Adopted Budget FY 2012-2013 - Kerr County

Adopted Budget FY 2012-2013 - Kerr County

Adopted Budget FY 2012-2013 - Kerr County

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

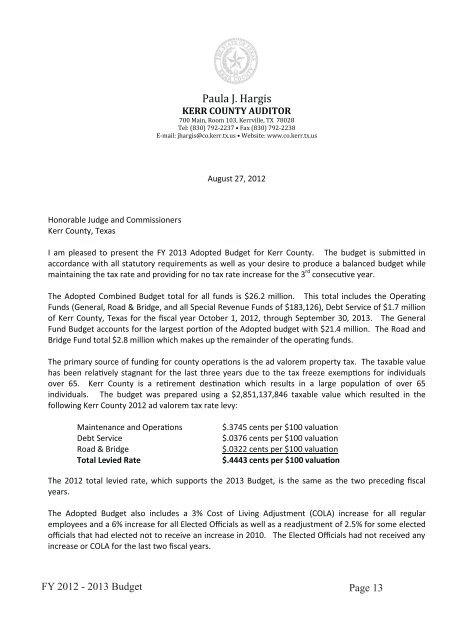

Paula J. Hargis<br />

KERR COUNTY AUDITOR<br />

700 Main, Room 103, <strong>Kerr</strong>ville, TX 78028<br />

Tel: (830) 792-2237 • Fax (830) 792-2238<br />

E-mail: jhargis@co.kerr.tx.us • Website: www.co.kerr.tx.us<br />

August 27, <strong>2012</strong><br />

Honorable Judge and Commissioners<br />

<strong>Kerr</strong> <strong>County</strong>, Texas<br />

I am pleased to present the <strong>FY</strong> <strong>2013</strong> <strong>Adopted</strong> <strong>Budget</strong> for <strong>Kerr</strong> <strong>County</strong>. The budget is submied in<br />

accordance with all statutory requirements as well as your desire to produce a balanced budget while<br />

maintaining the tax rate and providing for no tax rate increase for the 3 rd consecuve year.<br />

The <strong>Adopted</strong> Combined <strong>Budget</strong> total for all funds is $26.2 million. This total includes the Operang<br />

Funds (General, Road & Bridge, and all Special Revenue Funds of $183,126), Debt Service of $1.7 million<br />

of <strong>Kerr</strong> <strong>County</strong>, Texas for the fiscal year October 1, <strong>2012</strong>, through September 30, <strong>2013</strong>. The General<br />

Fund <strong>Budget</strong> accounts for the largest poron of the <strong>Adopted</strong> budget with $21.4 million. The Road and<br />

Bridge Fund total $2.8 million which makes up the remainder of the operang funds.<br />

The primary source of funding for county operaons is the ad valorem property tax. The taxable value<br />

has been relavely stagnant for the last three years due to the tax freeze exempons for individuals<br />

over 65. <strong>Kerr</strong> <strong>County</strong> is a rerement desnaon which results in a large populaon of over 65<br />

individuals. The budget was prepared using a $2,851,137,846 taxable value which resulted in the<br />

following <strong>Kerr</strong> <strong>County</strong> <strong>2012</strong> ad valorem tax rate levy:<br />

Maintenance and Operaons<br />

Debt Service<br />

Road & Bridge<br />

Total Levied Rate<br />

$.3745 cents per $100 valuaon<br />

$.0376 cents per $100 valuaon<br />

$.0322 cents per $100 valuaon<br />

$.4443 cents per $100 valuaon<br />

The <strong>2012</strong> total levied rate, which supports the <strong>2013</strong> <strong>Budget</strong>, is the same as the two preceding fiscal<br />

years.<br />

The <strong>Adopted</strong> <strong>Budget</strong> also includes a 3% Cost of Living Adjustment (COLA) increase for all regular<br />

employees and a 6% increase for all Elected Officials as well as a readjustment of 2.5% for some elected<br />

officials that had elected not to receive an increase in 2010. The Elected Officials had not received any<br />

increase or COLA for the last two fiscal years.<br />

<strong>FY</strong> <strong>2012</strong> - <strong>2013</strong> <strong>Budget</strong><br />

Page 13