Aviva Investors - Principles for Responsible Investment

Aviva Investors - Principles for Responsible Investment

Aviva Investors - Principles for Responsible Investment

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

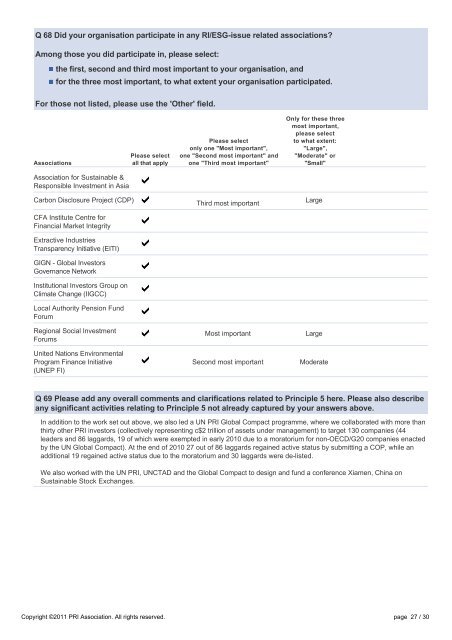

Q 68 Did your organisation participate in any RI/ESGissue related associations<br />

Among those you did participate in, please select:<br />

the first, second and third most important to your organisation, and<br />

<strong>for</strong> the three most important, to what extent your organisation participated.<br />

For those not listed, please use the 'Other' field.<br />

Associations<br />

Please select<br />

all that apply<br />

Please select<br />

only one "Most important",<br />

one "Second most important" and<br />

one "Third most important"<br />

Only <strong>for</strong> these three<br />

most important,<br />

please select<br />

to what extent:<br />

"Large",<br />

"Moderate" or<br />

"Small"<br />

Association <strong>for</strong> Sustainable &<br />

<strong>Responsible</strong> <strong>Investment</strong> in Asia<br />

Carbon Disclosure Project (CDP)<br />

CFA Institute Centre <strong>for</strong><br />

Financial Market Integrity<br />

Extractive Industries<br />

Transparency Initiative (EITI)<br />

GIGN Global <strong>Investors</strong><br />

Governance Network<br />

Institutional <strong>Investors</strong> Group on<br />

Climate Change (IIGCC)<br />

Local Authority Pension Fund<br />

Forum<br />

Regional Social <strong>Investment</strong><br />

Forums<br />

United Nations Environmental<br />

Program Finance Initiative<br />

(UNEP FI)<br />

Third most important<br />

Most important<br />

Second most important<br />

Large<br />

Large<br />

Moderate<br />

Q 69 Please add any overall comments and clarifications related to Principle 5 here. Please also describe<br />

any significant activities relating to Principle 5 not already captured by your answers above.<br />

In addition to the work set out above, we also led a UN PRI Global Compact programme, where we collaborated with more than<br />

thirty other PRI investors (collectively representing c$2 trillion of assets under management) to target 130 companies (44<br />

leaders and 86 laggards, 19 of which were exempted in early 2010 due to a moratorium <strong>for</strong> nonOECD/G20 companies enacted<br />

by the UN Global Compact). At the end of 2010 27 out of 86 laggards regained active status by submitting a COP, while an<br />

additional 19 regained active status due to the moratorium and 30 laggards were delisted.<br />

We also worked with the UN PRI, UNCTAD and the Global Compact to design and fund a conference Xiamen, China on<br />

Sustainable Stock Exchanges.<br />

Copyright ©2011 PRI Association. All rights reserved. page 27 / 30