PDF version of this press release - Royal and Sun Alliance

PDF version of this press release - Royal and Sun Alliance

PDF version of this press release - Royal and Sun Alliance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(iii)<br />

Daniel R. Keddie entered into a severance agreement dated 29 March 2005. His current<br />

basic salary is US$215,000 per annum.<br />

Both <strong>Royal</strong> Indemnity <strong>and</strong> the relevant US Director have the right to terminate the<br />

US Director’s employment, with or without notice, at any time <strong>and</strong> for any reason. The<br />

severance agreements provide that where the employment <strong>of</strong> the US Director is terminated by<br />

<strong>Royal</strong> Indemnity without cause (but not otherwise), the US Director is entitled to receive<br />

payment <strong>of</strong> 12 months’ base salary, payable in 26 bi-weekly payments.<br />

3.3 The following US Directors have letters <strong>of</strong> appointment with R&SA US, on the following<br />

terms:<br />

(i)<br />

(ii)<br />

(iii)<br />

Michael J. Crall was appointed as a non-executive director with effect from<br />

23 February 2005. He was appointed chairman <strong>of</strong> the board on 17 May 2006 <strong>and</strong> as<br />

chairman <strong>of</strong> the audit committee with effect from 23 February 2005. He is entitled to a<br />

fee <strong>of</strong> US$200,000;<br />

Edward J. Muhl was appointed as a non-executive director <strong>of</strong> the board <strong>and</strong> as a<br />

member <strong>of</strong> the compensation committee with effect from 23 January 2006. He is<br />

entitled to a fee <strong>of</strong> US$100,000; <strong>and</strong><br />

Larry G. Simmons was appointed as a non-executive director with effect from<br />

17 February 2004. He was appointed chairman <strong>of</strong> the compensation committee with<br />

effect from 1 September 2004. He is entitled to a fee <strong>of</strong> US$75,000.<br />

None <strong>of</strong> the letters <strong>of</strong> appointment provide for benefits upon termination.<br />

3.4 Save for the agreements referred to in paragraphs 3.1, 3.2 <strong>and</strong> 3.3 above, there are no existing<br />

service contracts between any Related Party <strong>and</strong> any member <strong>of</strong> the Group which provide for<br />

benefits upon termination <strong>of</strong> employment.<br />

4. Related Party Transactions with US Directors under IFRS reporting<br />

4.1 Save as disclosed in paragraph 4.2, for the period 1 January 2003 to 30 September 2006, the<br />

Company has not entered into any related party transactions (which for these purposes are<br />

those set out in the st<strong>and</strong>ards adopted according to the Regulation (EC) No 1606/2002) with<br />

any Related Party.<br />

4.2 For the purposes <strong>of</strong> IFRS, the Company has a related party relationship with John Tighe (being<br />

a member <strong>of</strong> key management). During the period 1 January 2003 to 30 September 2006,<br />

John Tighe received total remuneration <strong>of</strong> US$4,132,015 under his service contract with <strong>Royal</strong><br />

Indemnity. In addition, John Tighe, his close family <strong>and</strong> friends <strong>and</strong> entities under his control,<br />

have general insurance, health <strong>and</strong> welfare benefits with subsidiary companies <strong>of</strong> the Group.<br />

Such policies are on normal commercial terms except that John Tighe is entitled to special rates<br />

which are also available to other members <strong>of</strong> staff.<br />

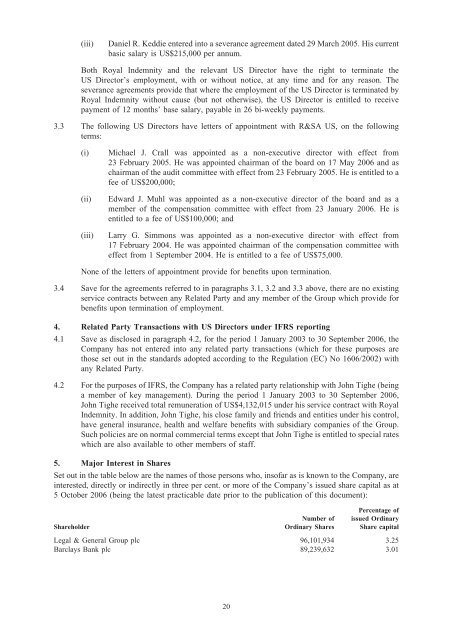

5. Major Interest in Shares<br />

Set out in the table below are the names <strong>of</strong> those persons who, ins<strong>of</strong>ar as is known to the Company, are<br />

interested, directly or indirectly in three per cent. or more <strong>of</strong> the Company’s issued share capital as at<br />

5 October 2006 (being the latest practicable date prior to the publication <strong>of</strong> <strong>this</strong> document):<br />

Shareholder<br />

Number <strong>of</strong><br />

Ordinary Shares<br />

Percentage <strong>of</strong><br />

issued Ordinary<br />

Share capital<br />

Legal & General Group plc 96,101,934 3.25<br />

Barclays Bank plc 89,239,632 3.01<br />

20