HUNGARY'S ESSENTIAL OIL INDUSTRY Csaba Fodor ... - IFEAT

HUNGARY'S ESSENTIAL OIL INDUSTRY Csaba Fodor ... - IFEAT

HUNGARY'S ESSENTIAL OIL INDUSTRY Csaba Fodor ... - IFEAT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Paper presented at the <strong>IFEAT</strong> 2002 International Conference – ‘Central & Eastern Europe: A source and a market<br />

for essential oils and aroma chemicals’; Warsaw, Poland, 13-17 Oct. 2002. Pages 35–49 in the Conference Proceedings.<br />

_________________________________________________________________________________________<br />

HUNGARY’S <strong>ESSENTIAL</strong> <strong>OIL</strong> <strong>INDUSTRY</strong><br />

<strong>Csaba</strong> <strong>Fodor</strong><br />

Silvestris & Szilas Ltd<br />

Vasút u. 42, H-2144 Kerepes, Hungary<br />

[ csaba_fodor@silvestris.hu ]<br />

Hungary has a long history as an origin of essential oils. However, the industry has undergone a<br />

number of major changes over last century. My intention is to give a brief overview of the whole<br />

history of commercial production and then to focus on the more recent developments.<br />

Background on Hungary<br />

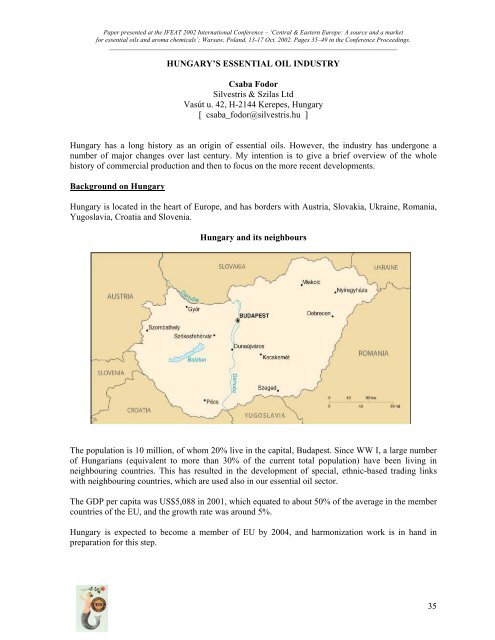

Hungary is located in the heart of Europe, and has borders with Austria, Slovakia, Ukraine, Romania,<br />

Yugoslavia, Croatia and Slovenia.<br />

Hungary and its neighbours<br />

The population is 10 million, of whom 20% live in the capital, Budapest. Since WW I, a large number<br />

of Hungarians (equivalent to more than 30% of the current total population) have been living in<br />

neighbouring countries. This has resulted in the development of special, ethnic-based trading links<br />

with neighbouring countries, which are used also in our essential oil sector.<br />

The GDP per capita was US$5,088 in 2001, which equated to about 50% of the average in the member<br />

countries of the EU, and the growth rate was around 5%.<br />

Hungary is expected to become a member of EU by 2004, and harmonization work is in hand in<br />

preparation for this step.<br />

35

Prior to 1990, Hungary was considered an agricultural economy and the main crops were wheat and<br />

corn. In the past decade, however, a large amount of foreign investment arrived in the country and<br />

changed the orientation to an industrial profile. Hungary succeeded in attracting the largest foreign<br />

investment per capita in the region up until 2001. This was due to the relatively cheap and skilled<br />

manpower resource, the advanced banking system, plus a stable economic and political environment.<br />

This inward investment trend stopped in 2002 as, probably due to the sharply increasing cost of skilled<br />

manpower, some large multinational companies moved their operations to cheaper developing<br />

countries, in several cases outside of the region.<br />

The Essential Oils Industry<br />

My discussion of the essential oil industry in Hungary examines the following time periods:<br />

• Before WW II.<br />

• The Communist era, 1945-90.<br />

• The transition period 1990-94.<br />

• The years of a market economy, 1994-2002<br />

• Future challenges<br />

Before WW II<br />

It is possible to trace the industry back to the 13 th century and the manufacture of the famous ‘Hungary<br />

(or Rosemary) Water’ but, instead, let us start with the birth of commercial essential oil production in<br />

the 1920s.<br />

The renowned Schimmel Co. of Miltitz in Germany established a subsidiary in Budapest in 1923. The<br />

company held a very strong position in supplying local users by offering a full range of aromatic<br />

products: liqueur and rum essences, essential oils, flower oils, perfume compounds and aroma<br />

chemicals.<br />

In the early 1920s, Dr. Jules Bittera introduced several new selected crops from abroad, including<br />

French lavender, English Mitcham peppermint and Dutch caraway. Next, he initiated a continuous<br />

crop selection programme to increase oil yields and qualities. As a result, the production levels grew<br />

year by year all products were exported and were praised as of very high quality (as recorded in Ernest<br />

Guenther’s The Essential Oils). Additionally, Dr. Bittera made products from wild grown plants.<br />

By 1941, production was as follows:<br />

From<br />

cultivation<br />

From wild<br />

plants<br />

Product Output (tonnes) Main producing areas<br />

Peppermint oil 8.5 Zalavár & Deáki<br />

Dillweed oil 3 Dömsöd & Deáki<br />

Lavender oil 0.6 Tihany<br />

Marjoram and caraway oils<br />

Kalocsa<br />

Juniper berry oil<br />

Oak moss extract.<br />

36

Chart 1: Production scale for the main oils<br />

in 1941 (kg)<br />

9000<br />

8000<br />

7000<br />

6000<br />

5000<br />

4000<br />

3000<br />

2000<br />

1000<br />

0<br />

Peppermint Dillweed Lavender<br />

Map 2: Distillery locations in 1941<br />

Deáki<br />

Tihany<br />

Dömsöd<br />

Zalavár<br />

Kalocsa<br />

37

The Communist Era (1945-1990)<br />

The end of WW II brought the Russians and the communist system to Hungary, and both stayed for 45<br />

years.<br />

Schimmel and Dr. Bittera’s distilleries of were appropriated by the communist regime, as were all<br />

companies in the country. In 1951, these state-owned operations were called the Kompozíció Essential<br />

Oil and Chemical Factory (and were renamed as KHV in 1962). In this organization, everything was<br />

centralized (fragrance and flavour manufacture, essential oil and aroma chemical production). It was a<br />

100% monopoly situation as no other company in the country was permitted to compete. Similarly, the<br />

only company entitled to export essential oils was state-owned, Medimpex.<br />

With the emergence of Cold War politics, the industry lost its traditional markets in the West and there<br />

was a consequent decline in essential oil production, reaching a minimum of 1.9 tons in 1954.<br />

However, this was followed by a strong recovery over the next 13 years. From 1954 to 1967:<br />

• production grew twenty-fold to 41.1 tonnes / year, (see Chart 2), and<br />

• the area under cultivation grew eight-fold from 250 ha to 2,000 ha (see Chart 3).<br />

Chart 2: Total Oil Production (tonnes)<br />

in 1941, 1954 and 1967<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

1941 1954 1967<br />

The reason behind this renaissance in the fortunes of the industry also was political: the communist<br />

love for redistribution. KHV made good profits on F&F products as the regional market was protected<br />

from international competition. At the same time, many aroma chemicals needed in F&F formulas<br />

were not available in the Eastern Bloc countries and, therefore, hard currency was needed for imports<br />

from the West. This led to the state subsidies for the production of essential oils destined for export to<br />

Western markets. As a result, many cooperatives all over the country were encouraged to grow<br />

aromatic herbs and to build distilleries.<br />

38

Chart 3: Essential oil crop cultivation area<br />

(ha) in 1954 and 1967<br />

2000<br />

1800<br />

1600<br />

1400<br />

1200<br />

1000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

1954 1967<br />

Map 3: Distilleries in 1967<br />

Újfehértó<br />

Kapuvár<br />

Enying<br />

Páty<br />

Papkeszi<br />

Tihany<br />

Balatonfenyves<br />

Öreglak<br />

Paks<br />

Daránypuszta<br />

Miske<br />

Székkutas<br />

Mohács<br />

There were 14 operating distilleries in 1965:<br />

• 7 operated by KHV (in Budapest, Kapuvár, Papkeszi, Paks, Miske, Mohács, Balatonfenyves),<br />

and<br />

• another 7 operated by cooperatives (at Páty, Újfehértó, Enying, Öreglak, Daránypuszta,<br />

Székkutas, Tihany).<br />

39

All distilleries delivered the oils to KHV in Budapest, where they were blended, filtered, packed and<br />

prepared for export.<br />

The oils produced in the mid-1960 were:<br />

Main products:<br />

• lavender and lavandin (8-10 tonnes)<br />

• peppermint (4-5 tonnes)<br />

• dillweed ((8-10 tonnes)<br />

• Pinus sylvestris (6-8 tonnes)<br />

Minor oils:<br />

• clary sage<br />

• tarragon<br />

• hyssop<br />

• fennel<br />

• coriander<br />

• caraway<br />

It is interesting to note that at this time the yields of almost all essential oil crops were low, usually<br />

half or one third of recent yields. The profitability of the 1960s industry in a market economy context<br />

would have been questionable, even with heavy subsidies - but it was the soviet system.<br />

Chart 4: Production of the main oils in<br />

1967 (tonnes)<br />

10<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

Lavender and<br />

Lavandin<br />

Peppermint Dillweed Pinus<br />

Sylvestris<br />

In 1977 the organizational arrangements changed. One of the cooperatives (Szilasmenti) took over the<br />

business of KHV and all distillation units of several cooperatives were delivered to Kerepes, creating a<br />

huge concentrated capacity there. Additionally, exporting was transferred from Medimpex to<br />

Pharmatrade, another state owned company. This change was smooth, although production figures in<br />

the 1970s were slightly lower than in the 1960s, around 30-35 tons/year, the major crops remained the<br />

same.<br />

40

In the 1980s, total production quantities remained more or less at the same level (~ 30 tons per year)<br />

but the product structure slowly changed:<br />

• peppermint and lavender oil production went down, while<br />

• output of fennel, caraway, angelica, blue and Roman chamomile increased.<br />

Chart 5: Total Oil Production Levels (tonnes)<br />

in 1941, 1954, 1967 and 1980<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

1941 1954 1967 1980<br />

The major export markets during the communist era were heavily European oriented with Germany<br />

and France accounting for 70% of the total.<br />

Chart 6: The Export Markets in the 1970s<br />

France 36%<br />

Germany 34%<br />

UK 8%<br />

USA 7%<br />

Switzerland 5%<br />

Rest 10%<br />

41

The Transition Period (1990-94)<br />

We had our first free election in 1990. Everyone was happy - the Russians had left - and the Hungarian<br />

people felt freedom and unlimited possibilities. However, the situation was not that rosy in the<br />

economy. Our new conservative government tried to find solutions but, unfortunately, their actions<br />

have not always been the best ones for the essential oils industry. The government’s programme<br />

involved:<br />

• The withdrawl of all subsidies.<br />

• A political attack on cooperatives, which were regarded as communist economy hang-overs.<br />

• Re-privatization of land.<br />

The immediate effect of the abolition of subsidies in the essential oil sector was profitability losses<br />

and, within 3 years, bankruptcy at the Szilasmenti cooperative. It was then privatized and acquired by<br />

Silvestris Ltd.<br />

Reprivatization of the land caused a tremendous problem for the whole of Hungarian agriculture:<br />

• All modern cultivation equipment was owned by the cooperatives but these were deprived of<br />

land.<br />

• The new landowners mainly held areas of only 1-2 ha and, moreover, had no intention or<br />

capability to undertake cultivation.<br />

An interesting example of the outcome is provided by the lavender plantation in Kerepes. In 1990, the<br />

plantation was just turning to the high yield stage, but the agrarian reform committee divided the land<br />

exactly crossing the rows of lavender. The Szilasmenti Cooperative tried to rent this land back, as it<br />

represented a huge investment made only a few years earlier, but this proved in vain. Some of the new<br />

smallholders decided to grow corn as feed for their pigs, so they weeded out the lavender. Eventually,<br />

the whole lavender plantation disappeared.<br />

Finally, all of the cooperatives involved in cultivation and distillation of aromatic herbs disintegrated.<br />

Distillation units were sold and, generally, everything was chaotic for 4 years.<br />

Chart 7: Hungary’s Essential Oil Exports 1984-97<br />

(US$ millions),<br />

2.5<br />

2<br />

1.5<br />

1<br />

0.5<br />

0<br />

1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997<br />

42

This is demonstrated by the export figures in Chart 7 for 1984-97. It reveals that 1990 was the peak<br />

year, a rapid fall occurred until 1993 (the year of privatization of Szilasmenti), afterwards there was a<br />

recovery and by 1997 exports re-attained the 1990 level.<br />

Stabilization in a Market Economy<br />

An interesting characteristic of the Hungarian essential oils industry is that always it has been<br />

dominated by one company. In the communist era, it was Kompozícó / KHV / Szilasmenti while,<br />

today, 80% of exports arise from Silvestris & Szilas. This is quite fascinating as modern Hungary<br />

apparently is following the good old soviet system in the market economy: one industry - one<br />

dominant company.<br />

Chart 8: Total Hungarian vs. Silvestris Exports<br />

from 1994-2001(US$ millions)<br />

2.5<br />

2<br />

1.5<br />

1<br />

0.5<br />

0<br />

1994 1995 1996 1997 1998 1999 2000 2001<br />

Silvestris<br />

Hungary<br />

The 20 % non-Silvestris part of Hungary’s exports are mostly comprised of re-export from the former<br />

Soviet Union and are based on the traditional links between the former Eastern Bloc countries. The<br />

largest products in this group are lavender, coriander, clary sage and fir needle oils.<br />

The essential oil production system in Hungary today has an even higher concentration than under the<br />

old regime:<br />

• 95% of the capacity is operated by Silvestris - the largest capacity (122 m 3 ) at Kerepes and<br />

another (18 m 3 ) at Nyiracsad.<br />

• Two other distilleries are run by farmers: at Szekkutas (5 m 3 ) and at Öreglak (2 m 3 ).<br />

43

The Kerepes distillery<br />

Map 4: Distilleries in 2002<br />

Nyíracsád<br />

Kerepes<br />

Öreglak<br />

Székkutas<br />

Charts 9 and 10 show that between 1967 and 2002:<br />

• the number of distillery sites decreased by 70%,<br />

• while capacity decreased only by 20%<br />

44

Chart 9: Number of Distilleries,<br />

1967 vs 2002<br />

20<br />

15<br />

10<br />

5<br />

0<br />

1967 2002<br />

Chart 10: Total Distillery Capacity (m 3 ),<br />

1967 vs. 2002<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

1967 2002<br />

However, the export markets have been changed radically. In 2000, the USA had the largest share<br />

(26%), followed by France (17%) and Germany (11%) – see Chart 11. The comparison figures for<br />

1970 and 2000 in Chart 12, illustrates the decline in the importance of the European market.<br />

45

Chart 11: The Export Markets in 2000<br />

USA 26%<br />

France 17%<br />

Germany 11%<br />

Japan 10%<br />

UK 9%<br />

Rest 27%<br />

Chart 12: Export Market Shares (%)<br />

1970 vs. 2000<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

France Germany USA Japan<br />

1970s 2000<br />

46

Also, there has been a significant change in the crop structure:<br />

Major crops of 1960s Major crops in 2000<br />

• Peppermint • Angelica root • Fennel<br />

• Lavender<br />

• Blue chamomile • Dill<br />

• Pinus sylvestris • Caraway<br />

• Parsley seed<br />

• Lovage<br />

• Origanum<br />

The comparative crop shares have changed every year but it is worth mentioning one important oil that<br />

influenced the country’s figures heavily between 1994-1998; namely, parsley seed. Some of you might<br />

still remember the extreme shortage and skyrocketing prices of this oil that were caused by the huge<br />

demand from US breath freshener manufacturers. This was followed by a huge overproduction that<br />

sent the prices far below production cost. This example leads to the last part of my discourse.<br />

Present and Future Challenges<br />

The essential oil industry faces general and country specific challenges.<br />

The general problems encountered by all essential oil producers are:<br />

Instable supply - Being natural products, a crop failure in a major producing country will result in a<br />

shortage, higher oil prices and, eventually, lower demand. This happened recently with our high<br />

azulene type milfoil oil, where – after 3 consecutive crop year failures in Hungary - the major users<br />

eliminated it from their formulas.<br />

Volatile demand – The parsley seed oil case is a very good example. There was a stable market: and<br />

distillers in France and Hungary used cheap non-germinating seeds for production of relatively cheap<br />

oil, which found some usage in the flavour industry. The annual world production was 1-2 tons a year,<br />

the price was stable around US$100-110 / kg and everyone involved was happy. But, in 1994<br />

American breath freshener companies created a new, immediate and huge market. They requested<br />

more than 10 tons of PSO annually. The result After eating up all existing stocks, prices skyrocketed<br />

to US$300 / kg by 1996. This oil price trend moved on to the raw material and it encouraged hundreds<br />

of farmers all over the world to plant parsley. By 1999 there was a huge supply but by that time the<br />

main user had changed the formula: reducing PSO incorporation by more than 50% as a first step and,<br />

finally, discontinuing manufacture of the brand. What had he left behind him Many essential oil<br />

distillers and dealers had large stocks of oil and hundreds of desperate farmers had huge quantities of<br />

seeds that had been begged for two years earlier but now nobody wanted the material. The result The<br />

oil price went down to US$70-75 / kg, several farmers went bankrupt and cursed parsley forever. This<br />

good old roller coaster probably will start again one day, when some new uses will be created on a<br />

delusionary low price. Perhaps we shall see soon a roller coaster developing with one of the oils from<br />

this region that has recently increased in price: coriander.<br />

Another problem is the unbalanced relationship between large F&F corporations and small raw<br />

material suppliers. Even if you can get through the painfully long process of approvals, you have filled<br />

up tons of documents and finally got a contract at a reasonable price, are you completely happy Not<br />

necessarily, if you think of the 2 years contract time and your forthcoming difficulties. You may have<br />

to get loans to finance your next production season, while you are still carrying the stock of giant<br />

corporations, from last year’s crop.<br />

47

Or, what can you do if one of your major customers is merging with another multinational, and your<br />

product is simply eliminated from the raw material list Shall we be worried again, listening to the<br />

news<br />

Legislation: I shall refrain from going into details, as there are a number of lectures during the<br />

conference dedicated to this subject. However, what can a distiller do if his customer is forced to<br />

eliminate his oil from the formula Unfortunately, several essential oils now should be considered as<br />

endangered species in the EU. Even in Hungary we have a local problem and our association is trying<br />

to fight a clever clerk in the Environmental Ministry who put a phrase into our law on Hazardous<br />

products two years ago. This regulation states that all waste material from aromatic herb processing<br />

must to be considered as hazardous material, unless otherwise proven by some very expensive tests.<br />

Now all exhausted residues of chamomile, dill, caraway, etc., formerly considered as valuable byproducts<br />

(natural fertilizers), are targets for our local agencies. It is a really crazy world.<br />

Other specific Hungarian problems include:<br />

• The strengthening of our currency (the Forint) by more than 15 % this year. This is quite a<br />

challenge considering the fact that more than 95% of the Hungarian essential oil production is<br />

exported. We have to compensate it with increased productivity, cost reductions, etc. which is<br />

not an easy job.<br />

• The lack of experienced farmers with large landholdings and cultivation equipment.<br />

• The cost of manpower is increasing sharply.<br />

Our answer to these challenges are:<br />

We will strive to develop better and better species. Sometimes the result of research is an existing<br />

crop with higher yield (as in case of fennel), or with higher contents of active ingredient (as in the case<br />

of blue chamomile with more that 10% chamazulene). Sometimes, we reintroduce traditional species,<br />

abandoned earlier due to heavy competition. Examples of this group are: lavender, coriander, tarragon,<br />

and peppermint; all were big Hungarian products in the past, are small today but any of them might be<br />

a key product tomorrow. Also, we must examine native flora that has previously never been distilled<br />

on a commercial scale; the most recent example of this work is origanum. Other research in these<br />

areas has given promising results.<br />

Reorganization of the raw material supply: To persuade and then teach farmers to grow an<br />

unknown aromatic herb is a difficult and sometimes hopeless job. They always compare the<br />

profitability with very different types of crops. Unless they see a large potential margin, they stay with<br />

their well-known annual crops, such as wheat and corn. Also, those who are already growing aromatic<br />

herbs tend to quit rather quickly at crop failure. They do not plan for long term. If you want stability<br />

you have to put some control on your raw material supply. For these reasons, Silvestris created a<br />

subsidiary to grow aromatic herb exclusively for its essential oil production in 2000. This proved to be<br />

successful in the first two years.<br />

Reorganization of production system: Eliminating manpower whenever possible, by using<br />

mechanisation in both agricultural and distillation operations. A new distillery is being established<br />

right on the field to reduce transportation costs.<br />

In summary, I think that the general trend in our industry is for shorter product lives, thus the time to<br />

adjust to market challenges all through the supply chain is becoming shorter and shorter. Those closely<br />

48

monitoring market demand trends and are the most flexible will be the winners, while those who are<br />

not will disappear. I think this will happen more often in the future even in our specialist sector.<br />

<strong>Csaba</strong> <strong>Fodor</strong> has been involved with the essential oils industry since 1987. He was born in Budapest<br />

and was educated as a chemical engineer, specialising in distillation technology. In his early career,<br />

Mr <strong>Fodor</strong> developed rectification units for the largest Hungarian essential oils manufacturing<br />

cooperative (Szilasmenti). In 1989, he established Silvestris Ltd., which acquired the essential oil<br />

business of the Szilasmenti cooperative in 1993. His company has been the principal essential oils<br />

manufacturing and exporting company in Hungary since that time.<br />

49