the U.S. dollar<br />

over the past 12 months, the largest<br />

gainer in Asia.<br />

Parliament has approved<br />

a government<br />

State power utility PLN<br />

has given indicative<br />

yields <strong>of</strong> 9.15-10.81%<br />

For Rp3 trillion in<br />

bonds it plans to float<br />

next month.<br />

Proceeds from the issue will<br />

be used to fund the firm’s program<br />

to modernize and expand<br />

its transmission and distribution<br />

network. PLN will issue two series<br />

<strong>of</strong> conventional bonds worth<br />

Rp2.5 trillion, a series A with a<br />

five year tenor and an indicative<br />

yield <strong>of</strong> 9.15-9.9%, and a series<br />

B with a 12 year maturity<br />

and an indicative yield <strong>of</strong> 10.08-<br />

10.81%. <strong>The</strong> firm will also issue<br />

Rp500 billion in syaria bonds in<br />

two series with tenors <strong>of</strong> five and<br />

12 years respectively. Danareska<br />

Sekuritas, Mandiri Sekuritas and<br />

Trimegah Securities have been<br />

appointed to underwrite the bond<br />

issue. Local ratings agency Pefindo<br />

has assigned an AA+ rating<br />

with a stable outlook for PLN’s<br />

bonds. <strong>The</strong> Indonesian stock<br />

exchange (BEI) is scheduled to<br />

list the debt paper with the local<br />

bourse on 9 July. As <strong>of</strong> Q1, PLN<br />

posted Rp2.9 trillion in net pr<strong>of</strong>-<br />

7.5<br />

7.0<br />

6.5<br />

6.0<br />

5.5<br />

Jun<br />

09<br />

US$ Mn<br />

3,500<br />

3,000<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

6.3<br />

0<br />

6.5<br />

56.6<br />

1,568<br />

INTERNATIONAL RESERVES<br />

AND TRADE BALANCE<br />

<strong>Trade</strong> Balance<br />

Net FX Reserves<br />

57.4<br />

837<br />

64.5<br />

1,960<br />

Deposit Rate<br />

Interbank Call Rate<br />

SBI<br />

J A Sep O N D J-10 F Mar A<br />

2009 2010<br />

3,048<br />

1,669<br />

A-09 May J Jul A S O N D J-10 F Mar<br />

2009 2010<br />

M<br />

78.6<br />

518<br />

Apr<br />

6.5<br />

US$ Bn<br />

88<br />

84<br />

80<br />

76<br />

72<br />

68<br />

64<br />

60<br />

56<br />

52<br />

48<br />

44<br />

40<br />

6.1<br />

21 -<br />

Jun