Introduction, Contents, Foreword, From the Editorial Desk ... - MCX

Introduction, Contents, Foreword, From the Editorial Desk ... - MCX

Introduction, Contents, Foreword, From the Editorial Desk ... - MCX

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

A<br />

Joint Endeavour<br />

CommoditY insights<br />

Yearbook 2010<br />

A bAnk of ExCLuSIvE knowLEdgE And<br />

InforMAtIon on CoMModItIES ECoSyStEM<br />

Global Products<br />

Global Practices<br />

Sponsors

introduction<br />

About Commodity Insights<br />

The idea behind ‘Commodity Insights’, a bank<br />

of exclusive knowledge and information on<br />

commodities ecosystem jointly published by <strong>the</strong><br />

Multi Commodity Exchange of India and PricewaterhouseCoopers,<br />

is to provide readers/users<br />

(economic stakeholders like traders, processors,<br />

consumers, financial institutions, policymakers,<br />

analysts, industry observers, academicians, and<br />

students) with rare insights into <strong>the</strong> commodities<br />

ecosystem. This is our small second step in making<br />

this yearbook a benchmark resource spreading<br />

knowledge and providing very useful market<br />

information in one place in a novel way: presenting<br />

useful data related to commodity markets in an<br />

easy-to-use way and a rich repertoire of analytical<br />

articles to portray an all-inclusive, up-to-date and<br />

lucid exposition of a range of issues and concerns<br />

that are of paramount importance to healthy<br />

development of <strong>the</strong> entire ecosystem.<br />

The focal point of <strong>the</strong> second edition, ‘Commodity<br />

Insights Yearbook 2010’, is ‘Global<br />

Products, Global Practices’. Towards this goal, we<br />

have sought to achieve keen involvement of internationally<br />

acclaimed authors who all are experts as<br />

well as prolific writers in <strong>the</strong>ir respective domain,<br />

especially in <strong>the</strong> areas of policymaking and ideation.<br />

Besides, our value-adds this year will include<br />

specific case studies on ‘oil hedging and metals price<br />

risk management’, data on ‘BRIC economies’, data<br />

giving a broad perspective global economy, etc.<br />

The yearbook, we promise, will be truly useful to<br />

all stakeholders as a year-long, one-stop reference<br />

material. A fascinating and engaging read too!<br />

2 | Commodity Insights Yearbook 2010

About PwC<br />

PwC refers to <strong>the</strong> network of member firms of<br />

PricewaterhouseCoopers International Limited, each<br />

of which is a separate and independent legal entity<br />

committed to working toge<strong>the</strong>r to consistently provide<br />

clients seamless services of high standards, giving<br />

PwC a competitive edge. More than 161,000 people<br />

(over 6,000 in India) in 154 countries across <strong>the</strong> PwC<br />

network share <strong>the</strong>ir thoughts, experience and solutions<br />

to develop fresh perspectives and practical advice. The<br />

130-year old Indian firm – PricewaterhouseCoopers Pvt.<br />

Ltd. (www.pwc.com/India) – is <strong>the</strong> oldest and largest<br />

professional services firm that offers a comprehensive<br />

portfolio of Advisory and Tax & Regulatory services,<br />

each presenting a basket of finely defined deliverables.<br />

With a global outlook and local knowledge of culture,<br />

laws and business needs, PwC through its solutions to<br />

<strong>the</strong> challenges of globalization helps clients in India<br />

make <strong>the</strong> most of <strong>the</strong> changing market scenario. In<br />

India, PwC has offices in nine cities – Ahmedabad,<br />

Bangalore, Bhubaneshwar, Chennai, Delhi NCR,<br />

Hyderabad, Kolkata, Mumbai, and Pune.<br />

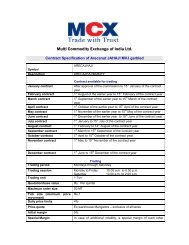

About <strong>MCX</strong><br />

Multi Commodity Exchange of India (<strong>MCX</strong>) is a<br />

demutualised commodity exchange with permanent<br />

recognition from <strong>the</strong> Government of India to facilitate<br />

online trading, clearing and settlement operations for<br />

commodity futures markets across <strong>the</strong> country. Since<br />

its inception in November 2003, millions of small<br />

and medium enterprises, corporate houses, exporters,<br />

importers and traders have benefitted from this<br />

nationwide electronic trading platform through its<br />

efficient and transparent price discovery and price risk<br />

management. <strong>MCX</strong> is <strong>the</strong> sixth largest commodity<br />

exchange in <strong>the</strong> world and ranks No. 1 in silver, No. 2<br />

in gold and natural gas, and No. 3 in crude oil and zinc<br />

futures trading (by <strong>the</strong> number of contracts traded),<br />

according to FIA and data on exchanges’ websites.<br />

A PwC & <strong>MCX</strong> Joint Endeavour | 3

<strong>Contents</strong><br />

<strong>Foreword</strong> ....................................................................................07<br />

<strong>From</strong> <strong>the</strong> <strong>Editorial</strong> <strong>Desk</strong> ................................................... 08<br />

Market Commentary:<br />

Commodity Markets – Poised to unlock value for <strong>the</strong><br />

stakeholders ...............................................................................10<br />

Experts’ Views:<br />

Commodity Exchanges: Role in a Globalising Economy<br />

- Jeffrey M. Christian .................................................................18<br />

Lessons from <strong>the</strong> Crisis: Future of Financial Regulation<br />

and Global Imbalances - Partha Ray .................................22<br />

Mumbai as an IFC – Role of Commodity Exchanges<br />

- Ashima Goyal ..........................................................................30<br />

Inter-Relation between Different Markets – Lessons for<br />

Commodities - Adam Gross ...................................................38<br />

Price Risk Management Instruments in Agriculture<br />

- Panos Varangis ........................................................................ 46<br />

Commodity Exposures – Best Practice Treatment for<br />

Hedge Accounting - Blaik Wilson ........................................52<br />

Carbon Markets: The Post-Copenhagen Scenario<br />

- Pamposh Bhat .......................................................................... 60<br />

Every effort has been made to ensure <strong>the</strong> high quality and accuracy of <strong>the</strong> content of <strong>the</strong> Yearbook. Under no circumstances, <strong>MCX</strong> and/or<br />

PwC shall not be liable to any user for unintended/accidental errors. The opinions/views expressed and shared by domain experts/authors<br />

in all documented materials are <strong>the</strong>ir own and do not necessarily reflect those of <strong>the</strong> organisations/institutions <strong>the</strong>y bear allegiance to,<br />

<strong>MCX</strong>, or PwC (<strong>the</strong> views shared by Jeffrey M. Christian, MD and Founder - CPM Group, are both his and <strong>the</strong> Group’s). Users/readers may<br />

carry out due diligence before using any data/information herein; nei<strong>the</strong>r <strong>MCX</strong> nor PwC will be responsible for any discrepancies/disputes<br />

arising out of such use.<br />

4 | Commodity Insights Yearbook 2010

Wea<strong>the</strong>r Derivatives: A Key Tool for Mitigating <strong>the</strong><br />

Impact of Climate Change – Rajas Parchure ................... 64<br />

Metal Price Risks – A New Reality - Jeffrey Bollebakker &<br />

Arnab Ghosh ................................................................................70<br />

Gas Pricing in India – Changing Contours<br />

- Deepak Mahurkar ....................................................................78<br />

Special Feature:<br />

Currency Futures - A Key to Managing Exchange<br />

Rate Risk .....................................................................................58<br />

Market Data for Ready Reference:<br />

Indian Economy - An overview ...........................................92<br />

Non-Agricultural Commodities .........................................132<br />

Agricultural Commodities ................................................. 226<br />

Emerging Commodities – Managing Price Risks for<br />

India Inc - Pankaj Chandak .....................................................86<br />

All rights reserved. No part of this publication may be reproduced, or transmitted in any form or by any means, electronic, mechanical,<br />

photocopying, recording, scanning, or o<strong>the</strong>rwise, without explicit prior permission of <strong>MCX</strong> or PwC.<br />

A PwC & <strong>MCX</strong> Joint Endeavour | 5

Tel. : +91-11-23782807<br />

+91-11-23070121<br />

Fax : +91-11-23384716<br />

e-mail: secy-ca@nic.in<br />

RAJIV AGARWAL<br />

Secretary<br />

Yeejle mejkeÀej<br />

GHeYeeskeÌlee ceeceues, KeeÐe SJeb meeJe&peefvekeÀ efJelejCe ceb$eeue³e<br />

GHeYeeskeÌlee ceeceues efJeYeeie<br />

ke=Àef

from <strong>the</strong> EDIToRIAL DESK<br />

Reaching Out<br />

to enrich <strong>the</strong> Ecosystem…<br />

In our continued commitment to<br />

enriching <strong>the</strong> commodity markets<br />

ecosystem, it is our pleasure<br />

to have joined hands once again<br />

to bring out <strong>the</strong> second edition of<br />

‘Commodities Insights Yearbook’.<br />

In line with <strong>the</strong> Multi Commodity<br />

Exchange’s stated focus on “global<br />

commodities and global practices”,<br />

we have reached out to some international<br />

experts, specialists in <strong>the</strong>ir<br />

respective domains, to contribute<br />

to <strong>the</strong> first part of <strong>the</strong> yearbook<br />

dedicated to continuous knowledge<br />

sharing and enrichment. The result<br />

of this knowledge delivery process<br />

is inside – for all stakeholders to<br />

read and benefit from. The experts’<br />

contributions cover multiple dimensions<br />

of commodity markets, from<br />

risk management in commodities/<br />

verticals to global best practices in<br />

markets and among <strong>the</strong>ir heterogeneous<br />

stakeholders to <strong>the</strong> role<br />

commodity exchanges can play in<br />

making Mumbai an International<br />

Financial Centre.<br />

Thanks to <strong>the</strong> warm response various<br />

ecosystem stakeholders and <strong>the</strong><br />

users of this yearly compendium<br />

have extended to our endeavour<br />

with <strong>the</strong>ir candid feedback, we have<br />

taken sincere efforts to provide an<br />

increased number of useful data<br />

sets on commodities and improve<br />

Standing (from left to right): Mr. Niteen Jain, Mr. Sujan Bhattacharyya, Ms. Vidya Shintre, Ms. Dhwani Mehta, Mr. Nazir Ahmed Moulvi, and Mr. Debojyoti Dey.<br />

Seated (from left to right): Dr. Kiran Karande, Ms. Carol Daver, and Dr. V. Shunmugam

<strong>the</strong> overall quality of <strong>the</strong> book<br />

based on <strong>the</strong>ir feedback.<br />

Having won several credentials<br />

in its journey to becoming India’s<br />

largest and <strong>the</strong> world’s sixth largest<br />

commodity exchange, driven<br />

by its strategic partnerships with<br />

various ecosystem players, it was<br />

time for <strong>MCX</strong> to focus on creating<br />

a global benchmark platform with<br />

worldwide-traded commodities,<br />

which would follow global benchmark<br />

practices to provide domestic<br />

economic stakeholders with a costeffective<br />

platform to mitigate <strong>the</strong><br />

forces of international commodity<br />

fundamentals in Indian time zone.<br />

priate guidance in <strong>the</strong>ir future<br />

decisions ranging from personal<br />

consumption to national economic<br />

policymaking.<br />

In our bid to reach out to a wider<br />

base of stakeholders – and give <strong>the</strong>m<br />

access to <strong>the</strong> yearbook – than <strong>the</strong><br />

limitation of a printed edition allows<br />

us to, we have already hosted <strong>the</strong><br />

electronic version of <strong>the</strong> first edition<br />

of ‘Commodity Insights’ on <strong>the</strong><br />

exchange website, www.mcxindia.<br />

com. It draws an average of 411 visitors<br />

everyday and has attracted nearly<br />

56,680 hits since it was uploaded in<br />

May-end. To inform those who are<br />

new to this joint endeavour of <strong>MCX</strong><br />

and PwC, <strong>the</strong> first issue was released<br />

on October 14, 2009.<br />

We would like to thank Mr. Jignesh<br />

Shah, Vice Chairman – <strong>MCX</strong>;<br />

Mr. Lamon Rutten, MD and CEO<br />

– <strong>MCX</strong>; Mr. Parveen Singhal, DMD<br />

– <strong>MCX</strong>; and Mr. Kumar Dasgupta,<br />

Partner – Price Waterhouse; for <strong>the</strong>ir<br />

continuous encouragement and<br />

support without which this initiative<br />

of ours would have remained<br />

unaccomplished. We also would<br />

PwC, which services clients <strong>the</strong><br />

world over in <strong>the</strong>ir efforts towards<br />

price risk management of globallytraded<br />

commodities, becomes<br />

<strong>MCX</strong>’s natural partner in this joint<br />

endeavour aimed at enlightening<br />

market participants, academicians,<br />

corporations, and policymakers<br />

with prices and <strong>the</strong> fundamentals<br />

that shape <strong>the</strong>m. We firmly believe<br />

that this effort of ours will help<br />

all <strong>the</strong>se stakeholders with approlike<br />

to thank Sujan Bhattacharyya,<br />

Niteen Jain, Nazir Moulvi, Dhwani<br />

Mehta and Debojyoti Dey, all from<br />

<strong>MCX</strong>, and Dr. Kiran Karande from<br />

Price Waterhouse for <strong>the</strong>ir relentless<br />

efforts, day in and day out, without<br />

which our idea would not have<br />

taken <strong>the</strong> shape of this book. It is our<br />

pleasure to acknowledge <strong>the</strong> work<br />

of summer interns from SCMHRD,<br />

Pune – Ms. Arshika Mishra, Mr.<br />

Ankit Dua and Mr. L. Deepak – on<br />

updating <strong>the</strong> data sets published in<br />

<strong>the</strong> 2009 edition. And finally, this<br />

message from <strong>the</strong> editorial desk will<br />

not be complete without thanking<br />

Ms. Carol Daver and Ms. Vidya<br />

Shintre who helped ga<strong>the</strong>r financial<br />

support for packaging this idea of<br />

ours in a most presentable manner.<br />

You may share your views,<br />

thoughts, and suggestions with<br />

us at ci@mcxindia.com, or at <strong>the</strong><br />

email addresses provided below;<br />

this surely will help us enrich<br />

‘Commodity Insights’ even fur<strong>the</strong>r<br />

in future attempts.<br />

Hope, you find this edition worth<br />

referring to, time and again.<br />

V. Shunmugam<br />

Chief Dr. V Sunmugam Economist<br />

Multi Commodity Exchange of India<br />

Kumar Dasgupta<br />

Dr. V Sunmugam<br />

Kumar Dasgupta<br />

Partner<br />

Kumar Dasgupta<br />

Price Waterhouse<br />

A PwC & <strong>MCX</strong> Joint Endeavour | 9

market CoMMENTARY<br />

Commodity Markets –<br />

Poised to unlock value<br />

for <strong>the</strong> stakeholders<br />

With gradual realisation and acceptance by<br />

economic stakeholders that in order to take<br />

necessary commercial decisions, <strong>the</strong>y have to<br />

factor in global (not just domestic) availability<br />

and prices of commodities, <strong>the</strong>re has also been<br />

a tacit recognition of <strong>the</strong> necessity of protecting<br />

commercial operations from <strong>the</strong> risks posed by<br />

high price volatility at <strong>the</strong> international level. An<br />

Ernst and Young survey in 2008 found that <strong>the</strong>re<br />

has been an overwhelming recognition of risks<br />

stemming from commodity price fluctuations<br />

and, thus, of <strong>the</strong> importance of hedging of inputs<br />

at pre-fixed prices as a risk-mitigating strategy.<br />

However, our markets, which are mature enough<br />

to unlock values for <strong>the</strong> stakeholders, now<br />

need an enabling environment that is based on<br />

imaginative and bold policy agenda.<br />

For reasons with multiple<br />

implications, commodities<br />

have been in <strong>the</strong> news for much<br />

of <strong>the</strong> period since ‘Commodities<br />

Insights’ made its appearance last<br />

autumn. Although much water<br />

has flown since <strong>the</strong>n, commodities<br />

with <strong>the</strong>ir varied economic dimensions<br />

have come to visit us more<br />

often, at times with a greater force<br />

than before. With globalisation of<br />

<strong>the</strong> Indian economy, nearly all<br />

its players – from tractor-driving<br />

farmers to jet-flying corporates –<br />

are getting exposed to <strong>the</strong> vagaries<br />

of international fundamentals<br />

affecting commodities that <strong>the</strong>y<br />

are concerned with. Whe<strong>the</strong>r<br />

<strong>the</strong> Indian economy is truly ‘decoupled’<br />

from <strong>the</strong> forces driving<br />

economies elsewhere in <strong>the</strong> world<br />

or not, particularly during a crisis<br />

scenario like <strong>the</strong> current one, our<br />

10 | Commodity Insights Yearbook 2010

market CoMMENTARY<br />

domestic commodity markets,<br />

undeniably, are linked to <strong>the</strong><br />

global fundamentals of demand,<br />

supply, policy actions and market<br />

expectations much more now than<br />

ever before.<br />

New global risks and<br />

increasing recognition<br />

of hedging<br />

With gradual realisation and acceptance<br />

by <strong>the</strong> country’s economic<br />

stakeholders that both global availability<br />

and prices of international<br />

commodities have to be factored<br />

in, to take <strong>the</strong> necessary production<br />

and o<strong>the</strong>r commercial decisions,<br />

<strong>the</strong>re is also a tacit recognition<br />

of <strong>the</strong> necessity of shielding <strong>the</strong>ir<br />

commercial operations from risks<br />

posed by commodity price volatility<br />

at <strong>the</strong> international level. A<br />

2008 survey by Ernst and Young<br />

(E&Y) across a broad range of<br />

Indian companies found that <strong>the</strong>re<br />

has been overwhelming recognition<br />

of <strong>the</strong> risks arising out of commodity<br />

price fluctuations and, thus,<br />

that of <strong>the</strong> importance of hedging<br />

of inputs at pre-fixed prices as a<br />

risk-mitigating strategy as per <strong>the</strong><br />

responses of most of <strong>the</strong> surveyed<br />

lot. Yet, protection against adverse<br />

commodity price movements is<br />

viewed more as a tactical measure<br />

than as a strategic device to manage<br />

risks.<br />

The effect of price volatility of various<br />

commodities on corporate bottom<br />

lines was amply demonstrated<br />

by a recent study carried out by a<br />

prominent Indian business daily.<br />

The study used quarterly results<br />

of over 1,500 manufacturing firms,<br />

which indicated that expenses on<br />

‘raw material’ had increasingly<br />

eaten away a higher share of <strong>the</strong><br />

o<strong>the</strong>rwise healthy performance of<br />

<strong>the</strong>ir sales.<br />

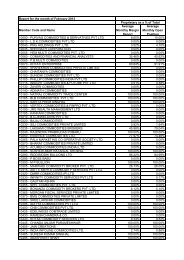

As <strong>the</strong> table shows, raw material<br />

expenses, which had, in fact,<br />

declined by 3.19% in December<br />

2009, increased by 59% in March<br />

2010 and 28 percent in June 2010<br />

for this large sample of companies.<br />

The expenses also consistently<br />

accounted for more than half <strong>the</strong><br />

sales since March 2010. Consequently,<br />

net profits of <strong>the</strong>se companies<br />

have been falling consistently<br />

over <strong>the</strong> past three quarters. And<br />

this is despite <strong>the</strong>ir net sales successfully<br />

wea<strong>the</strong>ring adverse world<br />

economic conditions to post robust<br />

year-on-year growth.<br />

Perhaps <strong>the</strong> companies could do<br />

pretty little to reduce <strong>the</strong>ir raw<br />

material bill. But what <strong>the</strong>y could<br />

have definitely done is to arrest<br />

<strong>the</strong> impact of commodity price<br />

volatility and, by extension, <strong>the</strong><br />

volatility in <strong>the</strong>ir net profits. As<br />

<strong>the</strong> table shows, increases in net<br />

profits gyrated wildly from 67.40%<br />

to 11.48% during <strong>the</strong> last three<br />

quarters. Evidently, a robust risk<br />

management tool like commodity<br />

futures trading to hedge against<br />

such volatility could have enabled<br />

<strong>the</strong>m to lock in input costs at predetermined<br />

levels. This, sadly, was<br />

not done to <strong>the</strong> desired extent by<br />

<strong>the</strong>se companies, a result of failure<br />

to take risk management from<br />

tactical to strategic levels by <strong>the</strong>ir<br />

management. What also added to<br />

<strong>the</strong>ir woes is lack of a policy and<br />

institutional environment that<br />

could promote risk management<br />

culture among <strong>the</strong>m.<br />

A similar survey of 1,100 companies,<br />

after <strong>the</strong>ir March 2010 quarter<br />

results were announced, was conducted<br />

by ano<strong>the</strong>r publication. The<br />

combined net profits of <strong>the</strong>se companies<br />

showed a marked increase<br />

of 28.5%, year on year. However, if<br />

<strong>the</strong> commodity companies (merely<br />

155 in all) were left out, <strong>the</strong> net<br />

profits of <strong>the</strong> rest fell by more<br />

than 9 percentage points to 19.8%!<br />

Conversely, <strong>the</strong> quarterly profits of<br />

<strong>the</strong>se 155 commodity companies<br />

grew by more than 103%, Y-o-Y, in<br />

March 2010, proving <strong>the</strong> dichotomous<br />

effect of commodity prices<br />

on corporate bottom lines.<br />

effect of commodity prices on corporate bottomlines<br />

Heads June ‘10 March ‘10 December ‘09<br />

Rs. /crore % change Rs. /crore % change Rs. /crore % change<br />

over over over<br />

June ‘09 March ‘09 Dec. ‘08<br />

Net sales 418,814 23.07 448,346 30.09 401,200 19.18<br />

Raw Mat. Expense 210,731 27.63 235,468 58.94 159,284 (-)3.19<br />

Raw Mat to sales (%) 50.32 1.80 52.52 9.53 39.70 (-)9.17<br />

Net Profit 43,419 11.48 47,649 40.92 48,218 67.40<br />

Source: Capitaline<br />

For an economy trying to wi<strong>the</strong>r<br />

<strong>the</strong> effects of <strong>the</strong> recent financial<br />

crisis on its foreign trade prospects,<br />

commodity price volatility has<br />

been a double whammy for its<br />

agriculture sector in <strong>the</strong> past one<br />

year. Such high volatility is, again,<br />

a result of Indian agricultural<br />

markets responding to signals emanating<br />

from international markets<br />

in an increasingly globalised world<br />

where rapid strides in information<br />

and communication technology<br />

(ICT) mean that <strong>the</strong> smallest news<br />

of relevance in <strong>the</strong> remotest part<br />

of <strong>the</strong> world can have its profound<br />

effect felt within domestic markets<br />

and that <strong>the</strong>re remains a structural<br />

12 | Commodity Insights Yearbook 2010

Healthy market growth<br />

– in need of policy<br />

initiatives<br />

Markets facilitating <strong>the</strong> trade in<br />

commodity-based derivatives in<br />

India are regulated under <strong>the</strong> Forcorrection<br />

of prices pending for<br />

long. The double whammy is due<br />

to volatility adversely impacting<br />

food prices and input costs and,<br />

thus, <strong>the</strong> bottom lines of industries<br />

using <strong>the</strong>m as raw materials. The<br />

state machinery often tries to<br />

intervene in <strong>the</strong> market to cushion<br />

both sides of <strong>the</strong> market by absorbing<br />

such volatility often at <strong>the</strong> cost<br />

of <strong>the</strong> exchequer.<br />

The moot point is that risks associated<br />

with commodity price spikes<br />

and volatility have, in recent times,<br />

risen considerably and affected<br />

more and more economic entities<br />

that are being exposed to risks<br />

associated with increasing volatility<br />

while being ever more aware of<br />

<strong>the</strong> impact of this exposure on <strong>the</strong>ir<br />

economic pursuits. While <strong>the</strong>y<br />

seek to cover <strong>the</strong>se risks through<br />

hedging against commodity price<br />

movements, how attractive does<br />

<strong>the</strong> market <strong>the</strong>y approach appear.<br />

The E&Y survey found nearly all<br />

respondents to hedge through<br />

recourse to plain vanilla products<br />

alone. Significantly, about 68% of<br />

<strong>the</strong>m had a hedging horizon of less<br />

than three months, indicating that<br />

<strong>the</strong>y could not explore possibilities<br />

of long-term hedging to protect<br />

long-term business cash flows.<br />

Clearly, <strong>the</strong>re is a demand for<br />

safe hedging through a variety of<br />

hedging instruments, many more<br />

than what <strong>the</strong> market currently<br />

provides. While OTC forward<br />

contracts can fulfil <strong>the</strong> demand<br />

for customised hedging products,<br />

<strong>the</strong>y lack <strong>the</strong> kind of liquidity<br />

and safety that exchange-traded<br />

and exchange-cleared derivatives<br />

provide. The market for <strong>the</strong> latter,<br />

unfortunately, seems to have<br />

run into a wall as <strong>the</strong> supply of<br />

67.4%<br />

To 11.5% – Companies’<br />

net profits gyrated, as<br />

wildly as this, in <strong>the</strong> past 3<br />

quarters. Surely, a robust risk<br />

management tool like commodity<br />

futures could have helped<br />

lock in input costs at<br />

predetermined<br />

levels.<br />

products has scarcely been able to<br />

match <strong>the</strong>ir ability and needs. The<br />

reason, as has been elucidated in<br />

several fora by several constituencies<br />

in recent years, is <strong>the</strong> slow pace<br />

of policy and institutional reforms<br />

for nurturing <strong>the</strong> use of commodity<br />

derivatives by <strong>the</strong> stakeholders<br />

in India.<br />

A PwC & <strong>MCX</strong> Joint Endeavour | 13

market CoMMENTARY<br />

ward Contracts (Regulation) Act,<br />

1952, an Act enacted in <strong>the</strong> backdrop<br />

of wartime shortages. Evidently, a<br />

market which has grown by nearly<br />

40% in <strong>the</strong> past four years to become<br />

one of <strong>the</strong> largest in <strong>the</strong> world<br />

(implying its enormous importance<br />

for <strong>the</strong> economy) and its products<br />

are reckoned as an investible asset<br />

class in <strong>the</strong> league of stocks and<br />

fixed income instruments, needs<br />

to function under <strong>the</strong> ambit of a<br />

market-enabling regime than this<br />

Act allows. The intended amendment<br />

to <strong>the</strong> Act is yet to see <strong>the</strong><br />

light of day, despite being at various<br />

stages of review by legislators for<br />

close to four years. As a result, not<br />

only is market development, incommensurate<br />

to <strong>the</strong> level of economic<br />

requirement being impossible to be<br />

taken up under <strong>the</strong> existing law but<br />

also that integration of <strong>the</strong> commodity<br />

futures market with <strong>the</strong><br />

physical ecosystem has been left<br />

incomplete. The reluctance of both<br />

capital and money market regulators<br />

to let <strong>the</strong>ir regulated entities<br />

enter <strong>the</strong> commodity futures market<br />

appears to be for two broad reasons:<br />

<strong>the</strong> lack of clear policy guidelines<br />

and <strong>the</strong> absence of an autonomous<br />

regulator for this market. Similarly,<br />

denying products such as options<br />

and intangibles, which could fulfil<br />

<strong>the</strong> hedging demand of a very large<br />

number of stakeholders – not <strong>the</strong><br />

least of who are from <strong>the</strong> farming<br />

community – is tantamount to<br />

keeping <strong>the</strong>se stakeholders away<br />

from an effective risk-mitigating<br />

device.<br />

That economic stakeholders are<br />

more prone to commodity price<br />

risks under effect of global forces<br />

has been well recognized by now.<br />

This has been <strong>the</strong> biggest contributor<br />

to <strong>the</strong> creation of <strong>the</strong> demand<br />

side of <strong>the</strong> commodities derivatives<br />

market. What has been less appreciated<br />

is <strong>the</strong> tremendous potential<br />

that a fast-growing large economy<br />

like India holds in <strong>the</strong> world of<br />

commodities market to get back<br />

its ancient price-setting power.<br />

Given <strong>the</strong> size of its population and<br />

nature and growth potential of its<br />

economy, India is one of <strong>the</strong> largest<br />

producers and/or consumers of<br />

most commodities. With liberalised<br />

markets – both physical and futures<br />

- and an accommodative policy<br />

regime that promotes new products<br />

and market participation from India<br />

and abroad, <strong>the</strong> commodity derivatives<br />

market in India can set global<br />

benchmarks not only in terms of<br />

prices discovered in its markets<br />

but also in terms of products and<br />

practices. Already, despite being<br />

under a relatively restrictive market,<br />

<strong>the</strong> country’s largest commodity<br />

futures exchange is <strong>the</strong> sixth largest<br />

in <strong>the</strong> world, occupying <strong>the</strong> top<br />

position in silver and second position<br />

in gold and natural gas. With<br />

an accommodative policy, India<br />

can definitely be <strong>the</strong> price-maker<br />

ra<strong>the</strong>r than a passive price-taker<br />

for most commodities in <strong>the</strong> world<br />

market, especially <strong>the</strong> ones that <strong>the</strong><br />

stakeholders actively trade in. Such<br />

policies would not only include<br />

Courage is not<br />

<strong>the</strong> absence of<br />

fear, but ra<strong>the</strong>r<br />

<strong>the</strong> judgment<br />

that something<br />

else is more<br />

important<br />

than fear<br />

Ambrose Redmoon<br />

those that promote futures trading<br />

in commodities but also remove <strong>the</strong><br />

hurdles on <strong>the</strong> way towards formation<br />

of a pan-India physical market<br />

for commodities setting up a solid<br />

platform for national commodity<br />

derivative markets.<br />

Today, as we stand at <strong>the</strong> cusp of<br />

history and a generation witnesses<br />

<strong>the</strong> transition of India from a<br />

poverty-stricken country to one<br />

of prosperity and economic might,<br />

<strong>the</strong> visages of control that inhibit<br />

this transition have to be identified<br />

and removed. Cynics argue against<br />

liberalising commodity markets for<br />

a range of imaginary fears, ranging<br />

from stoking fires of inflation to<br />

securing supplies of key intermediaries.<br />

But as our experience<br />

with liberalisation (toge<strong>the</strong>r with<br />

similar actions of <strong>the</strong> o<strong>the</strong>r emerging<br />

superpower, China) has clearly<br />

demonstrated, <strong>the</strong>re is much more<br />

to gain through liberalisation of<br />

markets and economy than to give<br />

into what <strong>the</strong> phantoms of imagination<br />

would lead us to believe.<br />

After all, <strong>the</strong> Indian economy has<br />

proven to be robust enough to<br />

withstand and emerge successfully<br />

from transitions and crises; and<br />

markets, under leadership-providing<br />

regulators, mature enough to<br />

unlock values for <strong>the</strong> economic<br />

stakeholders. What is needed now<br />

is only an enabling environment,<br />

created by an imaginative and bold<br />

policy agenda, so that <strong>the</strong>se values<br />

are reaped by all stakeholders to<br />

<strong>the</strong>ir fullest extent. As American<br />

writer Ambrose Redmoon once<br />

famously said, “Courage is not<br />

<strong>the</strong> absence of fear, but ra<strong>the</strong>r <strong>the</strong><br />

judgment that something else is<br />

more important than fear”, only<br />

some boldness in policymaking and<br />

a commitment towards fur<strong>the</strong>r<br />

liberalisation of economic forces<br />

can catapult us to <strong>the</strong> next level<br />

of growth<br />

14 | Commodity Insights Yearbook 2010

PricewaterhouseCoopers Pvt. Ltd.<br />

2nd Floor, 252, Veer Savarkar Marg, Shivaji Park, Dadar, Mumbai 400 028 (India)<br />

Phone: +91-22-6669 1000; Fax: +91-22-6654 7800<br />

Website: www.pwc.corn<br />

Multi Commodity Exchange of India Ltd.<br />

Exchange Square, CTS No. 255, Suren Road, Chakala, Andheri (East), Mumbai 400 093 (India)<br />

Tel: +91-22-6731 8888; Fax: +91-22-6649 4151<br />

Website: www.mcxindia.com