Print Page - tripura state co-operative bank

Print Page - tripura state co-operative bank

Print Page - tripura state co-operative bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

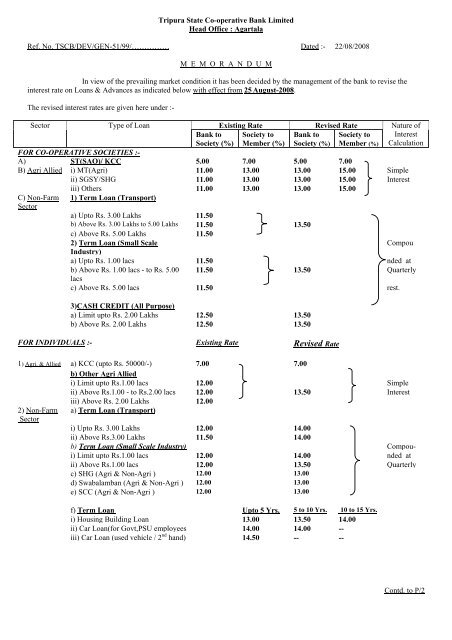

Tripura State Co-<strong>operative</strong> Bank Limited<br />

Head Office : Agartala<br />

Ref. No. TSCB/DEV/GEN-51/99/…………… Dated :- 22/08/2008<br />

M E M O R A N D U M<br />

In view of the prevailing market <strong>co</strong>ndition it has been decided by the management of the <strong>bank</strong> to revise the<br />

interest rate on Loans & Advances as indicated below with effect from 25 August-2008.<br />

The revised interest rates are given here under :-<br />

Sector<br />

Type of Loan<br />

Bank to<br />

Society (%)<br />

Existing Rate<br />

Society to<br />

Member (%)<br />

Bank to<br />

Society (%)<br />

Revised Rate<br />

Society to<br />

Member (%)<br />

Nature of<br />

Interest<br />

Calculation<br />

FOR CO-OPERATIVE SOCIETIES :-<br />

A) ST(SAO)/ KCC 5.00 7.00 5.00 7.00<br />

B) Agri Allied i) MT(Agri) 11.00 13.00 13.00 15.00 Simple<br />

ii) SGSY/SHG 11.00 13.00 13.00 15.00 Interest<br />

iii) Others 11.00 13.00 13.00 15.00<br />

C) Non-Farm<br />

Sector<br />

1) Term Loan (Transport)<br />

a) Upto Rs. 3.00 Lakhs 11.50<br />

b) Above Rs. 3.00 Lakhs to 5.00 Lakhs 11.50 13.50<br />

c) Above Rs. 5.00 Lakhs 11.50<br />

2) Term Loan (Small Scale<br />

Compou<br />

Industry)<br />

a) Upto Rs. 1.00 lacs 11.50 nded at<br />

b) Above Rs. 1.00 lacs - to Rs. 5.00 11.50 13.50 Quarterly<br />

lacs<br />

c) Above Rs. 5.00 lacs 11.50 rest.<br />

3)CASH CREDIT (All Purpose)<br />

a) Limit upto Rs. 2.00 Lakhs 12.50 13.50<br />

b) Above Rs. 2.00 Lakhs 12.50 13.50<br />

FOR INDIVIDUALS :- Existing Rate Revised Rate<br />

1) Agri. & Allied a) KCC (upto Rs. 50000/-) 7.00 7.00<br />

b) Other Agri Allied<br />

i) Limit upto Rs.1.00 lacs 12.00 Simple<br />

ii) Above Rs.1.00 - to Rs.2.00 lacs 12.00 13.50 Interest<br />

iii) Above Rs. 2.00 Lakhs 12.00<br />

2) Non-Farm<br />

Sector<br />

a) Term Loan (Transport)<br />

i) Upto Rs. 3.00 Lakhs 12.00 14.00<br />

ii) Above Rs.3.00 Lakhs 11.50 14.00<br />

b) Term Loan (Small Scale Industry) Compoui)<br />

Limit upto Rs.1.00 lacs 12.00 14.00 nded at<br />

ii) Above Rs.1.00 lacs 12.00 13.50 Quarterly<br />

c) SHG (Agri & Non-Agri ) 12.00 13.00<br />

d) Swabalamban (Agri & Non-Agri ) 12.00 13.00<br />

e) SCC (Agri & Non-Agri ) 12.00 13.00<br />

f) Term Loan Upto 5 Yrs. 5 to 10 Yrs. 10 to 15 Yrs.<br />

i) Housing Building Loan 13.00 13.50 14.00<br />

ii) Car Loan(for Govt,PSU employees 14.00 14.00 --<br />

iii) Car Loan (used vehicle / 2 nd hand) 14.50 -- --<br />

Contd. to P/2

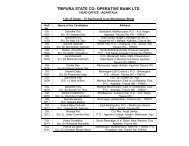

<strong>Page</strong>—2.<br />

Sector Type of Loan Existing Rate<br />

Revised Rate Nature of<br />

Interest<br />

Calculation<br />

d) Term Loan (Small Business)<br />

i) Limit upto Rs.1.00 Lacs 12.50<br />

ii) Above Rs.1.00 - to Rs.3.00 Lacs 12.50 14.00<br />

iii) Above Rs. 3.00 Lakhs 12.50<br />

e) Cash Credit (All purpose)<br />

i) Limit upto Rs.1.00 Lacs 12.50 14.00<br />

ii) Above Rs.1.00 - to Rs.3.00 Lacs 12.00 13.50<br />

iii) Above Rs. 3.00 Lakhs 11.50 13.50 Compounded<br />

g) Instalment Loan 13.00 14.00 Quarterly<br />

h) Festival Advance for Govt.<br />

12.00 14.00 Rest.<br />

Employees<br />

i) Cash Credit against Security of<br />

TDR of TSCB Ltd (Limit Maximum 80% 10.50 12.50<br />

of the face value of TDR)<br />

j) Adv. Against own TDR of TSCB 2 % above TDR rate<br />

k) Advance against Term Deposit<br />

3 % above TDR rate<br />

(TSCB) of third party<br />

I) Advance against Postal NSC, KVP 10.50 13.00<br />

II) Advance against LICI Policy<br />

(against surrender value)<br />

10.50 13.00<br />

N.B :- Agriculture & Agri-allied activity (Both Co<strong>operative</strong> Society &Individual Borrowers) SGSY &<br />

ST/SC Corporation, FFDA & Kishan Credit Card, interest will be calculated as simple interest & all types of other loan including<br />

Cash Credit against security of F/D & TDR, Advance against postal deposit shall be calculated on quarterly rest.<br />

( A. Bhattacharya )<br />

GENERAL MANAGER.<br />

Copy to :-<br />

The Branch Manager/D.O/A.D.O, ___________________ Branch/Division/District for information and necessary action.<br />

Copy forwarded for favour of information to :-<br />

1) The Registrar of Co<strong>operative</strong> Societies, Govt. of Tripura, Agartala.<br />

2) The Officer-In-Charge, NABARD Regional Office, Palace Compound, Agartala.<br />

3) The Executive Director, NAFSCOB, Po. Box No- 114, J.K. Chamber, 5 th Floor, Plot No.-76, Sector-17, Fashi, Navi<br />

Mumbai- 400 703.<br />

( A. Bhattacharya )<br />

GENERAL MANAGER.

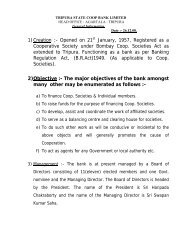

TRIPURA STATE CO-OPERATIVE BANK LIMITED<br />

(INSURED BANK as re<strong>co</strong>gnized by RBI)<br />

HEAD OFFICE : AGARTALA : TRIPURA Dial :- 0381-32-3144/32-5936/32-3929<br />

Ist Floor of Amulya Market, FAX :- 0381-32-3144.<br />

P.O. – Agartala, P.O. Box No.- 27,<br />

E. Mail : trcbl@yahoo.<strong>co</strong>m<br />

Tripura (West), PIN-799001.<br />

trscbl@bsnl.in<br />

Ref. No : TSCB/DEV/GEN-15(ii)R1/08/……… Date :- 18/08/2008<br />

M E M O R A N D U M<br />

In view of upward trend of rates on deposits in the Banking Sector for domestic Term<br />

Deposit, the Management of the Bank has reviewed the rate of interest on Domestic Term Deposit with<br />

effect from 20, August 2008 as indicated below :-<br />

Sl Duration<br />

Revised Rate<br />

No<br />

General Sr. Citizen<br />

1 From 15 Days to 45 Days 5.00 % 5.00 %<br />

2 From 46 Days to 90 Days 6.00 % 6.00 %<br />

3 From 91 Days to 179 Days 8.00 % 8.00 %<br />

4 From 180 Days to less then 1 year 8.50 % 8.50 %<br />

5 From 1 year to less then 2 years 10.00 % 10.50 %<br />

6 From 2 years to less then 3 years 9.75 % 10.25 %<br />

7 From 3 years to less then 5 years 9.75 % 10.25 %<br />

8 5 Years above and upto 10 years 9.50 % 10.00 %<br />

NB :- (1)The rate of interest on 5(five) years monthly in<strong>co</strong>me scheme (MIS) will also be<br />

maintained as above rate.<br />

(2) Payment of additional interest to employees, retired employees and spouses of deceased<br />

employee or retired deceased employees shall be paid 1% above the normal rate.<br />

(3) All the aforesaid revised rate of interest on Domestic Term Deposits will be applicable on<br />

fresh deposits effective from 20 August 2008.<br />

( A. Bhattacharya )<br />

General Manager