EpiTan Ltd. - Clinuvel Pharmaceuticals

EpiTan Ltd. - Clinuvel Pharmaceuticals

EpiTan Ltd. - Clinuvel Pharmaceuticals

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Oct. 07, 2004 7:04<br />

<strong>EpiTan</strong> <strong>Ltd</strong>.<br />

<strong>Pharmaceuticals</strong><br />

> Click here for Disclaimer<br />

Lead Drug „Melanotan“ sizzles with<br />

Blockbuster Potential<br />

Rating:<br />

Speculative Buy since: 07 Oct 2004<br />

Share price target: AUD 3.50<br />

since: 07 Oct 2004<br />

Current price: AUD 0.87<br />

High/Low 52W: AUD 1.08/0.57<br />

Figures per share in AUD<br />

2004 2005e 2006e<br />

EPS -0.07 -0.02 -0.02<br />

P/E n.m. n.m. n.m.<br />

CashFlow -0.11 -0.01 -0.01<br />

P/CF n.m. n.m. n.m.<br />

Dividend n.m. n.m. n.m.<br />

Yield n.m. n.m. n.m.<br />

Book Value 0.08 0.05 0.03<br />

Cash 0.05 0.07 0.13<br />

Fiscal Year as of 30.06.<br />

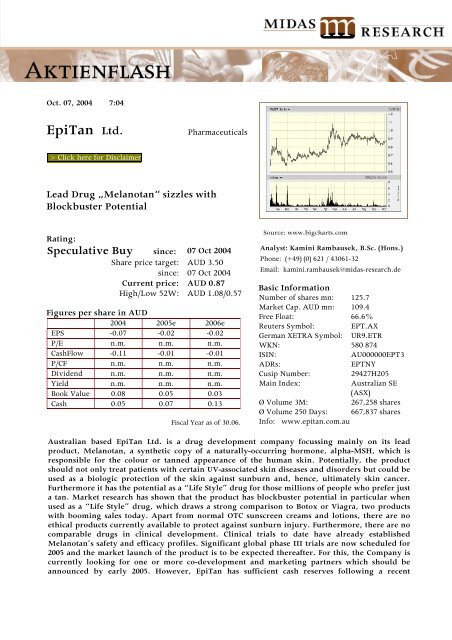

Source: www.bigcharts.com<br />

Analyst: Kamini Rambausek, B.Sc. (Hons.)<br />

Phone: (+49) (0) 621 / 43061-32<br />

Email: kamini.rambausek@midas-research.de<br />

Basic Information<br />

Number of shares mn: 125.7<br />

Market Cap. AUD mn: 109.4<br />

Free Float: 66.6%<br />

Reuters Symbol: EPT.AX<br />

German XETRA Symbol: UR9.ETR<br />

WKN: 580 874<br />

ISIN:<br />

AU000000EPT3<br />

ADRs:<br />

EPTNY<br />

Cusip Number: 29427H205<br />

Main Index:<br />

Australian SE<br />

(ASX)<br />

Ø Volume 3M:<br />

267,258 shares<br />

Ø Volume 250 Days: 667,837 shares<br />

Info: www.epitan.com.au<br />

Australian based <strong>EpiTan</strong> <strong>Ltd</strong>. is a drug development company focussing mainly on its lead<br />

product, Melanotan, a synthetic copy of a naturally-occurring hormone, alpha-MSH, which is<br />

responsible for the colour or tanned appearance of the human skin. Potentially, the product<br />

should not only treat patients with certain UV-associated skin diseases and disorders but could be<br />

used as a biologic protection of the skin against sunburn and, hence, ultimately skin cancer.<br />

Furthermore it has the potential as a “Life Style” drug for those millions of people who prefer just<br />

a tan. Market research has shown that the product has blockbuster potential in particular when<br />

used as a “Life Style” drug, which draws a strong comparison to Botox or Viagra, two products<br />

with booming sales today. Apart from normal OTC sunscreen creams and lotions, there are no<br />

ethical products currently available to protect against sunburn injury. Furthermore, there are no<br />

comparable drugs in clinical development. Clinical trials to date have already established<br />

Melanotan’s safety and efficacy profiles. Significant global phase III trials are now scheduled for<br />

2005 and the market launch of the product is to be expected thereafter. For this, the Company is<br />

currently looking for one or more co-development and marketing partners which should be<br />

announced by early 2005. However, <strong>EpiTan</strong> has sufficient cash reserves following a recent

financing round, to at least initiate further clinical studies should they have difficulty finding an<br />

appropriate pharmaceutical partner in the next 12 months.<br />

<strong>EpiTan</strong> - Corporate Profile<br />

Based in Melbourne (Australia) and listed on the Australian Stock Exchange (Melbourne) since February<br />

2001, <strong>EpiTan</strong> Limited is a pharmaceutical company with its primary focus on the development and<br />

commercialisation of its lead product, Melanotan. The product was originally developed in the 1980’s at<br />

the University of Arizona, USA. In 1995, the Melanotan Corporation Inc. was formed to seek a pharma<br />

company to further develop and commercialise Melanotan and <strong>EpiTan</strong> began negotiating with this Group<br />

to obtain the exclusive rights to the drug. <strong>EpiTan</strong> successfully acquired the exclusive rights to Melanotan<br />

and Melanotan Corporation became a major shareholder of the Company. It currently holds a 12.1% share.<br />

<strong>EpiTan</strong> has a strong Intellectual Property position, worldwide marketing rights, and has taken further<br />

steps to ensure commercial exclusivity preventing a likely competitor from gaining any market share.<br />

Australia has the highest rate of skin cancer in the world, and this was the case even before the hole in<br />

the ozone layer became a matter of concern. There is widespread interest and rigorous campaigning to<br />

promote public awareness of the effects of excess exposure to the sun. The geographical location of<br />

<strong>EpiTan</strong> provided the ideal conditions for rapid development of the Company and formed the basis for the<br />

alliance with Melanotan Corporation.<br />

<strong>EpiTan</strong> Strategy<br />

<strong>EpiTan</strong> currently envisages three target markets for Melanotan: prophylactic, therapeutic and cosmetic<br />

applications. Market research has shown that the product has blockbuster potential and could earn<br />

millions of dollars worldwide for the co-development partner, and ultimately for <strong>EpiTan</strong>. Furthermore, a<br />

potentially huge “latent market” may exist – comprising people who would request prescription drugs for<br />

the sake of vanity or to just “feel good” about themselves. This market draws a strong comparison to that<br />

of Botox or Viagra, two products with booming sales. The erectile dysfunction market was valued at<br />

approximately USD 100 million before Viagra reached the market – now the market is soaring at USD 2.2<br />

billion.<br />

<strong>EpiTan</strong>’s current strategy is to find a suitable partner or partners to co-develop, market and sell<br />

Melanotan in the USA, Europe and the Rest of the World, while marketing the product in Australia and<br />

New Zealand on its own. The Company may seek separate partners, each having market dominance in<br />

either one of the regions (Europe, USA, Rest of World). Clearly, the US and European markets have the<br />

greatest potential given their large fair-skinned population.<br />

We understand that the Company is actively progressing talks with prospective pharmaceutical<br />

companies and we expect an announcement at least by Q2/2005. With the new partner, <strong>EpiTan</strong> expects to<br />

receive a one-off signing fee, milestones, financing of remaining clinical studies, marketing and sales<br />

(USA, Europe), and a double digit royalty fee on the marketed product. By any standards, the funding of<br />

clinical trials, marketing and sales is challenging for any biotech company. Supposing <strong>EpiTan</strong> were to be<br />

granted these benefits, it would be just as likely that they would need to give up control of Melanotan at<br />

least partially. In other words, the pharma partner could demand complete control of the clinical trials and<br />

set the timelines for development according to the rest of its pipeline. This is probably a topic of great<br />

discussion with potential pharma partners, and we look forward to the final agreement. In any event,<br />

<strong>EpiTan</strong> expects to maintain the Australia/New Zealand region, and the worldwide IP rights to Melanotan.<br />

The partner/s will receive full exclusive rights to market and distribute Melanotan in other regions.<br />

- 2 -

<strong>EpiTan</strong> plans to take Melanotan into a phase II clinical study as a therapeutic agent to treat PMLE<br />

(Polymorphous Light Eruption), with trials set to begin during this coming European Winter, mainly in<br />

Germany and the UK. It is believed that between 10-20% of the population in the UK, Scandinavia and the<br />

USA suffer from PMLE. Also called sun poisoning, PMLE is a UV-induced skin allergy. As part of the<br />

trial, PMLE will be induced in patients at the outset. After allowing some time for the symptoms to<br />

develop, patients will receive Melanotan (as a sustained-release solid implant), and PMLE induction will<br />

occur again. Pigmentation (levels of melanin) will be measured one or two months later. The efficacy<br />

endpoint will be the reduction in symptoms (skin rash or patient discomfort). It is possible that the trials<br />

progress faster as there is a clearly defined clinical endpoint for this trial. Furthermore, there is a chance<br />

that there will be a quicker regulatory acceptance for this unmet medical need.<br />

Melanotan - the Drug<br />

Melanotan is a synthetic copy of a naturally-occurring hormone, alpha-MSH, which stimulates the<br />

production of melanin in the skin. Melanin is the pigment that gives the skin its dark colour or tanned<br />

appearance. Studies have shown that Melanotan is many times more potent than the naturally occurring<br />

alpha-MSH. Increased levels of melanin protect the body from skin damage as a result of sunburn and<br />

are associated with reduced incidences of skin cancer.<br />

An important issue for the application of Melanotan as a drug for the “mass market” is the right drug<br />

delivery formulation. Originally, Melanotan was developed to be administered as an aqueous<br />

injection, where patients were treated on an “out-patient” basis. This form of treatment was not patientfriendly<br />

as it meant that the patient would need ten daily injections to get an effective Melanotan dose.<br />

<strong>EpiTan</strong> has since explored alternative forms (see chart) of delivering Melanotan and has generated<br />

additional IP protection with these new formulations.<br />

<strong>EpiTan</strong>: Melanothan – Delivery Formulations<br />

Source: <strong>EpiTan</strong><br />

In collaboration with the Southern Research Institute (Alabama, USA), <strong>EpiTan</strong> has successfully developed<br />

a sustained-release solid injectable implant – this is an implant so small and thin that it can be injected<br />

into the patient using a normal blood transfusion needle. Future clinical trials and commercialisation will<br />

focus on this solid implant as the first generation product. The implant will be delivered via a single<br />

injection, delivering the implant under the skin (most likely in the region of the upper arm). The solid<br />

implant will, over 15-20 days, release a steady supply of Melanotan into the blood stream. It is made from<br />

the same material as self-dissolving stitches and does not have to be removed at the end of the treatment.<br />

- 3 -

<strong>EpiTan</strong> is currently conducting a dose-escalation study in Brisbane with this solid implant. We anticipate<br />

that the study will be completed by December 2004, with results expected in early 2005. The next clinical<br />

study, phase II PMLE in Europe, will use this solid implant. A separate phase II study, in sunburn injury,<br />

will be conducted in the USA – this news was published at the AGM held on 1 st October 2004. This trial<br />

will also commence as soon as possible after the dose-escalation results have been established.<br />

In September 2003, <strong>EpiTan</strong> entered into collaboration with pSiMedica <strong>Ltd</strong>., a subsidiary of Australianbased<br />

pSivida to develop a liquid based slow release formulation of Melanotan using pSivida’s BioSilicon<br />

nanotechnology. The microscopic porous structure of BioSilicon, with its “honeycomb” structure, will<br />

allow easy uptake of Melanotan. The slow release formulation will also be administered with a single<br />

liquid injection. <strong>EpiTan</strong> may develop this formulation as a future generation Melanotan product.<br />

In collaboration with Monash University, <strong>EpiTan</strong> has assessed the possibility of an oral formulation of<br />

Melanotan. We imagine that this would be a challenge considering that the drug (which is a peptide)<br />

might lose its potency once in contact with the acidic environment of the stomach. It is worth noting:<br />

there is yet to be a successful oral formulation for Insulin developed.<br />

Presenting a more immediate challenge to <strong>EpiTan</strong> would be getting a topical formulation developed,<br />

which would be more patient-friendly and easier to market and sell that an implant. Following agreements<br />

with several transdermal companies, including CollaGenex Pharmaceutical (USA), Thomas Sköld (Sweden)<br />

and Transdermal Technologies Inc., the development of a topical formulation of Melanotan, i.e. a lotion,<br />

spray or patch is currently underway with pre-clinical studies having just been completed – the results of<br />

which sound promising and further details should be released in the next few weeks. A phase I clinical<br />

trial in humans is planned to start by the end of 2004.<br />

<strong>EpiTan</strong> has prepared an Investigational New Drug (IND) application. Following expert regulatory advice<br />

and discussions with the FDA, <strong>EpiTan</strong> will lodge the IND with the FDA as soon as the dose-escalation<br />

studies are completed to allow clinical trials to begin in the USA. By waiting for the Australian doseescalation<br />

study to complete, <strong>EpiTan</strong> will save by avoiding a duplicate dose study in the USA and will<br />

begin trials in the USA at the phase II level. This phase II is expected to roll into a phase III study and<br />

should commence in 2005.<br />

Following initial talks with the FDA (November 2003), <strong>EpiTan</strong> believes that the most likely indication for<br />

Melanotan will be for the prevention or reduction in skin damage caused by UV exposure in people with<br />

high risk genetically. The slow-release implant is likely to receive approval first as there are similar<br />

products already on the market, such as Zoladex (AstraZeneca) for the treatment of prostate cancer.<br />

Melanotan is expected to be considered a “prescription sunscreen” in the form of this implant.<br />

Melanotan – the Market Potential<br />

A recent independent study by PharmaVentures (Oxford, UK) identified three main markets for<br />

Melanotan. It is worth noting that PharmaVentures was unable to find a comparable product either on the<br />

market or in development. This makes pricing of the drug particularly difficult. Nevertheless,<br />

assumptions were made on the price based on other dermatology products.<br />

The Prophylactic market targets people who do not tan well and are at increased risk of developing skin<br />

cancer. This refers to those who wish to be protected from sunburn and damaging UV radiation, which<br />

increases the risk of skin cancer, particularly people with Fitzpatrick’s Type I and II, with very fair skin.<br />

- 4 -

A word on the Fitzpatrick classification<br />

Melanin determines a person’s skin colour. The quantity of melanin produced by a person’s<br />

melanocytes is determined by genetics. Melanin helps protect the skin from sunburn. For instance,<br />

pale skinned or fair persons have little melanin and dark skinned persons have more melanin.<br />

Fitzpatrick devised a description of skin types known as the Fitzpatrick skin type classification. This<br />

classification denotes 6 different skin types, skin colour, and reaction to sun exposure.<br />

• Type I (very white or freckled) - Always burn<br />

• Type II (white) - Usually burn<br />

• Type III (white to olive) - Sometimes burn<br />

• Type IV (brown) - Rarely burn<br />

• Type V (dark brown) - Very rarely burn<br />

• Type VI (black) - Never burn<br />

Source: www.emedicine.com<br />

Skin cancer is the most prevalent of all cancers. The World Health Organisation claims that there are 2-3<br />

million non-melanoma skin cancers and over 130,000 malignant melanomas occurring globally each year.<br />

Australia has the highest incidence of skin cancer in the world with an average of 750,000 new cases<br />

diagnosed each year. The Australian government spends million of dollars each year trying to increase<br />

awareness of the destructive nature of UV exposure. Accordingly, the market for sun care products<br />

(sunscreens, sun block, etc.) has thrived. In the US, between 1997 and 2000 sun care product sales grew<br />

36% to reach USD 547 million (Source: www.marketresearch.com). In 2002, Australian sales were<br />

approximately AUD 26 million. Research shows that the European market for sun care products was<br />

valued at USD 1.4 billion in 1996.<br />

‣ PharmaVentures estimates the prophylactic market to be approximately USD 1 billion in<br />

annual sales.<br />

The Therapeutic market focuses on people with skin disorders such as PMLE (polymorphous light<br />

eruption), psoriasis, rosacea, solar uticaria, porphyria, vitiligo, and albinism. PharmaVentures has assumed<br />

that the sustained-release solid injectable implant will be the first generation product, to be developed for<br />

the therapeutic, prophylactic and cosmetic markets.<br />

‣ PharmaVentures has identified the therapeutic market to be in excess of USD 500 million in<br />

annual sales.<br />

The Cosmetic market is made up of people who want to look good, with no specific health reasons. These<br />

are mainly the people who go to tanning salons or solariums. The market for tanning salons in the US<br />

alone is estimated at USD 2 billion per annum, with a further USD 100 million spent on self-tanning<br />

products. <strong>EpiTan</strong>’s main focus is to develop an ethical drug to reduce the incidence of skin damage. By<br />

tapping into the “sunless” tanning market, the use of Melanotan will greatly reduce the need to use<br />

tanning salons or the need for sunbathing, thus reducing exposure to harmful UV radiation.<br />

- 5 -

‣ PharmaVentures estimates the cosmetic market to be in excess of USD 3.7 billion in<br />

annual sales.<br />

Aside from this cosmetic market, PharmaVentures has also identified a potential “latent<br />

market”, which describes people who do not currently use any artificial tanning methods.<br />

Melanotan will introduce a new method of feeling and looking better. Ethical products including<br />

Botox injections (“to smooth away wrinkles”) and Viagra (to treat erectile dysfunction) have<br />

given millions of people a better quality of life. Based on these newly created markets,<br />

PharmaVentures believes that Melanotan could target an USD 7 billion potential.<br />

Intellectual Property<br />

Source: <strong>EpiTan</strong><br />

<strong>EpiTan</strong> currently holds 34 granted patents, and is currently lodging patent applications for new IP that<br />

is being generated with the new formulations: slow release implant, lotion, patch, etc. These patents are<br />

expected to offer market protection beyond 2020.<br />

The original patents from the University of Arizona expire in 2008, with Melanotan due to be launched in<br />

2006/2007. However, according to regulatory law (1984 Hatch-Waxman Act), <strong>EpiTan</strong> (or its partners) will<br />

have commercial exclusivity for an additional 5 years in the USA once the product reaches the<br />

market. Similarly, Melanotan will enjoy such exclusivity in Europe for 8 years following its launch.<br />

Source: <strong>EpiTan</strong><br />

- 6 -

Competitors for Melanotan (for the ethical market) have not been identified. To the best of our (and<br />

<strong>EpiTan</strong>’s) knowledge, there are no products in clinical development for this indication. At best, tanning<br />

lotions and tanning salons (solariums) have been identified as competitors. Even if an ethical product was<br />

to begin clinical development now, it would need at least 8 years to reach the market. Melanotan, and<br />

therefore <strong>EpiTan</strong>, remain way ahead of the pack.<br />

Furthermore, <strong>EpiTan</strong> does hold the intellectual property that covers hundreds of analogues of alpha-<br />

MSH (molecules with a similar chemical structure as the naturally occurring hormone) for melanogenesis,<br />

the process of melanin production. These analogues were originally synthesized at the University of<br />

Arizona.<br />

Other Products<br />

In July 2004, <strong>EpiTan</strong> announced that it had acquired three products as part of its strategy to specialise<br />

in prescription dermatology products.<br />

Linotar (eczema) and Exorex (psoriasis) have been acquired from Transdermal <strong>Pharmaceuticals</strong> Australia<br />

Pty <strong>Ltd</strong>. These two products are currently on sale in Australia and are generating roughly AUD 0.5 million<br />

in turnover. <strong>EpiTan</strong> is furthermore awaiting news of Exorex being added to the Pharmaceutical Benefits<br />

Scheme listing in Australia, which would boost sales.<br />

The patents for both products are owned by a South African company (undisclosed). <strong>EpiTan</strong> is currently<br />

finalising the contract, in particular, the supply arrangements. As a result, the Company has not seen<br />

any revenues from these products yet. We expect some news on this deal by the end of 2004. A sales team<br />

for these two products is already in place (out-sourced), so <strong>EpiTan</strong> will not need to invest heavily in<br />

training new staff.<br />

A third product, Zindaclin (acne), has been in-licensed from Strakan <strong>Pharmaceuticals</strong> (UK). Financials<br />

were not disclosed. Zindaclin is awaiting TGA (Therapeutic Goods Administration) registration in<br />

Australia.<br />

All three products will be marketed initially in Australia and New Zealand only and are expected to reach<br />

sales of AUD 3 million for the period 2005/2006.<br />

The Company also revealed at the AGM on 1 st<br />

October 2004, that Management were actively seeking<br />

more in-licensing opportunities for dermatology products, particularly to treat psoriasis, acne and skin<br />

cancer. Further details were not announced. We believe that <strong>EpiTan</strong> is speaking with companies in the UK<br />

and the USA. We would be curious as to whether these potential products are already on the market and<br />

eagerly await news on this. Until now, we believe that <strong>EpiTan</strong> will end this current fiscal year with at<br />

least six dermatology products, including the three mentioned above.<br />

Financials and Shareholder Information<br />

<strong>EpiTan</strong> estimates that the remaining clinical trials (global) and marketing and sales costs for Melanotan<br />

(Australia and New Zealand) should cost roughly AUD 35 million. The Company expects to receive this<br />

funding from the prospective co-development partner. One advantage <strong>EpiTan</strong> enjoys is that costs for<br />

Melanotan clinical studies will be considerably lower than for a typical therapeutic product since the trial<br />

duration is shorter and patients are healthy volunteers, at least for the sunburn injury study. For the<br />

PMLE indication, the high patient numbers (100 million sufferers world wide) point to a fairly swift<br />

recruitment process for the next phase II study (Europe).<br />

- 7 -

<strong>EpiTan</strong> successfully raised AUD 8.9 million in 2003 and a further AUD 8 million in August 2004. <strong>EpiTan</strong>’s<br />

current cash position lies at AUD 10.9 million. In the coming fiscal year, it is expected that this money<br />

will be used as follows:<br />

• cost of running business entity approx. AUD 1.5 million<br />

• Melanotan development costs AUD 7 million<br />

• approx. AUD 0.5 million to be spent on newly acquired products<br />

<strong>EpiTan</strong> does not generate any revenues from product sales as yet. On the other hand, the current cash<br />

burn rate is fairly low at AUD 0.5 million per month.<br />

With <strong>EpiTan</strong> having 125,699,085 ordinary shares, major shareholders include (30 th September 2004):<br />

• Weighton Pty.(Wayne Millen, CEO of <strong>EpiTan</strong>): 14.2%<br />

• Melanotan Corporation Inc.: 12.1%<br />

• FM Fund Management (Absolute Return Europe Fund): 7.1%<br />

In July, <strong>EpiTan</strong> established a Level One American Depositary Receipt (ADR) program and the Bank of<br />

New York was appointed as the depositary bank for this. Each ADR represents 10 ordinary shares of<br />

<strong>EpiTan</strong> as traded on the ASX (Australian Stock Exchange).<br />

<strong>EpiTan</strong> also completed a listing on the Frankfurt Stock Exchange (Xetra) on the 1 st September 2004.<br />

Valuation and Stock Assessment<br />

Based on the figures from the PharmaVentures study as commissioned by <strong>EpiTan</strong>, we have derived a<br />

valuation (Net Present Value or NPV) for Melanotan in the various markets (namely therapeutic,<br />

prophylactic, cosmetic) and for the <strong>EpiTan</strong> stock in general according to a Discounted Cash Flow<br />

valuation. In addition, we have assessed the potential of the product in the Australia/New Zealand (ANZ)<br />

market separately as <strong>EpiTan</strong> will market and sell Melanotan on its own in this region and incur separate<br />

costs.<br />

The table below represents our assumptions and results for the NPV analysis of Melanotan. Perhaps<br />

our most significant assumption in our valuation is that the drug will enter phase III clinical trials and be<br />

launched in the USA, Europe and Australia/New Zealand. Equally important is our assumption that the<br />

Company will secure a pharma partner to finance the remaining clinical trials and the launch, marketing<br />

and sales of Melanotan in the USA and Europe. Our valuation is limited to the first generation product,<br />

the solid injectable sustained release formulation being evaluated in current clinical trials. We have<br />

assigned a 15% royalty rate to <strong>EpiTan</strong>, this being an average industry rate. We keep a conservative view<br />

regarding the market penetration (maximum 15%) – the degree to which Melanotan is able to<br />

penetrate the market will largely depend on the sales and marketing force of the pharma partner.<br />

Following the announcement, we could change our stance on this depending on the partner’s position in<br />

the market. Furthermore, we have factored in a probability of 65% that the product succeeds clinical<br />

tests and enters the market in 2007, based on the assumption that the product is about to enter phase III<br />

trials.<br />

Our discussions with Management combined with our research have led us to the price structure shown in<br />

the table below. Some might argue that it is over-priced at USD 250 per treatment per year – we,<br />

however, believe that it is quite realistic based on current dermatological prescription drugs and the price<br />

of “life style products” such as Botox. As there are no comparable products on the market, it is difficult to<br />

be accurate with the pricing – even PharmaVentures was unable to settle on a number. Once again, we<br />

may have more insight into the pricing once a partner is on board.<br />

- 8 -

We believe that <strong>EpiTan</strong> stands to receive up to USD 20 million in upfront payments and milestones (for<br />

example phase III, approval, and registration) between 2005 and 2007, the market launch. This cash<br />

would be a significant boost for the Company and will help finance <strong>EpiTan</strong>’s plans to scale up sales and<br />

marketing efforts in Australia/New Zealand (ANZ) where they plan to market the drug alone.<br />

Market penetration<br />

Price per<br />

treatment<br />

Net Present Value (NPV)<br />

No. of patients<br />

targeted initially<br />

(worldwide, excl.<br />

MIN MAX (USD) Estimated<br />

Peak Sales<br />

After tax (30%) per Share<br />

ANZ)<br />

(USD) AUD EUR<br />

USD 623<br />

Therapeutic (PMLE) 20.740.000 0.1% 10,0% 250 million (2010) 0,79 0,45<br />

Prophylactic 44.350.000 1,0% 10,0% 200<br />

USD 1.3<br />

billion (2012) 1,39 0,80<br />

Cosmetic 51.220.000 2,0% 15,0% 100<br />

Source: MIDAS Research<br />

USD 997<br />

million (2011) 1,10 0,63<br />

3,28 1,89<br />

We have come to the conclusion that the prophylactic market holds the largest commercial potential for<br />

Melanotan, with a NPV of EUR 0.80 per share (AUD 1.39), based on a retail price of approximately USD<br />

200 (EUR 160) per patient per year. As explained earlier, the prophylactic or preventative market<br />

encompasses those people “who do not tan well and are at increased risk of developing skin cancer”<br />

(according to PharmaVentures). Society is becoming increasingly aware that excess UV exposure is the<br />

primary cause of skin damage and skin cancer. In the USA alone, sales of sun care products (including<br />

sunscreens) amounted to USD 500 million in 2000. Clinical studies to date have proven that Melanotan has<br />

the ability to reduce the skin cell damage (caused by UV exposure) by 50%. More importantly in this<br />

prophylactic market, <strong>EpiTan</strong> needs to develop a topical formulation. In the form of a lotion, gel or patch,<br />

Melanotan would carry an even greater market potential, including of course children.<br />

Following closely behind in terms of commercial value is the therapeutic market, consisting of patients<br />

with UV-associated skin diseases or disorders. In our valuation, we looked at PMLE (a sun allergy) as<br />

<strong>EpiTan</strong> will base future clinical trials on patients with PMLE. Melanotan may initially be marketed as a<br />

treatment for PMLE. In this indication, we assumed that the product will be more expensive, priced at<br />

roughly USD 250 (EUR 200) per patient per year. The resulting NPV of EUR 0.45 (AUD 0.79) per share<br />

shows the therapeutic value of Melanotan compared to the current share price of EUR 0.52 (AUD 0.87).<br />

It is likely that the market penetration in this indication will be small initially as there may be some<br />

barriers to entry. It will take some time for society to warm up to the idea of having this implant,<br />

particularly as it requires a trip to the doctor. Much will depend on changing the mindset of<br />

dermatologists that will be treating and recommending Melanotan as well as marketing efforts. Once<br />

again, the partner’s position in the dermatology market will play a critical role.<br />

The cosmetic market for Melanotan comprises people who wish to have a tan to look good – with no<br />

specific health reasons. In this area, patient numbers could soar based on the solarium industry alone,<br />

worth over USD 2 billion per annum in the USA. Today’s society dictates the importance of striving for a<br />

healthier lifestyle: feeling good is not all – looking good is just as important. We believe <strong>EpiTan</strong> stands the<br />

chance of earning the highest revenues in this market, based on “off-label” use. This would be<br />

particularly true once the second generation product (topical: lotion, gel, patch) entered the market – such<br />

a product would also be attractive to children or teenagers. However, this could take longer to reach the<br />

market than the solid implant. For this reason, we focused on the solid implant making an entry to the<br />

cosmetic market. We prefer to remain cautious and assume a high barrier to entry, and therefore, low<br />

market penetration resulting in a NPV of EUR 0.63 (AUD 1.10) per share at a price of approximately USD<br />

- 9 -

100 (EUR 80) per annual treatment. If the Botox industry is anything to go by, then our caution could be<br />

over-stated.<br />

Within the cosmetic market, PharmaVentures has also identified a “latent” market for applications in those<br />

who do not use artificial tanning products at present – they may later realise that they actually enjoy the<br />

benefits of such a product. We find it much too speculative to valuate this market at this stage, and<br />

therefore, have not put a price to it at this stage.<br />

As <strong>EpiTan</strong> plans to market and sell the product in Australia/New Zealand, we conducted a separate<br />

valuation for Melanotan based on population statistics in this region and the following assumptions:<br />

• a larger market penetration, particularly in the preventative market (up to 17% in 2010), as this<br />

would be a “local product”<br />

• marketing costs at 30% of sales<br />

• manufacturing costs of 5%<br />

• 10% of sales to be paid as fees/royalties to Melanotan Corp. and formulation partners<br />

• launch costs of up to 20% of sales for the first year, amounting to approx. AUD 9 million<br />

The resultant after-tax NPV comes in at EUR 0.91 (AUD 1.57) for all three markets (preventative,<br />

therapeutic and cosmetic) in the ANZ region.<br />

Our DCF-derived fair value for the <strong>EpiTan</strong> Group as a whole is based on the same revenue assumptions<br />

described above in the NPV per product assessment, and included sales in the three markets together with<br />

ANZ revenues. It also included a small revenue stream from the three additional products (Linotar, Exorex,<br />

Zindaclin) collectively making up AUD 3-5 million per year (on average) in sales from 2007 onward.<br />

Management has indicated that they hope to have 6 products altogether in their product portfolio by the<br />

end of their current fiscal year, all of which are either awaiting registration or are currently on the market.<br />

We will receive more of an update in the coming weeks, and have only factored in the three products<br />

mentioned into our model. The DCF further included some general expenses incurred by the Group which<br />

have not been factored into the NPV analysis by product.<br />

The DCF model generates a fair value of EUR 2.13 per share, or AUD 3.63. This value is comparable with<br />

the first method of valuation: the sum of the NPV analysis by product of EUR 1.89 or AUD 3.29, excluding<br />

the ANZ region, and EUR 2.79 or AUD 4.85 including revenues from the ANZ region.<br />

Considering that all of these projections/estimates depend almost entirely on <strong>EpiTan</strong> securing a<br />

partner in the next 6 months, the stock is extremely speculative in our view. At the same time, the upside<br />

potential once a partner is announced seems magnificent. Thus, the current share price of EUR 0.50, or<br />

AUD 0.87 presents a clear buying opportunity as the stock stands to make significant gains in the next 6-<br />

12 months based on what Management has promised to be expected news flow: partner deal, phase III<br />

trials, other formulations, etc. Furthermore, at a price of EUR 0.50, a modest risk could be worth taking.<br />

We initiate coverage of <strong>EpiTan</strong> with a SPECULATIVE BUY recommendation. Our initial target price is<br />

set at EUR 2.00 or AUD 3.50 per share, close to the average of the fair values derived through the DCF<br />

method and the NPV assessment.<br />

- 10 -

Clinical Trials Summary<br />

Clinical phase<br />

Phase I/II<br />

Pharmacokinetic<br />

Initiation/Completion<br />

ended Nov/Dec 2001<br />

Phase II<br />

Sunburn Study<br />

ended Q3/2003<br />

Phase Ib<br />

Implant dose/<br />

Escalation study<br />

Phase II<br />

Genotype<br />

Study<br />

Began Nov 2003<br />

Resumed June 2004<br />

with batch of smaller<br />

Implants<br />

Results Q4/2004<br />

commence late 2004<br />

Phase II<br />

PMLE study<br />

commence late 2004<br />

(European Winter)<br />

Phase III<br />

Sunburn injury<br />

commence mid-2005<br />

Location of the trial<br />

Royal Adelaide Hospital<br />

Royal Prince Alfred Hospital<br />

(Sydney)<br />

Royal Adelaide Hospital<br />

Q-Pharm facility<br />

Clive Berghofer Cancer<br />

Research Centre, Royal<br />

Brisbane Hospital<br />

Queensland Institute of<br />

Medical Research (QIMR)<br />

Germany, UK<br />

Global (Australia, US,<br />

Europe)<br />

Patients/treatment<br />

12 healthy volunteers<br />

Subcutaneous injections for<br />

10 consecutive days<br />

61 Melanotan-treated<br />

20 Placebo<br />

Subcutaneous injections<br />

3 X 10 day treatments (3<br />

months)<br />

Slow-release implant injected<br />

under the skin.<br />

6 patients received implant<br />

Nov 2003<br />

Caucasian subjects with<br />

genetic susceptibility to<br />

sunburn, skin cancer,<br />

skin sun allergy<br />

Patients with Polymorphic<br />

Light<br />

Eruption (PMLE)<br />

Treatment with slow-release<br />

implant<br />

1,000-2,000 healthy<br />

individuals<br />

Objective<br />

Safety and toxicity profile<br />

Efficacy in inducing a tan with<br />

reduced skin cell damage<br />

following controlled UV<br />

exposure<br />

Optimal dosage, safety,<br />

compliance, efficacy of the<br />

implant.<br />

To establish the safety and<br />

degree of tanning in these<br />

genetically predisposed subjects.<br />

Endpoint: reduction in<br />

symptoms (sunburn, rash,<br />

blisters, patches)<br />

Measurement of melanin<br />

increase<br />

Efficacy in inducing melanin<br />

production with reduced skin<br />

cell damage following controlled<br />

UV exposure<br />

Description of trial<br />

Rapid absorption rate, short halflife,<br />

increased levels of melanin in<br />

the skin<br />

Safe and no obvious side effects<br />

Significant increase in melanin.<br />

Melanin density increases 100% in<br />

fair skinned patients.<br />

Amount of skin cell damage,<br />

following controlled UV exposure,<br />

reduced by 50%.<br />

Melanin levels are increased in the<br />

skin by means other than by<br />

damaging the cells with UV<br />

radiation.<br />

In Feb 2004, results showed less<br />

Melanotan needed in implant. New<br />

batch with less drug under<br />

production. Trial was rescheduled<br />

with the smaller implant.<br />

Assays will be developed to detect<br />

melanin receptor deficiencies.<br />

PMLE affects 10-20% of population<br />

in northern latitudes. Study will<br />

determine the individuals to whom<br />

Melanotan can be of most benefit.<br />

<strong>EpiTan</strong> seeks partner to share<br />

costs, co-develop, market and sell<br />

Melanotan.<br />

Launch planned late 2006/early<br />

2007.<br />

Aktienflash

Currency Exchange Rates:<br />

1 AUD = 0.7267 USD = 0.5915 EUR<br />

Source:<br />

<strong>EpiTan</strong> Limited<br />

MIDAS Research GmbH<br />

www.reuters.com<br />

www.maxblue.de<br />

www.marketresearch.com<br />

www.yahoo.com.au<br />

www.bigcharts.com<br />

www.emedicine.com<br />

MIDAS Research Subscription<br />

If you like to receive our research directly by Email please register on our Web Site<br />

http://www.midasresearch.de under „RESEARCH ABO“<br />

Disclaimer<br />

This report is not suited for any individuals resident in any jurisdiction in which access to such reports is regulated by<br />

applicable laws. No investment decision must be based on any aspect of, or statement in, this report. If you are<br />

uncertain if this might apply in your case you should not access and consider this report.<br />

This publication was produced by MIDAS Research GmbH. It represents only a non-binding view of the development of the capital markets as<br />

well as of quoted companies and gives information about the composition and/or change of the model portfolio as composed by MIDAS Research<br />

GmbH. Purpose of the publication is to supply information for the shaping of a personal opinion. The publication does not constitute any<br />

investment advice or recommendation of certain stock exchange transactions and cannot replace professional investment advice. Each reader<br />

remains requested to consult his personal investment advisor to discuss a possible purchase or sale of any of the securities mentioned in the<br />

publication before carrying out any such investment transaction. Data and facts forming basis of this publication have not been separately<br />

verified by MIDAS Research GmbH and MIDAS Research GmbH does not assume any liability for the content of this publication. If this<br />

publication contains opinions as far as the future development of prices of securities or of the business development of enterprises is concerned<br />

these are mere forecasts. The probability that forecast circumstances materialize is subject to substantial risk and can be assured in no way. Any<br />

views expressed in the publication or information about the model portfolio composed by MIDAS Research are only valid for the point in time as<br />

stated on the report and may change at any time without further notice.<br />

MIDAS Research GmbH does not conduct own account trading in shares or related derivatives of the companies discussed in this publication. This<br />

applies also to the authors and other persons connected with MIDAS Research GmbH, if they are familiar with the content of the publication or<br />

could have been familiar due to their business relation with MIDAS Research GmbH, however MIDAS Research GmbH does not assume any<br />

liability to the aforementioned.<br />

If MIDAS Research GmbH directly or indirectly maintains or has directly or indirectly maintained within the last five calendar years Paid<br />

Research Agreements or other Service Agreements with companies mentioned in this report these companies are indicated in the following:<br />

<strong>EpiTan</strong> <strong>Ltd</strong>.<br />

Any reproduction, change or use of this publication without previous written agreement of MIDAS Research GmbH is inadmissible.<br />

EMAIL: info@midas-research.de INTERNET: http://www.midasresearch.de CONTACT: Simone Drepper (responsible) +49 621/430 613 0