CARD SERVICES UNDERSTANDING INTEREST

CARD SERVICES UNDERSTANDING INTEREST

CARD SERVICES UNDERSTANDING INTEREST

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

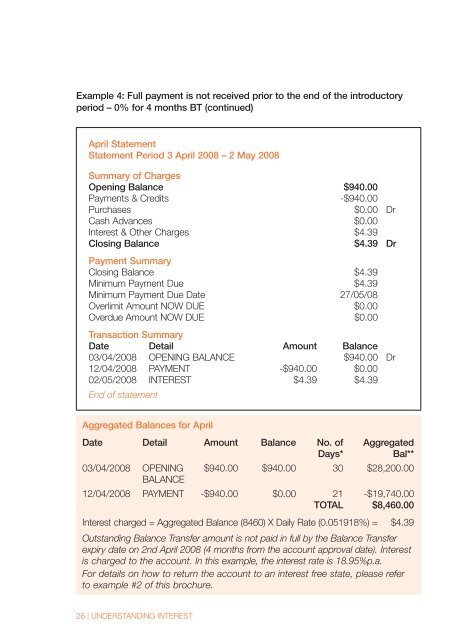

Example 4: Full payment is not received prior to the end of the introductory<br />

period – 0% for 4 months BT (continued)<br />

April Statement<br />

Statement Period 3 April 2008 – 2 May 2008<br />

Summary of Charges<br />

Opening Balance $940.00<br />

Payments & Credits -$940.00<br />

Purchases $0.00 Dr<br />

Cash Advances $0.00<br />

Interest & Other Charges $4.39<br />

Closing Balance $4.39 Dr<br />

Payment Summary<br />

Closing Balance $4.39<br />

Minimum Payment Due $4.39<br />

Minimum Payment Due Date 27/05/08<br />

Overlimit Amount NOW DUE $0.00<br />

Overdue Amount NOW DUE $0.00<br />

Transaction Summary<br />

Date Detail Amount Balance<br />

03/04/2008 OPENING BALANCE $940.00 Dr<br />

12/04/2008 PAYMENT -$940.00 $0.00<br />

02/05/2008 <strong>INTEREST</strong> $4.39 $4.39<br />

End of statement<br />

Aggregated Balances for April<br />

Date Detail Amount Balance No. of Aggregated<br />

Days* Bal**<br />

03/04/2008 OPENING $940.00 $940.00 30 $28,200.00<br />

BALANCE<br />

12/04/2008 PAYMENT -$940.00 $0.00 21 -$19,740.00<br />

TOTAL $8,460.00<br />

Interest charged = Aggregated Balance (8460) X Daily Rate (0.051918%) = $4.39<br />

Outstanding Balance Transfer amount is not paid in full by the Balance Transfer<br />

expiry date on 2nd April 2008 (4 months from the account approval date). Interest<br />

is charged to the account. In this example, the interest rate is 18.95%p.a.<br />

For details on how to return the account to an interest free state, please refer<br />

to example #2 of this brochure.<br />

Suggested tips for avoiding additional fees<br />

1. Pay your minimum payment by the due date as indicated on your statement.<br />

2. Set up a direct debit to avoid making a late payment.<br />

n To set up a direct debit facility on your account, complete a Direct Debit<br />

Request Form available on MyCards or by contacting us. You can select to<br />

either have the minimum payment, full statement balance, or a fixed amount<br />

debited from your nominated account.<br />

3. Monitor your transactions and available credit using MyCards.<br />

n Access MyCards, our internet banking website at xxxxxxxxxxx using your<br />

Access Code and internet banking password.<br />

Please contact us if you require your Access Code or internet banking password<br />

to access self service banking facilities.<br />

4. Ensure your credit card limit is manageable for your financial situation. If you have<br />

any concerns, please contact us.<br />

5. Ensure you have read your account terms and conditions.<br />

26 | <strong>UNDERSTANDING</strong> <strong>INTEREST</strong> <strong>UNDERSTANDING</strong> <strong>INTEREST</strong> | 27