Picasso - Pagan Osborne

Picasso - Pagan Osborne

Picasso - Pagan Osborne

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

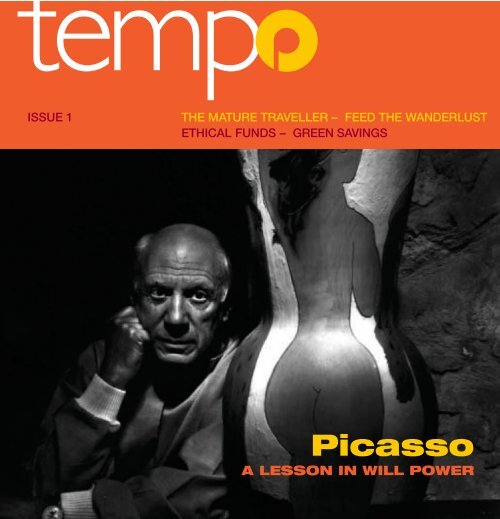

tempo<br />

ISSUE 1<br />

THE MATURE TRAVELLER – FEED THE WANDERLUST<br />

ETHICAL FUNDS – GREEN SAVINGS<br />

<strong>Picasso</strong><br />

A LESSON IN WILL POWER

Opening Soon<br />

<strong>Pagan</strong> <strong>Osborne</strong> Property Shop<br />

South Edinburgh

Contents<br />

2<br />

<strong>Picasso</strong><br />

A LESSON IN WILL POWER<br />

6<br />

The<br />

Ethical<br />

Funds<br />

GOOD FOR YOUR WALLET<br />

AND SAVING THE PLANET<br />

Regulars<br />

Ask the expert 5<br />

A week in the life of... 12<br />

Prop Idol<br />

HOW £2,000 CAN GET YOUR<br />

HOUSE READY FOR SALE<br />

4<br />

mature<br />

traveller<br />

RELEASING EQUITY TO FEED<br />

THE WANDERLUST<br />

9<br />

Financial<br />

PLANNING FOR THE FUTURE<br />

10Planning<br />

<strong>Pagan</strong> <strong>Osborne</strong> provides choices in life. As a firm,<br />

we offer a refreshing approach to managing and<br />

protecting your personal interests and assets and<br />

those of your family by combining legal, financial<br />

and property expertise.<br />

Our aim is to work with you to create a cohesive<br />

plan which provides direction and clarity around<br />

your personal affairs, helping you confidently meet<br />

and navigate the key stages in your life.<br />

Tempo is our magazine and it is designed to help<br />

guide you as you face up to important decisions.<br />

From buying your first property to making<br />

investments, from safeguarding your inheritance<br />

to planning for death, from obtaining the best<br />

advice on family relationships to managing the<br />

needs of the agricultural community and advising<br />

charities, Tempo will touch on subjects that<br />

shape your lives now and in the future.<br />

We hope you enjoy it.<br />

www.paganosborne.com<br />

tempo<br />

Tempo is published by <strong>Pagan</strong> <strong>Osborne</strong>, one of<br />

Scotland’s leading legal, financial and property<br />

specialists.<br />

<strong>Pagan</strong> <strong>Osborne</strong> is authorised and regulated by the<br />

Financial Services Authority.<br />

All rights reserved. Reproduction in whole or part<br />

without written permission is strictly prohibited.<br />

12 St Catherine Street, Cupar, Fife, KY15 4HH<br />

Cover image:<br />

Chouette Mate earthenware vase,<br />

No 200 of an edition of 200. Edition <strong>Picasso</strong> Madoura NMS<br />

© Succession <strong>Picasso</strong>/DACS 2007<br />

Acknowledgements:<br />

National Museum of Scotland<br />

Gillian Stuart<br />

Neville & Freda Walker<br />

Key Retirement Solutions<br />

temp<br />

1SSUE ONE 1

Prop Idol<br />

HOW £2,000 CAN GET YOUR<br />

HOUSE READY FOR SALE<br />

RELEASING EQUITY TO FEED<br />

THE WANDERLUST<br />

Selling your house can be one of life’s biggest<br />

stresses; a time when even the calmest of souls<br />

can turn into a nervous wreck.<br />

Worrying about getting the price you want, if<br />

the timing is right, or whether you should splash<br />

out on a new bathroom suite, means that moving<br />

home can cause its fair share of anxious<br />

moments. But not if you are prepared and ready<br />

for your ideal buyer.<br />

Getting your property looking good before it<br />

goes on the market is one of the best ways to<br />

ensure a stress-free sale. It doesn’t require a lot<br />

of effort or money either - a good clean and tidy,<br />

a few well placed props and some white paint<br />

can work wonders.<br />

Rob McGregor, a property valuer based at<br />

<strong>Pagan</strong> <strong>Osborne</strong>’s Queen Street office is used to<br />

advising clients on getting their homes ready for<br />

sale.<br />

He says: "A maximum of £2,000 would give a<br />

three bedroom house the ‘for sale’ makeover that<br />

could mean the difference between a quick sale<br />

and having the house languish on the market for<br />

months on end. It’s also an investment that is<br />

easily recouped in the sale price.<br />

"The reality is that whilst we love our homes<br />

and hope everyone will instantly feel the same<br />

way (whatever the state of the stair carpet)<br />

today’s purchasers want to see a house that they<br />

can quickly call their own. That means fresh<br />

neutral colours and simplicity.<br />

"So for a small amount of money, a new coat<br />

of paint, repairing some of the window locks,<br />

cleaning the carpets or replacing tired kitchen<br />

cupboards, can make a big difference. It’s money<br />

well spent.”<br />

2

Rob McGregor’s<br />

Top Tips<br />

By following Rob’s top tips, here’s how you can go<br />

to ‘des res’ in just ten steps:<br />

• Clear away clutter! Whether its children’s toys or<br />

lots of photographs, it’s important to tidy away<br />

belongings.<br />

• Look outside – has your property got kerb<br />

appeal? Look at the property as a whole; often<br />

gutters need to be cleared; a fresh, newly painted<br />

front door will appeal to buyers; as will plants and<br />

hanging baskets at the doorway.<br />

• Make the most of your property’s features. Don’t<br />

hide away period fireplaces, cornices, ceiling<br />

roses or paint over shutters: where possible<br />

restore them. Such features make properties<br />

unique.<br />

• When decorating, keep colours neutral<br />

remembering not everyone shares your taste.<br />

However, don’t go for cream carpets as they get<br />

dirty quickly; wooden floors are always a better<br />

option.<br />

• When it comes to dressing and preparing a<br />

property, those which look lived in sell better.<br />

Invest in stylish but not expensive furniture as this<br />

will aid the imagination of potential buyers.<br />

• If rooms are on the small or narrow side invest in<br />

some mirrors as they will instantly make the area<br />

look bigger.<br />

• Finishing touches, such as vases of freshly cut<br />

flowers and coloured olive oil bottles in the kitchen<br />

add some colour and provide a homely feel.<br />

• Kitchens and bathrooms help sell a property so<br />

make sure both are spotless and well presented.<br />

Put some nice soaps out and fresh, fluffy towels.<br />

• Make sure pets and children are out of sight.<br />

Giving undivided attention to purchasers is a must<br />

- you don’t want your furry companions or little<br />

angels running around riot distracting you.<br />

• Marketing is the key to a successful sale so look<br />

for flexible marketing packages and an estate<br />

agent that can make the process as hassle free<br />

as possible.<br />

Case<br />

Study<br />

Mother-of-three Gillian Stuart from Kirkcaldy has<br />

lived in her four bedroom cottage for a total of<br />

thirty years.<br />

Following a recent upgrade and<br />

refurbishment, Gillian is selling the property.<br />

She plans to downsize into a smaller home now<br />

that two of her children have flown the nest.<br />

Sharing her experience she says, "The<br />

cottage is truly a unique property retaining<br />

traditional feature fireplaces, fabulous cornices<br />

and plasterwork, as well as natural woodwork<br />

which has been stripped and enhanced over<br />

the years.<br />

"But the most recent transformation took<br />

about eight months to complete. In that time I've<br />

renewed two bathrooms with modern white suites<br />

adding complementary wall and floor tiling,<br />

upgraded the kitchen with a new cooker, sink,<br />

worktops, cabinet doors and stripped and sealed<br />

the floorboards.<br />

"I’ve also replaced fitted wardrobes in two of<br />

the bedrooms, laminated the entire upper floor,<br />

finally redecorating from top to bottom by<br />

co-ordinating neutral wall colours with window<br />

dressings and soft furnishings.<br />

"By creating a fresh blank canvas, new<br />

owners just need to move into the house,<br />

personalise it and enjoy."<br />

Looking for more information?<br />

Contact: Rob McGregor<br />

rmcgregor@pagan.co.uk<br />

temp<br />

1SSUE ONE 3

<strong>Picasso</strong> – a lesson in Will power<br />

Pablo <strong>Picasso</strong>, a 21st century icon, died at the<br />

age of 91 having lived a full life. For many, he was<br />

an artistic genius, who challenged<br />

perceptions and broadened horizons. He also<br />

had a string of lovers, four children by three<br />

women and two wives.<br />

Until the end of October, a fascinating<br />

exhibition is taking place at the National Museum<br />

of Scotland in Edinburgh that gives an insight into<br />

that genius as well as a glimpse at his rather<br />

colourful family life. <strong>Picasso</strong>: Fired with Passion is<br />

sponsored by <strong>Pagan</strong> <strong>Osborne</strong> and focuses on<br />

over 100 ceramics created at his Vallauris studio<br />

in the South of France, between 1947-61,<br />

drawings, paintings and many family<br />

photographs. It is well worth a visit.<br />

Interestingly, it might also provide a<br />

timely reminder to think about a Will.<br />

At the time of his death, <strong>Picasso</strong> left an<br />

estimated 1,885 paintings, 3,222 ceramic<br />

works, more than 1,200 sculptures, 7,000<br />

drawings and some 30,000 engravings, etchings,<br />

lithographs and tapestries. In addition, he left<br />

three French chateaux, two villas as well as cash<br />

and securities. Sources at the time put his<br />

estate at around $240m.<br />

But because <strong>Picasso</strong> left no Will, the trail left<br />

by his prolific personal life and his vast estate<br />

instantly became embroiled in a complex<br />

inheritance tangle, which took over four years to<br />

sort out. His life and death, therefore, offer a<br />

valuable lesson in why making a Will is so<br />

important.<br />

Visit <strong>Picasso</strong>: Fired with Passion at the<br />

National Museum of Scotland, Chambers Street,<br />

Edinburgh until 28th October 2007<br />

Why making a<br />

Will is important<br />

• A Will is a practical formality, which<br />

can prevent all kinds of unnecessary<br />

heartache in the event of someone’s<br />

death, as it legally states who is<br />

entitled to a share of the estate.<br />

• Some people may think that they don’t<br />

need a Will as their family will know<br />

what to do, or that it is a fatalistic<br />

omen. This is wrong.<br />

• It can be complicated when<br />

unmarried/non-Civil Partnership<br />

cohabiting couples do not have Wills,<br />

as although the surviving partner may<br />

make a claim to inherit some assets, it<br />

is the children who have the automatic<br />

right to them.<br />

• In such a situation, if there are no<br />

children, all of the deceased’s savings,<br />

personal items and sometimes even<br />

their share of the property, will be<br />

divided evenly between parents and<br />

siblings. The partner will be left with<br />

nothing unless he or she is successful<br />

in raising a costly court action within<br />

six months of their partner’s death.<br />

Looking for more information?<br />

Contact: Lianne Lodge<br />

llodge@pagan.co.uk<br />

4<br />

Chouette Mate earthenware vase,<br />

No 200 of an edition of 200. Edition<br />

<strong>Picasso</strong> Madoura NMS © Succession<br />

<strong>Picasso</strong>/DACS 2007<br />

Faune cavalier, silver<br />

platter. Studio Francois<br />

Hugo; 1977 Musée<br />

<strong>Picasso</strong>, Antibes ©<br />

Succession <strong>Picasso</strong>/<br />

DACS 2007<br />

6

ASK the expert<br />

1<br />

Fiona<br />

Gordon Brown<br />

wants us all to take<br />

out long term fixed<br />

rate mortgages.<br />

Is this a good idea?<br />

2<br />

Rachael<br />

I want to put money<br />

away for my<br />

grandchildren, what<br />

is the best way to<br />

go about this?<br />

I am about to get<br />

married and have<br />

heard a lot about<br />

pre-nuptial<br />

arrangements. We<br />

don’t have much, so<br />

is it something we<br />

3should think about?<br />

John Ross, managing consultant at <strong>Pagan</strong><br />

<strong>Osborne</strong> Independent Financial Advisers, says,<br />

"Proceed with caution! Long term fixed rate<br />

mortgages tend to come with a lot of<br />

restrictions; they have a higher interest rate and<br />

incur large penalties if you wish to change<br />

lender before your fixed period draws to an end.<br />

"Although signing up to a long term rate can<br />

offer peace of mind, it is also a long term<br />

gamble. If interest rates move up or down, they<br />

will either leave you feeling very smug or<br />

annoyed. With the majority of people barely<br />

looking beyond the next five years of their lives,<br />

their personal circumstances could dramatically<br />

change within the next 10-15 years, which is<br />

why it’s better to choose a mortgage that is<br />

fixed for two-five years as it offers a great<br />

degree of flexibility, unlike a long term fixed<br />

rate."<br />

McDonald, associate at <strong>Pagan</strong> <strong>Osborne</strong><br />

suggests, "From an Inheritance Tax (IHT)<br />

perspective, gifting during your lifetime can be a<br />

very sensible idea as it can also reduce potential<br />

IHT liabilities. In each tax year, you can gift<br />

£3,000 tax-free and can carry this forward one<br />

year if it is not fully utilised.<br />

"Additionally, if your intention is to make regular<br />

gifts to your grandchildren, the transfers may be<br />

able to be structured in such a way that would<br />

enable the gift to be treated as an exempt<br />

transfer for IHT, providing it is possible to show<br />

that the gifts you make are out of excess<br />

income so that your standard of living will not be<br />

affected.<br />

"Also, if you do not wish the funds to be<br />

transferred outright to your grandchildren,<br />

perhaps because they are young, a Child Trust<br />

Fund could be considered<br />

which would allow<br />

for flexibility and<br />

protection."<br />

Kelsey, partner at <strong>Pagan</strong> <strong>Osborne</strong> and<br />

family law specialist, said, "If you’re<br />

contemplating marriage, particularly second<br />

time around and own your own home, have<br />

savings, investments or other assets like<br />

antiques or art, you would be well advised to<br />

enter into a pre-nuptial agreement.<br />

"Pre-nups are now common in Scotland - the<br />

Family Team have prepared more this year than<br />

ever before. It’s not that our clients aren’t<br />

romantic - they’re simply realistic and know that<br />

there is a chance that their relationship might<br />

not last. They want to protect the assets that<br />

they have when they marry and to be able to<br />

avoid the uncertainty and expense of litigation<br />

in the future; they want to be able to decide<br />

themselves what they think is fair for them."<br />

temp<br />

1SSUE ONE 5

The mature<br />

traveller<br />

RELEASING EQUITY TO FEED THE WANDERLUST<br />

When Neville Walker took early retirement 17<br />

years ago, he and his wife Freda knew they<br />

wanted to live life to the full.<br />

Living in the family home, which Neville<br />

inherited from his father and with no dependants,<br />

the 67 year old couple have always enjoyed<br />

travelling, visiting various countries and, in<br />

particular, the USA.<br />

Now relying on police and state pensions to<br />

support their ever increasing living costs, Neville<br />

and Freda looked at other options to fuel their<br />

wanderlust. They needed extra income to fulfil<br />

their desire for travelling, but wanted a solution<br />

that would allow them to remain in their much<br />

loved home.<br />

Living in a 400 year old farmhouse and with<br />

no mortgage to pay, the couple were able to turn<br />

some of the value of their home into income,<br />

through a scheme called equity release.<br />

Neville said:<br />

"IT’S VERY SATISFYING TO KNOW<br />

WE HAVE SUFFICIENT FUNDS<br />

COMING IN. WE HAVE GREAT PEACE<br />

OF MIND KNOWING THAT BILLS CAN<br />

BE PAID AND WE CAN STILL<br />

TRAVEL AND ENJOY OURSELVES IN<br />

OUR RETIREMENT."<br />

"Recently, we returned from a trip to<br />

Yellowstone Park in Wyoming. Because I enjoy<br />

hunting, in particular deer stalking, we<br />

decided to go on a hunt, but as the rules of the<br />

National Parks don’t permit mechanical vehicles,<br />

horseback was the only method of travelling up<br />

the Rockies.<br />

"Although Freda and I had never been<br />

horseback riding before, we took a deep breath<br />

and decided to give it a go. We endured a three<br />

day riding course on Dartmoor prior to flying out<br />

and spent another three days riding and<br />

acclimatising at 9,000 feet above sea level before<br />

riding into the hills.<br />

"The experience was exhilarating. We slept<br />

under the stars, although it was known that grisly<br />

bears inhabited that region, but the fear was soon<br />

overcome when we sat back at the camp and<br />

saw all the stars in the sky flickering away. We<br />

also cooked and ate our food over the<br />

campfires and had a wonderful time. This isn’t<br />

the type of travelling experience you’d expect<br />

from a couple well into their 60’s, but we’re young<br />

at heart and enjoy living life to the full."<br />

Neville and Freda currently enjoy two or three<br />

holidays a year, which all seem to turn into<br />

adventures! They have booked another trip to<br />

Wyoming this autumn where they will trek through<br />

the Rockies on horseback, go fishing in remote<br />

trout streams and relax in the peaceful<br />

surroundings of a 300,000 acre ranch. The<br />

couple will also be making a return visit to<br />

Texas next year to visit some old friends – a<br />

holiday they have enjoyed taking for the<br />

past 17 years.<br />

inheritance tangle, which took over four years to<br />

sort out. His life and death, therefore offer a<br />

valuable lesson in why making a Will is so<br />

important.<br />

Visit <strong>Picasso</strong>: Fired with Passion at the<br />

National Museum of Scotland, Chambers<br />

Street, Edinburgh until 28th October 2007<br />

6

Neville and Freda Walker on horseback in Yellowstone<br />

Park in Wyoming<br />

temp<br />

1SSUE ONE 7

What is equity<br />

release?<br />

Equity release allows you to free tax-free<br />

cash from your home to boost your<br />

finances in retirement. The two main types<br />

of equity release plan available are lifetime<br />

mortgages and home reversion. Both types<br />

of equity release plan allow you to:<br />

• safely release equity from your home<br />

• spend the cash as you wish<br />

• make no monthly repayments<br />

• stay in your home for life<br />

If you want to release equity to go feed the<br />

wanderlust of travelling like Neville and<br />

Freda Walker, you need to:<br />

• speak to a financial adviser<br />

• decide realistically how much equity you<br />

can and are able to release<br />

• ask, are you planning on bequeathing<br />

your property to family? If so, decide<br />

how much of the estate value you wish<br />

to leave<br />

Looking for more information?<br />

Contact: John Ross<br />

jross@pagan.co.uk<br />

8

Ethical funds SOCIAL CONSCIENCE CAN BE GOOD<br />

FOR YOUR WALLET AND YOU CAN SAVE THE PLANET<br />

The stock market wouldn’t generally be the first<br />

thing you’d think of if you were looking for ways<br />

to improve the world around you and leave it<br />

better than you found it. And yet, ethical<br />

investment is one of the fastest growing areas of<br />

the market, with "green" funds expected to top<br />

£7 billion this year.<br />

The origins of moral investing date back to the<br />

early 20th century when the Methodist Church<br />

decided to invest in the stock market with a view<br />

to avoid firms with an involvement in gambling<br />

and alcohol. In 1984, Friends Provident launched<br />

the first ethical fund for private investors (now<br />

managed as the F&C Stewardship Growth Fund)<br />

and nowadays, there are over 90 ethical funds to<br />

choose from. So there has never been more<br />

choice should you wish to keep your money<br />

clean and green.<br />

But does this sound too good to be true?<br />

Is it really possible to invest profitably and ethically<br />

at the same time? Well – yes and no.<br />

To understand the financial implications<br />

of ethical investment, it’s important<br />

to understand what it means in<br />

the first place.<br />

Here, St Andrews Asset<br />

Managers, part of <strong>Pagan</strong><br />

<strong>Osborne</strong>, offer some<br />

guidance.<br />

Lindsay Fraser head of St Andrews Asset<br />

Managers (SAM) says,<br />

“Investing ethically means different things to<br />

different people, but for the majority, it means<br />

investing in line with their principles.<br />

“For some, it may be avoiding certain sectors<br />

or stocks within the market, such as tobacco,<br />

armaments, alcohol, gambling or pornography.<br />

For others, it may be ruling out pharmaceuticals<br />

because of animal testing, or oil testing due to the<br />

environmental damage they cause.”<br />

What is the difference between light green<br />

and dark green funds?<br />

Ethical funds are sometimes defined on a scale<br />

from light green to dark green. Light green<br />

funds are those using some ethical principles,<br />

whereas dark green investments are those that<br />

adhere to strict ethical criteria.<br />

But as investors are becoming more<br />

discerning nowadays and are looking for a<br />

positive commitment from companies that are<br />

actively behaving in a socially responsible way,<br />

there is a third level of ethical investment whereby<br />

investors will call upon fund managers to engage<br />

with firms in order to help them improve their<br />

policies. Therefore, it is possible for people to get<br />

an ethical fund investing in the likes of a tobacco<br />

company in order to put pressure on the<br />

company to behave responsibly towards its<br />

suppliers, employees and customers.”<br />

Will my savings grow more using an ethical<br />

investment vehicle?<br />

Like all investment tools, the peaks and troughs<br />

of the market conditions, coupled with the<br />

sectors people have invested in can either<br />

produce returns significantly better or worse.<br />

Although ethical unit trusts or Open-Ended<br />

Investment Companies have more or less<br />

matched the wider market over the past five<br />

years, there have been times when this has<br />

not always been the case and green investors have<br />

missed out on some major market themes. The<br />

general consensus is that greenness can come at a<br />

cost, so it’s important to seek the right advice.<br />

What ethical funds are worth investigating<br />

further?<br />

A good place to start is to sit down with a fund<br />

manager at SAM. The most important thing, as<br />

with all investment decisions, is for you to<br />

understand the implications of whichever route<br />

you take, and for this you can’t beat good<br />

professional advice.<br />

If you are ready to delve further EIRIS is the<br />

leading provider of independent research into the<br />

social, environmental and ethical performance of<br />

companies – www.eiris.org. Insight Investment,<br />

has also been leading the way in socially<br />

responsible investing and it’s worth taking a look at.<br />

www.insightinvestment.com has a wealth of<br />

helpful information.<br />

Looking for more information?<br />

Contact: Lindsay Fraser<br />

lcfraser@pagan.co.uk<br />

temp<br />

1SSUE ONE 9

Financial<br />

Planning<br />

A FATHER-OF-TWO HOPES TO TAKE EARLY<br />

RETIREMENT, BUT WITH TWO YOUNG CHILDREN<br />

IN PRIVATE EDUCATION HE KNOWS HE NEEDS<br />

TO GET ORGANISED<br />

Self-employed IT consultant Michael Jamieson*<br />

has enjoyed a successful career, but is looking<br />

forward to the day when he can switch off his<br />

computer for the very last time. Now 47, he<br />

has always hoped to retire well before he<br />

reaches the age of 65.<br />

However, with two small boys, the matter<br />

of school fees may affect his plans.<br />

Mike’s eldest son has just started his<br />

primary education at one of Edinburgh’s<br />

leading public schools, with the younger boy<br />

expected to attend the same school in three<br />

years time. With the average cost of private<br />

education to 18 now around £100,000, Mike<br />

has made a big commitment. He will also be<br />

63 by the time his youngest child finishes<br />

school.<br />

To supplement his own income, Mike’s wife<br />

works part time and the family has two rental<br />

properties (one which is mortgage free and the<br />

other which has a 50% buy-to-let mortgage).<br />

In addition, Mike has two pensions, which he’s<br />

being paying into for the past 20 years and a<br />

handful of other investments.<br />

Mike says: "Ever since I got my first proper<br />

wage packet over 20 years ago, planning for<br />

retirement has always been in my mind. I’ve<br />

always been careful and believed in setting<br />

aside a sum of money each month to be<br />

invested into company pensions and savings<br />

accounts to assist in leading a more<br />

comfortable lifestyle. Now that the children<br />

have come along and my financial situation has<br />

changed I am conscious that I need to review<br />

my financial position, if I still hope to take early<br />

retirement."<br />

*Our client’s name has been changed<br />

inheritance tangle, which took over four years to<br />

sort out. His life and death, therefore offer a<br />

valuable lesson in why making a Will is so<br />

important.<br />

Visit <strong>Picasso</strong>: Fired with Passion at the<br />

National Museum of Scotland, Chambers<br />

Street, Edinburgh until 28th October 2007<br />

10

Here’s what the experts say<br />

John Ross, managing consultant for <strong>Pagan</strong><br />

<strong>Osborne</strong> Independent Financial Advisers, says:<br />

"Whilst planning for retirement is prudent, the big<br />

question Mike needs to ask himself is what if he<br />

loses his income through illness or even death? It<br />

is not just a case of taking out an ‘insurance<br />

policy’, but making sure his future family<br />

aspirations are protected if such an event<br />

happens.<br />

"It is necessary that Mike reviews his current<br />

provision to ensure that should such incidents<br />

arise, his family will at least have no financial<br />

worries and their future plans can continue as<br />

hoped. Therefore, various contracts, such as term<br />

assurance and critical illness cover must be<br />

considered.<br />

"Also, Mike’s future retirement income could<br />

be at risk if his current income is lost, so it is<br />

important that he thinks about income protection<br />

as well to enable him to continue to contribute to<br />

his pension."<br />

Looking for more information?<br />

Contact: John Ross<br />

jross@pagan.co.uk<br />

Lindsay Fraser, head of St Andrews Asset<br />

Managers, part of <strong>Pagan</strong> <strong>Osborne</strong>, suggests:<br />

"Mike has a number of investments and looks to<br />

have taken the right route in terms of<br />

diversification as he has a very balanced portfolio.<br />

He has the right balance between ‘risky’ and<br />

‘non-risky’ assets in that he needs the capital<br />

growth from the risky ones to keep up with<br />

school fee inflation, plus some stability and<br />

flexibility to allow for unexpected events.<br />

"In terms of what Mike can do to see his<br />

finances work more effectively, he needs to sit<br />

down now with a wealth management specialist<br />

and agree a cashflow projection covering<br />

expected income versus expenditure that will<br />

allow him to plan the next 16 years with<br />

confidence. It would also be worth reviewing<br />

his overall financial position to make sure he’s<br />

contributing the right amount to his pension."<br />

Looking for more information?<br />

Contact: Lindsay Fraser<br />

lfraser@pagan.co.uk<br />

Anona Simpson-Greig, solicitor at <strong>Pagan</strong><br />

<strong>Osborne</strong>, suggests Mike could use trusts as a<br />

way of paying for the children’s education. "The<br />

secret to planning for school fees is to start as<br />

early as possible," she says. "And Mike is in a<br />

good position as he is already considering how<br />

he will fund his sons’ education and has<br />

established various strategies already.<br />

"One option is to speak to the grandparents.<br />

They are often seeking to minimise their<br />

Inheritance Tax (IHT) bill and it can therefore be<br />

useful for them to help with school fees by setting<br />

up a Discretionary Trust for the benefit of the<br />

grandchildren. Money can be added into the<br />

Trust and this will be tax free as long as the sum<br />

is less than the Nil Rate Band (NRB) for IHT which<br />

is currently £300,000. The funds will grow over a<br />

period of time and the fund can be used to pay<br />

the school fees. As long as the value of the Trust<br />

remains under the NRB, then no Inheritance Tax<br />

will be due. This also offers the benefit of<br />

transferring the tax liability on future income and<br />

Capital Gains Tax to the children to utilise their<br />

own personal annual allowances."<br />

Looking for more information?<br />

Contact: Anona Simpson-Greig<br />

asimpson-greig@pagan.co.uk<br />

temp<br />

1SSUE ONE 11

A Week in the Life of…<br />

The countdown<br />

is on!<br />

Not only am I an associate at <strong>Pagan</strong><br />

<strong>Osborne</strong> in the Trusts & Charities Team<br />

based between Edinburgh and Cupar – I<br />

am also trying to organise my wedding.<br />

Welcome to the diary of a very manic<br />

Anona Simpson-Greig<br />

(aka FMG, the Future Mrs Gow!).<br />

Monday<br />

Wedding panic attacks, 0; Calls from<br />

Mother, 8; Client Meetings,1<br />

After a blissful weekend hunting for wedding<br />

dresses all over Scotland, I am now<br />

concentrating on drafting a complex but<br />

interesting Charitable Trust for an elderly client.<br />

I met her this morning. I am so glad she’s<br />

doing this because she would really like her<br />

estate to make a difference and this way she<br />

12<br />

will be remembered and her good works will<br />

continue. I’m also swamped with dealing with<br />

weekend mail and telephone messages but it all<br />

gets done. I mean to start this week as I intend<br />

to continue: with no wedding panics at all and<br />

being thoroughly organised.<br />

Tuesday<br />

Wedding panic attacks, 2; Calls from Mother, 5;<br />

Client Meetings, 3<br />

Disaster – invitations and orders of service were<br />

due to arrive today and they haven’t – panic<br />

attack number 1. Second attack followed rather<br />

quickly when I realised that the candles I bought<br />

for the table centre pieces don’t fit the candle<br />

sticks – why would this happen?<br />

I had various client meetings today to discuss<br />

Inheritance Tax planning and setting up Trusts.<br />

Met with two very different sets of clients, but<br />

who, nonetheless, want the same peace of mind.<br />

In the afternoon I met with new clients to discuss<br />

their Wills and Powers of Attorney and now have<br />

instructions to draft Deeds which will complement<br />

the family’s wishes. It’s a practical step that I know<br />

they found hard, but worthwhile. I try to<br />

encourage them that this should be reviewed<br />

every five years.<br />

Excellent end to a day which began badly!<br />

Wednesday<br />

Wedding panic attacks, 0; Calls from Mother,<br />

0; (Mother with friends all day so no access to<br />

telephone – hooray!!); Client Meetings,0<br />

Out at an Office of the Scottish Charity Regulator<br />

seminar all day discussing the merit of and how<br />

best to re-organise smaller charities to make them<br />

more cost effective and easier to deal with. This is<br />

a particularly salient subject for <strong>Pagan</strong> <strong>Osborne</strong>,<br />

rgh until 28th October 2007<br />

as it applies to some of our Charitable Trusts.<br />

Charities which were established several hundred<br />

years ago are often based round an outdated idea,<br />

which also may not be applicable to society now.<br />

Sometimes, these Trusts only hold a small amount<br />

of funds and therefore cannot bear the costs of<br />

administration. If these charities, however, are<br />

re-organised and amalgamated together, then the<br />

cost of administration can be shared.<br />

Thursday<br />

Wedding panic attacks, 1; Calls from Mother, 4;<br />

Client Meetings, 2<br />

Trauma, trauma, trauma – the marquee company<br />

will not return my calls which is so frustrating as I<br />

have a list of questions to go over with them. The<br />

Big Day is rapidly approaching.<br />

Determined not to be so inaccessible with my<br />

own clients, I pick up the phone to discuss Deeds<br />

of Variation as a good instrument of Inheritance<br />

Tax planning. My appointment at the end of the<br />

day was a fairly lengthy meeting with the Trustees<br />

of a Charitable Trust that I manage. This meeting<br />

went very well and good progress was made.<br />

Friday<br />

Wedding panic attacks, 3; Calls from Mother, 7;<br />

Client Meetings, 1<br />

I end the week on a bright note, I finished and sent<br />

out a draft Charitable Trust for approval and met a<br />

family this afternoon to discuss their family’s Trusts<br />

in light of the changes the Finance Act 2006<br />

introduced - keeping everything up-to-date.<br />

But its Friday and the weekend mayhem is<br />

about to begin. The schedule is all organised and all<br />

I have to worry about is the seemingly endless<br />

length of time it takes to make a wedding dress!<br />

t<br />

isit <strong>Picasso</strong>: Fired with Passion at the<br />

National Museum of Scotland, Chambers Street,<br />

Edinburgh until 28th October 2007

We’re with you every step of the way<br />

Providing choices in life

To find out more contact any one of <strong>Pagan</strong> <strong>Osborne</strong>’s offices<br />

Edinburgh<br />

55-56 Queen Street<br />

Edinburgh<br />

EH2 3PA<br />

Tel: 0131 226 4081<br />

Fax: 0131 220 1612<br />

Cupar<br />

12 St. Catherine Street<br />

Cupar<br />

Fife<br />

KY15 4HH<br />

Tel: 01334 653777<br />

Fax: 01334 655063<br />

St Andrews<br />

106 South Street<br />

St. Andrews<br />

Fife<br />

KY16 9QD<br />

Tel: 01334 475001<br />

Fax: 01334 476322<br />

Anstruther<br />

5a Shore Street<br />

Anstruther<br />

Fife<br />

KY10 3EA<br />

Tel: 01333 310703<br />

Fax: 01333 311918<br />

Or, visit our website at:<br />

www.paganosborne.com<br />

<strong>Pagan</strong> <strong>Osborne</strong> is authorised and regulated by the Financial Services Authority.