November / December - Minnesota Precision Manufacturing ...

November / December - Minnesota Precision Manufacturing ...

November / December - Minnesota Precision Manufacturing ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

COVER STORY | MANUFACTURING<br />

Intellectual Property/<br />

National Security (continued)<br />

equipment for the lower-end product standing right next to<br />

IBM and Hewlett Packard equipment for the high-end runs.<br />

Interestingly enough, they have learned this concept from<br />

Americans.<br />

“Ultimately, why do we do business in China? They are<br />

inexpensive labor and aggressive towards capital. However,<br />

I must say that we must be deeply vigilant about both<br />

intellectual property and national security. We maintain<br />

control by splitting off processes between China and Korea<br />

so that no process is completely understood or managed at<br />

one site.<br />

“China is a tool to be utilized where appropriate.<br />

However, they are less and less attractive due to increasing<br />

costs of fuel, raw material and labor. For <strong>Minnesota</strong> Wire,<br />

China already is much less attractive today than it was even<br />

a year ago. Mandatory wage increases, as an example, are<br />

ranging 10 to 15 percent per year.<br />

“What I do know is that as we keep growing, especially<br />

as we design for robotics, we are better able to protect<br />

our intellectual property and our technology. Indeed,<br />

we are finding that it is cheaper to keep the new product<br />

manufacturing here. Total cost efficiencies include control,<br />

quality, quick turn . . . and they all impact our decisions.<br />

“I don’t want to give Asian manufacturers anything I<br />

don’t have to. As I see it, there’s a security issue with these<br />

countries. Technology absolutely is a security issue, and we<br />

intend to protect ourselves.”<br />

The Case for Offshore<br />

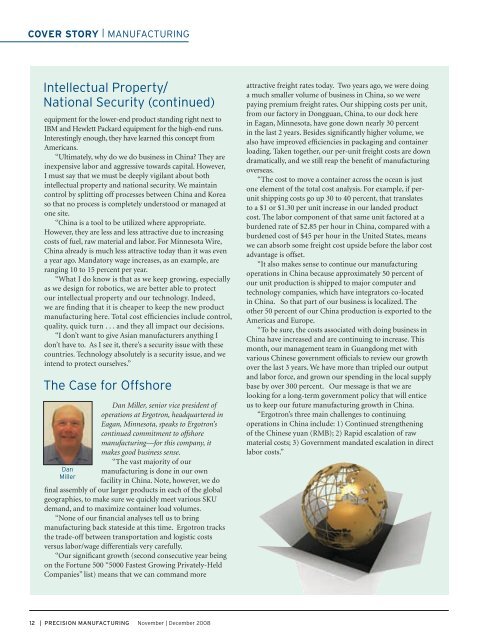

Dan<br />

Miller<br />

Dan Miller, senior vice president of<br />

operations at Ergotron, headquartered in<br />

Eagan, <strong>Minnesota</strong>, speaks to Ergotron’s<br />

continued commitment to offshore<br />

manufacturing—for this company, it<br />

makes good business sense.<br />

“The vast majority of our<br />

manufacturing is done in our own<br />

facility in China. Note, however, we do<br />

final assembly of our larger products in each of the global<br />

geographies, to make sure we quickly meet various SKU<br />

demand, and to maximize container load volumes.<br />

“None of our financial analyses tell us to bring<br />

manufacturing back stateside at this time. Ergotron tracks<br />

the trade-off between transportation and logistic costs<br />

versus labor/wage differentials very carefully.<br />

“Our significant growth (second consecutive year being<br />

on the Fortune 500 “5000 Fastest Growing Privately-Held<br />

Companies” list) means that we can command more<br />

attractive freight rates today. Two years ago, we were doing<br />

a much smaller volume of business in China, so we were<br />

paying premium freight rates. Our shipping costs per unit,<br />

from our factory in Dongguan, China, to our dock here<br />

in Eagan, <strong>Minnesota</strong>, have gone down nearly 30 percent<br />

in the last 2 years. Besides significantly higher volume, we<br />

also have improved efficiencies in packaging and container<br />

loading. Taken together, our per-unit freight costs are down<br />

dramatically, and we still reap the benefit of manufacturing<br />

overseas.<br />

“The cost to move a container across the ocean is just<br />

one element of the total cost analysis. For example, if perunit<br />

shipping costs go up 30 to 40 percent, that translates<br />

to a $1 or $1.30 per unit increase in our landed product<br />

cost. The labor component of that same unit factored at a<br />

burdened rate of $2.85 per hour in China, compared with a<br />

burdened cost of $45 per hour in the United States, means<br />

we can absorb some freight cost upside before the labor cost<br />

advantage is offset.<br />

“It also makes sense to continue our manufacturing<br />

operations in China because approximately 50 percent of<br />

our unit production is shipped to major computer and<br />

technology companies, which have integrators co-located<br />

in China. So that part of our business is localized. The<br />

other 50 percent of our China production is exported to the<br />

Americas and Europe.<br />

“To be sure, the costs associated with doing business in<br />

China have increased and are continuing to increase. This<br />

month, our management team in Guangdong met with<br />

various Chinese government officials to review our growth<br />

over the last 3 years. We have more than tripled our output<br />

and labor force, and grown our spending in the local supply<br />

base by over 300 percent. Our message is that we are<br />

looking for a long-term government policy that will entice<br />

us to keep our future manufacturing growth in China.<br />

“Ergotron’s three main challenges to continuing<br />

operations in China include: 1) Continued strengthening<br />

of the Chinese yuan (RMB); 2) Rapid escalation of raw<br />

material costs; 3) Government mandated escalation in direct<br />

labor costs.”<br />

12 | PRECISION MANUFACTURING <strong>November</strong> | <strong>December</strong> 2008