Request for Proposal RFP - tripura state co-operative bank

Request for Proposal RFP - tripura state co-operative bank

Request for Proposal RFP - tripura state co-operative bank

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:6.11 DC & DRC Requirements ______________________________________ 986.12 Facilities Management ________________________________________ 986.13 S<strong>co</strong>pe of Services___________________________________________ 100Strictly Confidential Main Document Page 3

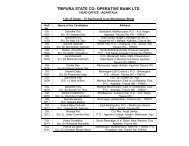

List of Annexure: -Annexure 01 – Details of Existing SoftwareAnnexure 02 – List of CBS branchesAnnexure 03 –Technical S<strong>co</strong>ring ChartAnnexure 04 – Minimum Standards <strong>for</strong> DCAnnexure 05 – Minimum IT infrastructure SpecificationsAnnexure 06 - Bank Guarantee FormatAnnexure 07 - Service LevelsAnnexure 08 - Con<strong>for</strong>mity with Hard<strong>co</strong>py LetterAnnexure 09 - Con<strong>for</strong>mity LetterAnnexure 10 - Letter from Hardware OEMAnnexure 11 – Minimum level 2 Data Centre Specifications<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:List of Appendix:-Appendix 1 -Appendix 2 01 -Appendix 2 02 -Appendix 3 Form A 01 -Appendix 3 Form A 02 -Appendix 3 Form A 03 -Appendix 3 Form A 04 -Appendix 3 Form A 05 -Appendix 3 Form A 06 -Appendix 3 Form A 07 -Appendix 3 Form A 08 -Appendix 3 Form A 09 -Appendix 3 Form A 10 -Appendix 3 Form A 11 -Appendix 3 Form B 01 -Appendix 3 Form B 02 -Appendix 4 -Functional <strong>RFP</strong>Security Components & EMS SpecificationCore Banking TechnicalTechnical Offer IndexTechnical Offer Cover LetterConsortium DetailsBid SecurityTechnical Offer DetailsPersonal ScheduleFacilities Management DetailsManufacturer DetailsManufacturer Authorization FormService Centre DetailsQuery FormatCommercial Bid – DetailsTechnical Bid – Bill of MaterialEligibility CriteriaStrictly Confidential Main Document Page 4

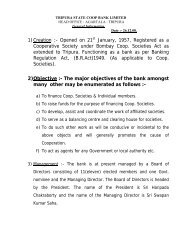

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:1. REQUEST FOR PROPOSAL (<strong>RFP</strong>) FOR CORE BANKING SOLUTIONS (CBS)The Tripura State Co<strong>operative</strong> Bank Limited (TSCB) was established on 21 01-1957 with its headquarters at Agartala. Since its <strong>for</strong>mation it has proved to beflag-bearer among the Co<strong>operative</strong> Credit Institutions in the <strong>co</strong>untry. It ischanneling Co<strong>operative</strong> credit through its member District Co<strong>operative</strong> CentralBanks and Primary Agricultural Co<strong>operative</strong> Credit Societies to the resource-needyand enterprising farmers in the <strong>state</strong>. TSCB is a Government partnered Bank.Tripura State Govt. is the major share holder of this <strong>bank</strong> with more than 56% ofpaid –up share capital. Thanks to the <strong>co</strong>nstant support and patronize of StateGovernment the <strong>bank</strong> occupies a remarkable position in the overall e<strong>co</strong>nomy ofthe State. TSCB has its full time <strong>co</strong>mmitment to rural e<strong>co</strong>nomy. Already the <strong>bank</strong>is having the highest CD Ratio in the State.2. OBJECTIVES OF THE BANK• To promote the e<strong>co</strong>nomic interest of the members of the Bank inac<strong>co</strong>rdance WITH Co<strong>operative</strong> Principles;• To serve as a balancing centre <strong>for</strong> all Co-<strong>operative</strong> Banks and Societies inthe State of Tripura registered under the Tripura Co-<strong>operative</strong> Societies Act,1954, as amended from time to time.• To receive money on deposit in Current, Savings, Fixed or other Ac<strong>co</strong>untsand to raise or borrow from time to time such sums of money as may berequired <strong>for</strong> the purposes of the Bank.• To carry on and undertake any business undertaking, transaction operationwhich may be carried on or undertaken by a Bank registered under the TripuraCo- <strong>operative</strong> Societies’ Act 1954 as amended from time to time.• To grant loans to Co-<strong>operative</strong> Societies registered under the TripuraCo<strong>operative</strong> Societies’ Act 1954.• To receive <strong>for</strong> safe custody securities, ornaments and valuables but be<strong>for</strong>eundertaking this business the Bank will see that proper safety arrangements aremade <strong>for</strong> protection of the articles in custody.• To open branches in any part of the State of Tripura, Agencies andRegional Offices, where necessary, with the previous sanction of the Registrar ofCo<strong>operative</strong> Societies, Tripura.(i) To buy and sell securities of the Government of India or the Governmentof Tripura or other securities specified in clauses (a), (b), (c), (d) and (f) ofSection 20 of the Indian Trust Act <strong>for</strong> investment of both statutory and otherfunds and to purchase and sell bonds and scrips and other <strong>for</strong>ms ofsecurities on behalf of <strong>co</strong>nstituents and depositors.(ii) To buy and sell bonds and scrips and other <strong>for</strong>ms of securities of publicsector/ joint sector units and Mutual Funds <strong>for</strong> investing surplus fund of theBank.(iii) To buy and sell units issued by the Unit Trust of India as specified inclause (ee) of Section 20 of Indian Trust Act.To grant advances to:-1. individual members,Strictly Confidential Main Document Page 5

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:2. private, proprietary or partnership firms,3. institutions registered under the Indian Companies’ Act or theSocieties’ Registration Act.4. Co-<strong>operative</strong> Societies registered in Tripura which are members of this Bank,upon deposit of Government Securities and other securities specified in clauses(a), (b), (c) and (d) of Section 20 of the Indian Trusts Act 11 of 1882 or uponthe pledge of agricultural produce or gold and silver in ornaments or in barsbelonging to them or on hypothecation of any other marketable goods or ofcrops, provided always that in making such loans, advances <strong>co</strong>ntemplated bythese Bye-laws, orders and instructions with regard to the making of such loanswhich may from time to time be issued by the Government of Tripura or theRegistrar of Co-<strong>operative</strong> Societies shall be <strong>co</strong>mplied with; and on securities ofland and buildings approved by the Board of Directors.5. To draw, accept, endorse, buy, sell and negotiate inland bills of exchange andother negotiable instruments with or without security or to issue demand draftsand to undertake inland exchange business by <strong>co</strong>llecting bills of exchange orhundies.6. To act as Agents <strong>for</strong> any Bank or <strong>for</strong> any Government or public bodies in theUnion of India with the Registrar’s sanction.7. To purchase and take on lease or otherwise acquire lands, buildings andgodowns <strong>for</strong> the purpose of the business of the Bank or <strong>for</strong> satisfaction ofdues to the Bank and to utilize by letting them out or otherwise or dispose ofsuch property by sale.8. To establish and support or aid in the establishment and support of fundcalculated to benefit employees of the <strong>bank</strong> or the dependents of suchpersons.9. To undertake liquidation work of affiliated societies indebted to the <strong>bank</strong> on<strong>co</strong>nditions laid down by the Registrar of Co-<strong>operative</strong> Societies with a view tofacilitating re<strong>co</strong>veries from the affiliated societies.10. To undertake Managing Agency of Co-<strong>operative</strong> Societies or of the e<strong>state</strong>s ofdebtors and appoint employees and sub agents <strong>for</strong> such purposes to facilitatere<strong>co</strong>veries.11. To lend money to members or non-members upon the security of fixeddeposits.12. To maintain general supervision over and to inspect Central Banks orregistered societies affiliated to or financed by the Bank and to take up themanagement of such of them as may so desire.13. To stand guarantee <strong>for</strong> any Society registered under the Co-<strong>operative</strong>Societies’ Act or <strong>for</strong> any individual member or firms and <strong>co</strong>mpanies in respectof their obligations with the Government or with any other Bank or <strong>co</strong>ncern orSociety.14. To subscribe to the share capital or to purchase debentures of theCo<strong>operative</strong> Institutions, the Industrial Finance Corporation of India, the TripuraFinancial Corporation, the Central and Tripura State WarehousingStrictly Confidential Main Document Page 6

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:Corporations and the Industrial Refinance Corporation and AgriculturalRefinance Corporation and such other institutions if and when necessary15. Generally to undertake such activities as may be incidental or <strong>co</strong>nducive tothe attainments of the above objects.3. Project Overview3.1 As a part of further modernization of its Banking services ,the Bank isplanning to implement Core Banking Solution in all 47 branches & 9 ExtensionCounters including 1 HO totalling to 57 locations. The Bank, <strong>for</strong> this purpose,invites <strong>Proposal</strong>s from Prime Vendors <strong>for</strong> primarily undertaking inter-alia thefollowing activities <strong>for</strong> the Bank in respect of Banking Solutions:-Implement a Core Banking Solution including Retail, Corporate and otherApplications namely• Core Banking Solution including KCC, Micro-Finance• Share Management solution• Loan processing, <strong>co</strong>rporate GL, fixed asset management and salary processing• Advances, Deposits, Locker, General Ledger,• Collection/Payment Services• AML, ALM & Transfer Pricing customized solution under CBS• Comprehensive Financial Inclusion module including standard external interface• Closing related :-a. P & L initializationb. Balance Sheet3.2 Maintain Data Centre as is suggested by the Bank in the hosted location basedout of Kolkata. The hosted DC should be level 3 <strong>co</strong>mplaint.3.3 Design and build <strong>co</strong>mplete network <strong>co</strong>nnecting the 57 locations <strong>co</strong>nsisting ofbranches and Head Offices across the eight districts of Tripura with the datacentre, data re<strong>co</strong>very centre, help desk, Technical help desk, NOC and ProjectManagement Office (PMO). Bank has all it’s branches across the State ofTripura - India. The network should also be capable of integrating with thirdparty networks like ATM, financial inclusion service provider and others,thereby ensuring security and <strong>co</strong>nfidentiality of data.3.4 Provide Facilities Management Services to the Bank <strong>for</strong> the identified locationsincluding <strong>co</strong>mplete roll out of 57 branches including one HO4. EligibilityThe Bank will follow a 3-stage evaluation and selection process. These stagesare :-4.1 Eligibility Bid Evaluation4.2 Technical Bid Evaluation4.3 Commercial Bid EvaluationStrictly Confidential Main Document Page 7

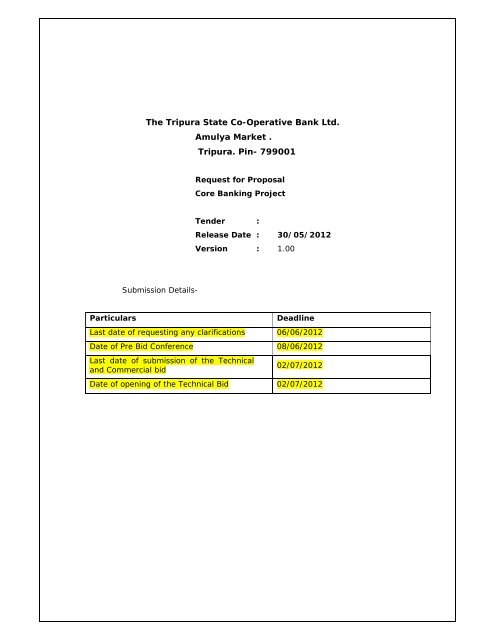

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:5. <strong>RFP</strong> AVAILABILITY:-5.1 The <strong>RFP</strong> document can be obtained from:The Managing DirectorThe Tripura State Co-Operative Bank Ltd.Amulya Market Agartala.Tripura .Pin-799001On any working day from during office hours to. The <strong>RFP</strong> can be obtained at a<strong>co</strong>st of Rs. 10,000/- ( Ten Thousand ). The payment has to be made by ademand draft from a scheduled public sector <strong>bank</strong> and should be favouringTripura State Co-<strong>operative</strong> Bank Ltd. payable at Agartala. The original <strong>RFP</strong> (anyany further addendums) needs to be signed and stamped by the SystemIntegrator / Prime Bidder and has to be submitted along with the Eligibilityproposal.ORtsc<strong>bank</strong>.nic.inThe bidders who will participate thereby downloading the <strong>RFP</strong> document from theinternet, such bidders are expected to furnish the bid amount of Rs. 10,000/= ina sealed envelope mentioned as ‘bid value’ to the Bank. This envelope needs tobe included in the tender submission document.5.2 The bid security should be provided by the Vendors <strong>for</strong> INR 20,00,000/- (INRtwenty lakhs only) in <strong>for</strong>m of a Financial Bank Guarantee or a Demand Draft or aPay Order. The draft/pay order should be drawn in favour of “Tripura State Co<strong>operative</strong>Bank Ltd.”, payable at Agartala. The Financial Bank Guaranteeshould be valid upto 18/07/2013 renewable thereafter, if needed and issued by apublic Sector Bank Or any other scheduled Bank with prior permission of theBank. The guarantee should have a claim period of further 3 months after expiryof its validity,5.3 The schedule <strong>for</strong> the tendering process is:ParticularsDeadlineDate of Issue of <strong>RFP</strong> 30/05/2012Last date of requesting anyclarifications06/06/2012Date of Pre Bid Conference 08/06/2012Last date <strong>for</strong> issuance of <strong>RFP</strong> 02/07/2012Last date of submission of theEligibility, Technical andCommercial bid02/07/2012Strictly Confidential Main Document Page 8

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:Address<strong>co</strong>mmunication<strong>for</strong>THE MANAGING DIRECTORTripura State Co-Operative Bank Ltd.Amulya Market Agartala. Tripura .Pin-799001Tel–0381-232-3929/2339Fax No. 0381-232-3144Email – <strong>tripura</strong>scbltd@gmail.<strong>co</strong>m or<strong>tripura</strong><strong>state</strong><strong>co</strong>opertive<strong>bank</strong>@rediffmail.<strong>co</strong>m6. There will be a meeting with all the Vendors, who have obtained this tender at thetime specified above to address any queries in <strong>co</strong>nnection with the tenderdocument. It is essential that all clarifications/queries be submitted to the<strong>co</strong>mmunication address as specified above, be<strong>for</strong>e the date of meeting.7. The Bank reserves the right to accept or reject in part or full any or all the offerswithout assigning any reasons whatsoever.8. The <strong>RFP</strong>, response to the <strong>RFP</strong> and its subsequent evaluation is not a <strong>co</strong>ntract. Theprovisions of the <strong>co</strong>ntract shall be<strong>co</strong>me binding to both the parties when Bank willenter into an exclusive <strong>co</strong>ntract separately with the final selected bidder.9. Technical Specifications, Terms and Conditions and various <strong>for</strong>mats and pro<strong>for</strong>ma<strong>for</strong> submitting the tender offer are described in the tender document, Appendicesand its Annexure.9. Eligibility CriteriaThe eligibility criteria <strong>for</strong> the <strong>co</strong>nsortium would be as followsPrime Vendor Strength• The prime vendor should have a minimum gross turnover of INR 100 crores per annum <strong>for</strong>the last three financial years as per the prime vendor’s audited balance sheet <strong>for</strong> the lastthree financial years.• The prime vendor should be in business <strong>for</strong> the last 5 years• The prime vendor should have at least any one of the following accreditations i.e. SEI CMMLevel 5, SAS 70, ISO 9001:2000,.• The Prime vendor should have project managed at least one <strong>co</strong>re <strong>bank</strong>ing solutionimplementation in India during last 5 years.• A <strong>co</strong>mpany or <strong>co</strong>nsortium - having due authorization of manufacturer(s) and beingotherwise qualified will be eligible to bid. Specifically, the Lead bidder should belegally and technically capable of customizing the <strong>co</strong>re <strong>bank</strong>ing software as per<strong>bank</strong>’s needs.Core Banking Capability• The suggested Core <strong>bank</strong>ing Solution with key modules like Retail & Corporate should belive in at least ONE State / District Co-<strong>operative</strong> <strong>bank</strong> or One Public sector <strong>bank</strong> inIndia.• The suggested Core Banking Solution with key modules like Retail & Corporate,should have been successfully implemented and currently live in at least 45 branchesof a single Bank (One Centralized Server system <strong>for</strong> all the branches) in India.Strictly Confidential Main Document Page 9

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:• The Prime vendor or the Application vendor must have implemented thesuggested <strong>co</strong>re <strong>bank</strong>ing system in at least one <strong>bank</strong> in <strong>co</strong>mprising of 45branches in India.Network, Data Centre and Facilities Management CapabilityThe Prime Vendor should have experience as a Prime Vendor in at-least three ofthe following areas :• Network implementation and Core <strong>bank</strong>ing hardware implementation <strong>for</strong> aminimum of 45 locations of one Bank in India.• Managed any one Bank’s hardware and network infrastructure <strong>for</strong> <strong>co</strong>reBanking including the overall network management in a Data Centre Managingthe environmental aspect of a data centre operations like BMS, Security,power, <strong>co</strong>oling, alarm system in a DC in India.• Facility Management <strong>for</strong> the maintenance of Centralised Banking Application,branch hardware in at least 45 branches of a <strong>bank</strong> in IndiaThe prime vendor is expected to provide documentary proof <strong>for</strong> each of the abovecriteria by way of client letters, third party certificates, client <strong>co</strong>ntracts and<strong>co</strong>rporate registration documents as applicable to indisputably and factually provetheir eligibility <strong>for</strong> this bid.12. A broad overview of the overall model is provided below:Sl.NoComponent Purchase Model of the Bank(Operational expenditure or Capitalexpenditure)1 DC Space and environment Operational Expenditure3 DC servers Capital expenditure4 DR servers Capital expenditure5 DC routers and switches Capital expenditure6 DR routers and switches Capital expenditure7 DC security Capital expenditure8 DR security Capital expenditure9 EMS and NMS Operational expenditure11 Technology help desk * This will be out of Bank premises.Capital expenditure12 Application help desk * This will be out of Bank premise13 NMS & Network OperationCentre14 Branch Network<strong>co</strong>mponentsCapital ExpenditureThis will be out of Bank premises.Operational expenditureOperational expenditureStrictly Confidential Main Document Page 10

15 Branch peripherals Capital expenditure16 Software licenses Capital expenditure<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:17 Bandwidth rates For VSAT and MPLS bandwidth modes of<strong>co</strong>nnectivity, vendor to propose and s<strong>co</strong>peac<strong>co</strong>rdingly, MPLS bandwidth to be availedfrom BSNL.Operational expenditureNoteThe Operational expenditure model refers to Operating Expenditure, wherein theexpense will be leased, over a definitive time period and staggered. The Capitalexpenditure model refers to ‘Capital Expenditure’, wherein the expense will be onan immediate basis, the item will be purchased and then post sales service will beavailed.For all operational expenditure items the <strong>bank</strong> will sign any leasing agreements ifrequired only with the prime bidder and the prime bidder needs to factor legal andoperational implications and <strong>co</strong>sts pertaining to this in this bid itself.10. Tripura State Co<strong>operative</strong> Banks VisionThe Bank has outlined ambitious visions <strong>for</strong> their strategic objectives. This vision isto be<strong>co</strong>me <strong>co</strong>mpetitive <strong>bank</strong>ing organizations while improving their prime positionin niche areas through qualitative and quantitative growth with generation ofsurplus in an environment of growing professional and technological <strong>co</strong>mpetence.The major per<strong>for</strong>mance and quantitative parameters are:TABLE # 1Business Growth of the BankFinancial YearTurnover in lacs INR2009 – 10 94043.882010 – 11 115668.462011 – 12 151203.38TotalThe total Customer base of the <strong>bank</strong> is 5.25 Lakhs.TABLE # 2Future Business Plans of the TSCB ( Rs. In lacs )Business/Year 2009-10 2010-11 2011-12Deposits 75978.24 90440.64 115563.38Advances 18065.64 25227.82 35640.00Total 94043.88 115668.46 151203.38Strictly Confidential Main Document Page 11

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:Organization structure of the BankThe Tripura State Co-<strong>operative</strong> Bank has a three tier operationalorganisation structure as shown below:HEAD OFFICEDISTRICT OFFICEBRANCH1.5.2 Category of BranchesTable # 3BusinessBranchesCategory of BranchesGrade A Grade B Grade C Grade D Grade EDeposits 3 NIL 16 22 6Advances1.5.3 Level of ComputerizationTable # 4Number of TBA/PBA Branches (Data as provided by the Bank’s team –Please verify)Type of BranchTotal Branch Automation 45PartialBranchAutomation 2PartialExtensionCounters & HO 9Manual Extension <strong>co</strong>unter 1Total 57TSCBStrictly Confidential Main Document Page 12

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:1.5.4 Distribution of branches & tentative Transactions per day.Table # 5Sl. No.BranchWest District1 Agartala 13102 Battala 6703 Battala Evening 1604 M.G. Bazar 3305 Secretariat 3506 Durgachowmohani 2207 Lakechowmohani 1308 G.B. Bazar 1409 Khayerpur 32010 Champaknagar 35011 Teliamura 31012 Khowai 136013 Mohanpur 32014 Takarjala 7015 Jampaijala 13016 M.B. Tila 25017 Bikramnagar 14018 Bishalgarh 40019 Charilam 31020 Melaghar 42021 Sonamura 30022 Kathalia 4023 Gorkhabasti Extn.24 Capital Complex25 Khumulwing 13026 Tulashikhar Ext. 32027 Padmabil Ext. 380Dhalai District1 Kamalpur 2502 Ambassa 5203 Chailengta 4004 Chowmanu Branch 6505 Jawaharnagar Extn. 1126 Gandachara 200Avg. No. Txn. PerdayStrictly Confidential Main Document Page 13

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:South Tripura1 Udaipur 840Udaipur‐DM Office2 Amarpur 6503 Karbook 2804 Killa 1405 Salgarah 806 Belonia 5507 Santirbazar 1908 Hrishyamukh 2409 Baikhora 28010 Manubazar 29011 Sabroom 15012 Nutanbazar 12013 Mirza Ext. Counter 10014 Kalachara 4015 Nalua 20North Tripura1 Dharmanagar 2602 Kailashahar 8703 Gournagar4 Panisagar 5505 Machmara 5906 Pechartal Ext. 1607 Kumarghat 600Head OfficeTotal 57 179921.5.5. Products offeredTable # 6 (Indicative)TSCB Deposit and Advance productsDepositsSavings Bank Deposit ( Ind./Society/Govt.Salary/No-Frill/Autonomous & Undertakingsetc )Current Bank Deposit (Ind./Society/Govt./SwabalambanSociety(TSSPS)/Autonomous& Undertakings etc )Micro Savings DepositRecurring DepositFixed Deposit ( Individual/Society/Govt/Autonomous &Undertakings )AdvancesST Loan (Ind/Soc)KCC (Ind/Soc)MT Loan (Agri/Non Agri Credit)LT Loan ( Rubber Project)Cash CreditStrictly Confidential Main Document Page 14

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:Re Investment PlanRe Investment PlanCash CertificateMonthly In<strong>co</strong>me linkedFixed DepositSecurity Deposit (Fixed/MSS Security/Locker)Bankers Cheque Ac<strong>co</strong>untVariable GPF A/cOther Deposit A/c ( GiftCheque/Cash Credit Cr.Balance/Deposit at Call/KeyDeposit/StaffBalance of Coop. SaralRin/Special Deposit)Over DraftTerm Loan (Transport/Small Business/BrickKiln/Housing/Industries/Car/Education & Others)IRDPBlock LoanInstalment LoanST/SC CorporationFFDAPMEGP/SGSY/KVIC/Swabalamban/TSSPS(SHG)Security/Cr. Bill Dis<strong>co</strong>untStaff LoanMicro CreditFestival Loan to Govt. EmployeesMini Diary (Agri-allied) & other Agri AlliedCo<strong>operative</strong> Bank Saral Rin&Volume of Transactions1.7.1 Volumes by PhasesThe details of number of business transactions per day by phase and year arementioned below in Table # 8 and the number of ac<strong>co</strong>unts by each phase ismentioned in Table # 9. The figures given below are absolute figures by each yearand not increase over the previous year figures. This does not include batch jobslike interest accruals etc. The transactions include number of debits and credits,enquiry transactions expected over the next 5 years. This data needs to be used bythe Vendor to size the entire solution.Estimated Average percentage of transactions through:• Branch: 100%• Enquiry Transactions, any future delivery channels and a buffer of 30% of total.Currently, the Bank have envisaged the number of transactions as mentionedbelow, based on current requirements. The Bank, in the future may requireadditional volume of transaction to be managed by the solution and the samesolution should be scalable without any obsolescence risk. The Bank and the Vendorshall negotiate the additional requirement at such time.The vendor has to size the hardware to support the total cumulative transactions ofthe Bank, <strong>for</strong> the tenure of the <strong>co</strong>ntract.Strictly Confidential Main Document Page 15

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:TSCB’s year wise number of transactions scalability across Five Years.(daily)growthrate assumed?Table # 7Year 1 Year Year Year YearPhase2345Pilot 3170 3646 4193 4822 5546Phase 1 7411 8523 9802 11272 12962Phase 2 7419 8523 9802 11272 12962Total 18000 20692 23797 27366 314701.7.2Number of Ac<strong>co</strong>unts by phase:Table # 8Tripura State Co-<strong>operative</strong> Bank phase-wise and year-wise number ofac<strong>co</strong>unts scalability ( 15 % YoY Growth)Phase Year 1 Year 2 Year 3 Year 4 Year 5Pilot 77070 88630 101925 117213 134796PhaseIPhase2Phase397096 111660 128410 147670 169821123566 142101 163416 187928 216118152268 175108 201354 231580 266317Total 450000 517500 595125 684393 787052In<strong>for</strong>mation Technology Initiatives1.8.1 Existing IT infrastructure & level of <strong>co</strong>mputerization The Bank hasinitiated branch automation in all most all of their branches (as on30-April-2012) :-Viz Total Branch Automation and Partial Branch AutomationTable # 10Total Branch Automation -TBABankTSCBNo. of Branches & HO 57No. Of TBA Branches 45No. Of PBA Branches 2Ext. Counter & Ho 9Manual Ext. Counter 1Application Name Win<strong>bank</strong>er 3.0VendorVirmatiPlat<strong>for</strong>mSQL 2000,Visual basic, D-base PlusStrictly Confidential Main Document Page 16

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:Project DetailsProject OverviewTo achieve the Banks business objectives and long term goals including attaininghigher levels of operational efficiency, growth in business and improvingprofitability, the Bank intends to implement new technology solutions that wouldsupport all the current and future needs of the Bank and their customers.Project ObjectiveThe Bank wish to implement a Core Banking Solution suite <strong>for</strong> their 57 branchesincluding 1 Head Office. The Bank may also implement CBS in any new branchesopened during the next few years. Considering these facts the proposed CBS shouldbe scalable to handle 100 branches.Project S<strong>co</strong>peA brief description of the envisaged s<strong>co</strong>pe is enumerated as under. The detailedrequirements on each of the area mentioned below are available in Section 6 of thisdocument. However, the Bank reserves its right to change the s<strong>co</strong>pe of the <strong>RFP</strong><strong>co</strong>nsidering the size and variety of the requirements and the changing business<strong>co</strong>nditions.Based on the <strong>co</strong>ntents of the <strong>RFP</strong>, the System Integrator (SI) shall be required toindependently arrive at a solution, which is suitable <strong>for</strong> the Bank, after taking into<strong>co</strong>nsideration the ef<strong>for</strong>t estimated <strong>for</strong> implementation of the same and the resourceand the equipment requirements. The Bank expressly stipulates the SystemIntegrator’s (SI) selection under this <strong>RFP</strong> is on the express understanding that this<strong>RFP</strong> <strong>co</strong>ntains only the principal provisions <strong>for</strong> the entire assignment and thatdelivery of the deliverables and the services in <strong>co</strong>nnection therewith are only a partof the assignment. The SI shall be required to undertake to per<strong>for</strong>m all such tasks,render requisite services and make available such resources as may be required <strong>for</strong>the successful <strong>co</strong>mpletion of the entire assignment at no additional <strong>co</strong>st to theBank.Considering the enormity of the assignment and the envisaged relationship with theSI, any service, which <strong>for</strong>ms a part of facilities management that is not explicitlymentioned in this <strong>RFP</strong> as excluded would <strong>for</strong>m part of this <strong>RFP</strong>, and the SI isexpected o provide the same at no additional <strong>co</strong>sts to the Bank.2.3.1 Deployment of a CBS (“CBS”)2.3.1.1 Implement a centralized CBS at the identified locations listed in Annexure 02with the functionalities as listed in Appendix 1. However, <strong>co</strong>nsidering thechanges in requirements of business, the functional requirements of theCBS branches selected <strong>for</strong> Pilot and future roll out may undergo a change.The Core Banking suite of solutions would include Retail, Corporate, TradeFinance and other Applications namely• Core Banking Solution including KCC, Micro Finance• Collection/Payment Services• Corporate General Ledger• Credit appraisal facility / Retail loan origination facility <strong>for</strong> RuralStrictly Confidential Main Document Page 17

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:Agricultural and SME financing Asset Liability Management, AMLreports• Transfer pricing solution Government business Locker system IBR & DDRfacility• Shares2.3.1.2 The Centralised CBS would need to technologically enable all Bankingfunctionalities / products like Deposits, Advances, Retail / Corporate Loans,Credit Monitoring / NPA management, Clearing functions at service branchesand other branches, Term Lending, Customer In<strong>for</strong>mation System, GeneralLedger, MIS and reports, etc. as mentioned in Appendix 1. The Core <strong>bank</strong>ingsystem should support a 24x7 processing environment.2.3.1.3 The Bank expects the SI to take up the responsibility of implementing theproposed solution at all 57 locations including the Pilot branchesimplementation.2.3.1.4 Interface the Centralised CBS to proposed third party applications under thistender. The solution must be interface able to delivery channels (like ATMNetwork, Internet Banking, mobile Banking, SMS Banking and other deliverychannel).2.3.1.5 Implement an Application Help Desk and Technology Help Desk (<strong>for</strong> min. of 6Agents) <strong>for</strong> the Bank in Agartala, Head Office. The Bank has identified anadditional space of 500 sq. Ft <strong>for</strong> the Application and Technology help desk.The Application Help desk and the Technology Help Desk would be build andmaintained by the selected vendor with cubicle <strong>for</strong> workstation spaceincluding all relevant infrastructure required <strong>for</strong> the proper functioning of theHelp Desk. The vendor to factor <strong>for</strong> all furniture’s, fixtures & fittings (includingair-<strong>co</strong>nditioning etc) <strong>for</strong> the same. The detailed lay-out plan will be finalisedbetween Bank and the selected vendor. This help-desk will support thebranches <strong>for</strong> application related and hardware related issues, including issuesrelated to Network and <strong>co</strong>nnectivity. The vendor shall also provide managedservices from his own Technology Help Desk, vis a vis EMS, NOC, ServerManagement etc.The selected Vendor must also factor the price and deliver, <strong>co</strong>nfigure, setupand manage the items as is needed <strong>for</strong> the Project Management Officeincluded in the above 500 sq ft <strong>for</strong> a minimum of 20 persons of the Bank’steam. This should include Desktops, printers, UPS, the structured LAN cabling<strong>for</strong> the PMO office. Connectivity of the PMO and helpdesks to the DC and DRwill be through HO <strong>co</strong>nnectivity.2.3.1.6 Enable the introduction of new products by building interfaces where requiredwith third party applications. For detailed requirements on the new productsrefer to Section 6.2.3.1.7 The <strong>co</strong>re <strong>bank</strong>ing and other 3rd party applications will have to be <strong>co</strong>nfigured bythe selected vendor.2.3.2 Data Migration2.3.2.1 Entire data pertaining to live ac<strong>co</strong>unts (<strong>for</strong> all branches as of the cut-offdate) <strong>for</strong> all ac<strong>co</strong>unts like savings, current, term deposits, recurringdeposits, loans and advances, etc.and general ledger balances should bemigrated to the proposed solution <strong>for</strong> all the branches being <strong>co</strong>nverted toStrictly Confidential Main Document Page 18

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:CBS as of the implementation date.2.3.2.2 Migrate all outstanding entries as of the implementation date from thelegacy system and manual branches to the new CBS Application <strong>for</strong> theidentified general ledger and profit and loss heads <strong>for</strong> future re<strong>co</strong>nciliation<strong>for</strong> the TBA and PBA branches as of the identified date.2.3.2.3 For branches which are partially <strong>co</strong>mputerised, the Bank is <strong>co</strong>nverting themanual data into electronic <strong>for</strong>mat, SI will have to not only update thelegacy system master data but also the electronically <strong>co</strong>nvert master datainto CBS apart from taking data as of the cut-off date.2.3.2.4 The vendor is expected to <strong>co</strong>nduct the above data migration activities <strong>for</strong> alllegacy software of the <strong>bank</strong> over and above what may be mentioned in the<strong>RFP</strong>2.3.3 The SI needs to provide a test environment <strong>for</strong> 25 <strong>co</strong>ncurrent users. The SIneeds to provide separate test environments <strong>for</strong> CBS and otherapplications being a part of the solution to be provided by the SI.2.3.4 The SI needs to develop and provide automated Audit Tools <strong>for</strong> the Banksinternal and <strong>co</strong>ncurrent auditors <strong>for</strong> auditing all the <strong>co</strong>mponents of thesolution provided.2.3.5 Provide training to the Banks management, end users in 57 locations,auditors and in<strong>for</strong>mation technology users on all the above products(including the migration tool). The SI also needs to provide training toBank personnel on training end users on the Applications <strong>for</strong> the purpose ofrollout of the Application.2.3.6 Implement the required software as needed at the desktops to run theproposed <strong>co</strong>re Banking solution and its interfaces. The SI will ensure thatthe Banks functions <strong>co</strong>ntinue to operate through upgrades and newreleases of software. The SI will further ensure minimum interruptionduring upgrades to the software.2.3.7 The SI is expected to customise all gaps observed in the Functional <strong>RFP</strong>,Product Demonstrations, Core Team and End User Training, UAT andimplementation phase during the Pilot <strong>for</strong> all the above solutions. The <strong>co</strong>stof customisation should be included in the price bid. The SI also needs toprovide all statutory reports as required by the regulatory institutions. TheBanks will not pay any additional customisation <strong>co</strong>sts either <strong>for</strong> gapsobserved <strong>for</strong> the above and/or statutory reports as required by the Bank.2.3.9 Network and Security DeploymentBank intends to implement a VSAT and leased line based Wide AreaNetwork (WAN). The Vendor shall be responsible to design, size, install<strong>co</strong>mmission and maintain the WAN based on the business volumes. Thedeployment of the network links should be in line with the branch/officerollout plan. The Branches will directly be on leased line/RF as the primary<strong>co</strong>nnection based on the location feasibility report shared by BSNL andVSAT as the se<strong>co</strong>ndary <strong>co</strong>nnection and wherever Leased line is not feasible,VSAT would be treated as the only link.The activities are -Strictly Confidential Main Document Page 19

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:2.3.9.1 Deploy the WAN network <strong>for</strong> the Bank.2.3.9.1.2 Bank wishes to have MPLS links from BSNL. The vendor is expected todetermine the feasibility of locations <strong>for</strong> MPLS <strong>co</strong>nnectivity based upon areport by BSNL. The branch list as per Annexure 02 needs to be shared withBSNL, Agartala. The vendor is expected to submit this signed BSNLfeasibility report as part of the Technical bid and base the network planningon the same.Also, the vendors need to take bandwidth rates from BSNL andquote, and provide an official <strong>co</strong>nfirmation of such rates from BSNL as partof the Commercial Bid. This BSNL letter should also <strong>co</strong>nfirm that the level ofsupport should be gold support <strong>for</strong> all links from BSNL. All vendors areexpected to quote <strong>for</strong> MPLS <strong>co</strong>nnectivity only as per the BSNL report. Theback up in all the MPLS branches is expected to be VSAT.2.3.9.2 Deploy point to point Leased Line between DC (Kolkata) and DRC(Agartala).The primary link should be from service provider 1 and se<strong>co</strong>ndary link fromthe service provider 2 <strong>for</strong> each of the locations.2.3.9.3 Deploy two links between DC and Service Provider’s MPLS VPN Network,Primary link from one service provider 1 and se<strong>co</strong>ndary link from serviceprovider 2.2.3.9.4 Deploy two links as last mile between MPLS clud and DC, DRC from 2separate service providers. The link should of equal capacity across DC andDRC.2.3.9.5 Deploy MPLS VPN network <strong>for</strong> all the branches & Head Office of the Bankincluding the extension <strong>co</strong>unters to <strong>co</strong>nnect to DC and DRC through MPLSNetwork.2.3.9.6 The <strong>co</strong>nnectivity between the technical and application Help Desk and the datacentre would be through the replication link between the DC and DRC withredundency in the <strong>co</strong>nnectivity and at the switch and port level.2.3.9.7 Deploy MPLS VPN network <strong>for</strong> all the branches to <strong>co</strong>nnect to DC and DRC.Based on the Leased Line feasibility as per BSNL’s report, the Branchesshould be <strong>co</strong>nnected to the MPLS VPN network using fiber or <strong>co</strong>per as thelast mile-2.3.9.8.1 MPLS backed by VSAT <strong>for</strong> the remaining branch locations.2.3.9.9.3 Finally if MPLS is not feasible, VSAT should be used <strong>for</strong> the primary<strong>co</strong>nnectivity; and at later stage if the LL is made feasibile, LL should be usedas a primary mode of <strong>co</strong>nnectvity backed up by VSAT Network.2.3.9.9.4 Those locations which are having VSAT as a primary mode of <strong>co</strong>nnectvity,there should be a <strong>co</strong>mmon bandwidth pool. The service providers VSAT hublocation should be <strong>co</strong>nnected to DC (primary) using one Leased line Link onefrom the service provider.2.3.9.9.5 There should be end to end IP Sec Encryption. The IP Sec should be<strong>co</strong>nfigured on Branch, , DC and DRC Routers. The data should traverseover the WAN Network through IP Sec Tunnel. IPSec should be <strong>co</strong>niguredand operational across all branches irrecpective of LL or VSAT.2.3.9.10 Vendor to size bandwidth of entire WAN network, that includesStrictly Confidential Main Document Page 20

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:• Link between DC and DRC• Link between MPLS cloud to DC and DRC,• Link between Branches and MPLS VPN cloud.• Link between Zonal Offices to MPLS VPN Network• Link between VSAT Hub location to DC and DRC from two seperate SP’s• The shared pool bandwidth (<strong>for</strong> VSAT shared locations).2.3.9.11 Bank Wide Corporate Network (“BWCN”)2.3.9.11.1 SI is expected to size, supply, implement & maintain the Wide Area Network(WAN) and security devices <strong>for</strong> the Bank DC and DRC, head offices andBranches. The Bank intends to network all the branches along with DC,DRC, HO and other offices in a phased manner.2.3.9.11.2 The Bank expect the Vendor to liaise with MPLS VPN and VSAT serviceprovider’s authorities <strong>for</strong> the necessary license providing wide area networkacross India. The Vendor is also expected to design and implement the IPaddressing scheme <strong>for</strong> the Bank and liaise with the service providers toobtain the necessary equipment, links and all necessary permissions.2.3.9.11.3 The BWCN should have the capability of handling Data, Video and Voice.2.3.9.11.4 The BWCN should ensure high availability and reliability, should be scalableand flexible to ac<strong>co</strong>mmodate any business and operational changes infuture.2.3.9.11.5 IT Infrastructure including Servers, Storage, WAN infrastructure includingNetwork and Security devices, should be monitored from the managedNetwork Operating Centre of the service provider. Vendor should monitorthe Servers, Storage, Network and Security devices at DC, DRC andBranches, Head office including devices hosted at Data Centre and DisasterRe<strong>co</strong>very Centre from Service Providers NOC. The vendor should submitavailability and per<strong>for</strong>mance report on 5 th of every month and the sameneeds to be reviewed by <strong>bank</strong> and Vendor within next two working days.2.3.9.11.6 Provide training to the Bank in<strong>for</strong>mation technology users onimplementation and management of the BWCN.2.3.9.11.7 All the network equipment, <strong>co</strong>mponents and hardware proposed as part ofthis tender should be rack mounted.2.3.9.11.8 The Vendor is expected to size and provide racks and structured cabling <strong>for</strong>routers and other equipments which they would be supplying as a part oftender at Data Hosting Centre and DRC.2.3.9.11.9 SI to ensure the data hosting setup requirements are mentioned along withthe details of <strong>co</strong>mponents and activities involved at DC and DRC.2.3.9.11.10 All the proposed network and security equipments in the DC and DRC shouldbe rack mountable and sliding <strong>for</strong> easy maintenance activities.2.3.9.11.11 The racks should be sized ac<strong>co</strong>rdingly and calculated <strong>for</strong> the quantity to beproposed as part of this solution. Each rack should have dual power stripswith adequate 15A/5A power input sockets. Each power strip should be<strong>co</strong>nnected to separate UPS output. All proposed racks should be per<strong>for</strong>atedracks with air flow from the front of the rack.2.3.9.11.12 The Colocated Data Centre should be of Data Centre level 3 standards. Theminimum specifications of the Hosted Data Centre is in Annexure 4.Thevendor is expected to provide a certificate from a third party asserting thatStrictly Confidential Main Document Page 21

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:the build Data Centre is certified at level 3 standards.2.3.9.10.13 The SI is expected to provide the Bandwidth <strong>co</strong>nsidering the solutions thatwill be implemented, network <strong>co</strong>mponents in branches and requisite buffer.2.3.9.10.14 The SI is expected to have <strong>co</strong>mplete responsibility of the Network and will beresponsible <strong>for</strong> uptime and other related service levels as is in Annexure 09.The vendor will liaise with BSNL <strong>for</strong> expediting LL <strong>co</strong>nnectivity in nonfeasiblelocations.2.3.9.10.15 The SI is expected to deploy the Bank network in the following priority-1) MPLS Backed by VSAT where MPLS is feasible.2) Other branches. In case where in MPLS mode of <strong>co</strong>nnectivity isnot available/ feasible, VSAT should be used as a mode of<strong>co</strong>nnectivity2.3.9.10.16 Branches on MPLS VPN Network - The Antivirus, Patch management, EMSpolling distribution servers should be located at the Data Centre. For anyAntivirus updation, Patch updation, distribution of systems and userspolicies, security and procedures across the entire network of CBS centrallyEMS polling traffic at branches, should take update from the distributionservers located at DC and DRC. All such activities should be done in the offpeak hours.2.3.9.10.17 Branches on MPLS VPN Network - CBS traffic will directly flow from branchesto DC and DRC using MPLS Cloud.2.3.9.10.18 Branches on VSAT Network – For any Antivirus updation, Patch updation,and EMS polling traffic at branches, will take update from the Serverslocated at DC and DRC.2.3.9.10.18 The Vendor is required to provide the Network Schematic, NetworkArchitecture of the proposed solution <strong>for</strong> <strong>co</strong>nnectivity. The Vendor shallsubmit the Network Plan along with the technical proposal as per theirproposed solution. The Vendor is required to arrange <strong>for</strong> acquisition ofleased lines as per the network plan approved by the Bank. The Vendor isalso required to do all the necessary <strong>co</strong>-ordination with regulatory agency orservice provider etc.2.3.10 Network and Security HardwareTo provide the well Secured IT infrastructure at DC and DRC. The servershoused at the data Center & disaster re<strong>co</strong>very site should not be accesseddirectly from any network. It should be designed in such a way that the databeing accessed from any location at the DC and DRC should pass throughthe firewall & IPS systems and other security devices.2.3.10.1 To size network and security devices <strong>co</strong>nsidering the applications that will beaccessed from the branches and other Bank locations. The Network andSecurity Devices sized <strong>for</strong> DC and DRC should be redundant & scalable. Allthe <strong>co</strong>mponents within the Network and Security devices should be hotswappable and should incur no downtime due to <strong>co</strong>mponent failure. All theproposed active network <strong>co</strong>mponents should be from same OEM (Originalequipment manufacturer)2.3.10.2 All the Core Network and Security devices suggested <strong>for</strong> DC and DRC shouldStrictly Confidential Main Document Page 22

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:have dual power supplies. The power input to the power supplies will befrom separate UPS. In case of failure of one power supply, the se<strong>co</strong>nd powersupply should be able to take the full load without causing any interruptionin services.2.3.10.3 The CPU and Memory utilization of the network and security devices shouldnot exceed 70%, and bandwidth utilization at DC and DRC, District Offices,and HO should not exceed 80% at any given point of time.2.3.11 Deployment of Network & Security Solution at Data Centre (“DC”) &Disaster Re<strong>co</strong>ver Centre (“DRC”)2.3.11.1 Design, size, supply, implement & maintain the Network & Security solutionat DC & DRC. The SI has to <strong>co</strong>nfigure the network <strong>for</strong> 57 locations. The SI isrequired to take up the management of the network including FacilityManagement <strong>co</strong>nsisting of the CBS branches & other offices.2.3.11.2 The proposed Network & Security solution should <strong>co</strong>mply with standards, theBanks security policy as approved by the board, IT Act 2000 andNABARD/State Government Guidelines/Co-<strong>operative</strong> act. The Bank will sharetheir security policies with the selected SI as available at the time of project<strong>co</strong>mmencement. The SI should make sure that the solutions being providedare <strong>co</strong>mplying with the Security Policies of the Bank, regulatory <strong>co</strong>mpliancesand the Industry’s leading practices.2.3.11.3 The proposed solution should ensure high availability and reliability, shouldbe scalable and flexible to ac<strong>co</strong>mmodate any business and operationalchanges in future.2.3.11.4 Provide an Enterprise Management Solution (“EMS”) –en<strong>co</strong>mpassing theproducts proposed as a part of this tender and other existing/proposedtechnology infrastructure of the Bank.2.3.11.5 Provide training to the Banks in<strong>for</strong>mation technology users onimplementation and management of the Security solution.2.3.11.6 All the equipments/<strong>co</strong>mponents and hardware should be rack optimized atthe DC & DRC.2.3.11.7 The SI is expected to size and provide racks <strong>for</strong> all the equipments proposedas a part of this <strong>RFP</strong>. The racks should be provided with Industrial Powerprotection switches.2.3.11.8 Provide an Antivirus solution <strong>for</strong> the Bank the licenses should be included <strong>for</strong>the DC and DR servers and the branch desktops hardware.2.3.12 Data Centre (“DC”)2.3.12.1 The SI is expected to Co-locate the Data Centre preferably in Kolkata. TheSI is expected to implement the servers at the Data Centre, of 250 sq. Ft.The vendor should also have his resources ( 5 <strong>for</strong> Application Help Desk and4 <strong>for</strong> Technology Help Desk ) and needs to factor such <strong>co</strong>sts separately.The table below shows how exactly the technology <strong>co</strong>mponents are expectedto be structuredStrictly Confidential Main Document Page 23

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:TABLE # 12ItemABCDEFComponentCBS Application instanceThird Party applications instanceCBS Database instanceThird party application Database instanceServer plat<strong>for</strong>ms <strong>for</strong> above <strong>co</strong>mponentsSAN Storage <strong>for</strong> above <strong>co</strong>mponentsEach of the environments of the solution like CBS Application and Databaseshould be hosted on independent instance of Operating System andseparate server hardware. The other third party applications and therelevant Database environments <strong>co</strong>uld be hosted in the same serverhardware with independent instances of OS but dedicated systemresources.2.3.12.2 The SI to ensure adequate power is available <strong>for</strong> all the <strong>co</strong>mponents thatare being proposed <strong>for</strong> DC.2.3.12.3 The SI to ensure that all <strong>co</strong>mmunication links are terminated at the servercage area.2.3.12.2.1 Certified structured LAN Cabling of the racks and seating space.2.3.12.2.2 Provide adequate environmental and physical security and <strong>co</strong>ntrols, in linewith the Bank security policy, <strong>for</strong> the DC.2.3.12.2.3 Ensure availability, security and environmental <strong>co</strong>ntrols as per Level 3standards.2.3.12.3 Maintenance of the proposed architecture in the DC.2.3.12.4 Provide training to the Banks In<strong>for</strong>mation Technology users on managingthe DC and the DRC.2.3.12.5 All the proposed equipments in the DC and DRC should be rack optimized<strong>for</strong> easy maintenance activities.2.3.12.6 Racks should be sized ac<strong>co</strong>rdingly and calculated <strong>for</strong> the quantity to beproposed as part of this solution. Each rack should have dual power stripswith adequate power input sockets. Each power strip should be <strong>co</strong>nnectedto separate UPS output. All proposed racks should be per<strong>for</strong>ated racks toensure proper air flow within and outside the rack.2.3.13 Disaster Re<strong>co</strong>very Centre (“DRC”)2.3.13.1 The Bank would use a space in the Tripura State Data Centre ( SDC ),Agartala.The vendor is expected to <strong>co</strong>nnect the leased line setup to the DRC andthe servers in the identified DRC space. The DRC will have 100 sq feet offree space to host the <strong>bank</strong>s infrastructure at the DRC and office space toseat 2 <strong>bank</strong>s personnel.Strictly Confidential Main Document Page 24

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:2.3.13.2 The SI should per<strong>for</strong>m DR drill as part of acceptance test of DR. The DRdrill should be carried out every six months by the SI to test thefunctionality of DR on the dates mutually agreeable by both the parties.2.3.14 CBS Hardware2.3.14.1 The SI should size <strong>for</strong> adequate hardware based on the transactionvolumes <strong>for</strong> the Core Banking Application & Database. The CentralisedBanking Application & Database should be sized <strong>for</strong> individual Active-Passive cluster solutions at DC & Active-Passive cluster at the DRC.2.3.14.2 The hardware sized <strong>for</strong> all the Applications should be redundant & scalable(horizontally and vertically . All the <strong>co</strong>mponents within the server should behot swappable and should incur no downtime due to <strong>co</strong>mponent failure.The Hardware sized <strong>for</strong> all the Data Base should be redundant & scalablevertically. The <strong>co</strong>mponents within the server should be hot swappable(power Supply, system board, processor etc.) on the fly and should notincur any downtime due to <strong>co</strong>mponent failure in the proposed server.2.3.14.3 The Hardware should be sized initially <strong>for</strong> 57 locations but should bescalable to support up to at least 100 locations.2.3.14.4 Separate adequately sized hardware should be quoted <strong>for</strong> test &development, migration and training servers. Separate hardware should bequoted <strong>for</strong> migration servers.2.3.14.5 All the servers suggested should have redundant power supplies. Thepower input to the power supplies should be from separate UPS. In case offailure of one power supply, the se<strong>co</strong>nd power supply should be able totake the full load without causing any interruption in services.2.3.14.6 All servers should have a redundant 10/100/1000 Mbps network interfaceand other Host based adapter cards (NIC and HBA) installed on differentslots. Each NIC/HBA should be cabled from a different module on theswitch using gigabit speed cabling.2.3.14.7 The hardware proposed <strong>for</strong> the solution as part of this <strong>RFP</strong> should notexceed 70% of CPU(s), memory(s), hard disk(s) & NIC(s) utilisation levelsat any given point in time within the operational window of the Bank.Adequate weekly report from the EMS tool needs to be furnishedsubstantiating the same. The interval of utilization reporting should beevery 1 hour. In case the above requirement is not met, the vendor wouldbe adequately responsible to <strong>co</strong>mply at no additional <strong>co</strong>st to the <strong>bank</strong>.2.3.14.8 The vendor will have to size the SAN storage capacity based on thenumbers of ac<strong>co</strong>unts both at DC and DR. The SAN storage utilizationshould not exceed 70%. In case the above requirement is not met, theadditional hardware would have to be provided by the Vendor at no further<strong>co</strong>st to the Bank. If the individual solutions suggested by the SIsnecessitate additional capacity, then the SI would need to provideac<strong>co</strong>rdingly to meet the <strong>RFP</strong> and SLA requirements. Replication betweenDC & DRC should be Storage-to-Storage based replication with automaticrole reversal.2.3.14.9 For sizing purposes, empirical third party reports / evidence would berequired in the <strong>for</strong>m of benchmarks on that class of hardware with thesuggested processors <strong>for</strong> the proposed <strong>co</strong>re <strong>bank</strong>ing solution to accept thehardware sizing calculations.Strictly Confidential Main Document Page 25

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:in the Help Desk.Strictly Confidential Main Document Page 27

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:2.4 Project Timelines2.4.1` Pilot ImplementationThe Pilot implementation would include the following 7 branches. The details of the<strong>co</strong>ncurrent <strong>co</strong>mputer users is mentioned. The Pilot Branches <strong>co</strong>ntains mix ofManual, partial and TBA type of branches which have been selected <strong>for</strong> the Pilotimplementation of the CBS including the trade finance module:Table # 14Sr.No.Branch Name Concurrent Users perBranch1 Agartala 102 Pecharthal 33 Dharmanagar 74 Udaipur 55 Amarpur 56 Billonia 77 Ambassa 58 Durgachowmohani 4For further details about the above branch please refer to Annexure 02. The Pilotimplementation should also <strong>co</strong>ver, apart from the above,2.4.2 Interface Building:All interfaces as mentioned in Annexure 03 should be developed and successfullyimplemented by the end of the Pilot implementation Phase.2.4.3 Testing:For the Pilot implementation phase to be <strong>co</strong>mplete all the testing including“Computer Room Pilot” and “User Acceptance Testing” should be <strong>co</strong>mpleted. It willbe the SI’s responsibility to create the testing environment <strong>for</strong> the Banksemployees to do the testing and the SI will be required to assist the Bank in theentire testing phase. The testing environment should at all times support 50<strong>co</strong>ncurrent users. The SI needs to provide separate test environment <strong>for</strong> CBS andother applications being a part of the solution to be provided by the SI.2.4.4 Facilities Management:2.4.4.1 Help Desk – The application and technology Help Desks should be fully functionalfrom the day the first Pilot branch is successfully implemented.2.4.4.2 The Bank expects every new branch / office being migrated to the centralised-Banking solution to be able to utilize the services of both the Help Desks fromday one of go live.2.4.5 Roll Out PlanThe Bank expects the SI to roll out the branches on CBS as mentioned inStrictly Confidential Main Document Page 28

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:Annexure 02 of this document. However the Bank reserves the exclusive right tochange any of the branches mentioned in Annexure 02 at any point in time.Further it is assumed that any new branch opened by the Bank may be broughtunder CBS.Implementation & Roll out Plan in a nutshell – excluding training andcustomosationTable # 15Major ActivitiesEstablishment of hostedData CentreCritical Customization ofCBS Suite of applicationPackagesEstablishment of DisasterRe<strong>co</strong>very SiteDeployment of Enterprisemanagement systemsoftware (EMS)User acceptance of variousapplications/solution/s bythe BankEstablishment of Help Desk(Application & Technology)Data migration from TBAapplication to CBSapplication including datacleaning and creation ofcustomer in<strong>for</strong>mation file (This activity reoccurs as andwhen branches are<strong>co</strong>nverted to CBS branchesirrespective of phases)Executive AwarenessTrainingBranchRoll-outNetworkRoll-outTimeframe– requiresrevision- - December-2012- - November-2012- - November-2012- - December-2012- - January-2013- - December-2012(Be<strong>for</strong>eroll out ofthe firstbranch)- - January-2013- - December-2012Go-Live (1 st CBS Branch) 1 branch 10branchesFebruary-2013Remaining CBS Pilot 7branches 15branches April-2013Phase I 2532June-2013Branches branchesPhase II 25Branches September-2013Strictly Confidential Main Document Page 29

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:Other third party solutionsRoll-outTimeframeDelivery ChannelsMay-2013Strictly Confidential Main Document Page 30

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:3 Terms & Conditions3.1.1 GeneralThe Bank expect the vendors to adhere to the terms of this <strong>Request</strong> <strong>for</strong><strong>Proposal</strong> (<strong>RFP</strong>) and would not like or accept any deviations to the same. Ifthe vendors have absolutely genuine issues only then should they providetheir nature of non – <strong>co</strong>mpliance to the same in the <strong>for</strong>mat provided. TheBank reserve their right to not accept such deviations to the tender terms.The Bank intends that the Vendor appointed under the <strong>RFP</strong> shall have thesingle point responsibility <strong>for</strong> fulfilling all obligations and providing alldeliverables and services required <strong>for</strong> successful implementation of theproject, notwithstanding the fact that the Vendor may appoint / procureservices of third party suppliers (including software vendors) to per<strong>for</strong>m allor part of the obligations <strong>co</strong>ntained under this <strong>RFP</strong> and that the Bank may<strong>for</strong> <strong>co</strong>nvenience enter into arrangements, including tripartite agreements,with such third party vendors, if required.Unless agreed to specifically by the Bank in writing <strong>for</strong> any changes to the<strong>RFP</strong> issued, the Vendor responses would not be in<strong>co</strong>rporated automatically inthe <strong>RFP</strong> document.The Bank reserves the right to place part order or not to place order <strong>for</strong> anyof the <strong>co</strong>mponents <strong>for</strong>ming part of this tender, with the selected vendorduring the tenure of the <strong>co</strong>ntract.Unless expressly overridden by the specific agreement to be entered intobetween the Bank and the Vendor, the <strong>RFP</strong> shall be the governing document<strong>for</strong> arrangement between the Bank and the Vendors.Rules <strong>for</strong> responding to this <strong>Request</strong> <strong>for</strong> <strong>Proposal</strong> (<strong>RFP</strong>) –3.1.1.1 Last date <strong>for</strong> submission of bids is 02 nd July, 2012 14:00 hrs.3.1.1.2 All responses received after the due date / time would be <strong>co</strong>nsidered lateand would not be accepted or opened.3.1.1.3 All responses should be in English language. All responses by the vendorsto this <strong>RFP</strong> document shall be binding on such vendors <strong>for</strong> a period of 180days after the opening of the technical bids.3.1.1.4 All responses including <strong>co</strong>mmercial and technical bids would be deemed tobe irrevocable offers/proposals from the vendors and may if accepted by theBank <strong>for</strong>m part of the final <strong>co</strong>ntract between the Bank and the selectedVendor. Vendors are requested to attach a letter from an authorizedsignatory attesting the veracity of in<strong>for</strong>mation provided in the responses.Unsigned responses would be treated as in<strong>co</strong>mplete and are liable to berejected.3.1.1.5 Any technical or <strong>co</strong>mmercial bid, submitted cannot be withdrawn / modifiedafter the last date <strong>for</strong> submission of the bids unless specifically permitted bythe Bank. In case, due to unavoidable circumstances, the Bank do not awardthe <strong>co</strong>ntract within 180 days from the last date of the submission of thebids, and there is a possibility to award the same within a short duration, theVendor would have the choice to maintain the bid security with the Bank orto withdraw the bid and obtain the security provided.3.1.1.6 The Vendor may modify or withdraw its offer after submission, providedthat, the Bank, prior to the closing date and time receives a written notice ofStrictly Confidential Main Document Page 31

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:the modification or withdrawal prescribed <strong>for</strong> submission of offers. No offercan be modified or withdrawn by the Vendor subsequent to the closing dateand time <strong>for</strong> submission of the offers.3.1.1.7 The Vendors are required to quote <strong>for</strong> all the <strong>co</strong>mponents mentioned in theSection 2.3 “Project S<strong>co</strong>pe” and Section 6 “Detailed Requirements” of thisdocument. In case any Vendor does not quote <strong>for</strong> any of the <strong>co</strong>mponents,the response would be deemed to include the quote <strong>for</strong> such unquoted<strong>co</strong>mponents. During evaluation, if any particular item quote is found asblank, then the highest of the other bidders quotes <strong>for</strong> that item will betaken and notionally loaded <strong>for</strong> arriving at the Total Cost of Ownership <strong>for</strong>the purpose of evaluation of the defaulting / deviating Vendor. But, Bank willactually not pay <strong>for</strong> such non-quoted items.It is mandatory to submit the technical details in the <strong>for</strong>mats in given inAnnexure /Appendices, given along with this document duly filled in, alongwith the offer. The Banks reserve the right not to allow / permit changes inthe technical specifications and not to evaluate the offer in case of nonsubmissionof the technical details in the required <strong>for</strong>mat or partialsubmission of technical details.3.1.1.8 Based on the Bank’s requirement as listed in this document, the Vendorshould identify the best-suited solution that would meet the requirement andquote <strong>for</strong> the same. In case the Vendor quotes <strong>for</strong> more than one solution(<strong>for</strong> example one quote <strong>for</strong> software x and y and another quote <strong>for</strong> softwarex and z) then the response would be <strong>co</strong>nsidered as improper and liable to berejected. The Vendor should not give options to the Bank to select. TheVendor is expected to select the best option and quote <strong>for</strong> the same. (Forexample the Vendor should not quote <strong>for</strong> two database servers, one xyz andother abc, and leave it to the Bank to choose any one of them.)3.1.1.9 Each offer should specify only a single solution, which is <strong>co</strong>st-effective andmeeting the tender specifications. It is the responsibility of the Vendor todecide the best suitable solution.3.1.1.10 In the event the Vendor has not quoted <strong>for</strong> any mandatory items as requiredby the Vendor and <strong>for</strong>ming a part of the <strong>RFP</strong> document circulated to thevendors and responded to by the vendors, the same will be deemed to beprovided by the Vendor at no extra <strong>co</strong>st.3.1.1.11 The Bank is not responsible <strong>for</strong> any assumptions or judgments made by thevendors <strong>for</strong> arriving at any type of sizing or <strong>co</strong>sting. The Bank at all timeswill benchmark the per<strong>for</strong>mance of the Vendor to the <strong>RFP</strong> documentscirculated to the vendors and the expected service levels as mentioned inthese documents. In the event of any deviations from the requirements ofthese documents, the Vendor must make good the same at no extra <strong>co</strong>sts tothe Bank in order to achieve the desired service levels as well as meetingthe requirements of these documents. The Bank shall not be responsible <strong>for</strong>any assumptions made by the Vendor. The Bank’s interpretation will be final.3.1.1.12 The Bank shall ascertain and <strong>co</strong>nclude that everything as mentioned in the<strong>RFP</strong> documents circulated to the vendors and responded by the vendorshave been quoted <strong>for</strong> by the vendors, and there will be no extra <strong>co</strong>stassociated with the same in case the Vendor has not quoted <strong>for</strong> the same.3.1.1.13 In the event the Bank has not asked <strong>for</strong> any quotes <strong>for</strong> alternative prices,and the Vendor furnishes the alternative price in the Vendors financial bid,the higher of the prices will be taken <strong>for</strong> calculating and arriving at the TotalCost of Ownership. However payment by the Bank will be made at the lowerStrictly Confidential Main Document Page 32

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:price.3.1.1.14 In the event optional prices are not quoted by the Vendor, <strong>for</strong> items wheresuch prices are a must and required to be quoted <strong>for</strong>, the highest pricequoted by any of the participating Vendor will be taken as the <strong>co</strong>sts, <strong>for</strong> suchalternatives and also <strong>for</strong> arriving at the Total Cost of Ownership <strong>for</strong> thepurpose of evaluation of the defaulting / deviating Vendor.3.1.1.15 All out of pocket expenses, travelling, boarding and lodging expenses <strong>for</strong> theentire life of the <strong>co</strong>ntract should be a part of the financial bid submitted bythe Vendor to the Bank. No extra <strong>co</strong>sts on ac<strong>co</strong>unt of any items or servicesor by way of any out of pocket expenses, including travel, boarding andlodging etc. will be payable by the Bank. The Vendor cannot take the plea ofomitting any charges or <strong>co</strong>sts and later lodge a claim on the Bank <strong>for</strong> thesame.3.1.1.16 The Vendor at no point in time can excuse themselves from any claims madeby the Bank whatsoever <strong>for</strong> their deviations in <strong>co</strong>nfirming to the terms and<strong>co</strong>nditions, payments schedules, time frame <strong>for</strong> implementation etc. asmentioned in the <strong>RFP</strong> documents circulated by the Bank. Vendor shall befully responsible <strong>for</strong> deviations to the terms & <strong>co</strong>nditions, project scheduleetc. as proposed in the <strong>RFP</strong>.3.1.2 Price bids3.1.2.1 The Vendor is requested to quote in Indian Rupees (‘INR’). Bids in currenciesother than INR would not be <strong>co</strong>nsidered.3.1.2.2 The prices and other terms offered by Vendors must be firm <strong>for</strong> anacceptance period of 180 days from the last date <strong>for</strong> submitting this bid.3.1.2.3 The prices quoted by the Vendor shall include all <strong>co</strong>sts such as, taxes, levies,cess, excise and custom duties, installation, insurance etc. that need to beincurred. The prices quoted will also include transportation to respectivesites, insurance till supervision, <strong>co</strong>mmissioning and final acceptance by theBank. Any delay in installation of the hardware <strong>for</strong> whatsoever reason shouldnot entail in expiry of insurance and the same should be <strong>co</strong>ntinued to beextended up-to the date of installation and acceptance of the hardware andother infrastructure by the Bank. The price payable to the Vendor shall beinclusive of carrying out any modifications changes / upgrades to the CBS orother software or equipment that is required to be made in order to <strong>co</strong>mplywith any statutory or regulatory requirements or any industry-wide changesarising during the subsistence of this agreement, and the Bank shall not payany additional <strong>co</strong>st <strong>for</strong> the same. Though the equipment would be at theBank premises, Vendor shall be responsible <strong>for</strong> the installation,implementation and acceptance testing and the ownership would not havetransferred to the Bank at this stage. Hence the Vendor should bear the riskof loss and any damages and there<strong>for</strong>e insure the equipment till acceptancetesting, and final acceptance by the Bank. The vendor needs to providedetails of Taxes <strong>for</strong> each <strong>co</strong>mponent, as part of <strong>co</strong>mmercial bid.3.1.2.4 In case of any variation (upward or down ward) in Government levies /taxes / cess / excise / custom duty etc. up-to the date of invoice, the benefitor burden of the same shall be passed on or adjusted to the Bank. If theVendor makes any <strong>co</strong>nditional or vague offers, without <strong>co</strong>n<strong>for</strong>ming to theseguidelines, the Bank will treat the prices quoted as in <strong>co</strong>n<strong>for</strong>mity with theseguidelines and proceed ac<strong>co</strong>rdingly. Local entry taxes or Octroi whichever isapplicable, if any, will be paid by the Bank on production of relative paymentreceipts / documents. Necessary documentary evidence should be producedStrictly Confidential Main Document Page 33

<strong>RFP</strong> <strong>for</strong> TSCB Core Banking ProjectTender #:<strong>for</strong> having paid the customs / excise duty, sales tax, if applicable, and orother applicable levies. “Variation” would also include the introduction of anynew tax /cess /excise.3.1.2.5 If any Tax authorities of any <strong>state</strong>, including, Local authorities likeCorporation, Municipality, Mandal Panchayat, etc. or any CentralGovernment authority or Statutory or autonomous or such other authorityimposes any tax, penalty or levy or any cess / charge other than entry taxor Octroi and if the Bank have to pay the same <strong>for</strong> any of the items orsupplies made here under by the Vendor, <strong>for</strong> any reason including the delayor failure or inability of the Vendor to make payment <strong>for</strong> the same, the Bankhave to be reimbursed such amounts paid, on being intimated to the Vendoralong with the documentary evidence. If the Vendor does not reimburse theamount within a <strong>for</strong>tnight, the Bank reserves the right to adjust the amountout of the payments due to the Vendor from the Bank.3.1.2.6 Terms of payment as indicated in the Purchase Contract that will be issuedby the Bank on the selected Vendor will be final and binding on the Vendorand no interest will be payable by the Bank on outstanding amounts underany circumstances. If there are any clauses in the Invoice <strong>co</strong>ntrary to theterms of the Purchase Contract, the Vendor should give a declaration on theface of the Invoice or by a separate letter explicitly stating as follows“Clauses, if any <strong>co</strong>ntained in the Invoice which are <strong>co</strong>ntrary to the terms<strong>co</strong>ntained in the Purchase Contract will not hold good against the Bank andthat the Invoice would be governed by the terms <strong>co</strong>ntained in the Contract<strong>co</strong>ncluded between the Bank and the Vendor”. Vendor should ensure thatthe project should not suffer <strong>for</strong> any reason.3.1.2.7 Price Comparisons:3.1.2.7.1 The Bank will <strong>co</strong>nsider the Total Cost of Ownership (TCO) over a 5-yearperiod. The <strong>co</strong>st of the 43 additional new branches to be included as part ofthe TCO The roll out plan of which would be shared at a later time but wouldbe undertaken within the tenure of 5 years of the project.3.1.2.7.2 Vendors are expected to maintain the solution and equipment supplied andto <strong>co</strong>mmence FM from the date of acceptance of such solution andequipment by the Bank.3.1.2.7.3 Comprehensive facilities management charges must be quoted, on yearlybasis, after taking due <strong>co</strong>nsideration <strong>for</strong> the warranty period and providingthe adequate benefit to the Bank;3.1.2.7.4 Bank will pay facility management charges post <strong>co</strong>mpletion of <strong>co</strong>ntracttenure at rates not exceeding the original rates quoted <strong>for</strong> the facilitiesmanagement in reply to this <strong>RFP</strong> on the <strong>co</strong>st of the solution, hardware,peripherals, other equipments, infrastructure and services provided by theVendor, if the Bank opt <strong>for</strong> the same. The Bank have no obligation to acceptthe post facilities management services and the decision on the same wouldbe taken towards the end of the facility management period;3.1.2.7.5 To determine L1 status, Bank will <strong>co</strong>mpute and <strong>co</strong>mpare the total <strong>co</strong>st of allitems <strong>for</strong> all branches / offices involved, as quoted by the Vendors who havequalified on the technical specifications and hence short-listed by the Bank.The Bank will calculate total <strong>co</strong>st of ownership <strong>for</strong> a 5-year period, which willinclude <strong>co</strong>st of 100 man-days of additional customisation ef<strong>for</strong>t <strong>for</strong> CBS andproposed 3 rd party solutions <strong>for</strong> the purpose of equating all the bids;3.1.2.7.6 While the Bank will summarily reject the equipments of a lower <strong>co</strong>nfigurationStrictly Confidential Main Document Page 34