PDF version of this press release - Royal and Sun Alliance

PDF version of this press release - Royal and Sun Alliance

PDF version of this press release - Royal and Sun Alliance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

PART V<br />

ADDITIONAL INFORMATION<br />

1. Company Details<br />

The Company is domiciled in the United Kingdom with its registered <strong>of</strong>fice at 9th Floor, One<br />

Plantation Place, 30 Fenchurch Street, London EC3M 3BD. The telephone number <strong>of</strong> the Company’s<br />

registered <strong>of</strong>fice is 020 7111 7000.<br />

2. Interest <strong>of</strong> Related Parties<br />

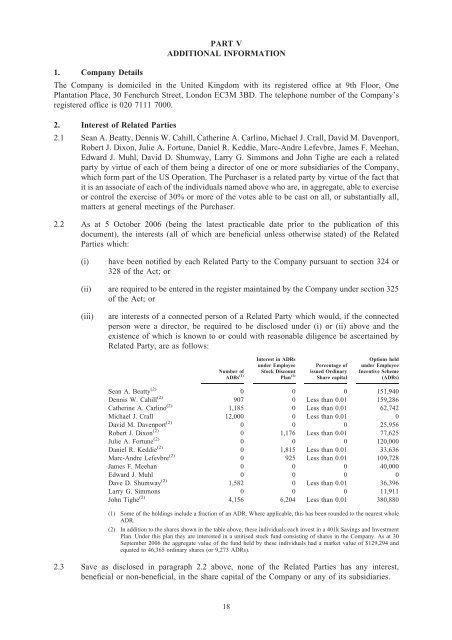

2.1 Sean A. Beatty, Dennis W. Cahill, Catherine A. Carlino, Michael J. Crall, David M. Davenport,<br />

Robert J. Dixon, Julie A. Fortune, Daniel R. Keddie, Marc-Andre Lefevbre, James F. Meehan,<br />

Edward J. Muhl, David D. Shumway, Larry G. Simmons <strong>and</strong> John Tighe are each a related<br />

party by virtue <strong>of</strong> each <strong>of</strong> them being a director <strong>of</strong> one or more subsidiaries <strong>of</strong> the Company,<br />

which form part <strong>of</strong> the US Operation. The Purchaser is a related party by virtue <strong>of</strong> the fact that<br />

it is an associate <strong>of</strong> each <strong>of</strong> the individuals named above who are, in aggregate, able to exercise<br />

or control the exercise <strong>of</strong> 30% or more <strong>of</strong> the votes able to be cast on all, or substantially all,<br />

matters at general meetings <strong>of</strong> the Purchaser.<br />

2.2 As at 5 October 2006 (being the latest practicable date prior to the publication <strong>of</strong> <strong>this</strong><br />

document), the interests (all <strong>of</strong> which are beneficial unless otherwise stated) <strong>of</strong> the Related<br />

Parties which:<br />

(i)<br />

have been notified by each Related Party to the Company pursuant to section 324 or<br />

328 <strong>of</strong> the Act; or<br />

(ii) are required to be entered in the register maintained by the Company under section 325<br />

<strong>of</strong> the Act; or<br />

(iii)<br />

are interests <strong>of</strong> a connected person <strong>of</strong> a Related Party which would, if the connected<br />

person were a director, be required to be disclosed under (i) or (ii) above <strong>and</strong> the<br />

existence <strong>of</strong> which is known to or could with reasonable diligence be ascertained by<br />

Related Party, are as follows:<br />

Number <strong>of</strong><br />

ADRs (1)<br />

Interest in ADRs<br />

under Employee<br />

Stock Discount<br />

Plan (1)<br />

Percentage <strong>of</strong><br />

issued Ordinary<br />

Share capital<br />

Options held<br />

under Employee<br />

Incentive Scheme<br />

(ADRs)<br />

Sean A. Beatty (2) 0 0 0 151,940<br />

Dennis W. Cahill (2) 907 0 Less than 0.01 159,286<br />

Catherine A. Carlino (2) 1,185 0 Less than 0.01 62,742<br />

Michael J. Crall 12,000 0 Less than 0.01 0<br />

David M. Davenport (2) 0 0 0 25,956<br />

Robert J. Dixon (2) 0 1,176 Less than 0.01 77,625<br />

Julie A. Fortune (2) 0 0 0 120,000<br />

Daniel R. Keddie (2) 0 1,815 Less than 0.01 33,636<br />

Marc-Andre Lefevbre (2) 0 925 Less than 0.01 109,728<br />

James F. Meehan 0 0 0 40,000<br />

Edward J. Muhl 0 0 0 0<br />

Dave D. Shumway (2) 1,582 0 Less than 0.01 36,396<br />

Larry G. Simmons 0 0 0 11,911<br />

John Tighe (2) 4,156 6,204 Less than 0.01 380,880<br />

(1) Some <strong>of</strong> the holdings include a fraction <strong>of</strong> an ADR. Where applicable, <strong>this</strong> has been rounded to the nearest whole<br />

ADR.<br />

(2) In addition to the shares shown in the table above, these individuals each invest in a 401k Savings <strong>and</strong> Investment<br />

Plan. Under <strong>this</strong> plan they are interested in a unitised stock fund consisting <strong>of</strong> shares in the Company. As at 30<br />

September 2006 the aggregate value <strong>of</strong> the fund held by these individuals had a market value <strong>of</strong> $129,294 <strong>and</strong><br />

equated to 46,365 ordinary shares (or 9,273 ADRs).<br />

2.3 Save as disclosed in paragraph 2.2 above, none <strong>of</strong> the Related Parties has any interest,<br />

beneficial or non-beneficial, in the share capital <strong>of</strong> the Company or any <strong>of</strong> its subsidiaries.<br />

18