Aviva Investors - Principles for Responsible Investment

Aviva Investors - Principles for Responsible Investment

Aviva Investors - Principles for Responsible Investment

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

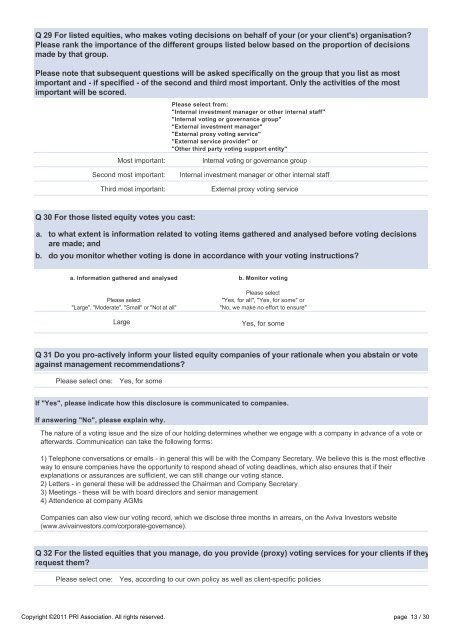

Q 29 For listed equities, who makes voting decisions on behalf of your (or your client's) organisation<br />

Please rank the importance of the different groups listed below based on the proportion of decisions<br />

made by that group.<br />

Please note that subsequent questions will be asked specifically on the group that you list as most<br />

important and if specified of the second and third most important. Only the activities of the most<br />

important will be scored.<br />

Most important:<br />

Second most important:<br />

Third most important:<br />

Please select from:<br />

"Internal investment manager or other internal staff"<br />

"Internal voting or governance group"<br />

"External investment manager"<br />

"External proxy voting service"<br />

"External service provider" or<br />

"Other third party voting support entity"<br />

Internal voting or governance group<br />

Internal investment manager or other internal staff<br />

External proxy voting service<br />

Q 30 For those listed equity votes you cast:<br />

a. to what extent is in<strong>for</strong>mation related to voting items gathered and analysed be<strong>for</strong>e voting decisions<br />

are made; and<br />

b. do you monitor whether voting is done in accordance with your voting instructions<br />

a. In<strong>for</strong>mation gathered and analysed b. Monitor voting<br />

Please select<br />

"Large", "Moderate", "Small" or "Not at all"<br />

Large<br />

Please select<br />

"Yes, <strong>for</strong> all", "Yes, <strong>for</strong> some" or<br />

"No, we make no ef<strong>for</strong>t to ensure"<br />

Yes, <strong>for</strong> some<br />

Q 31 Do you proactively in<strong>for</strong>m your listed equity companies of your rationale when you abstain or vote<br />

against management recommendations<br />

Please select one:<br />

Yes, <strong>for</strong> some<br />

If "Yes", please indicate how this disclosure is communicated to companies.<br />

If answering "No", please explain why.<br />

The nature of a voting issue and the size of our holding determines whether we engage with a company in advance of a vote or<br />

afterwards. Communication can take the following <strong>for</strong>ms:<br />

1) Telephone conversations or emails in general this will be with the Company Secretary. We believe this is the most effective<br />

way to ensure companies have the opportunity to respond ahead of voting deadlines, which also ensures that if their<br />

explanations or assurances are sufficient, we can still change our voting stance.<br />

2) Letters in general these will be addressed the Chairman and Company Secretary<br />

3) Meetings these will be with board directors and senior management<br />

4) Attendence at company AGMs<br />

Companies can also view our voting record, which we disclose three months in arrears, on the <strong>Aviva</strong> <strong>Investors</strong> website<br />

(www.avivainvestors.com/corporategovernance).<br />

Q 32 For the listed equities that you manage, do you provide (proxy) voting services <strong>for</strong> your clients if they<br />

request them<br />

Please select one:<br />

Yes, according to our own policy as well as clientspecific policies<br />

Copyright ©2011 PRI Association. All rights reserved. page 13 / 30