Financials - Santos

Financials - Santos

Financials - Santos

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

30. Share‐based Payment Plans (continued)<br />

(b) Executive Long‐term Incentive Programme (continued)<br />

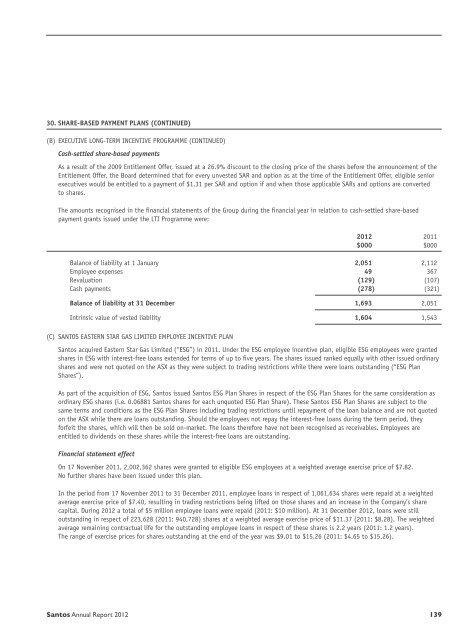

Cash‐settled share‐based payments<br />

As a result of the 2009 Entitlement Offer, issued at a 26.9% discount to the closing price of the shares before the announcement of the<br />

Entitlement Offer, the Board determined that for every unvested SAR and option as at the time of the Entitlement Offer, eligible senior<br />

executives would be entitled to a payment of $1.31 per SAR and option if and when those applicable SARs and options are converted<br />

to shares.<br />

The amounts recognised in the financial statements of the Group during the financial year in relation to cash‐settled share‐based<br />

payment grants issued under the LTI Programme were:<br />

2012 2011<br />

$000 $000<br />

Balance of liability at 1 January 2,051 2,112<br />

Employee expenses 49 367<br />

Revaluation (129) (107)<br />

Cash payments (278) (321)<br />

Balance of liability at 31 December 1,693 2,051<br />

Intrinsic value of vested liability 1,604 1,543<br />

(c) <strong>Santos</strong> Eastern Star Gas Limited Employee Incentive Plan<br />

<strong>Santos</strong> acquired Eastern Star Gas Limited (“ESG”) in 2011. Under the ESG employee incentive plan, eligible ESG employees were granted<br />

shares in ESG with interest‐free loans extended for terms of up to five years. The shares issued ranked equally with other issued ordinary<br />

shares and were not quoted on the ASX as they were subject to trading restrictions while there were loans outstanding (“ESG Plan<br />

Shares”).<br />

As part of the acquisition of ESG, <strong>Santos</strong> issued <strong>Santos</strong> ESG Plan Shares in respect of the ESG Plan Shares for the same consideration as<br />

ordinary ESG shares (i.e. 0.06881 <strong>Santos</strong> shares for each unquoted ESG Plan Share). These <strong>Santos</strong> ESG Plan Shares are subject to the<br />

same terms and conditions as the ESG Plan Shares including trading restrictions until repayment of the loan balance and are not quoted<br />

on the ASX while there are loans outstanding. Should the employees not repay the interest‐free loans during the term period, they<br />

forfeit the shares, which will then be sold on‐market. The loans therefore have not been recognised as receivables. Employees are<br />

entitled to dividends on these shares while the interest‐free loans are outstanding.<br />

Financial statement effect<br />

On 17 November 2011, 2,002,362 shares were granted to eligible ESG employees at a weighted average exercise price of $7.82.<br />

No further shares have been issued under this plan.<br />

In the period from 17 November 2011 to 31 December 2011, employee loans in respect of 1,061,634 shares were repaid at a weighted<br />

average exercise price of $7.40, resulting in trading restrictions being lifted on those shares and an increase in the Company’s share<br />

capital. During 2012 a total of $5 million employee loans were repaid (2011: $10 million). At 31 December 2012, loans were still<br />

outstanding in respect of 223,628 (2011: 940,728) shares at a weighted average exercise price of $11.37 (2011: $8.28). The weighted<br />

average remaining contractual life for the outstanding employee loans in respect of these shares is 2.2 years (2011: 1.2 years).<br />

The range of exercise prices for shares outstanding at the end of the year was $9.01 to $15.26 (2011: $4.65 to $15.26).<br />

<strong>Santos</strong> Annual Report 2012 139