AUDITOR'S REPORT ON REVIEW OF INTERIM ... - CS LoxInfo

AUDITOR'S REPORT ON REVIEW OF INTERIM ... - CS LoxInfo

AUDITOR'S REPORT ON REVIEW OF INTERIM ... - CS LoxInfo

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

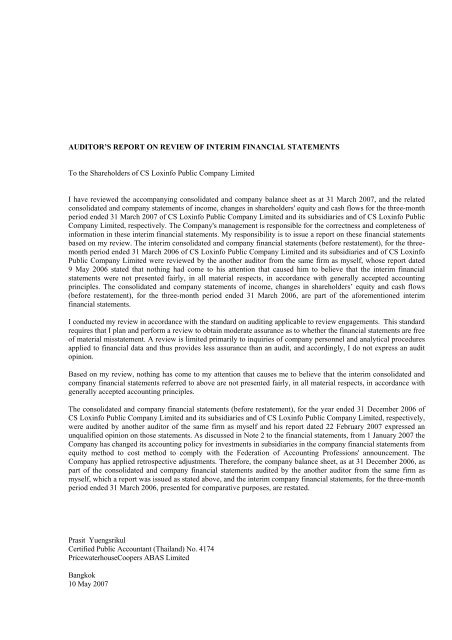

AUDITOR’S <strong>REPORT</strong> <strong>ON</strong> <strong>REVIEW</strong> <strong>OF</strong> <strong>INTERIM</strong> FINANCIAL STATEMENTS<br />

To the Shareholders of <strong>CS</strong> Loxinfo Public Company Limited<br />

I have reviewed the accompanying consolidated and company balance sheet as at 31 March 2007, and the related<br />

consolidated and company statements of income, changes in shareholders' equity and cash flows for the three-month<br />

period ended 31 March 2007 of <strong>CS</strong> Loxinfo Public Company Limited and its subsidiaries and of <strong>CS</strong> Loxinfo Public<br />

Company Limited, respectively. The Company's management is responsible for the correctness and completeness of<br />

information in these interim financial statements. My responsibility is to issue a report on these financial statements<br />

based on my review. The interim consolidated and company financial statements (before restatement), for the threemonth<br />

period ended 31 March 2006 of <strong>CS</strong> Loxinfo Public Company Limited and its subsidiaries and of <strong>CS</strong> Loxinfo<br />

Public Company Limited were reviewed by the another auditor from the same firm as myself, whose report dated<br />

9 May 2006 stated that nothing had come to his attention that caused him to believe that the interim financial<br />

statements were not presented fairly, in all material respects, in accordance with generally accepted accounting<br />

principles. The consolidated and company statements of income, changes in shareholders’ equity and cash flows<br />

(before restatement), for the three-month period ended 31 March 2006, are part of the aforementioned interim<br />

financial statements.<br />

I conducted my review in accordance with the standard on auditing applicable to review engagements. This standard<br />

requires that I plan and perform a review to obtain moderate assurance as to whether the financial statements are free<br />

of material misstatement. A review is limited primarily to inquiries of company personnel and analytical procedures<br />

applied to financial data and thus provides less assurance than an audit, and accordingly, I do not express an audit<br />

opinion.<br />

Based on my review, nothing has come to my attention that causes me to believe that the interim consolidated and<br />

company financial statements referred to above are not presented fairly, in all material respects, in accordance with<br />

generally accepted accounting principles.<br />

The consolidated and company financial statements (before restatement), for the year ended 31 December 2006 of<br />

<strong>CS</strong> Loxinfo Public Company Limited and its subsidiaries and of <strong>CS</strong> Loxinfo Public Company Limited, respectively,<br />

were audited by another auditor of the same firm as myself and his report dated 22 February 2007 expressed an<br />

unqualified opinion on those statements. As discussed in Note 2 to the financial statements, from 1 January 2007 the<br />

Company has changed its accounting policy for investments in subsidiaries in the company financial statements from<br />

equity method to cost method to comply with the Federation of Accounting Professions' announcement. The<br />

Company has applied retrospective adjustments. Therefore, the company balance sheet, as at 31 December 2006, as<br />

part of the consolidated and company financial statements audited by the another auditor from the same firm as<br />

myself, which a report was issued as stated above, and the interim company financial statements, for the three-month<br />

period ended 31 March 2006, presented for comparative purposes, are restated.<br />

Prasit Yuengsrikul<br />

Certified Public Accountant (Thailand) No. 4174<br />

PricewaterhouseCoopers ABAS Limited<br />

Bangkok<br />

10 May 2007

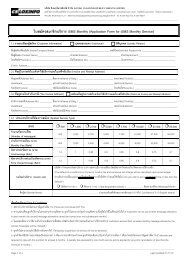

<strong>CS</strong> Loxinfo Public Company Limited<br />

Balance Sheets<br />

As at 31 March 2007 and 31 December 2006<br />

ASSETS<br />

Consolidated<br />

Company<br />

Unaudited Audited Unaudited Audited<br />

31 March 31 December 31 March 31 December<br />

2007 2006 2007 2006<br />

Restated<br />

Notes Baht ’000 Baht ’000 Baht ’000 Baht ’000<br />

Current assets<br />

Cash and cash equivalents 922,221 779,014 231,875 177,706<br />

Trade accounts receivable and<br />

accrued income, net 5,14 623,679 323,453 132,758 144,078<br />

Amounts due from related parties 14 628 162 282 420<br />

Inventories, net 163,854 113,342 5,862 7,181<br />

Advance payments to a related party for services 14 1,676 8,336 1,676 8,336<br />

Other current assets 54,486 42,372 16,518 9,387<br />

Total current assets 1,766,544 1,266,679 388,971 347,108<br />

Non-current assets<br />

Investments in subsidiaries and an associate 6 3,724 3,693 963,825 957,635<br />

Long-term investment - other 2,560 2,551 - -<br />

Property and equipment, net 7 335,732 334,945 173,205 199,840<br />

Equipment under concession<br />

agreements, net 7 8,580 13,272 8,580 13,272<br />

Intangible assets, net 7 42,949 47,793 15,654 17,088<br />

Goodwill, net 8 719,040 739,158 - -<br />

Deferred tax assets 9 78,707 84,033 28,811 29,430<br />

Withholding tax, net 73,257 97,362 47,106 47,250<br />

Deposits 25,952 25,760 13,403 13,395<br />

Total non-current assets 1,290,501 1,348,567 1,250,584 1,277,910<br />

Total assets 3,057,045 2,615,246 1,639,555 1,625,018<br />

Director _________________________________ Director _________________________________<br />

Date _________________________________<br />

The notes to the interim consolidated and company financial statements on pages 8 to 30 are an integral part of these<br />

interim financial statements.<br />

2

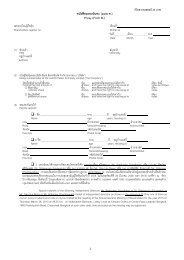

<strong>CS</strong> Loxinfo Public Company Limited<br />

Balance Sheets (Continued)<br />

As at 31 March 2007 and 31 December 2006<br />

LIABILITIES AND<br />

SHAREHOLDERS’ EQUITY<br />

Consolidated<br />

Company<br />

Unaudited Audited Unaudited Audited<br />

31 March 31 December 31 March 31 December<br />

2007 2006 2007 2006<br />

Restated<br />

Notes Baht ’000 Baht ’000 Baht ’000 Baht ’000<br />

Current liabilities<br />

Trade accounts payable 14 315,788 306,240 196,737 190,825<br />

Other accounts payable 14 8,069 26,672 451 7,847<br />

Amounts due to related parties 14 5,087 2,528 2,010 35<br />

Foreign currency forward contracts<br />

payable, net 108 707 - -<br />

Unearned income and advances received<br />

from customers 646,484 210,716 113,968 112,148<br />

Accrued expenses 14 60,202 105,368 22,110 46,074<br />

Provision from acquisition of investment 10 122,121 - 122,121 -<br />

Other current liabilities 28,290 22,906 11,171 7,530<br />

Total current liabilities 1,186,149 675,137 468,568 364,459<br />

Non-current liabilities<br />

Provision from acquisition of investment 10 - 120,765 - 120,765<br />

Other non-current liabilities 10,920 10,909 9,706 9,695<br />

Total non-current liabilities 10,920 131,674 9,706 130,460<br />

Total liabilities 1,197,069 806,811 478,274 494,919<br />

Shareholders’ equity<br />

Share capital<br />

Authorised share capital - ordinary shares 11 649,020 649,020 649,020 649,020<br />

Issued and paid-up share capital - ordinary shares 625,000 625,000 625,000 625,000<br />

Premium on share capital 992,142 992,142 992,142 992,142<br />

Retained earnings<br />

Appropriated<br />

Legal reserve 18 45,636 45,636 45,636 45,636<br />

Unappropriated 163,809 107,301 (501,497) (532,679)<br />

Total parent's shareholders’ equity 1,826,587 1,770,079 1,161,281 1,130,099<br />

Minority interests 19 33,389 38,356 - -<br />

Total shareholders’ equity 1,859,976 1,808,435 1,161,281 1,130,099<br />

Total liabilities and shareholders’ equity 3,057,045 2,615,246 1,639,555 1,625,018<br />

The notes to the interim consolidated and company financial statements on pages 8 to 30 are an integral part of these<br />

interim financial statements.<br />

3

<strong>CS</strong> Loxinfo Public Company Limited<br />

Statements of Income (Unaudited)<br />

For the three-month periods ended 31 March 2007 and 2006<br />

Consolidated<br />

Company<br />

Unaudited Unaudited Unaudited Unaudited<br />

31 March 31 March 31 March 31 March<br />

2007 2006 2007 2006<br />

Restated<br />

Notes Baht ’000 Baht ’000 Baht ’000 Baht ’000<br />

Revenues 14<br />

Revenues from sales and services 606,467 581,763 353,743 354,178<br />

Other income 11,047 8,060 3,031 6,827<br />

Share of net results from investments - equity method 32 5 - -<br />

Total revenues 617,546 589,828 356,774 361,005<br />

Expenses 14<br />

Cost of sales and services 337,773 322,833 243,986 236,008<br />

Selling and administrative expenses 187,072 168,232 68,796 66,208<br />

Directors’ remuneration 14 760 675 750 675<br />

Loss on foreign exchange 475 1,174 168 212<br />

Total expenses 526,080 492,914 313,700 303,103<br />

Profit before interest expense and income tax 91,466 96,914 43,074 57,902<br />

Interest expense (1,356) (1,360) (1,356) (1,356)<br />

Profit before income tax 90,110 95,554 41,718 56,546<br />

Income tax 13 (31,803) (34,660) (10,536) (14,008)<br />

Profit before minority interests 58,307 60,894 31,182 42,538<br />

Profit attributable to minority interests, net 19 (1,799) 460 - -<br />

Net profit for the period 56,508 61,354 31,182 42,538<br />

Basic and diluted earnings per share (Baht) 4<br />

Net profit for the period 0.09 0.10 0.05 0.07<br />

The notes to the interim consolidated and company financial statements on pages 8 to 30 are an integral part of these<br />

interim financial statements.<br />

4

<strong>CS</strong> Loxinfo Public Company Limited<br />

Statements of Changes in Shareholders’ Equity (Unaudited)<br />

For the three-month periods ended 31 March 2007 and 2006<br />

Consolidated (Baht ’000)<br />

Issued and Premium<br />

paid-up on share Legal Minority<br />

share capital capital reserve Retained interests<br />

Notes (Note 11) (Note 11) (Note 18) earnings (Note 19) Total<br />

Opening balance at 1 January 2006 625,000 992,142 35,006 486,597 19,740 2,158,485<br />

Legal reserve 18 - - 3,069 (3,069) - -<br />

Net profit for the period - - - 61,354 - 61,354<br />

Decrease in minority interests - - - - (460) (460)<br />

Closing balance as at 31 March 2006 625,000 992,142 38,075 544,882 19,280 2,219,379<br />

Opening balance at 1 January 2007 625,000 992,142 45,636 107,301 38,356 1,808,435<br />

Net profit for the period - - - 56,508 - 56,508<br />

Acquisition of shares in a subsidiary 19 - - - - (6,766) (6,766)<br />

Increase in minority interests 19 - - - - 1,799 1,799<br />

Closing balance as at 31 March 2007 625,000 992,142 45,636 163,809 33,389 1,859,976<br />

The notes to the interim consolidated and company financial statements on pages 8 to 30 are an integral part of these interim financial statements.<br />

5

<strong>CS</strong> Loxinfo Public Company Limited<br />

Statements of Changes in Shareholders’ Equity (Unaudited) (Continued)<br />

For the three-month periods ended 31 March 2007 and 2006<br />

Company (Baht ’000)<br />

Issued and Premium<br />

paid-up on share Legal Retained<br />

share capital capital reserve earnings Minority Total<br />

Notes (Note 11) (Note 11) (Note 18) (Restated) interests (Restated)<br />

Opening balance at 1 January 2006 625,000 992,142 35,006 486,597 - 2,138,745<br />

Prior period adjustment 2 - - - (617,295) - (617,295)<br />

Opening balance at 1 January 2006 - as restated 625,000 992,142 35,006 (130,698) - 1,521,450<br />

Legal reserve 18 - - 3,069 (3,069) - -<br />

Net profit for the period - - - 42,538 - 42,538<br />

Closing balance as at 31 March 2006 - as restated 625,000 992,142 38,075 (91,229) - 1,563,988<br />

Opening balance at 1 January 2007 625,000 992,142 45,636 107,301 - 1,770,079<br />

Prior period adjustment 2 - - - (639,980) - (639,980)<br />

Opening balance at 1 January 2007 - as restated 625,000 992,142 45,636 (532,679) - 1,130,099<br />

Net profit for the period - - - 31,182 - 31,182<br />

Closing balance as at 31 March 2007 625,000 992,142 45,636 (501,497) - 1,161,281<br />

The notes to the interim consolidated and company financial statements on pages 8 to 30 are an integral part of these interim financial statements.<br />

6

<strong>CS</strong> Loxinfo Public Company Limited<br />

Statements of Cash Flows (Unaudited)<br />

For the three-month periods ended 31 March 2007 and 2006<br />

Consolidated<br />

Company<br />

Unaudited Unaudited Unaudited Unaudited<br />

31 March 31 March 31 March 31 March<br />

2007 2006 2007 2006<br />

Restated<br />

Note Baht ’000 Baht ’000 Baht ’000 Baht ’000<br />

Cash flows receipts from operating activities 12 211,734 265,267 71,422 63,370<br />

Cash flows from investing activities<br />

Payment for long-term investment - other (9) (2) - -<br />

Payment for acquisition of additional shares in<br />

a subsidiary (6,190) - (6,190) -<br />

Proceeds from reduction in share capital of a subsidiary - - - 200,000<br />

Payments for acquisitions of equipment (61,404) (26,485) (11,203) (21,594)<br />

Payments for acquisitions of intangible assets (4,653) (7,452) (30) (2,072)<br />

Proceeds from sale of equipment 623 1 52 1<br />

Proceeds from sale of intangible assets 3,000 - - -<br />

Net cash flows used in investing activities (68,633) (33,938) (17,371) 176,335<br />

Cash flows from financing activities<br />

Repayments of finance leases - (255) - -<br />

Net cash flows used in financing activities - (255) - -<br />

Net increase in cash and cash equivalents 143,101 231,074 54,051 239,705<br />

Cash and cash equivalents, opening balance 779,014 774,028 177,706 223,232<br />

Effects of exchange rate changes 106 (419) 118 (64)<br />

Cash and cash equivalents, closing balance 922,221 1,004,683 231,875 462,873<br />

Supplementary information for cash flows:<br />

Withholding tax deducted at source 17,578 8,423 7,755 6,764<br />

Interest paid - 4 - -<br />

Non-cash transactions<br />

Acquisitions of equipment through credit 7,469 16,905 451 13,506<br />

Acquisitions of intangible assets through credit 600 1,500 - -<br />

The notes to the interim consolidated and company financial statements on pages 8 to 30 are an integral part of these<br />

interim financial statements.<br />

7

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

1 Basis of preparation<br />

These interim consolidated and company financial statements have been prepared in accordance with Thai<br />

generally accepted accounting principles under the Accounting Act B.E. 2543, being those Thai Accounting<br />

Standards issued under the Accounting Profession Act B.E. 2547, and the financial reporting requirements of<br />

the Securities and Exchange Commission. The primary financial statements (i.e., balance sheets, statements<br />

of income, changes in shareholders’ equity and cash flows) have been prepared in the full format as required<br />

by the Securities and Exchange Commission. The notes to the interim financial statements have been<br />

prepared in a condensed format according to Thai Accounting Standard No. 41: ‘Interim Financial<br />

Reporting’, and additional information is presented as required by the Securities and Exchange Commission.<br />

<strong>CS</strong> Loxinfo Public Company Limited (“the Company”) and its subsidiaries are collectively referred to as<br />

“the Group”.<br />

An English version of the interim consolidated and company financial statements have been prepared from the<br />

interim financial statements that are in the Thai language. In the event of a conflict or a difference in<br />

interpretation between the two languages, the Thai language interim financial statements shall prevail.<br />

The Company entered into concession agreements with CAT Telecom Public Company Limited (“CAT”)<br />

for a period of 22 years from 9 August 1994 to 8 August 2016 to provide satellite uplink-downlink and<br />

satellite internet services, and to provide internet services in Thailand for a period of ten years from 16 April<br />

1997 to 15 April 2007. Currently, the National Telecommunications Commission (“NTC”) is responsible for<br />

granting licenses to provide Internet access services in Thailand.<br />

The Company and its subsidiary received one-year Type I licenses from NTC to provide Internet access<br />

services for one year from 8 September 2006 to 7 September 2007 and 29 June 2006 to 28 June 2007,<br />

respectively. According to the conditions specified by NTC, if the authorised licensee is not in significant<br />

violation of the conditions as specified in the license, NTC will consider renewing the license as a normal<br />

procedure.<br />

Certain equipment that the Company has been using is equipment for which the title has been transferred to<br />

CAT under a concession contract, for which such contract will expire on 15 April 2007. The Company is<br />

currently in the process of purchasing the equipment from CAT, as presented in Note 7.<br />

The preparation of financial statements in conformity with Thai generally accepted accounting principles<br />

requires management to make estimates and assumptions that affect the reported amounts of assets and<br />

liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and<br />

the amounts of revenues and expenses in the reported periods. Although these estimates are based on<br />

management’s best knowledge of current events and actions, actual results may differ from those estimates.<br />

The accounting principles applied may differ from generally accepted accounting principles adopted in other<br />

countries and jurisdictions. The accompanying interim consolidated and company financial statements are<br />

therefore not intended to present the financial position and results of operations and cash flows in<br />

accordance with jurisdictions other than Thailand. Consequently, these interim consolidated and company<br />

financial statements are only addressed to those who are informed about Thai generally accepted accounting<br />

principles and practices.<br />

Costs that are incurred unevenly during the financial year are recognised as expenses or deferred in<br />

the interim report only if it would also be appropriate to anticipate or defer such costs at the end of<br />

the financial year.<br />

As at 31 March 2007, the Group employs 1,005 people (31 December 2006: 997 people).<br />

8

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

1 Basis of preparation (Continued)<br />

These interim financial statements should be read in conjunction with the 2006 annual financial statements.<br />

These interim consolidated and company financial statements have been approved for issue by the Board of<br />

Directors on 10 May 2007.<br />

Amendment to Accounting Standards effective in 2007 and 2008<br />

On 2 May 2007, the Federation of Accounting Professions (“FAP”) has announced the amendment to Thai<br />

Accounting Standards (“TAS”) as followings:<br />

TAS No. 25 “Cash Flow Statements”<br />

TAS No. 33 “Borrowing Costs”<br />

TAS No. 44 “Consolidated and Separate Financial Statements”<br />

TAS No. 45 “Investment in Associates”<br />

TAS No. 46 “Interests in Joint Ventures”<br />

TAS No. 49 “Construction Contracts”<br />

The effective date for the revised TAS No. 44 “Consolidated and Separate Financial Statements”, TAS No.<br />

45 “Investment in Associates” and TAS No. 46 “Interests in Joint Ventures” is for the accounting periods<br />

beginning on or after 1 January 2007. The effects relating to the revised standards are stated in Note 2.<br />

TAS No. 25 “Cash Flow Statements”, TAS No. 33 “Borrowing Costs” and TAS No. 49 “Construction<br />

Contracts” will be effective for the accounting periods beginning on or after 1 January 2008.<br />

2 Change in accounting policy<br />

Notifications of the Federation of Accounting Professions No.26/2549 dated 11 October 2006 and<br />

No.32/2549 dated 3 November 2006 relating to amendment of TAS 44 “Consolidated Financial Statements<br />

and Accounting for Investment in Subsidiaries” and TAS 45 “Accounting for Investments in Associates”<br />

require a change from the equity method of accounting to the cost method of accounting for investment in<br />

subsidiaries and associates presented in the separate financial statements. Under the cost method, income<br />

from investment will be recognised when the right to receive payment is established. The notification is<br />

mandatory from 1 January 2007. The change has an impact on the separate financial statements only and<br />

does not affect the consolidated financial statements.<br />

The Group has adopted the cost method commencing from 1 January 2007 by applying retrospective<br />

adjustments. The effects of the change to the company balance sheet as of 31 December 2006 and the<br />

company statement of income for the three-month period ended 31 March 2006 are as follows:<br />

Company<br />

Baht ’000<br />

Balance sheet as of 31 December 2006<br />

Decrease in investments in subsidiaries and an associate 639,980<br />

Shareholders’ equity<br />

Decrease in beginning balance of retained earnings 617,295<br />

Decrease in closing balance of retained earnings 639,980<br />

Statement of income for the three-month period ended 31 March 2006<br />

Decrease in share of net results from investments - equity method 39,928<br />

Decrease in administrative and selling expenses 21,112<br />

Decrease in net profit 18,816<br />

Decrease in basic earnings per share (Baht) 0.03<br />

Decrease in diluted earnings per share (Baht) 0.03<br />

9

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

3 Segment information<br />

Financial information by business segment:<br />

For the three-month period ended 31 March 2007 (Baht ’000)<br />

Satellite<br />

uplinkdownlink<br />

services<br />

Internet<br />

services<br />

Media and<br />

advertising<br />

Mobile<br />

contents<br />

Consolidation<br />

eliminations<br />

Group<br />

Revenues 6,185 346,975 214,833 45,393 (6,919) 606,467<br />

Share of net results from<br />

investment in an associate - 32 - - - 32<br />

Total revenues 6,185 347,007 214,833 45,393 (6,919) 606,499<br />

Segment results 1,528 39,625 34,085 5,657 - 80,895<br />

Operating profit 80,895<br />

For the three-month period ended 31 March 2006 (Baht ’000)<br />

Satellite<br />

uplinkdownlink<br />

services<br />

Internet<br />

services<br />

Media and<br />

advertising<br />

Consolidation<br />

eliminations<br />

Group<br />

Revenues 9,262 349,128 223,607 (234) 581,763<br />

Share of net results from<br />

investment in an associate - 5 - - 5<br />

Total revenues 9,262 349,133 223,607 (234) 581,768<br />

Segment results 3,080 39,118 47,830 - 90,028<br />

Operating profit 90,028<br />

Thailand is the home country of the Group and the operating territory.<br />

The Group is organised into the following business segments:<br />

• Satellite uplink-downlink services<br />

• Sales and services relating to the Internet business<br />

• Media and advertising<br />

• Mobile contents.<br />

10

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

4 Basic and diluted earnings per share<br />

Basic earnings per share is calculated by dividing the net profit for the period attributable to ordinary<br />

shareholders by the weighted average number of ordinary shares in issue and paid up during the period.<br />

For the diluted earnings per share, the weighted average number of ordinary shares in issue and paid up is<br />

adjusted to assume conversion of all potential dilutive ordinary shares, which is the weighted average<br />

number of ordinary shares which would be issued on the conversion of all the dilutive potential ordinary<br />

shares into ordinary shares. The assumed proceeds from the exercise of ESOP would be considered to have<br />

been received from the issue of shares at fair value. These represent share options where the exercise price is<br />

less than the average market price of the Company’s shares for the three-month ended 31 March 2007.<br />

Basic and diluted earnings per share are as follows:<br />

Consolidated<br />

Company<br />

For the three-month period ended 31 March 2007 2006 2007 2006<br />

Restated<br />

Net profit (Baht ’000)<br />

- As previously reported 56,508 61,354 31,182 61,354<br />

- Prior period adjustment (Note 2) - - - (18,816)<br />

- As restated 56,508 61,354 31,182 42,538<br />

Number of shares (’000 Shares) 625,000 625,000 625,000 625,000<br />

The effect of dilutive potential ordinary shares<br />

(ESOP Grant IV) 1,460 - 1,460 -<br />

Diluted shares (’000 Shares) 626,460 625,000 626,460 625,000<br />

Basic earnings per shares (Baht)<br />

- As previously reported 0.09 0.10 0.05 0.10<br />

- Prior year adjustment (Note 2) - - - (0.03)<br />

- As restated 0.09 0.10 0.05 0.07<br />

The effect of dilutive potential ordinary shares<br />

(ESOP Grant IV) - - - -<br />

Diluted earnings per share (Baht) 0.09 0.10 0.05 0.07<br />

As at 31 March 2007 and 2006, the outstanding warrants in connection with the share option plan of the<br />

directors, employees, and advisors of the Company did not affect the diluted earnings per share since the<br />

average share price for the period calculated from the opening period or the date the warrants were granted to<br />

the reporting period was below the exercise price of the outstanding warrants.<br />

11

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

5 Trade accounts receivable and accrued income, net<br />

Consolidated<br />

Company<br />

31 March 31 December 31 March 31 December<br />

2007 2006 2007 2006<br />

Baht ’000 Baht ’000 Baht ’000 Baht ’000<br />

Trade accounts receivable:<br />

- Third parties 652,874 318,601 108,708 107,087<br />

- Related parties (Note 14) 55,312 67,148 25,212 40,257<br />

Total trade accounts receivable 708,186 385,749 133,920 147,344<br />

Accrued income:<br />

- Third parties 11,869 12,156 4,907 3,880<br />

- Related parties (Note 14) 2,509 1,354 2,584 1,354<br />

Total accrued income 14,378 13,510 7,491 5,234<br />

Total trade accounts receivable and<br />

accrued income 722,564 399,259 141,411 152,578<br />

Less Allowance for doubtful accounts (98,885) (75,806) (8,653) (8,500)<br />

Total trade accounts receivable and<br />

accrued income, net 623,679 323,453 132,758 144,078<br />

Outstanding trade accounts receivable - third parties, associates and subsidiaries as at 31 March 2007 and as<br />

at 31 December 2006 can be analysed as follows:<br />

Consolidated<br />

Company<br />

31 March 31 December 31 March 31 December<br />

2007 2006 2007 2006<br />

Baht ’000 Baht ’000 Baht ’000 Baht ’000<br />

Current 304,418 81,816 64,302 53,201<br />

Overdue less than 3 months 233,033 90,146 46,984 61,933<br />

Overdue 3-6 months 7,831 34,809 7,399 7,678<br />

Overdue 6-12 months 78,497 105,307 6,346 10,853<br />

Overdue more than 12 months 84,407 73,671 8,889 13,679<br />

708,186 385,749 133,920 147,344<br />

Less Allowance for doubtful<br />

accounts (98,885) (75,806) (8,653) (8,500)<br />

Trade accounts receivable, net 609,301 309,943 125,267 138,844<br />

As at 31 March 2007, the Group had allowances for doubtful accounts of Baht 98.9 million (31 December<br />

2006: Baht 75.8 million) and the Company’s allowances for doubtful accounts were Baht 8.7 million<br />

(31 December 2006: Baht 8.5 million). In view of the collection history, management believes that the<br />

allowances for doubtful account are appropriate.<br />

12

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

6 Investments in subsidiaries and an associate<br />

a) Investments in subsidiaries and an associate as at 31 March 2007 and 31 December 2006 comprise:<br />

Consolidated<br />

Company<br />

31 March 31 December 31 March 31 December<br />

2007 2006 2007 2006<br />

Restated<br />

Baht ’000 Baht ’000 Baht ’000 Baht ’000<br />

Investment recorded as cost method<br />

Investment in subsidiaries - - 963,773 957,583<br />

Investment in an associate - - 52 52<br />

Total - - 963,825 957,635<br />

Investment recorded as equity method<br />

Investment in an associate 3,724 3,693 - -<br />

Total 3,724 3,693 - -<br />

b) Movements in investments in subsidiaries and an associate for the three-month period ended 31 March<br />

2007 are as follows:<br />

Consolidated Company<br />

(Equity method) (Cost method)<br />

For the three-month period ended 31 March 31 March<br />

2007 2007<br />

Restated<br />

Baht ’000 Baht ’000<br />

Opening net book value<br />

- As previously reported 3,693 1,597,615<br />

- Prior year adjustment (Note 2) - (639,980)<br />

Opening net book value - as restated 3,693 957,635<br />

Share of net profit from investment 31 -<br />

Acquisition of investment in a subsidiary - 6,190<br />

Closing net book value 3,724 963,825<br />

On 2 February 2007, the Company acquired 480,000 ordinary shares in Loxley Information Services<br />

Company Limited (“Loxserv”) from CAT Telecom Public Company Limited at Baht 12.90 per share,<br />

representing 1.85% of share capital, at a total price of Baht 6.2 million. As a result, the Company owns<br />

96.04% of Loxserv following this acquisition. Negative goodwill recognised from the acquisition of<br />

these ordinary shares in Loxserv of Baht 0.58 million (Note 8) is recognised as income in the statement<br />

of income based on the remaining weighted average useful life and future benefit of non-monetary<br />

assets of Loxserv for a period of four years.<br />

13

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

6 Investments in subsidiaries and an associate (Continued)<br />

c) The details of investments in subsidiaries and an associate can be summarised as follows:<br />

% of holding<br />

31 March 31 December<br />

Name Business Country Currency 2007 2006<br />

Subsidiaries<br />

Loxley Information Services<br />

Company Limited<br />

Teleinfo Media Public Company<br />

Limited<br />

AD Venture Company Limited<br />

Providing Internet<br />

services<br />

Publishing telephone<br />

directories and<br />

advertising<br />

Holding company<br />

- mobile contents<br />

Thailand Baht 96.04 94.19<br />

Thailand Baht 100.00 100.00<br />

Thailand Baht 100.00 -<br />

Associate<br />

<strong>CS</strong> Loxinfo Solutions Company<br />

Limited<br />

In the process of<br />

liquidation<br />

Thailand Baht 44.99 44.99<br />

Subsidiaries of AD Venture<br />

Company Limited Group<br />

Shineedotcom Company Limited<br />

and subsidiaries<br />

Mobile contents Thailand Baht 70.00 70.00<br />

Hunsa Dot Com Company Limited Banner advertising Thailand Baht 100.00 100.00<br />

Sodamag Corp Company Limited Banner advertising Thailand Baht 100.00 100.00<br />

d) Carrying values of investments in subsidiaries and an associate are as follows:<br />

Consolidated - 31 March 2007 (Baht ’000)<br />

(Equity method)<br />

Paid-up % of<br />

capital Investment Cost<br />

Associate:<br />

<strong>CS</strong> Loxinfo Solutions Company Limited 5,000 44.99 52<br />

Consolidated - 31 December 2006 (Baht ’000)<br />

(Equity method)<br />

Paid-up % of<br />

capital Investment Cost<br />

Associate:<br />

<strong>CS</strong> Loxinfo Solutions Company Limited 5,000 44.99 52<br />

14

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

6 Investments in subsidiaries and an associate (Continued)<br />

d) Carrying values of investments in subsidiaries and an associate are as follows: (Continued)<br />

Company - 31 March 2007 (Baht ’000)<br />

(Cost method)<br />

Paid-up % of<br />

capital Investment Cost<br />

Subsidiaries:<br />

Loxley Information Services Company Limited 260,100 96.04 252,487<br />

Teleinfo Media Public Company Limited 173,534 100.00 675,322<br />

AD Venture Company Limited 620,000 100.00 35,964<br />

Total 963,773<br />

Associate:<br />

<strong>CS</strong> Loxinfo Solutions Company Limited 5,000 44.99 52<br />

Total 963,825<br />

Company - 31 December 2006 (Baht ’000)<br />

(Cost method)<br />

Restated<br />

Paid-up % of<br />

capital Investment Cost<br />

Subsidiaries:<br />

Loxley Information Services Company Limited 260,100 94.19 246,297<br />

Teleinfo Media Public Company Limited 173,534 100.00 675,322<br />

AD Venture Company Limited 620,000 100.00 35,964<br />

Total 957,583<br />

Associate:<br />

<strong>CS</strong> Loxinfo Solutions Company Limited 5,000 44.99 52<br />

Total 957,635<br />

15

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

7 Capital expenditure and commitments<br />

Consolidated (Baht ’000)<br />

Equipment<br />

under Intangible<br />

Buildings concession assets<br />

& equipment contracts - other Total<br />

Transactions during the three-month<br />

period ended 31 March 2007<br />

Opening net book value 334,945 13,272 47,793 396,010<br />

Additions 46,504 - 950 47,454<br />

Transfers, net (6,622) 6,622 - -<br />

Disposal, net (583) - (1,907) (2,490)<br />

Depreciation / amortisation charges (38,512) (11,314) (3,887) (53,713)<br />

Closing net book value 335,732 8,580 42,949 387,261<br />

As at 31 March 2007<br />

Cost 1,553,546 207,171 96,085 1,856,802<br />

Less Accumulated depreciation /<br />

accumulated amortisation (1,217,814) (198,591) (36,334) (1,452,739)<br />

Accumulated impairment loss - - (16,802) (16,802)<br />

Net book value 335,732 8,580 42,949 387,261<br />

Company (Baht ’000)<br />

Equipment<br />

under Intangible<br />

Buildings concession assets<br />

& equipment contracts - other Total<br />

Transactions during the three-month<br />

period ended 31 March 2007<br />

Opening net book value 199,840 13,272 17,088 230,200<br />

Additions 3,807 - 30 3,837<br />

Transfers, net (6,622) 6,622 - -<br />

Disposal, net (56) - - (56)<br />

Depreciation / amortisation charges (23,764) (11,314) (1,464) (36,542)<br />

Closing net book value 173,205 8,580 15,654 197,439<br />

As at 31 March 2007<br />

Cost 765,221 207,171 27,066 999,458<br />

Less Accumulated depreciation /<br />

accumulated amortisation (592,016) (198,591) (11,412) (802,019)<br />

Net book value 173,205 8,580 15,654 197,439<br />

As at 31 March 2007, an impairment loss of intangible assets amounting to Baht 16.8 million in the<br />

subsidiary has been recognised because the anticipated net discounted future cash flow from the continuing<br />

use of the asset is less than the carrying amount of this asset. The subsidiary has used the discounted rate of<br />

12% per annum to calculate the net future cash flow.<br />

16

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

8 Goodwill<br />

Consolidated (Baht ’000)<br />

Negative<br />

Goodwill goodwill Total<br />

Transactions during the three-month period<br />

ended 31 March 2007<br />

Opening net book value 747,015 (7,857) 739,158<br />

Increase from additional acquisition of a subsidiary (Note 6 b) - (576) (576)<br />

Recognition / amortisation charges (21,112) 1,570 (19,542)<br />

Closing net book value 725,903 (6,863) 719,040<br />

As at 31 March 2007<br />

Cost 941,331 (11,346) 929,985<br />

Less Recognition / accumulated amortisation (215,428) 4,483 (210,945)<br />

Net book value 725,903 (6,863) 719,040<br />

9 Deferred income tax<br />

Deferred income taxes are calculated in full on temporary differences based on the liability method using a<br />

principal tax rate of 25% for the interim company financial statements (2006 : 25%) and 25% - 30% for<br />

the interim consolidated financial statements (2006 : 25% - 30%).<br />

Deferred tax assets for tax loss carried forward are recognised to the extent that it is probable that future<br />

taxable profit will be available against which the temporary differences can be utilised. The subsidiaries<br />

have tax loss carried forward to offset future taxable income which is not recognised in the interim<br />

consolidated financial statements as follows:<br />

Expired year<br />

Million Baht<br />

2007 28<br />

2008 21<br />

2009 40<br />

2010 54<br />

2011 222<br />

2012 1<br />

Total 366<br />

17

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

9 Deferred income tax (Continued)<br />

The movement in deferred tax assets for the three-month period ended 31 March 2007 is as follows::<br />

Consolidated (Baht ’000)<br />

For the three-month period ended 31 March 2007<br />

Recognition<br />

Unearned income of income<br />

Allowance for Allowance for and advances and cost<br />

Deferred tax Loss carried doubtful obsolete received from of telephone<br />

assets forward accounts inventories customers books Depreciation Total<br />

Opening balance 18,108 21,428 615 22,955 12,686 8,241 84,033<br />

Charged to<br />

statement<br />

of income (4,664) 2,147 (195) (596) (2,448) 430 (5,326)<br />

Closing balance 13,444 23,575 420 22,359 10,238 8,671 78,707<br />

Consolidated (Baht ’000)<br />

For the three-month period ended 31 March 2006<br />

Recognition<br />

Unearned income of income<br />

Allowance for Allowance for and advances and cost<br />

Deferred tax Loss carried doubtful obsolete received from of telephone<br />

assets forward accounts inventories customers books Depreciation Total<br />

Opening balance 114,567 28,774 354 34,545 12,298 6,436 196,974<br />

Charged to<br />

statement<br />

of income (34,367) 1,388 64 (705) (1,437) 397 (34,660)<br />

Closing balance 80,200 30,162 418 33,840 10,861 6,833 162,314<br />

Company (Baht ’000)<br />

For the three-month period ended 31 March 2007<br />

Unearned income<br />

Allowance for Allowance and advances<br />

Loss carried doubtful for obsolete received from<br />

Deferred tax assets forward accounts inventories customers Depreciation Total<br />

Opening balance - 2,125 588 22,874 3,843 29,430<br />

Charged to statement<br />

of income - 38 (196) (576) 115 (619)<br />

Closing balance - 2,163 392 22,298 3,958 28,811<br />

Company (Baht ’000)<br />

For the three-month period ended 31 March 2006<br />

Unearned income<br />

Allowance for Allowance and advances<br />

Loss carried doubtful for obsolete received from<br />

Deferred tax assets forward accounts inventories customers Depreciation Total<br />

Opening balance 30,305 7,284 326 33,220 3,381 74,516<br />

Charged to statement<br />

of income (14,136) 171 64 (222) 115 (14,008)<br />

Closing balance 16,169 7,455 390 32,998 3,496 60,508<br />

Deferred income tax assets and liabilities are offset for the purpose of financial statement presentation when<br />

there is a legally enforceable right to offset the income taxes levied by the same taxation authority.<br />

18

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

10 Provision from acquisition of investment<br />

On 29 June 2005, the Company acquired an additional 25.51 million common and preferred shares in Teleinfo<br />

Media Public Company Limited (“TMC”) at Baht 25 per share (representing a 36.75% shareholding) from TOT<br />

Public Company Limited (“TOT”). The acquisition was subject to the following significant conditions:<br />

• On 29 June 2005, the Company paid an amount of Baht 20 per share to purchase these shares.<br />

• The Company will pay TOT an additional Baht 5 per share if TMC achieves an aggregate total revenue<br />

from the fiscal year 2006 to 2007 of Baht 2,000 million or more. The payment is due within 30 days<br />

after TMC’s financial statements for the year ending 31 December 2007 are approved by a certified<br />

public accountant authorised by the Securities and Exchange Commission.<br />

Provision from acquisition of investment amounting to Baht 122.12 million was derived from the purchase<br />

of common and preferred shares from TMC. In connection with this acquisition, the Company has a<br />

commitment to pay an additional amount for the shares of Baht 127.5 million to TOT in 2008. The Company<br />

has estimated that the additional amount will be paid and has, therefore, recognised the provision for this<br />

obligation at its present value using discounted future cash flow at a rate of 4.6%, which reflects the market<br />

assessments at the date of acquisition, the time value of money and the risks specific to the liability. As the<br />

Company recorded this provision from acquisition of investment using the discounted future cash flow<br />

method, the net book value of the provision will increase in each subsequent period. The Company has<br />

recognised the increase in the provision as a financial cost, which is included in interest expense in the<br />

income statement for the three-month period ended 31 March 2007, amounting to Baht 1.36 million.<br />

Movements of the provision from acquisition of investment for the periods are as follows:<br />

Consolidated<br />

Company<br />

For the three-month periods ended 31 March 2007 2006 2007 2006<br />

Baht ’000 Baht ’000 Baht ’000 Baht ’000<br />

Opening provision form acquisition<br />

of investment balance 120,765 115,340 120,765 115,340<br />

Charged to income statement 1,356 5,425 1,356 5,425<br />

Closing provision form acquisition<br />

of investment balance 122,121 120,765 122,121 120,765<br />

11 Share capital and premium on share capital<br />

For the three-month period ended 31 March 2007<br />

Number of Ordinary Premium on<br />

shares shares share capital Total<br />

’000 Shares Baht ’000 Baht ’000 Baht ’000<br />

Issued and paid-up share capital<br />

As at 31 December 2006 625,000 625,000 992,142 1,617,142<br />

As at 31 March 2007 625,000 625,000 992,142 1,617,142<br />

The Company’s registered share capital as at 31 March 2007 comprised 649 million ordinary shares<br />

(31 December 2006: 649 million shares) of Baht 1 each (31 December 2006: Baht 1 each). 625 million<br />

ordinary shares were fully paid-up (31 December 2006: 625 million ordinary shares).<br />

19

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

11 Share capital and premium on share capital (Continued)<br />

At the Board of Director’s meeting of the Company held on 22 February 2007, the Board of Directors passed<br />

a resolution to approve the allocation of 8,354,400 ordinary shares, equivalent to 1.34% of the Company’s<br />

total paid-up share capital as at the date on which the warrant allocation will be approved, under an ESOP<br />

scheme (Grant V), by granting warrants to directors and employees of the Company and its subsidiary. The<br />

exercise ratio will be one warrant per ordinary share. The warrants will be in registered form and will be<br />

non-transferable. The term of the warrants will not exceed five years from the date on which they are granted<br />

and the warrants will have no offering price. The exercise price will be the weighted-average closing price of<br />

the Company’s shares traded on the Stock Exchange of Thailand for the period of 30 days prior to the<br />

shareholders’ meeting on 23 April 2007. One-third of the allocated warrants may be exercised to purchase<br />

ordinary shares; one year from the grant date for the first exercise, and two years and three years from the<br />

grant date for the second and third exercises, respectively. The Board of Directors will propose this to the<br />

shareholders for approval.<br />

As a result of the payment of interim dividend on 4 September 2006, the exercise ratio of the warrants issued<br />

under ESOP Grant I, Grant II, Grant III and Grant IV has been affected. At the Board of Directors’ meeting<br />

of the Company on 22 February 2007, a resolution was passed to approve the registering of 3,475,000<br />

additional ordinary shares to support the change in the exercise ratio, equivalent to 0.56% of the total issued<br />

and paid-up share capital of the Company as of 31 March 2007. The Board of Directors will propose this to<br />

the shareholders for approval.<br />

At the Board of Directors’ meeting of the Company on 22 February 2007, the Board of Directors passed<br />

a resolution to recommend to shareholders the payment of dividends for the second half of 2006.The<br />

proposed dividends must be approved by the shareholders at the annual ordinary shareholders meeting. The<br />

proposed dividend is greater than 50% of the net profit after tax. As a result, the exercise ratio and exercise<br />

price of the warrants under the ESOP schemes (Grant I, Grant II, Grant III and Grant IV) will be affected.<br />

Hence the Company changed the exercise ratio and exercise price of the warrants as detailed below,<br />

effective from 28 March 2007 onwards.<br />

Exercise ratio<br />

Exercise prices<br />

unit : share<br />

Baht/unit<br />

Former New Former New<br />

ESOP - Grant I 1 : 1.22090 1 : 1.24101 7.371 7.252<br />

ESOP - Grant II 1 : 1.22090 1 : 1.24101 7.610 7.487<br />

ESOP - Grant III 1 : 1.19881 1 : 1.21856 5.780 5.686<br />

ESOP - Grant IV 1 : 1.12898 1 : 1.14758 3.171 3.120<br />

The details of the warrants of the Company as of 31 March 2007 are as follows:<br />

Before<br />

dilution<br />

Exercise Exercise<br />

Issued ratio prices Exercise period<br />

Issued dates units unit : share Baht/unit First Last<br />

ESOP - Grant I 14 May 2004 3,096,300 1 : 1.24101 7.252 30 May 2004 30 April 2009<br />

ESOP - Grant II 16 May 2005 2,213,700 1 : 1.24101 7.487 30 May 2005 30 April 2010<br />

ESOP - Grant III 31 May 2005 8,559,100 1 : 1.21856 5.686 31 May 2006 30 May 2010<br />

ESOP - Grant IV 31 May 2006 8,354,300 1 : 1.14758 3.120 31 May 2007 30 May 2011<br />

20

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

11 Share capital and premium on share capital (Continued)<br />

Movements in the number of outstanding warrants under the ESOP scheme are as follows:<br />

For the three-month period ended 31 March 2007 (’000 units)<br />

ESOP - Grant I ESOP - Grant II ESOP - Grant III ESOP - Grant IV<br />

Employees Employees Employees Employees Grand Total<br />

Opening balance 3,096 2,214 8,559 8,354 22,223<br />

Issued during the period - - - - -<br />

Exercised during the period - - - - -<br />

Closing balance 3,096 2,214 8,559 8,354 22,223<br />

Compensation costs related to the warrants are not recognised in these financial statements for the fair value<br />

of the non-exercised warrants granted.<br />

21

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

12 Cash flows from operating activities<br />

Reconciliation of net profit for the three-month periods ended 31 March 2007 and 2006 to cash flows from<br />

operating activities:<br />

Consolidated<br />

Company<br />

31 March 31 March 31 March 31 March<br />

2007 2006 2007 2006<br />

Restated<br />

Notes Baht ’000 Baht ’000 Baht ’000 Baht ’000<br />

Net profit for the period 56,508 61,354 31,182 42,538<br />

Adjustments for:<br />

Depreciation of property and equipment 7 38,512 33,173 23,764 20,051<br />

Allowance for doubtful accounts 8,463 7,175 1,432 1,655<br />

Allowance for obsolete inventory 6 256 6 256<br />

Write-off withholding tax 847 570 - -<br />

Amortisation of equipment under<br />

concession agreements 7 11,314 11,215 11,314 7,027<br />

Amortisation of goodwill 8 21,112 21,112 - -<br />

Recognition of negative goodwill 8 (1,570) - - -<br />

Financial expenses for provision from<br />

acquisition of investment 10 1,356 1,356 1,356 1,356<br />

Amortisation of intangible assets - other 7 3,887 1,549 1,464 739<br />

Deferred income tax 9 5,326 34,660 619 14,008<br />

Loss (gain) on sales of property and<br />

equipment (40) (1) 4 (1)<br />

Gain on sales of intangible asset (1,093) - - -<br />

Unrealised loss (gain) on exchange rate (106) 419 (118) 64<br />

Share of net profit from investment<br />

- equity method (32) (5) - -<br />

Minority interests 19 1,799 (459) - -<br />

Changes in operating assets and liabilities:<br />

- trade accounts receivable and accrued<br />

income (308,689) (317,538) 9,888 (333)<br />

- amounts due from related parties (466) - 139 (821)<br />

- inventories (50,518) 15,659 1,313 989<br />

- advance payment for service to a<br />

related party 6,659 13,969 6,659 13,969<br />

- other current assets (12,114) (8,675) (7,131) (4,702)<br />

- withholding tax 23,258 2,164 144 (6,764)<br />

- non other current assets (190) 1,294 (7) (2,592)<br />

- accounts payable and accrued expenses (36,218) (77,242) (18,052) (27,269)<br />

- amounts due to related parties 2,559 517 1,975 -<br />

- unearned income and advances<br />

received from customers 435,767 455,704 1,820 (886)<br />

- other current liabilities 5,386 5,265 3,640 2,310<br />

- other non-current liabilities 11 1,776 11 1,776<br />

Cash flows from operating activities 211,734 265,267 71,422 63,370<br />

22

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

13 Income tax expense<br />

Consolidated<br />

Company<br />

31 March 31 March 31 March 31 March<br />

2007 2006 2007 2006<br />

Baht ’000 Baht ’000 Baht ’000 Baht ’000<br />

Current tax 26,477 - 9,917 -<br />

Deferred tax (Note 9) 5,326 34,660 619 14,008<br />

31,803 34,660 10,536 14,008<br />

Reconciliation of income tax expense and the results of the accounting profit multiplied by the income tax rate is<br />

as follows:<br />

Consolidated<br />

Company<br />

31 March 31 March 31 March 31 March<br />

2007 2006 2007 2006<br />

Restated<br />

Baht ’000 Baht ’000 Baht ’000 Baht ’000<br />

Profit before tax 90,110 95,554 41,718 56,546<br />

Tax rate 27.35% 28.34% 25.00% 25.00%<br />

The result of the accounting profit<br />

multiplied by the income tax rate 24,645 27,076 10,429 14,136<br />

Share of net results from investments -<br />

equity method 8 (1) - -<br />

Unearned income 786 2,231 - (2,871)<br />

Expenses not deductible for tax<br />

purposes 6,364 5,354 107 2,743<br />

Tax charge 31,803 34,660 10,536 14,008<br />

As a listed company, the Company has been granted a discounted tax rate of 25% for five fiscal years from<br />

2004 to 2008. After the granted period, the applicable tax rate for the Company will be 30%.<br />

14 Related party transactions<br />

The Company is an associate of Shin Satellite Public Company Limited, a company incorporated in<br />

Thailand and a subsidiary of Shin Corporation Public Company Limited (collectively “Shin Group”). Shin<br />

Broadband Internet (Thailand) Company Limited, which is a wholly owned subsidiary of Shin Satellite<br />

Public Company Limited, owns 40.02% of the Company’s share capital, and Point Asia Dot Com (Thailand)<br />

Company Limited, a subsidiary of Loxley Public Company Limited, and Singapore Telecommunications<br />

Limited, owns 6.61% and 13.45% of the Company’s share capital respectively. Shin Corporation Public<br />

Company Limited and Singapore Telecommunications Limited are within the group companies of Temasek<br />

Holdings Pte Limited incorporated in Singapore. Transactions with entities within these group companies<br />

are recognised as related party transactions of the Company.<br />

23

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

14 Related party transactions (Continued)<br />

The following significant transactions were carried out with related parties:<br />

a) Revenues<br />

Sales and services income:<br />

Consolidated<br />

Company<br />

31 March 31 March 31 March 31 March<br />

2007 2006 2007 2006<br />

Baht ’000 Baht ’000 Baht ’000 Baht ’000<br />

Major shareholder and its related parties 53,967 26,309 12,614 12,667<br />

Subsidiaries - - 1,358 234<br />

Other related parties 2,688 3,763 2,688 3,763<br />

Other income:<br />

Major shareholder and its related parties 18 754 18 754<br />

Subsidiaries - - 920 4,638<br />

Total revenues 56,673 30,826 17,598 22,056<br />

b) Expenses<br />

Purchases of goods and services:<br />

Consolidated<br />

Company<br />

31 March 31 March 31 March 31 March<br />

2007 2006 2007 2006<br />

Baht ’000 Baht ’000 Baht ’000 Baht ’000<br />

Major shareholder and its related parties 50,987 37,495 49,761 37,492<br />

Subsidiary - - 18,578 18,412<br />

Other related parties 1,930 2,120 1,930 2,120<br />

Other expenses:<br />

Major shareholder and its related parties 608 7,437 608 3,486<br />

Subsidiaries - - 437 133<br />

Other related parties 1,792 3,891 1,792 3,891<br />

Total expenses 55,317 50,943 73,106 65,534<br />

24

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

14 Related party transactions (Continued)<br />

c) Outstanding balances arising from sales/purchases of goods/services and expenses<br />

Consolidated<br />

Company<br />

31 March 31 December 31 March 31 December<br />

2007 2006 2007 2006<br />

Baht ’000 Baht ’000 Baht ’000 Baht ’000<br />

Trade accounts receivable<br />

Major shareholder and its related parties 49,796 61,319 21,253 30,054<br />

Subsidiaries - - 409 6,341<br />

Other related parties 5,516 5,829 3,550 3,862<br />

55,312 67,148 25,212 40,257<br />

Less Allowance for doubtful accounts (2,235) (2,076) (600) (600)<br />

Total trade accounts receivable 53,077 65,072 24,612 39,657<br />

Accrued income<br />

Major shareholder and its related parties 2,509 1,354 2,509 1,354<br />

Subsidiary - - 75 -<br />

Total accrued income 2,509 1,354 2,584 1,354<br />

Total trade accounts receivable and<br />

accrued income 55,586 66,426 27,196 41,011<br />

Amounts due from related parties<br />

Major shareholder and its related parties 628 162 - -<br />

Subsidiary - - 282 420<br />

Total amounts due from related parties 628 162 282 420<br />

Advance payment<br />

Major shareholder and its related parties 1,676 8,336 1,676 8,336<br />

Total advance payment 1,676 8,336 1,676 8,336<br />

Trade accounts payable<br />

Major shareholder and its related parties 36,161 27,425 31,678 22,945<br />

Subsidiaries - - 6,676 7,319<br />

Other related parties 2,769 1,425 2,769 1,425<br />

Total trade accounts payable 38,930 28,850 41,123 31,689<br />

Account payable of fixed assets<br />

Major shareholder and its related parties - 5,801 - 5,801<br />

Total account payable of fixed assets - 5,801 - 5,801<br />

Amount due to related parties<br />

Major shareholder and its related parties 3,207 2,485 138 -<br />

Other related parties 1,880 43 1,872 35<br />

Total amount due to related parties 5,087 2,528 2,010 35<br />

Accrued expenses<br />

Major shareholder and its related parties 405 667 107 667<br />

Other related parties - 1,624 - 1,624<br />

Total accrued expenses 405 2,291 107 2,291<br />

25

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

14 Related party transactions (Continued)<br />

d) Warrants of Shin Corporation Public Company Limited and Shin Satellite Public Company<br />

Limited were granted to members of the Board of Directors of the Company<br />

Shin Satellite Public Company Limited (“SSA”), the parent company of Shin Broadband Internet<br />

(Thailand) Company Limited, and Shin Corporation Public Company Limited (“Shin”), the parent<br />

company of SSA, issued their warrants to members of the Board of Directors of SSA and Shin<br />

respectively. The warrants of both companies are in registered form, are non-transferable and have<br />

no offering price. The terms of the warrants do not exceed five years. The details of the warrants<br />

are shown below:<br />

Shin Satellite Public Company Limited<br />

Before dilution<br />

Exercise ratio Exercise prices Exercise period<br />

Issued dates Issued units (unit : share) (Baht/unit) First Last<br />

ESOP - Grant I 27 March 2002 2,436,400 1 : 2.04490 13.081 Expired on 26 March 2007<br />

ESOP - Grant II 30 May 2003 1,235,200 1 : 2.04490 6.279 30 May 2004 30 May 2008<br />

ESOP - Grant III 31 May 2004 1,154,200 1 : 1.02245 13.913 31 May 2005 31 May 2009<br />

ESOP - Grant IV 31 May 2005 929,900 1 : 1.02245 16.441 31 May 2006 31 May 2010<br />

ESOP - Grant V 31 May 2006 1,099,800 1 : 1 11.870 31 May 2007 31 May 2011<br />

Shin Corporation Public Company Limited<br />

Before dilution<br />

Exercise ratio Exercise prices Exercise period<br />

Issued dates Issued units (unit : share) (Baht/unit) First Last<br />

ESOP - Grant I 27 March 2002 18,336,200 1 : 1.06942 16.645 Expired on 26 March 2007<br />

ESOP - Grant II 30 May 2003 12,222,100 1 : 1.06942 12.782 31 May 2004 30 May 2008<br />

ESOP - Grant III 31 May 2004 8,823,100 1 : 1.06942 34.046 31 May 2005 30 May 2009<br />

ESOP - Grant IV 31 May 2005 8,329,800 1 : 1.05540 39.568 31 May 2006 30 May 2010<br />

ESOP - Grant V 31 July 2006 6,991,100 1 : 1.02307 36.830 31 July 2007 30 July 2011<br />

e) Directors’ remuneration<br />

For the three-month period ended 31 March 2007, total directors’ remuneration was Baht 0.76 million<br />

(For the three-month period ended 31 March 2006: Baht 0.68 million). Directors’ remuneration<br />

represents meeting fees as approved by the shareholders of the Group and the Company at their annual<br />

ordinary shareholders’ meetings.<br />

f) Special reward program of subsidiaries<br />

Some subsidiaries have granted rights to receive special rewards (“Special Reward Program”) to eligible<br />

employees. These rights will be granted every year for five consecutive years. The rights will be<br />

exercisable after the first year and within five years of the date on which they were granted. The Special<br />

Reward Program Grant I to Grant III shall be calculated based on the improvement in the subsidiaries’<br />

operational performance on the exercise date compared with that on the grant date and other factors.<br />

However, the approved budget for each individual will not be exceeded. The special rewards granted to<br />

employees of subsidiaries for Grant IV are in the form of warrants of the Company under the ESOP<br />

program.<br />

26

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

14 Related party transactions (Continued)<br />

f) Special reward program of subsidiaries (Continued)<br />

Movements in the Special Reward Program are as follows:<br />

Units<br />

For the three-month period ended 31 March 2007<br />

Opening balance 65,481<br />

Issued during the period -<br />

Exercised during the period -<br />

Closing balance 65,481<br />

As at 31 March 2007, rights under the special reward program of subsidiaries amounting to 65,481 units<br />

will expire in 2007.<br />

g) Warrants of Shin granted to certain directors of AD Venture Company Limited (“ADV”)<br />

Shin granted its warrants to certain ADV directors in accordance with the Employee Stock Option Plan<br />

(ESOP) Grant I on 27 March 2002, Grant II on 30 May 2003, Grant III on 31 May 2004, Grant IV on<br />

31 May 2005 and Grant V on 31 July 2006 amounting to 23.10 million units, 14.48 million units, 10.48<br />

million units, 10.55 million units and 9.10 million units, respectively.<br />

The movement in the number of warrants issued and offered to directors and employees is as follows:<br />

Million units<br />

For the three-month period ended 31 March 2007<br />

Opening balance 30.39<br />

Issued during the period -<br />

Exercised during the period -<br />

Closing balance 30.39<br />

15 Financial instruments<br />

The principal financial risk faced by the Group is credit risk. However, the Group has no significant<br />

concentrations of credit risk.<br />

The carrying amounts of financial assets and liabilities approximate fair value.<br />

Foreign currency forward contracts payable, net<br />

As at 31 March 2007 and 31 December 2006, a subsidiary has entered into foreign currency forward<br />

contracts to hedge the foreign exchange rate risk in respect of accounts payable. The foreign currency<br />

forward contracts payable under these contracts are shown below:<br />

Consolidated<br />

31 March 2007 31 December 2006<br />

USD ’000 Baht ’000 USD ’000 Baht ’000<br />

Within 1 year 197 6,967 2,055 74,595<br />

Total 197 6,967 2,055 74,595<br />

27

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

15 Financial instruments (Continued)<br />

Consolidated<br />

Company<br />

31 March 31 December 31 March 31 December<br />

2007 2006 2007 2006<br />

Baht ’000 Baht ’000 Baht ’000 Baht ’000<br />

Foreign currency forward contracts<br />

payable, net<br />

Contracts receivable 6,859 73,888 - -<br />

Contracts payable 6,967 74,595 - -<br />

Total foreign currency forward contracts<br />

payable, net 108 707 - -<br />

Net fair values of derivative financial instruments<br />

The net fair values of derivative financial instruments at the balance sheet date were:<br />

Financial derivatives Consolidated Company<br />

31 March 31 December 31 March 31 December<br />

2007 2006 2007 2006<br />

Baht ’000 Baht ’000 Baht ’000 Baht ’000<br />

Foreign currency forward contracts 7,054 73,888 - -<br />

The net fair values of foreign currency forward contracts and option contracts have been calculated based on<br />

rates quoted by the Group’s bankers to terminate the contracts at the balance sheet date.<br />

16 Guarantees<br />

As at 31 March 2007, the Group had commitments with its bankers, whereby the banks have issued letters of<br />

guarantee in respect of business contracts and others amounting to approximately Baht 21 million<br />

(31 December 2006: Baht 24 million).<br />

17 Commitments<br />

At 31 March 2007, future minimum lease payments under non-cancellable operating lease agreements are as<br />

follows:<br />

Consolidated<br />

Company<br />

31 March 31 December 31 March 31 December<br />

2007 2006 2007 2006<br />

Baht ’000 Baht ’000 Baht ’000 Baht ’000<br />

Not later than 1 year 51,025 56,311 23,708 34,294<br />

More than 1 year but less than 5 years 24,634 29,537 19,357 24,455<br />

Total 75,659 85,848 43,065 58,749<br />

28

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

18 Legal reserve<br />

Movements of the legal reserve are as follows:<br />

Consolidated<br />

Company<br />

For the three-month periods ended 31 March 31 March 31 March 31 March<br />

2007 2006 2007 2006<br />

Baht ’000 Baht ’000 Baht ’000 Baht ’000<br />

Opening balance 45,636 35,006 45,636 35,006<br />

Reserve increased during the period - 3,069 - 3,069<br />

Closing balance 45,636 38,075 45,636 38,075<br />

Under the Public Limited Company Act., B.E. 2535, the Company is required to set aside as a legal reserve<br />

at least 5% of its net profit after accumulated deficit brought forward (if any) until the reserve is not less than<br />

10% of the registered capital. The legal reserve is non-distributable.<br />

19 Minority interest<br />

Consolidated Company<br />

31 March 31 March<br />

2007 2007<br />

Baht ’000 Baht ’000<br />

Opening balance 38,356 -<br />

Acquisition of shares in a subsidiary (6,766) -<br />

Share of net profit of a subsidiary 1,799 -<br />

Closing balance 33,389 -<br />

20 Credit facilities<br />

The available credit facilities for borrowings from financial institutions as at 31 March 2007 were Baht 585<br />

million (31 December 2006: Baht 585 million).<br />

21 Subsequent events<br />

a) Approved dividend payment<br />

At the annual ordinary shareholders’ meeting of the Company held on 23 April 2007, the shareholders<br />

passed a resolution to approve the dividend payment for 2006 of Baht 0.14 per share, totaling Baht<br />

87.50 million.<br />

29

<strong>CS</strong> Loxinfo Public Company Limited<br />

Unaudited Condensed Notes to the Interim Consolidated and Company Financial Statements<br />

For the three-month periods ended 31 March 2007 and 2006<br />

21 Subsequent events (Continued)<br />

b) Approved dividend payment and allocation of warrants of the Company granted to directors,<br />

employees of the Company and its subsidiary<br />

At the annual ordinary shareholders meeting of the Company held on 23 April 2007, the shareholders<br />

passed a resolution to approve the allocation of 8,354,400 ordinary shares, equivalent to 1.34% of the<br />

Company’s total issued and paid-up share capital as at the date the warrants allocation was approved,<br />

under an ESOP scheme (Grant V), by granting warrants to directors and employees of the Company and<br />

its subsidiary. The exercise ratio is one warrant per ordinary share. The warrants are in registered form<br />

and are non-transferable. The term of the warrants does not exceed five years from the date on which<br />

they were granted, and the warrants have no offering price. The exercise price is the weighted-average<br />

closing price of the Company’s shares traded on the Stock Exchange of Thailand during the period of<br />

30 days prior to the annual ordinary shareholders meeting held on 23 April 2007. One-third of the<br />

allocated warrants may be exercised to purchase ordinary shares, one year from the grant date for the<br />

first exercise, and two years and three years from the grant date for the second and third exercises,<br />

respectively. The Company is currently in the process of obtaining approval from the Securities and<br />

Exchange Commission.<br />

In addition, the shareholders also passed a resolution to approve the increase in registered share capital<br />

from 649,020,074 ordinary shares at a par value of Baht 1 each to 660,849,474 ordinary shares at a par<br />

value of Baht 1 each by registering 11,829,400 additional ordinary shares. These newly registered<br />

ordinary shares will be reserved for exercising the rights under ESOP Grant I to Grant IV (3,475,000<br />

shares) in accordance with the exercise ratio adjustment. The remaining 8,354,400 newly issued<br />

ordinary shares will be reserved for the exercise of ESOP Grant V. The increase in the registered share<br />

capital is currently in the process of registration with the Ministry of Commerce.<br />

c) The offset of legal reserve and premium on share capital with deficit<br />

At the annual ordinary shareholders meeting of the Company held on 23 April 2007, the shareholders<br />

passed a resolution to approve the offset of legal reserve of Baht 45.6 million and premium on share<br />

capital of Baht 574.5 million, totaling Baht 620.1 million with deficit. The offset is allowed under the<br />

Public Limited Companies Act section 119; which states “Where approval of the shareholder meeting<br />

has been obtained, the company may transfer the reserve fund referred to premium on share, the reserve<br />

fund referred to legal reserve or other reserves to compensate for the deficit of the company”.<br />

d) Acquisition of Watta Classified Company Limited<br />

On 25 April 2007, the Company acquired 120,000 common shares of Watta Classified Company<br />

Limited (“Watta”) at Baht 733.34 per share, equivalent to 60% of the share capital of Watta at a total<br />

price of approximately Baht 88 million. The Company made payment for the shares on 27 April 2007.<br />

As a result, Watta and its subsidiaries changed status to be the Company’s subsidiary from the date on<br />

which control was transferred to the Company.<br />

e) Acquisition of common shares, land and a building from Point Asia Dot Com (Thailand)<br />

Company Limited<br />

At the Board of Director’s meeting of the Company held on 10 May 2007, the Board of Directors<br />

passed a resolution to approve the acquisition of 991,593 ordinary shares of Loxley Information<br />

Services Company Limited from Point Asia Dot Com (Thailand) Company Limited at Baht 2.02 per<br />

share, equivalent to 3.81% of the share capital of Loxley Information Services Company Limited at a<br />

total price of approximately Baht 2 million. Moreover, the Board of Directors passed a resolution to<br />

approve the acquisition of the land and building, located at Pattaya and used as the Company’s branch<br />

office, from Point Asia Dot Com (Thailand) Company Limited, amounting to Baht 3.2 million.<br />

30

<strong>CS</strong> LOXINFO PUBLIC COMPANY LIMITED<br />

<strong>INTERIM</strong> C<strong>ON</strong>SOLIDATED AND COMPANY<br />

FINANCIAL STATEMENTS<br />

31 March 2007